Descripción general

La estrategia es una estrategia de inversión inteligente que combina la ley del promedio de costos en dólares (DCA) y los indicadores técnicos de la banda de Brin. Se invierte utilizando el principio de la regresión de la mediana, construyendo sistemáticamente una posición durante la corrección de precios. El núcleo de la estrategia es realizar operaciones de compra de una cantidad fija cuando el precio cae por debajo de la banda de Brin, lo que permite obtener un mejor precio de entrada durante los períodos de ajuste del mercado.

Principio de estrategia

El principio central de la estrategia se basa en tres fundamentos: 1) el promedio de costos en dólares, que reduce el riesgo al momento de elegir invertir una cantidad fija periódicamente; 2) la teoría de la regresión a la media, que considera que los precios finalmente regresarán a sus niveles promedio históricos; 3) el indicador de la banda de Brin, que se utiliza para identificar las zonas de sobreventa y sobreventa. Cuando los precios rompen la banda de Brin, se activa una señal de compra.

Ventajas estratégicas

- Reducir el riesgo de error humano a través de la compra sistemática en lugar de un juicio subjetivo

- Aprovechar las oportunidades de reajuste - ejecutar automáticamente la operación de compra cuando el precio supera la caída

- Ajuste de parámetros flexibles - los parámetros de la banda de Bryn y el monto de la inversión se pueden ajustar según las diferentes condiciones del mercado

- Reglas claras de entrada y salida - señales objetivas basadas en indicadores técnicos

- Ejecución automatizada - sin intervención humana y evitando transacciones emocionales

Riesgo estratégico

- Riesgo de fallo de la regresión a la media - puede generar más señales falsas en un mercado de tendencia

- Riesgo de gestión de fondos - Necesidad de reservar fondos suficientes para responder a las señales de compra en serie

- Riesgo de optimización de parámetros: la optimización excesiva puede hacer que la estrategia no funcione

- Dependencia del entorno del mercado - puede tener un rendimiento deficiente en mercados con gran volatilidad Se recomienda la adopción de un sistema de gestión de fondos estricto y la evaluación periódica del rendimiento de la estrategia para administrar estos riesgos.

Dirección de optimización de la estrategia

- Introducción de filtros de tendencia para evitar operaciones de reversión en una tendencia fuerte

- Mecanismo de confirmación de múltiples períodos de tiempo

- Optimizar el sistema de gestión de fondos y ajustar el monto de las inversiones en función de la fluctuación de la tasa

- Se añade el mecanismo de cierre de ganancias, que se cierra cuando el precio regresa a la media

- Considerar la combinación de otros indicadores técnicos para mejorar la fiabilidad de la señal

Resumir

Es una estrategia robusta que combina análisis técnico con métodos de inversión sistematizados. Se trata de una estrategia robusta que combina el análisis técnico con métodos de inversión sistematizados. Se trata de una estrategia robusta que combina el análisis técnico con métodos de inversión sistematizados. Se trata de una estrategia robusta que combina el análisis técnico con métodos de inversión sistematizados.

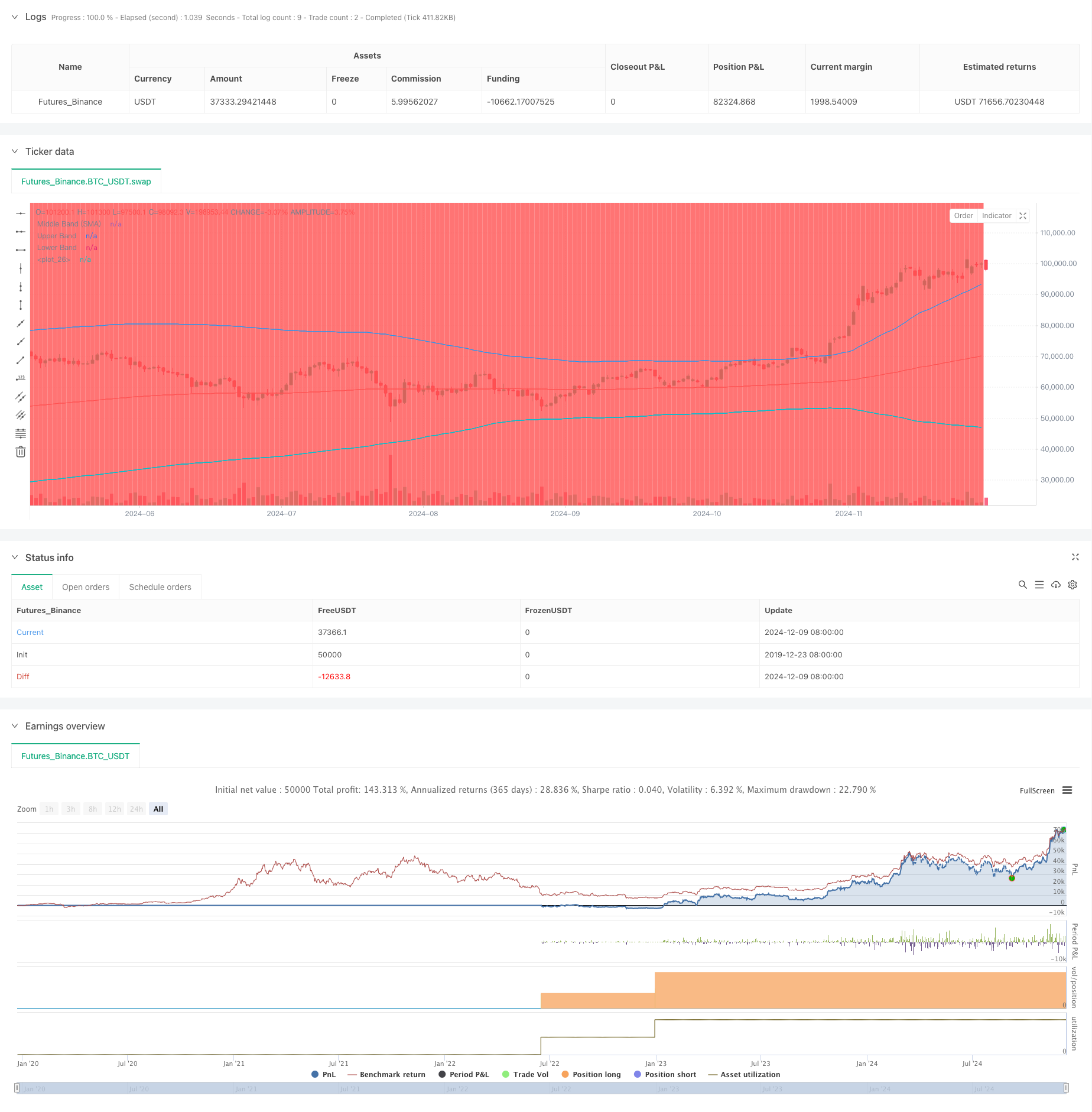

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("DCA Strategy with Mean Reversion and Bollinger Band", overlay=true) // Define the strategy name and set overlay=true to display on the main chart

// Inputs for investment amount and dates

investment_amount = input.float(10000, title="Investment Amount (USD)", tooltip="Amount to be invested in each buy order (in USD)") // Amount to invest in each buy order

open_date = input(timestamp("2024-01-01 00:00:00"), title="Open All Positions On", tooltip="Date when to start opening positions for DCA strategy") // Date to start opening positions

close_date = input(timestamp("2024-08-04 00:00:00"), title="Close All Positions On", tooltip="Date when to close all open positions for DCA strategy") // Date to close all positions

// Bollinger Band parameters

source = input.source(title="Source", defval=close, group="Bollinger Band Parameter", tooltip="The price source to calculate the Bollinger Bands (e.g., closing price)") // Source of price for calculating Bollinger Bands (e.g., closing price)

length = input.int(200, minval=1, title='Period', group="Bollinger Band Parameter", tooltip="Period for the Bollinger Band calculation (e.g., 200-period moving average)") // Period for calculating the Bollinger Bands (e.g., 200-period moving average)

mult = input.float(2, minval=0.1, maxval=50, step=0.1, title='Standard Deviation', group="Bollinger Band Parameter", tooltip="Multiplier for the standard deviation to define the upper and lower bands") // Multiplier for the standard deviation to calculate the upper and lower bands

// Timeframe selection for Bollinger Bands

tf = input.timeframe(title="Bollinger Band Timeframe", defval="240", group="Bollinger Band Parameter", tooltip="The timeframe used to calculate the Bollinger Bands (e.g., 4-hour chart)") // Timeframe for calculating the Bollinger Bands (e.g., 4-hour chart)

// Calculate BB for the chosen timeframe using security

[basis, bb_dev] = request.security(syminfo.tickerid, tf, [ta.ema(source, length), mult * ta.stdev(source, length)]) // Calculate Basis (EMA) and standard deviation for the chosen timeframe

upper = basis + bb_dev // Calculate the Upper Band by adding the standard deviation to the Basis

lower = basis - bb_dev // Calculate the Lower Band by subtracting the standard deviation from the Basis

// Plot Bollinger Bands

plot(basis, color=color.red, title="Middle Band (SMA)") // Plot the middle band (Basis, EMA) in red

plot(upper, color=color.blue, title="Upper Band") // Plot the Upper Band in blue

plot(lower, color=color.blue, title="Lower Band") // Plot the Lower Band in blue

fill(plot(upper), plot(lower), color=color.blue, transp=90) // Fill the area between Upper and Lower Bands with blue color at 90% transparency

// Define buy condition based on Bollinger Band

buy_condition = ta.crossunder(source, lower) // Define the buy condition when the price crosses under the Lower Band (Mean Reversion strategy)

// Execute buy orders on the Bollinger Band Mean Reversion condition

if (buy_condition ) // Check if the buy condition is true and time is within the open and close date range

strategy.order("DCA Buy", strategy.long, qty=investment_amount / close) // Execute the buy order with the specified investment amount

// Close all positions on the specified date

if (time >= close_date) // Check if the current time is after the close date

strategy.close_all() // Close all open positions

// Track the background color state

var color bgColor = na // Initialize a variable to store the background color (set to 'na' initially)

// Update background color based on conditions

if close > upper // If the close price is above the Upper Band

bgColor := color.red // Set the background color to red

else if close < lower // If the close price is below the Lower Band

bgColor := color.green // Set the background color to green

// Apply the background color

bgcolor(bgColor, transp=90, title="Background Color Based on Bollinger Bands") // Set the background color based on the determined condition with 90% transparency

// Postscript:

// 1. Once you have set the "Investment Amount (USD)" in the input box, proceed with additional configuration.

// Go to "Properties" and adjust the "Initial Capital" value by calculating it as "Total Closed Trades" multiplied by "Investment Amount (USD)"

// to ensure the backtest results are aligned correctly with the actual investment values.

//

// Example:

// Investment Amount (USD) = 100 USD

// Total Closed Trades = 10

// Initial Capital = 10 x 100 = 1,000 USD

// Investment Amount (USD) = 200 USD

// Total Closed Trades = 24

// Initial Capital = 24 x 200 = 4,800 USD