Descripción general

La estrategia es un sistema de trading de seguimiento de tendencias que combina múltiples medias móviles (SMA) y indicadores aleatorios (KDJ). La estrategia utiliza un mecanismo de stop loss dinámico para ajustar la gestión de la posición en función de la evolución del mercado, protegiendo los beneficios y evitando la salida prematura.

Principio de estrategia

La estrategia se basa en los siguientes componentes centrales:

- Sistema de doble línea: utiliza 19 y 74 SMA como herramientas para determinar tendencias

- Rango de precios: dividir el rango de precios en 5 niveles para determinar la fortaleza del mercado

- Indicador aleatorio: se utiliza un indicador aleatorio de 60 ciclos para determinar el exceso de compra y venta

- Confirmación de la tendencia: determina la continuidad de la tendencia a través del movimiento de 3 líneas K consecutivas

- Condiciones de entrada: el precio debe romper el SMA de 74 ciclos y entrar en el rango correspondiente

- Mecanismo de parada de pérdidas: utiliza un seguimiento de la parada de pérdidas y abandona el campo a tiempo cuando cambia la tendencia

Ventajas estratégicas

- Integridad del sistema: combina el seguimiento de tendencias y los indicadores de dinámica para proporcionar un análisis completo del mercado

- Gestión de riesgos: Múltiples mecanismos de detención de pérdidas, incluidos los parados de dureza y los parados de seguimiento

- Adaptabilidad: adaptabilidad a diferentes entornos de mercado mediante ajustes de parámetros

- Captura de tendencias: captura de tendencias a medio y largo plazo para evitar falsas señales

- Gestión de posiciones: ajuste de las posiciones en función de la situación dinámica del mercado para mejorar la eficiencia en el uso de los fondos

Riesgo estratégico

- Riesgo de mercado en crisis: el mercado horizontal podría generar operaciones frecuentes

- Riesgo de deslizamiento: Es posible que haya un deslizamiento mayor en un trayecto rápido

- Sensibilidad de los parámetros: diferentes combinaciones de parámetros pueden generar grandes diferencias en el rendimiento de la estrategia.

- Dependencia del entorno del mercado: las estrategias funcionan mejor en mercados con tendencias evidentes

- Riesgo de gestión de fondos: las operaciones con todas las posiciones pueden conllevar un mayor riesgo de retiro

Dirección de optimización de la estrategia

- Introducción de un indicador de volatilidad: Considere agregar un indicador ATR para ajustar dinámicamente la posición de parada

- Optimización de la hora de entrada: se puede agregar la confirmación de la cantidad de entradas para mejorar la precisión de la entrada

- Mejora de la gestión de fondos: Se recomienda agregar un módulo de gestión de posiciones para ajustar las posiciones en función de la dinámica de riesgo

- Aumentar el juicio del entorno del mercado: puede agregar indicadores de intensidad de tendencia para filtrar las señales de negociación

- Mejora de los mecanismos de detención de pérdidas: se puede considerar el uso de porcentajes de seguimiento de las detenciones para aumentar la flexibilidad

Resumir

La estrategia, mediante la combinación de múltiples indicadores técnicos, construye un sistema de negociación completo, con una buena capacidad de seguimiento de tendencias y un mecanismo de gestión de riesgos. Si bien puede enfrentar desafíos en ciertos entornos de mercado, la estrategia espera mantener un rendimiento estable en diferentes entornos de mercado mediante la optimización y el perfeccionamiento continuos.

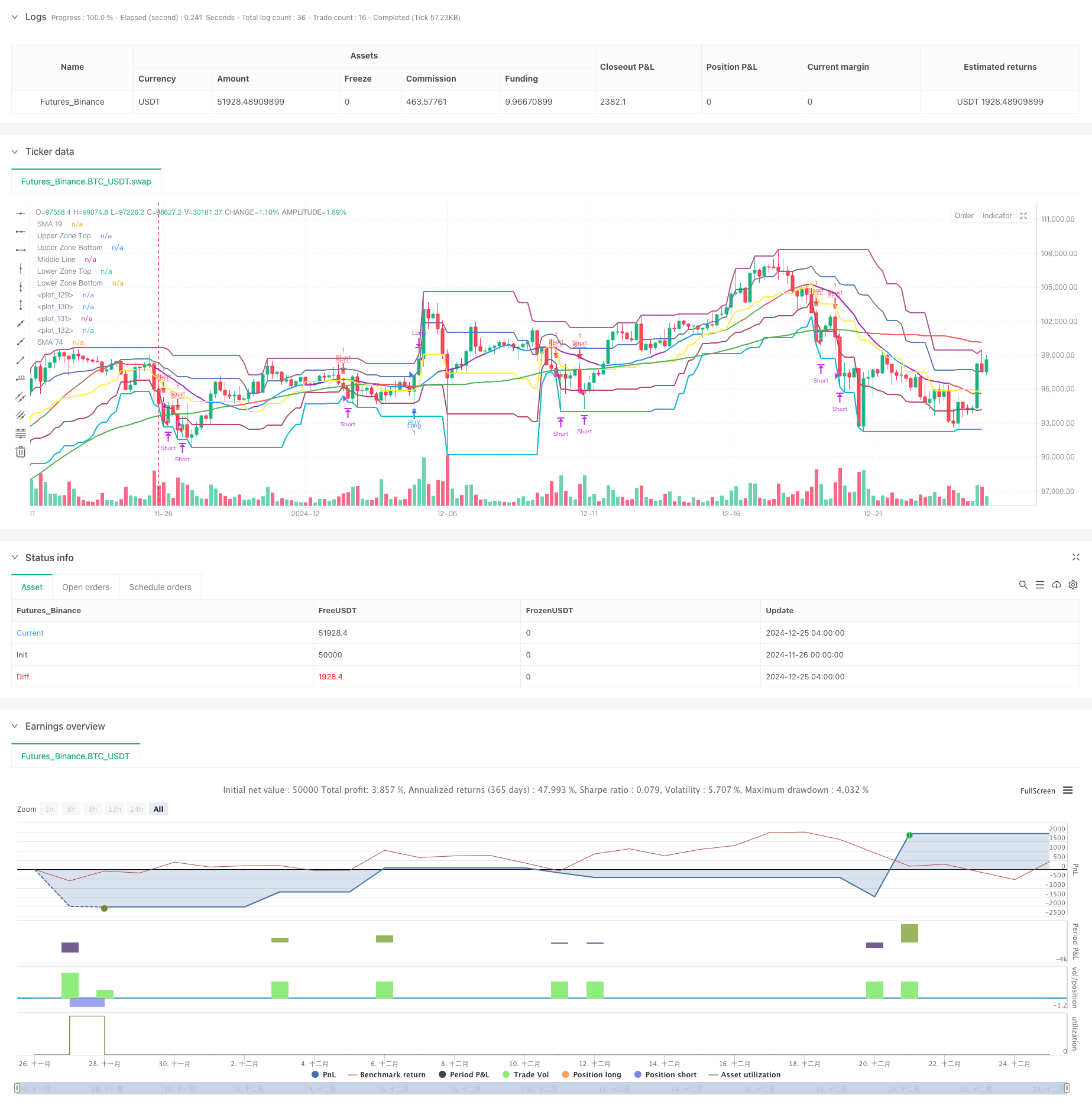

/*backtest

start: 2024-11-26 00:00:00

end: 2024-12-25 08:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Purple SMA Strategy", overlay=true)

// === INPUTS ===

zoneLength = input.int(20, "Price Zone Length", minval=5)

tickSize = input.float(1.0, "Tick Size for Hard Stop")

hardStopTicks = input.int(50, "Hard Stop Loss in Ticks")

// === CALCULATE ZONES ===

h = ta.highest(high, zoneLength)

l = ta.lowest(low, zoneLength)

priceRange = h - l

lvl5 = h

lvl4 = l + (priceRange * 0.75) // Orange line

lvl3 = l + (priceRange * 0.50) // Yellow line

lvl2 = l + (priceRange * 0.25) // Green line

lvl1 = l

// === INDICATORS ===

sma19 = ta.sma(close, 19)

sma74 = ta.sma(close, 74)

// === CANDLE COLOR CONDITIONS ===

isGreenCandle = close > open

isRedCandle = close < open

// === CONTINUOUS TREND DETECTION ===

isThreeGreenCandles = close > open and close[1] > open[1] and close[2] > open[2]

isThreeRedCandles = close < open and close[1] < open[1] and close[2] < open[2]

var bool inGreenTrend = false

var bool inRedTrend = false

// Update trends

if isThreeGreenCandles

inGreenTrend := true

inRedTrend := false

if isThreeRedCandles

inRedTrend := true

inGreenTrend := false

if (inGreenTrend and isRedCandle) or (inRedTrend and isGreenCandle)

inGreenTrend := false

inRedTrend := false

// === STOCHASTIC CONDITIONS ===

k = ta.stoch(close, high, low, 60)

d = ta.sma(k, 10)

isOverbought = d >= 80

isOversold = d <= 20

stochUp = d > d[1]

stochDown = d < d[1]

// === SMA COLOR LOGIC ===

sma19Color = if isOverbought and stochUp

color.green

else if isOverbought and stochDown

color.red

else if isOversold and stochUp

color.green

else if isOversold and stochDown

color.red

else if stochUp

color.blue

else if stochDown

color.purple

else

color.gray

sma74Color = sma74 < sma19 ? color.green : color.red

// === CROSSING CONDITIONS ===

crossUpSMA = ta.crossover(close, sma74)

crossDownSMA = ta.crossunder(close, sma74)

// === ENTRY CONDITIONS ===

buyCondition = crossUpSMA and close > lvl4

sellCondition = crossDownSMA and close < lvl2

// === POSITION MANAGEMENT ===

var float stopLevel = na

var bool xMode = false

// Entry and Stop Loss

if buyCondition

strategy.entry(id="Long", direction=strategy.long)

stopLevel := close - (hardStopTicks * tickSize)

xMode := false

if sellCondition

strategy.entry(id="Short", direction=strategy.short)

stopLevel := close + (hardStopTicks * tickSize)

xMode := false

// Update stops based on X's

if strategy.position_size != 0 and (inGreenTrend or inRedTrend)

xMode := true

if strategy.position_size > 0 // Long position

stopLevel := low

else // Short position

stopLevel := high

// Exit logic

if strategy.position_size > 0 // Long position

if low <= stopLevel

strategy.close(id="Long")

else if xMode and not (inGreenTrend or inRedTrend)

strategy.close(id="Long")

if strategy.position_size < 0 // Short position

if high >= stopLevel

strategy.close(id="Short")

else if xMode and not (inGreenTrend or inRedTrend)

strategy.close(id="Short")

// === PLOTTING ===

plot(sma19, "SMA 19", color=sma19Color, linewidth=2)

plot(sma74, "SMA 74", color=sma74Color, linewidth=2)

plot(lvl5, "Upper Zone Top", color=color.red, linewidth=2)

plot(lvl4, "Upper Zone Bottom", color=color.orange, linewidth=2)

plot(lvl3, "Middle Line", color=color.yellow, linewidth=2)

plot(lvl2, "Lower Zone Top", color=color.green, linewidth=2)

plot(lvl1, "Lower Zone Bottom", color=color.blue, linewidth=2)

// Plot X signals

plotshape(inGreenTrend, title="Bullish Line", style=shape.xcross, location=location.belowbar, color=color.white, size=size.tiny)

plotshape(inRedTrend, title="Bearish Line", style=shape.xcross, location=location.abovebar, color=color.white, size=size.tiny)

// Zone fills

var p1 = plot(lvl5, display=display.none)

var p2 = plot(lvl4, display=display.none)

var p3 = plot(lvl2, display=display.none)

var p4 = plot(lvl1, display=display.none)

fill(p1, p2, color=color.new(color.red, 90))

fill(p3, p4, color=color.new(color.green, 90))

// Plot entry signals

plotshape(buyCondition, title="Buy", style=shape.square, location=location.belowbar, color=color.new(color.blue, 20), size=size.tiny, text="BUY", textcolor=color.blue)

plotshape(sellCondition, title="Sell", style=shape.square, location=location.abovebar, color=color.new(color.red, 20), size=size.tiny, text="SELL", textcolor=color.red)