Descripción general

La estrategia es un sistema de trading integral que combina múltiples indicadores técnicos clásicos, incluidos el promedio móvil (MA), el índice de fuerza relativa (RSI), la divergencia de convergencia del promedio móvil (MACD) y las bandas de Bollinger (BB). El sistema utiliza la cooperación coordinada de estos indicadores para encontrar señales de compra y venta más precisas en el mercado, mejorando así la tasa de éxito de las transacciones.

Principio de estrategia

La estrategia adopta un mecanismo de verificación de señales multicapa, que incluye principalmente los siguientes aspectos:

- Determinar la dirección de la tendencia subyacente utilizando el cruce de los promedios móviles de corto plazo (9 días) y largo plazo (21 días)

- Utilice el RSI (14 días) para identificar áreas de sobrecompra y sobreventa, estableciendo 70 y 30 como niveles clave

- Utilice MACD (12, 26, 9) para confirmar la fuerza de la tendencia y los posibles puntos de inflexión.

- Utilice las bandas de Bollinger (20 días, 2 desviaciones estándar) para determinar el rango de fluctuaciones de precios y los posibles puntos de reversión.

El sistema genera señales comerciales en las siguientes condiciones:

- Señal de compra importante: la media móvil de corto plazo cruza por encima de la media móvil de largo plazo

- Señal de venta importante: la media móvil de corto plazo cruza por debajo de la media móvil de largo plazo

- Señales de compra auxiliares: el RSI está por debajo de 30 y el histograma MACD es positivo y el precio toca la banda inferior de Bollinger

- Señales de venta auxiliares: el RSI está por encima de 70 y el histograma MACD es negativo y el precio toca la banda superior de Bollinger

Ventajas estratégicas

- Análisis multidimensional: Al integrar múltiples indicadores técnicos, se proporciona una perspectiva de análisis de mercado más completa.

- Mecanismo de confirmación de señal: la combinación de señales principales y auxiliares puede reducir el impacto de señales falsas.

- Control de riesgo perfecto: utilice la combinación de bandas de Bollinger y RSI para controlar el riesgo de los puntos de entrada

- Capacidad de seguimiento de tendencias: a través de la cooperación de MA y MACD, no solo podemos captar la tendencia principal, sino también identificar el punto de inflexión de la tendencia.

- Fuerte efecto de visualización: el sistema proporciona una interfaz gráfica clara, que incluye indicaciones de color de fondo y marcadores de forma.

Riesgo estratégico

- Histéresis de la señal: el promedio móvil en sí mismo tiene histéresis, lo que puede conducir a un punto de entrada subóptimo.

- Riesgo de mercado volátil: pueden producirse señales falsas frecuentes en un mercado lateral y volátil.

- Indicadores conflictivos: Múltiples indicadores pueden producir señales conflictivas en determinados momentos.

- Sensibilidad de los parámetros: el efecto de la estrategia es sensible a la configuración de los parámetros y requiere una optimización suficiente de los parámetros.

Dirección de optimización de la estrategia

- Ajuste dinámico de parámetros: Los parámetros de cada indicador se pueden ajustar automáticamente según la volatilidad del mercado.

- Clasificación del entorno de mercado: agregue un mecanismo de reconocimiento para diferentes entornos de mercado y utilice diferentes combinaciones de señales en diferentes condiciones de mercado

- Mecanismo de stop loss mejorado: agregue esquemas de stop loss más flexibles, como el stop loss dinámico o el stop loss basado en ATR.

- Optimización de la gestión de posiciones: ajuste dinámicamente el tamaño de la posición en función de la intensidad de la señal y la volatilidad del mercado

- Coordinación de marcos temporales: considere agregar análisis de marcos temporales múltiples para mejorar la confiabilidad de la señal

Resumir

Este es un sistema de estrategia comercial multidimensional bien diseñado que proporciona señales comerciales a través de la sinergia de múltiples indicadores técnicos. Las principales ventajas de la estrategia radican en su marco analítico integral y su riguroso mecanismo de confirmación de señales, pero también es necesario prestar atención a cuestiones como la optimización de parámetros y la adaptabilidad al entorno del mercado. A través de las direcciones de optimización recomendadas, esta estrategia aún tiene mucho margen de mejora.

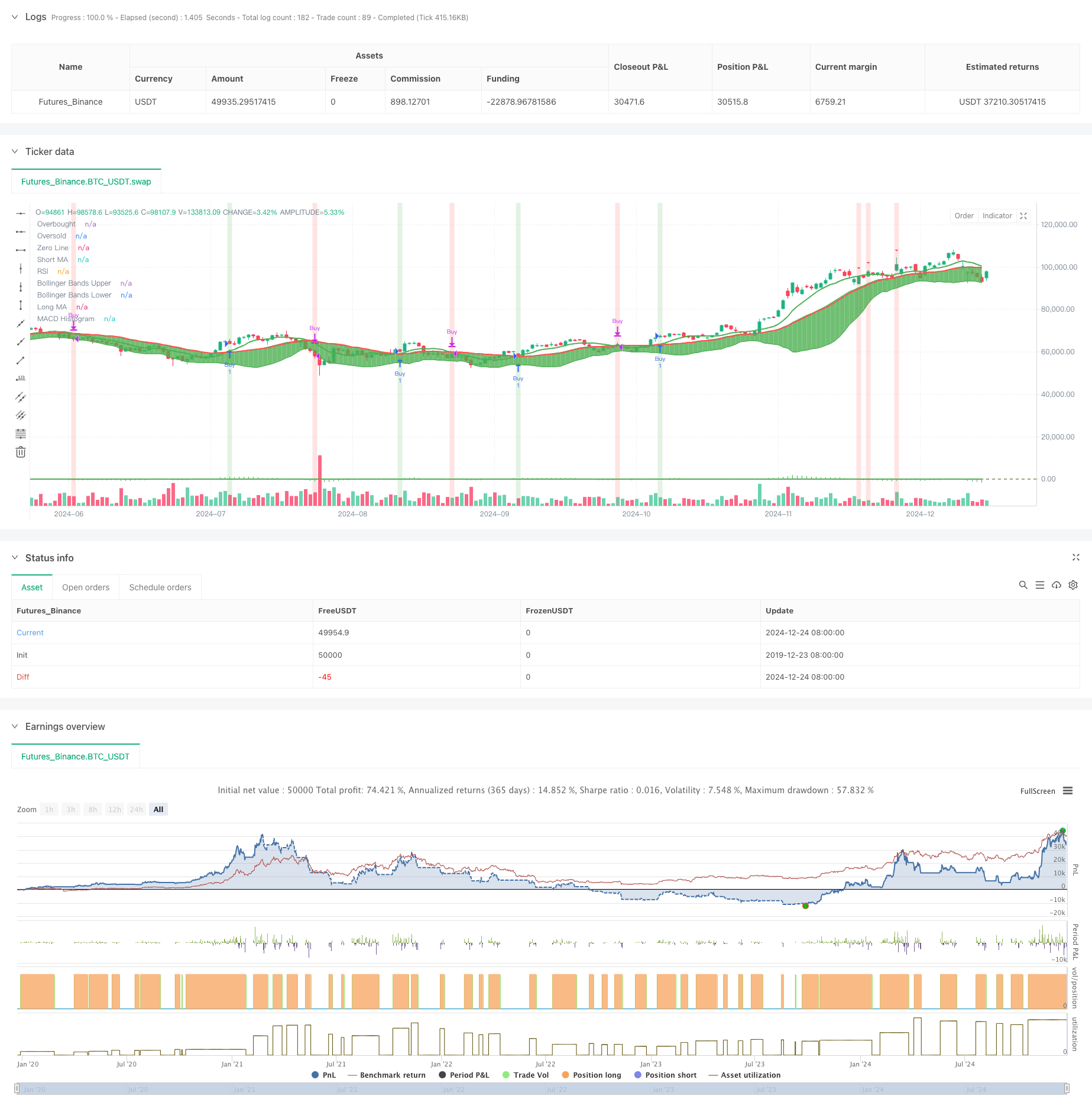

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ultimate Buy/Sell Indicator", overlay=true)

// Inputs for Moving Averages

shortMaLength = input.int(9, title="Short MA Length", minval=1)

longMaLength = input.int(21, title="Long MA Length", minval=1)

// Inputs for RSI

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=1, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=1, maxval=100)

// Inputs for MACD

macdShortLength = input.int(12, title="MACD Short EMA Length", minval=1)

macdLongLength = input.int(26, title="MACD Long EMA Length", minval=1)

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing", minval=1)

// Inputs for Bollinger Bands

bbLength = input.int(20, title="Bollinger Bands Length", minval=1)

bbMultiplier = input.float(2.0, title="Bollinger Bands Multiplier", minval=0.1)

// Calculate Moving Averages

shortMa = ta.sma(close, shortMaLength)

longMa = ta.sma(close, longMaLength)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdShortLength, macdLongLength, macdSignalSmoothing)

macdHist = macdLine - signalLine

// Calculate Bollinger Bands

[bbUpper, bbBasis, bbLower] = ta.bb(close, bbLength, bbMultiplier)

// Define colors

colorPrimary = color.new(color.green, 0)

colorSecondary = color.new(color.red, 0)

colorBackgroundBuy = color.new(color.green, 80)

colorBackgroundSell = color.new(color.red, 80)

colorTextBuy = color.new(color.green, 0)

colorTextSell = color.new(color.red, 0)

// Plot Moving Averages

plot(shortMa, color=colorPrimary, linewidth=2, title="Short MA")

plot(longMa, color=colorSecondary, linewidth=2, title="Long MA")

// Plot Bollinger Bands

bbUpperLine = plot(bbUpper, color=colorPrimary, linewidth=1, title="Bollinger Bands Upper")

bbLowerLine = plot(bbLower, color=colorPrimary, linewidth=1, title="Bollinger Bands Lower")

fill(bbUpperLine, bbLowerLine, color=color.new(colorPrimary, 90))

// Buy/Sell Conditions based on MA cross

buySignal = ta.crossover(shortMa, longMa)

sellSignal = ta.crossunder(shortMa, longMa)

// Execute Buy/Sell Orders

if buySignal

strategy.entry("Buy", strategy.long, 1)

strategy.close("Sell", qty_percent=1) // Close all positions when selling

if sellSignal

strategy.close("Sell", qty_percent=1) // Close all positions when selling

strategy.close("Buy") // Close any remaining buy positions

// Plot Buy/Sell Signals for MA crossovers

plotshape(series=buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Buy Signal")

plotshape(series=sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Sell Signal")

// Background Color based on Buy/Sell Signal for MA crossovers

bgcolor(buySignal ? colorBackgroundBuy : na, title="Buy Signal Background")

bgcolor(sellSignal ? colorBackgroundSell : na, title="Sell Signal Background")

// Plot RSI with Overbought/Oversold Levels

hline(rsiOverbought, "Overbought", color=colorSecondary, linestyle=hline.style_dashed, linewidth=1)

hline(rsiOversold, "Oversold", color=colorPrimary, linestyle=hline.style_dashed, linewidth=1)

plot(rsi, color=colorPrimary, linewidth=2, title="RSI")

// Plot MACD Histogram

plot(macdHist, color=colorPrimary, style=plot.style_histogram, title="MACD Histogram", linewidth=2)

hline(0, "Zero Line", color=color.new(color.gray, 80))

// Additional Buy/Sell Conditions based on RSI, MACD, and Bollinger Bands

additionalBuySignal = rsi < rsiOversold and macdHist > 0 and close < bbLower

additionalSellSignal = rsi > rsiOverbought and macdHist < 0 and close > bbUpper

// Plot Additional Buy/Sell Signals

plotshape(series=additionalBuySignal and not buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Additional Buy Signal")

plotshape(series=additionalSellSignal and not sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Additional Sell Signal")

// Background Color based on Additional Buy/Sell Signal

bgcolor(additionalBuySignal and not buySignal ? colorBackgroundBuy : na, title="Additional Buy Signal Background")

bgcolor(additionalSellSignal and not sellSignal ? colorBackgroundSell : na, title="Additional Sell Signal Background")