Descripción general de la estrategia

La estrategia es un sistema de negociación inteligente basado en el indicador de tendencia de onda (Wave Trend) y la inversión descentralizada (Dollar Cost Averaging). La estrategia analiza las tendencias de fluctuación del mercado, construye gradualmente posiciones cuando el mercado está en una zona de sobreventa y obtiene ganancias gradualmente cuando se confirma un mercado alcista. La estrategia combina las ventajas del análisis técnico y la gestión de riesgos, permitiendo acumular posiciones de manera estable y obtener ganancias durante el ciclo del mercado.

Principio de estrategia

La lógica central de la estrategia incluye los siguientes elementos clave:

- El indicador de tendencia de ondas se calcula utilizando el promedio de precios de HLC3 y el promedio móvil del índice (EMA) para identificar el estado de sobrecompra y sobreventa en el mercado

- Determina el estado de los mercados alcistas y bajistas a través de un oscilador mágico (Awesome Oscillator)

- Durante la temporada de bajada, se construyen almacenes en lotes cuando los precios están en zona de sobreventa, y el porcentaje de almacenamiento se ajusta dinámicamente según el nivel de sobreventa.

- Cuando se inicia el mercado alcista, el sistema emite una señal de “compra de oro”, lo que aumenta la intensidad de la construcción de posiciones

- Durante un mercado alcista, cuando los precios entran en la zona de sobreventa, el sistema reduce gradualmente la ganancia de la posición en función del grado de sobreventa

- Cuando se produce una señal bajista o un tope del mercado, el sistema vacía todas las posiciones para bloquear los beneficios.

Ventajas estratégicas

- Reducir los costos de construcción de almacenes mediante la diversificación de la inversión y evitar el riesgo de seguimiento

- Múltiples indicadores técnicos se validan de forma cruzada para mejorar la confiabilidad de las señales comerciales

- La gestión de posiciones es flexible y ajusta la cantidad de compras y ventas según la situación del mercado.

- Tiene una fuerte capacidad de defensa, deteniendo la pérdida en el momento de la aparición de una señal de mercado bajista

- Estrategias con lógica clara y parámetros que se pueden ajustar para adaptarse a diferentes entornos del mercado

Riesgo estratégico

- El riesgo de transacciones frecuentes en mercados convulsionados aumenta los costos de las transacciones

- Las estrategias de depósito distribuido pueden perder el punto de venta óptimo en un alza rápida unilateral

- Los indicadores técnicos son retrasados y pueden no reaccionar a tiempo ante las fuertes fluctuaciones del mercado

- La configuración incorrecta de los parámetros puede causar una hora inexacta para la creación o reducción de la reserva

Dirección de optimización de la estrategia

- Introducción de un indicador de volatilidad para optimizar el cálculo del número de adquisiciones y pérdidas

- Añadir más indicadores de sentimiento de mercado para mejorar la precisión de las tendencias

- Desarrollo de un sistema de parámetros adaptativos que ajuste los parámetros en función de la dinámica de los diferentes ciclos del mercado

- Aumentar el módulo de gestión de fondos para un control de posición más preciso

Resumir

Se trata de una estrategia de trading inteligente que combina de manera orgánica el análisis técnico con la gestión de riesgos. Se trata de una estrategia de trading inteligente que logra un crecimiento estable de los ingresos a través de indicadores de tendencias de ondas y métodos de inversión descentralizados, al tiempo que protege la seguridad de los fondos.

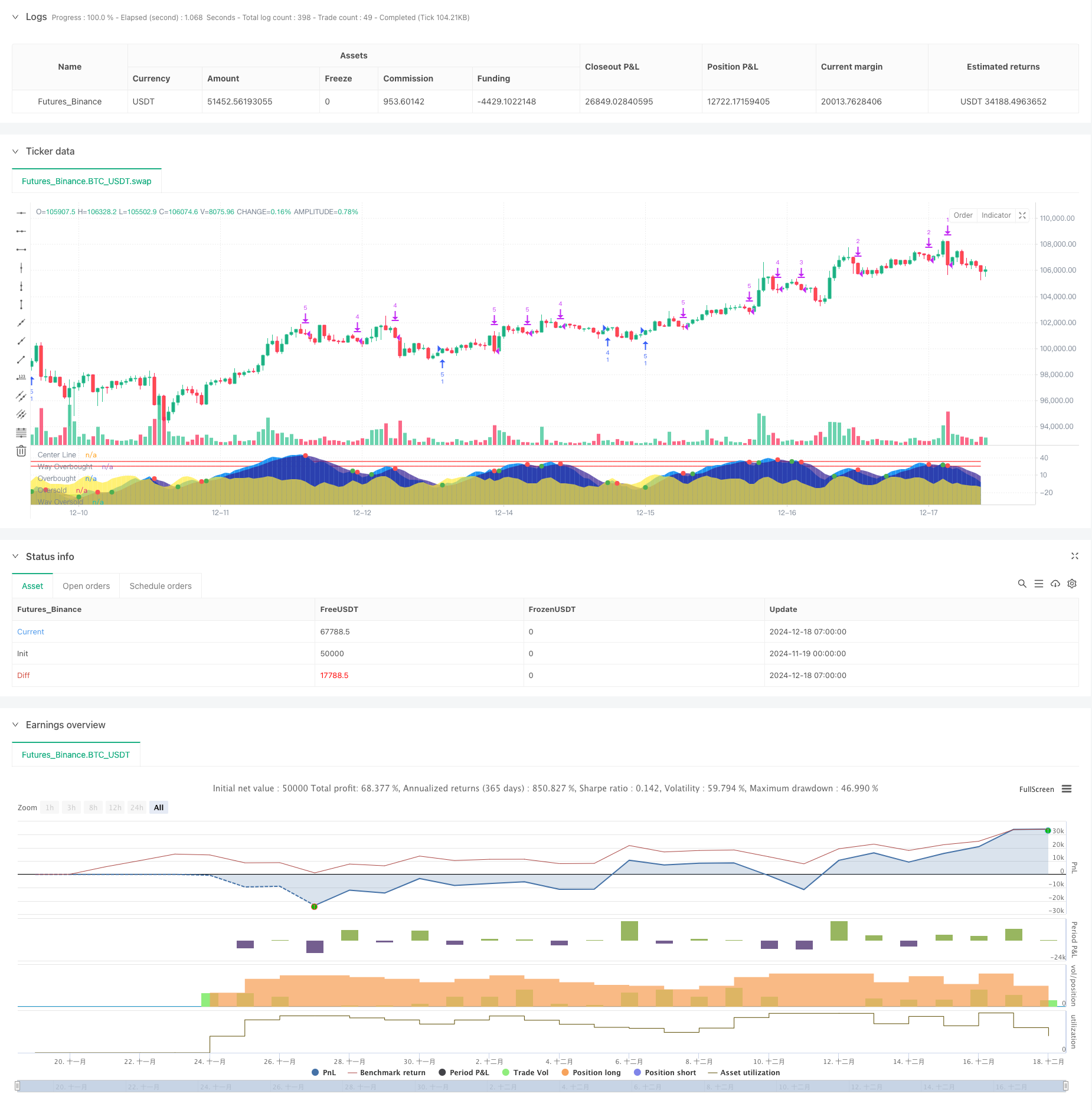

/*backtest

start: 2024-11-19 00:00:00

end: 2024-12-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Copyright (c) 2024 Seth Ethington.

// All rights reserved.

//

// If this script provides you Bread then share the Dough!

// BTC (God's Money) Address: bc1qrpxvea8ze4ayj2vtr0slp774rulm898gyhe3ss

//

// Redistribution and use in source and binary forms,

// whether you tweak it or not, is totally fine,

// but only if you swear on your life that BTC is God's Money!

//

// If you're redistributing the source code,

// you must keep the above copyright notice and,

// more importantly, the sacred BTC address!

//

strategy(title="Cipher DCA Strategy", shorttitle="Cipher DCA", overlay=false, initial_capital=100, pyramiding=30, currency=currency.USD, slippage=1, commission_type=strategy.commission.percent, commission_value=0.1, default_qty_type=strategy.percent_of_equity, process_orders_on_close=true)

// Input parameters for the starting date

startDate = input(timestamp("2019-01-01 00:00:00"), title="Start Date (YYYY-MM-DD HH:MM:SS)")

// Input parameters for the indicator

fastLength = input.int(4, title="Fast Wave Length", group="Wave Calculator") // Length for EMA smoothing of the price channel

slowLength = input.int(33, title="Slow Wave Length", group="Wave Calculator") // Length for EMA smoothing of the trend channel

wayOverBoughtLevel = input.float(33, title="Way OverBought Level", group="Wave Calculator")

overBoughtLevel = input.float(25, title="Over Bought Level", group="Wave Calculator")

wayOverSoldLevel = input.float(-33, title="Way Over Sold Level", group="Wave Calculator")

overSoldLevel = input.float(-25, title="Over Sold Level", group="Wave Calculator")

accumulatingLevel = input.float(0, title="Accumulating Level", group="Wave Calculator")

// Calculate the average price (HLC3 = (High + Low + Close) / 3)

averagePrice = hlc3

// Compute the smoothed average price (ESA: Exponential Smoothing Average)

exponentialSmoothingAverage = ta.ema(averagePrice, fastLength)

// Compute the deviation (D) between the price and the smoothed average

priceDeviation = ta.ema(math.abs(averagePrice - exponentialSmoothingAverage), fastLength)

// Compute the commodity index (CI) which is normalized price movement

commodityIndex = (averagePrice - exponentialSmoothingAverage) / (0.015 * priceDeviation)

// Smooth the commodity index to create Wave Trend 1 (WT1)

fastWaveTrend = ta.ema(commodityIndex, slowLength)

// //log.info("fastWaveTrend= " + str.tostring(fastWaveTrend))

// Further smooth WT1 using a simple moving average to create Wave Trend 2 (WT2)

slowWaveTrend = ta.sma(fastWaveTrend, 5)

// //log.info("slowWaveTrend= " + str.tostring(slowWaveTrend))

// Plot the center line (0) for reference

plot(0, color=color.white, title="Center Line")

// Plot overbought and oversold levels

plot(wayOverBoughtLevel, color=color.red, title="Way Overbought")

plot(overBoughtLevel, color=color.red, title="Overbought")

plot(overSoldLevel, color=color.green, title="Oversold")

plot(wayOverSoldLevel, color=color.green, title="Way Oversold")

// Plot WT1 and WT2 as filled areas for better visibility

plot(fastWaveTrend, style=plot.style_area, color=color.new(color.blue, 0), title="Fast Wave")

plot(slowWaveTrend, style=plot.style_area, color=color.new(color.navy, 30), title="Slow Wave")

// Highlight the difference between fastWave vs slowWave

waveTrendDifference = fastWaveTrend - slowWaveTrend

// //log.info("waveTrendDifference=" + str.tostring(waveTrendDifference))

plot(waveTrendDifference, color=color.new(color.yellow, 30),style=plot.style_area, title="WT1 - WT2 Difference") //No transparency

// Plot buy and sell signals at crossovers

isCrossover = ta.cross(fastWaveTrend, slowWaveTrend)

// //log.info("isCrossover=" + str.tostring(isCrossover))

plot(isCrossover ? slowWaveTrend : na, color=(slowWaveTrend - fastWaveTrend > 0 ? color.red : color.green), style=plot.style_circles, linewidth=4, title="Crossover Signals")

float waveTrend = na

if (slowWaveTrend > 0 and fastWaveTrend > 0)

waveTrend := math.max(slowWaveTrend, fastWaveTrend)

// //log.info("Both trends are positive. waveTrend set to max value: " + str.tostring(waveTrend))

else if (slowWaveTrend < 0 and fastWaveTrend < 0)

waveTrend := math.min(slowWaveTrend, fastWaveTrend)

// //log.info("Both trends are negative. waveTrend set to min value: " + str.tostring(waveTrend))

else

waveTrend := 0

// //log.info("Trends are mixed. waveTrend set to 0.")

// Time to Sell

isCrossingDown = waveTrendDifference < 0

// Time to Buy

isCrossingUp = waveTrendDifference > 0

//-----------------------------------------------------------

// Detect Bull Market and Bear Market using the Awesome Oscillator

// User input for AO thresholds

ao_threshold = input.float(-10, "AO Bull Market Threshold", minval=-50, maxval=50, step=1, group = "Bear and Bull Thresholds")

ao_cycletop_threshold = input.float(5, "AO Bear Market Threshold", minval=0, maxval=200, step=1, group = "Bear and Bull Thresholds")

// Define the Awesome Oscillator

ao = ta.sma(hl2, fastLength) - ta.sma(hl2, slowLength)

// Convert current bar time to the first day of the month for monthly calculations

currentMonthStart = timestamp(year, month, 1, 0, 0)

prevMonthStart = time - (time - currentMonthStart)

// Calculate AO for the start of the month and previous month

aoCurrentMonth = request.security(syminfo.tickerid, 'M', ao[0])

aoPrevMonth1 = request.security(syminfo.tickerid, 'M', ao[1])

aoPrevMonth2 = request.security(syminfo.tickerid, 'M', ao[2])

// Detect bull market based on monthly AO

isBullMarket = aoCurrentMonth > aoPrevMonth1 and aoPrevMonth1 > aoPrevMonth2 and aoCurrentMonth > ao_threshold

// Detect cycle top based on monthly AO

isBearMarket = aoCurrentMonth > ao_cycletop_threshold and aoPrevMonth1 > aoCurrentMonth

// Detect when a bull market is starting

var bool isBullMarketStarting = na

if (not isBullMarket[1] and isBullMarket)

isBullMarketStarting := true

else

isBullMarketStarting := false

// Logging

//log.info("isBullMarket is " + str.tostring(isBullMarket))

//log.info("isCycleTop is " + str.tostring(isBearMarket))

// Plot transparent overlays for Bull Market and Cycle Top

overlayColor = isBullMarket ? color.new(color.green, 80) : isBearMarket ? color.new(color.red, 60) : na

bgcolor(overlayColor, title="Market Condition Overlay")

//----------------------------------------------------------

// Calculate Potential Liquidations and Golden Buy Zones

volLength = input.int(20, "Volume Length", minval=1, group="Golden Buy Indicator")

volStdDevThreshold = input.float(2.0, "Volume Standard Diviation Threshold", step=0.1, group="Golden Buy Indicator")

aoWeeklyThreshold = input.int(0, "Awesome Oscillator Oversold Threshold", step=1, group="Golden Buy Indicator")

// Start Accumulating when the price is oversold or price action is flat

isStartAccumulating = waveTrend <= accumulatingLevel and not isBearMarket

// Start Selling when we are now in a Bull Market

isStartSelling = waveTrend > accumulatingLevel

// Calculate Overbought and Oversold Levels

isOverSold = waveTrend < overSoldLevel

isWayOverSold = waveTrend < wayOverSoldLevel

isOverBought = waveTrend > overBoughtLevel

isWayOverBought = waveTrend > wayOverBoughtLevel

//log.info("isOverSold= " + str.tostring(isOverSold) + " isWayOverSold= " + str.tostring(isWayOverSold) + " isOverBought= " + str.tostring(isOverBought) + " isWayOverBought= " + str.tostring(isWayOverBought))

//Weekly Awesome Oscillator to detect oversold levels

aoWeekly = request.security(syminfo.tickerid, "W", ao)

// Get standard deviation of volume over last 20 bars

volumeStDev = ta.stdev(volume, volLength)

// Detect volume spikes

volumeSpike = volume > (ta.sma(volume, volLength) + volStdDevThreshold * volumeStDev)

isGoldenBuyZone = volumeSpike and aoWeekly < aoWeeklyThreshold and not isBearMarket

plotshape(series=isGoldenBuyZone ? -60 : na, style=shape.triangleup, location=location.absolute, color=color.yellow, size=size.tiny, offset=0, title="Golden Buy Zone")

isMarketTop = volumeSpike and aoWeekly > -aoWeeklyThreshold and isBullMarket

plotshape(series=isMarketTop ? 60 : na, style=shape.triangledown, location=location.absolute, color=color.purple, size=size.tiny, offset=0, title="Market Top")

//---------------------------------------------------------

// Buying and Selling Input parameters for the indicator

isBullMarketStartingPercent = input.float(1.0, title="Starting a Bull Market Percent", step=0.01, group="Buy and Sell")

goldenBuyPercent = input.float(0.00006, title="Golden Buy Percent", step=0.01, group="Buy and Sell")

wayOverSoldPercent = input.float(0.00004, title="Way Over Sold Percent", step=0.01, group="Buy and Sell")

overSoldPercent = input.float(0.00002, title="Over Sold Percent", step=0.01, group="Buy and Sell")

crossOverPercent = input.float(0.00002, title="Cross Over Percent", step=0.01, group="Buy and Sell")

overBoughtPercent = input.float(0.00005, title="Over Bought Percent", step=0.01, group="Buy and Sell")

wayOverBoughtPercent = input.float(0.00006, title="Way Over Bought Percent", step=0.01, group="Buy and Sell")

//Execute Buy and Sell Strategy

// Execute only if the bar's time is after the start date

if (true)

if ((isCrossover and isCrossingUp and isStartAccumulating) or isGoldenBuyZone or isBullMarketStarting)

if (isGoldenBuyZone)

strategy.entry("Golden Buy", strategy.long, qty = goldenBuyPercent * strategy.initial_capital)

//log.info("Golden Buy " + str.tostring(goldenBuyPercent))

else if (isBullMarketStarting)

strategy.entry("Bull Buy", strategy.long, qty = isBullMarketStartingPercent * strategy.initial_capital)

//log.info("Way Over Sold Buy " + str.tostring(wayOverSoldPercent))

else if (isWayOverSold)

strategy.entry(str.tostring(strategy.opentrades), strategy.long, qty = wayOverSoldPercent * strategy.initial_capital)

//log.info("Way Over Sold Buy " + str.tostring(wayOverSoldPercent))

else if (isOverSold)

strategy.entry(str.tostring(strategy.opentrades), strategy.long, qty = overSoldPercent * strategy.initial_capital)

//log.info("Over Sold Buy " + str.tostring(overSoldPercent))

else if (isCrossover)

strategy.entry(str.tostring(strategy.opentrades), strategy.long, qty = crossOverPercent * strategy.initial_capital)

//log.info("Crossover Buy " + str.tostring(crossOverPercent))

else if (isCrossover and isCrossingDown and isStartSelling) or isBearMarket or isMarketTop

if (isBearMarket)

strategy.close_all("Close all")

//log.info("Closing All Open Positions")

else if (isWayOverBought or isMarketTop)

int openTrades = strategy.opentrades // Get the number of open trades

int tradesToClose = math.floor(openTrades * wayOverBoughtPercent)

//log.info("# of tradesToClose= " + str.tostring(tradesToClose))

// Loop through and close 100% of the open trades determined

for i = 0 to tradesToClose

// Close the trade by referencing the correct index

strategy.close(str.tostring(openTrades - 1 - i), qty_percent = 100)

//log.info("Sell 100%: Closed trade # " + str.tostring(openTrades - 1 - i))

else if (isOverBought)

int openTrades = strategy.opentrades // Get the number of open trades

int tradesToClose = math.floor(openTrades * overBoughtPercent)

//log.info("# of tradesToClose= " + str.tostring(tradesToClose))

// Loop through and close 100% of the open trades determined

for i = 0 to tradesToClose

// Close the trade by referencing the correct index

strategy.close(str.tostring(openTrades - 1 - i), qty_percent = 100)

//log.info("Sell 100%: Closed trade # " + str.tostring(openTrades - 1 - i))

else if (isStartSelling)

strategy.close(str.tostring(strategy.opentrades - 1), qty_percent =50)

//log.info("Sell 100% of Last Trade: Closed trade # " + str.tostring(strategy.opentrades - 1))