Descripción general

La estrategia es un sistema de negociación integral que combina varios indicadores técnicos, principalmente para capturar oportunidades de negociación mediante la monitorización dinámica de la dinámica del mercado y los cambios de tendencia. La estrategia integra varios indicadores, como el sistema de medias medias (EMA), el indicador de fuerza relativa (RSI), el indicador de dispersión de convergencia de la media móvil (MACD) y el cinturón de Brin (BB), e introduce un mecanismo de stop loss dinámico basado en la amplitud real de la onda (ATR), que permite el análisis y el control del riesgo de múltiples dimensiones del mercado.

Principio de estrategia

La estrategia utiliza un mecanismo de confirmación de señales de varios niveles, que incluye:

- Determinación de tendencias: utiliza el cruce de las EMA de 7 y 14 ciclos para determinar la dirección de la tendencia del mercado

- Análisis dinámico: el indicador RSI monitoriza el estado de sobreventa y sobrecompra en el mercado y establece un umbral dinámico de 30⁄70

- Confirmación de la intensidad de la tendencia: la introducción del indicador ADX para determinar la intensidad de la tendencia, confirma la existencia de una tendencia fuerte cuando el ADX es> 25

- Juzga de bandas de fluctuación: utiliza el Brin para definir bandas de fluctuación de precios y genera señales de negociación en combinación con el contacto de precios con la banda de Brin

- Verificación de transacción: utiliza un filtro de transacción dinámico y lineal para garantizar que las transacciones se realicen con suficiente actividad en el mercado

- Control de riesgo: estrategia de stop loss dinámica diseñada en base a los indicadores ATR, con una distancia de stop loss de 1,5 veces el ATR

Ventajas estratégicas

- La verificación de señales multidimensionales puede reducir eficazmente las falsas señales

- El mecanismo de suspensión de pérdidas dinámicas mejora la capacidad de adaptación al riesgo de las estrategias

- Combinación de análisis de volumen y intensidad de tendencias para mejorar la fiabilidad de las transacciones

- Los parámetros del indicador son ajustables y tienen una buena adaptabilidad

- Mecanismos completos de entrada y salida, lógica de transacción clara

- Indicadores técnicos estandarizados, fáciles de entender y mantener

Riesgo estratégico

- Múltiples indicadores pueden causar retraso en la señal

- La optimización de parámetros puede tener el riesgo de sobreajuste

- El mercado horizontal puede generar transacciones frecuentes

- Los sistemas de señales complejos pueden aumentar la carga computacional

- Se requiere una mayor cantidad de muestras para comprobar la eficacia de la estrategia

Dirección de optimización de la estrategia

- Introducción de un mecanismo de adaptación a la volatilidad del mercado y ajuste dinámico de los parámetros del indicador

- Aumentar el filtro de tiempo para evitar el comercio en tiempos desfavorables

- Optimización de las estrategias de contención, considerando el uso de contención móvil

- Incluye el coste de la transacción para optimizar las condiciones de apertura de posiciones

- Introducción de un mecanismo de gestión de posiciones para el ajuste dinámico de posiciones

Resumir

La estrategia se basa en la colaboración de múltiples indicadores para construir un sistema de negociación más completo. Las ventajas centrales se encuentran en el mecanismo de confirmación de señales multidimensional y el sistema de control de riesgo dinámico, pero también se debe tener en cuenta la optimización de los parámetros y la adaptabilidad del mercado.

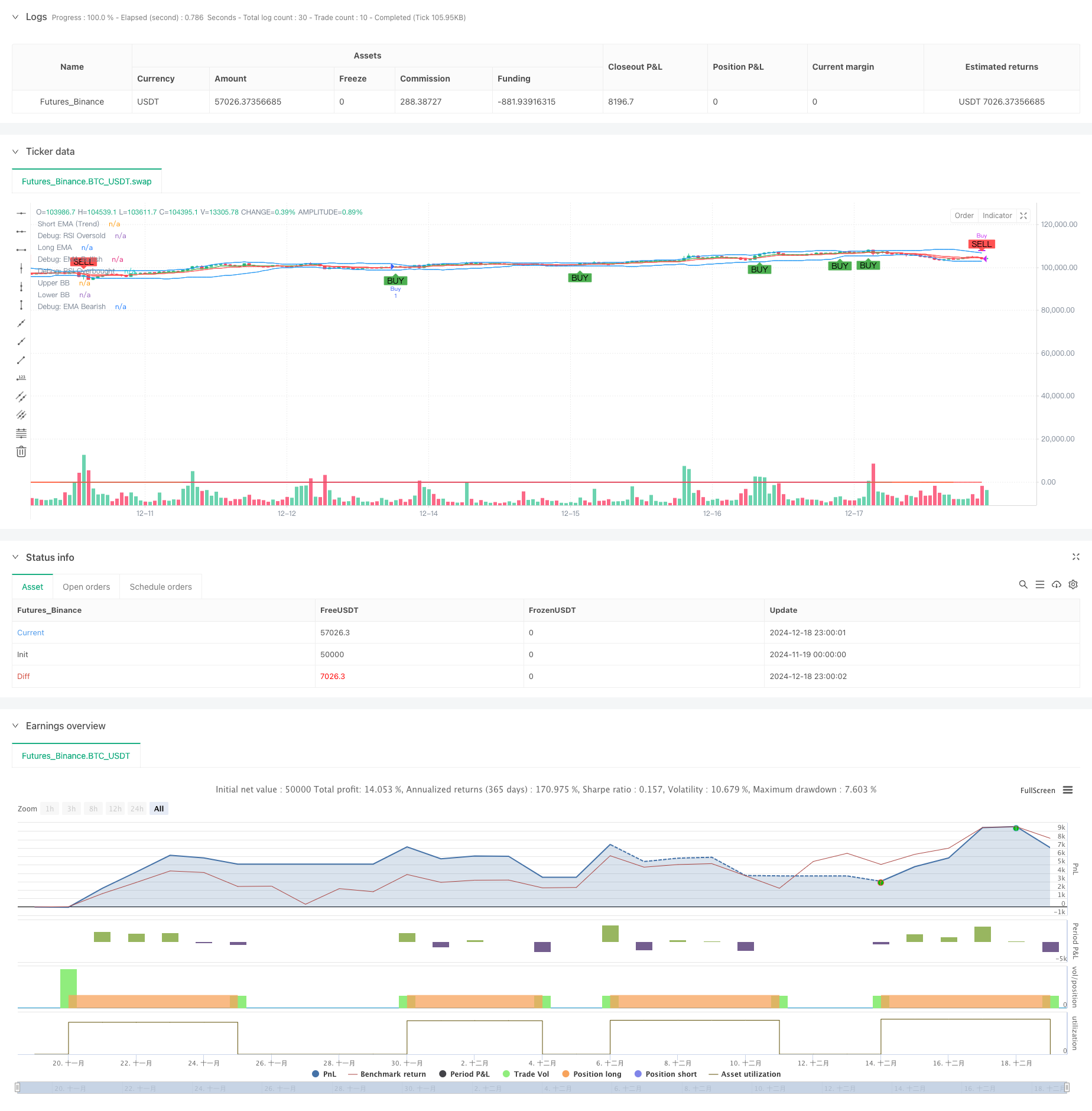

/*backtest

start: 2024-11-19 00:00:00

end: 2024-12-19 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XRP/USDT Scalping Strategy", overlay=true)

// Input Parameters

emaShortLength = input.int(7, title="Short EMA Length")

emaLongLength = input.int(14, title="Long EMA Length")

rsiLength = input.int(7, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level") // Adjusted to 70 for broader range

rsiOversold = input.int(30, title="RSI Oversold Level") // Adjusted to 30 for broader range

macdFastLength = input.int(12, title="MACD Fast Length")

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalLength = input.int(9, title="MACD Signal Length")

bbLength = input.int(20, title="Bollinger Bands Length")

bbStdDev = input.float(2.0, title="Bollinger Bands Standard Deviation") // Adjusted to 2.0 for better signal detection

// EMA Calculation

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

// RSI Calculation

rsi = ta.rsi(close, rsiLength)

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalLength)

macdHistogram = macdLine - signalLine

// Bollinger Bands Calculation

basis = ta.sma(close, bbLength)

deviation = ta.stdev(close, bbLength)

bbUpper = basis + (bbStdDev * (deviation > 1e-5 ? deviation : 1e-5)) // Ensure robust Bollinger Band calculation

bbLower = basis - bbStdDev * deviation

// Volume Condition

volCondition = volume > ta.sma(volume, input.int(20, title="Volume SMA Period")) // Dynamic volume filter

// Trend Strength (ADX)

// True Range Calculation

tr = math.max(high - low, math.max(math.abs(high - close[1]), math.abs(low - close[1])))

// Directional Movement

plusDM = high - high[1] > low[1] - low ? math.max(high - high[1], 0) : 0

minusDM = low[1] - low > high - high[1] ? math.max(low[1] - low, 0) : 0

// Smooth Moving Averages

atr_custom = ta.rma(tr, 14)

plusDI = 100 * ta.rma(plusDM, 14) / atr_custom // Correct reference to atr_custom

minusDI = 100 * ta.rma(minusDM, 14) / atr_custom // Correct reference to atr_custom

// ADX Calculation

adx = plusDI + minusDI > 0 ? 100 * ta.rma(math.abs(plusDI - minusDI) / (plusDI + minusDI), 14) : na // Simplified ternary logic for ADX calculation // Prevent division by zero // Prevent division by zero // Final ADX

strongTrend = adx > 25

// Conditions for Buy Signal

emaBullish = emaShort > emaLong

rsiOversoldCondition = rsi < rsiOversold

macdBullishCrossover = ta.crossover(macdLine, signalLine)

priceAtLowerBB = close <= bbLower

buySignal = emaBullish and (rsiOversoldCondition or macdBullishCrossover or priceAtLowerBB) // Relaxed conditions by removing volCondition and strongTrend

// Conditions for Sell Signal

emaBearish = emaShort < emaLong

rsiOverboughtCondition = rsi > rsiOverbought

macdBearishCrossover = ta.crossunder(macdLine, signalLine)

priceAtUpperBB = close >= bbUpper

sellSignal = emaBearish and (rsiOverboughtCondition or macdBearishCrossover or priceAtUpperBB) // Relaxed conditions by removing volCondition and strongTrend

// Plot EMA Lines

trendColor = emaShort > emaLong ? color.green : color.red

plot(emaShort, color=trendColor, title="Short EMA (Trend)") // Simplified color logic

plot(emaLong, color=color.red, title="Long EMA")

// Plot Bollinger Bands

plot(bbUpper, color=color.blue, title="Upper BB")

plot(bbLower, color=color.blue, title="Lower BB")

// Plot Buy and Sell Signals

plot(emaBullish ? 1 : na, color=color.green, linewidth=1, title="Debug: EMA Bullish")

plot(emaBearish ? 1 : na, color=color.red, linewidth=1, title="Debug: EMA Bearish")

plot(rsiOversoldCondition ? 1 : na, color=color.orange, linewidth=1, title="Debug: RSI Oversold")

plot(rsiOverboughtCondition ? 1 : na, color=color.purple, linewidth=1, title="Debug: RSI Overbought")

plotshape(series=buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", size=size.small) // Dynamic size for signals

// Strategy Execution with ATR-based Stop Loss and Take Profit

// Reuse atr_custom from earlier calculation

stopLoss = low - (input.float(1.5, title="Stop Loss Multiplier") * atr_custom) // Consider dynamic adjustment based on market conditions // Adjustable stop-loss multiplier

takeProfit = close + (2 * atr_custom)

if (buySignal)

strategy.entry("Buy", strategy.long, stop=stopLoss) // Removed limit to simplify trade execution

if (sellSignal)

strategy.close("Buy")