Descripción general

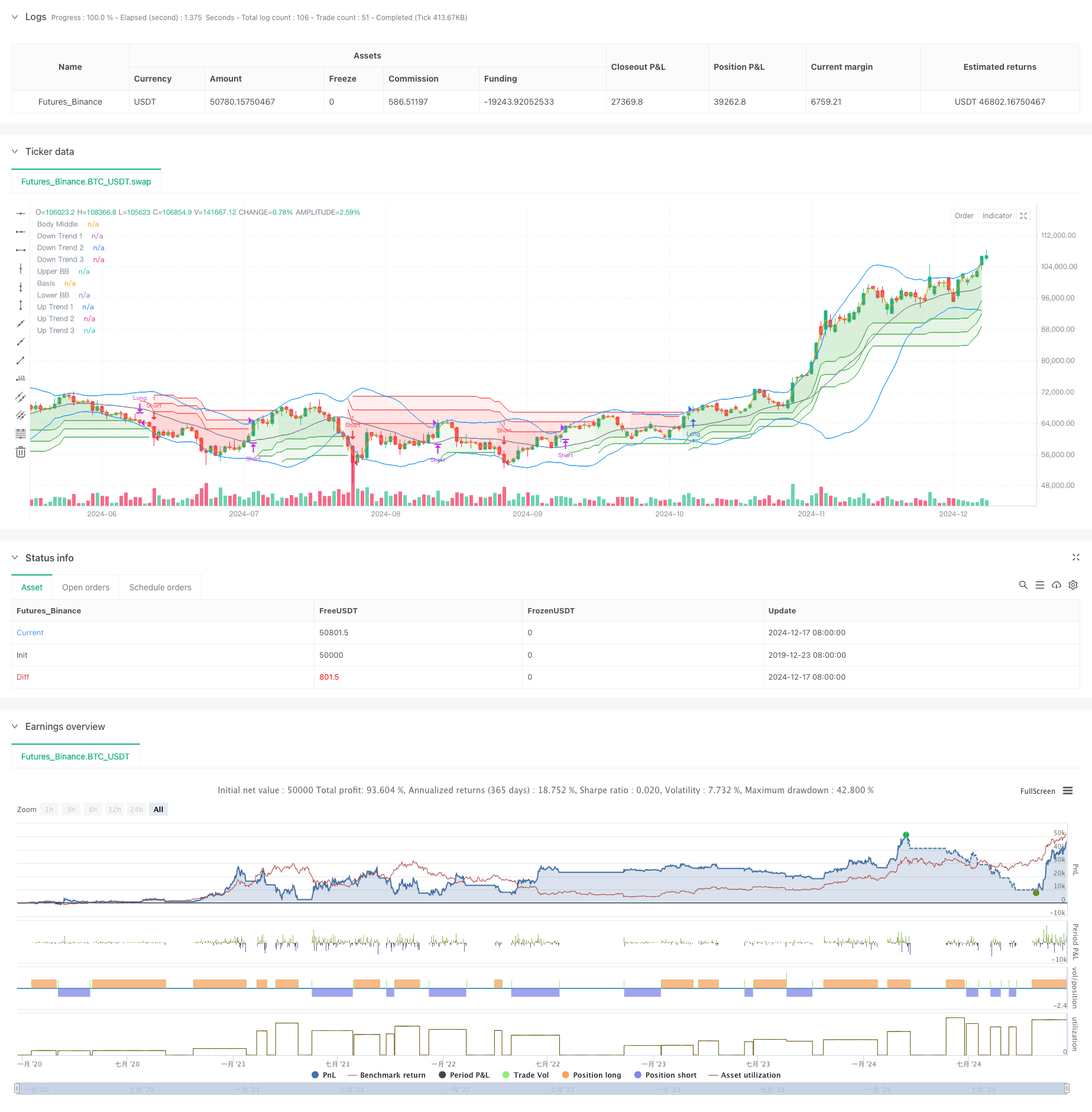

La estrategia utiliza una combinación de la banda de Brin y el indicador de triple supertrend para operar. La banda de Brin se utiliza para identificar las fluctuaciones extremas de los precios, mientras que la triple supertrend proporciona una confirmación múltiple de la dirección de la tendencia a través de diferentes configuraciones de parámetros. La combinación mantiene las ventajas del seguimiento de tendencias y aumenta la fiabilidad de la operación.

Principio de estrategia

La lógica central de la estrategia incluye las siguientes partes clave:

- El uso de bandas de Brin de 20 ciclos, con un coeficiente de diferencia estándar de 2.0, para juzgar las fluctuaciones de los precios

- Establezca tres líneas de tendencia súper con periodos de 10 y parámetros de 3.0, 4.0 y 5.0

- Condiciones de entrada múltiples: el precio se pone en marcha tras la ruptura de la banda de Brin y las tres líneas de tendencia superior muestran una tendencia alcista

- Condiciones de entrada de cabeza: el precio cae por debajo de la banda de Brin y las tres líneas de tendencia superior muestran una tendencia a la baja

- Cuando cualquier línea de tendencia se desvía, la posición se mantiene a la par.

- Usar la línea de precio intermedia como referencia de relleno para aumentar el efecto visual

Ventajas estratégicas

- Mecanismos de confirmación múltiple: Reducción de las señales falsas a través de la combinación de la banda de Bryn y la triple tendencia

- Fuertes capacidades de seguimiento de tendencias: configuración de parámetros progresivos de indicadores de tendencias extremas para capturar de manera efectiva las tendencias a diferentes niveles

- Control de riesgos: cerrar posiciones rápidamente y controlar el retiro cuando se presentan signos de cambio de tendencia

- Parámetros ajustables: los parámetros de los indicadores se pueden optimizar según las diferentes características del mercado

- Alto grado de automatización: la lógica de la estrategia es clara y la implementación es sistemática

Riesgo estratégico

- Riesgo de un mercado convulso: las falsas brechas pueden ser frecuentes en un mercado convulso

- Efecto de los puntos de deslizamiento: puede haber grandes pérdidas de puntos de deslizamiento en períodos de gran volatilidad

- Riesgo de retraso: el mecanismo de confirmación múltiple puede provocar retrasos en el ingreso

- Sensibilidad de los parámetros: diferentes combinaciones de parámetros pueden generar grandes diferencias en el rendimiento de la estrategia.

- Dependencia del entorno del mercado: las estrategias se desempeñan mejor en mercados con tendencias evidentes

Dirección de optimización de la estrategia

- Introducción de indicadores de volumen de negocios: la efectividad de las rupturas de precios se confirma a través del volumen de negocios

- Mecanismo de pérdida optimizado: se puede agregar pérdida móvil o pérdida dinámica basada en ATR

- Aumentar el filtro de tiempo: prohibir el comercio en períodos de tiempo específicos para evitar fluctuaciones ineficientes

- Añadir filtros de volatilidad: ajustar posiciones o suspender la negociación durante períodos de exceso de volatilidad

- Mecanismo de adaptación de parámetros para el desarrollo: Parámetros de ajuste dinámico según la situación del mercado

Resumir

Se trata de una estrategia de seguimiento de tendencias que combina la banda de Brin y la triple supertrend para mejorar la fiabilidad de las operaciones mediante la confirmación de múltiples indicadores técnicos. La estrategia tiene una fuerte capacidad de captura de tendencias y control de riesgos, pero también se debe tener en cuenta el impacto del entorno de mercado en el rendimiento de la estrategia.

//@version=5

strategy("Demo GPT - Bollinger + Triple Supertrend Combo", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3)

// -------------------------------

// User Input for Date Range

// -------------------------------

startDate = input(title="Start Date", defval=timestamp("2018-01-01 00:00:00"))

endDate = input(title="End Date", defval=timestamp("2069-12-31 23:59:59"))

// -------------------------------

// Bollinger Band Inputs

// -------------------------------

lengthBB = input.int(20, "Bollinger Length")

multBB = input.float(2.0, "Bollinger Multiplier")

// -------------------------------

// Supertrend Inputs for 3 lines

// -------------------------------

// Line 1

atrPeriod1 = input.int(10, "ATR Length (Line 1)", minval = 1)

factor1 = input.float(3.0, "Factor (Line 1)", minval = 0.01, step = 0.01)

// Line 2

atrPeriod2 = input.int(10, "ATR Length (Line 2)", minval = 1)

factor2 = input.float(4.0, "Factor (Line 2)", minval = 0.01, step = 0.01)

// Line 3

atrPeriod3 = input.int(10, "ATR Length (Line 3)", minval = 1)

factor3 = input.float(5.0, "Factor (Line 3)", minval = 0.01, step = 0.01)

// -------------------------------

// Bollinger Band Calculation

// -------------------------------

basis = ta.sma(close, lengthBB)

dev = multBB * ta.stdev(close, lengthBB)

upperBand = basis + dev

lowerBand = basis - dev

// Plot Bollinger Bands

plot(upperBand, "Upper BB", color=color.new(color.blue, 0))

plot(basis, "Basis", color=color.new(color.gray, 0))

plot(lowerBand, "Lower BB", color=color.new(color.blue, 0))

// -------------------------------

// Supertrend Calculation Line 1

// -------------------------------

[supertrendLine1, direction1] = ta.supertrend(factor1, atrPeriod1)

supertrendLine1 := barstate.isfirst ? na : supertrendLine1

upTrend1 = plot(direction1 < 0 ? supertrendLine1 : na, "Up Trend 1", color = color.green, style = plot.style_linebr)

downTrend1 = plot(direction1 < 0 ? na : supertrendLine1, "Down Trend 1", color = color.red, style = plot.style_linebr)

// -------------------------------

// Supertrend Calculation Line 2

// -------------------------------

[supertrendLine2, direction2] = ta.supertrend(factor2, atrPeriod2)

supertrendLine2 := barstate.isfirst ? na : supertrendLine2

upTrend2 = plot(direction2 < 0 ? supertrendLine2 : na, "Up Trend 2", color = color.new(color.green, 0), style = plot.style_linebr)

downTrend2 = plot(direction2 < 0 ? na : supertrendLine2, "Down Trend 2", color = color.new(color.red, 0), style = plot.style_linebr)

// -------------------------------

// Supertrend Calculation Line 3

// -------------------------------

[supertrendLine3, direction3] = ta.supertrend(factor3, atrPeriod3)

supertrendLine3 := barstate.isfirst ? na : supertrendLine3

upTrend3 = plot(direction3 < 0 ? supertrendLine3 : na, "Up Trend 3", color = color.new(color.green, 0), style = plot.style_linebr)

downTrend3 = plot(direction3 < 0 ? na : supertrendLine3, "Down Trend 3", color = color.new(color.red, 0), style = plot.style_linebr)

// -------------------------------

// Middle line for fill (used as a reference line)

// -------------------------------

bodyMiddle = plot(barstate.isfirst ? na : (open + close) / 2, "Body Middle", display = display.none)

// Fill areas for each supertrend line

fill(bodyMiddle, upTrend1, color.new(color.green, 90), fillgaps = false)

fill(bodyMiddle, downTrend1, color.new(color.red, 90), fillgaps = false)

fill(bodyMiddle, upTrend2, color.new(color.green, 90), fillgaps = false)

fill(bodyMiddle, downTrend2, color.new(color.red, 90), fillgaps = false)

fill(bodyMiddle, upTrend3, color.new(color.green, 90), fillgaps = false)

fill(bodyMiddle, downTrend3, color.new(color.red, 90), fillgaps = false)

// Alerts for the first line only (as an example)

alertcondition(direction1[1] > direction1, title='Downtrend to Uptrend (Line 1)', message='Supertrend Line 1 switched from Downtrend to Uptrend')

alertcondition(direction1[1] < direction1, title='Uptrend to Downtrend (Line 1)', message='Supertrend Line 1 switched from Uptrend to Downtrend')

alertcondition(direction1[1] != direction1, title='Trend Change (Line 1)', message='Supertrend Line 1 switched trend')

// -------------------------------

// Strategy Logic

// -------------------------------

inDateRange = true

// Long Conditions

longEntryCondition = inDateRange and close > upperBand and direction1 < 0 and direction2 < 0 and direction3 < 0

longExitCondition = direction1 > 0 or direction2 > 0 or direction3 > 0

// Short Conditions

shortEntryCondition = inDateRange and close < lowerBand and direction1 > 0 and direction2 > 0 and direction3 > 0

shortExitCondition = direction1 < 0 or direction2 < 0 or direction3 < 0

// Execute Long Trades

if longEntryCondition and strategy.position_size <= 0

strategy.entry("Long", strategy.long)

if strategy.position_size > 0 and longExitCondition

strategy.close("Long")

// Execute Short Trades

if shortEntryCondition and strategy.position_size >= 0

strategy.entry("Short", strategy.short)

if strategy.position_size < 0 and shortExitCondition

strategy.close("Short")