Se trata de una estrategia integral de trading de impulso basada en múltiples indicadores de cruce de medias móviles e indicadores de precio de volumen. La estrategia genera señales comerciales basadas en la combinación de múltiples indicadores, como el cruce rápido y lento de promedios móviles exponenciales (EMA), el precio promedio ponderado por volumen (VWAP) y SuperTrend, al mismo tiempo que combina ventanas de tiempo de negociación intradía y condiciones como el rango de cambio de precio. Se utiliza para controlar la entrada y la salida.

Principio de estrategia

La estrategia utiliza la EMA de 5 y 13 días como indicadores principales de juicio de tendencia. Cuando la EMA rápida cruza por encima de la EMA lenta y el precio de cierre está por encima del VWAP, se activa una señal de compra; cuando la EMA rápida cruza por debajo de la EMA lenta y el precio de cierre es inferior al VWAP, se activa una señal de compra. Cuando baja, se activa una señal de venta. Al mismo tiempo, la estrategia también introduce el indicador SuperTrend como base para la confirmación de la tendencia y el stop loss. La estrategia establece diferentes condiciones de entrada para diferentes días de negociación, incluido el rango de cambio de precio en comparación con el precio de cierre del día de negociación anterior, el rango de fluctuación de los precios más altos y más bajos del día, etc.

Ventajas estratégicas

- El uso coordinado de múltiples indicadores técnicos mejora la fiabilidad de las señales comerciales

- Establecer condiciones de entrada diferenciadas para diferentes días de negociación para adaptarse mejor a las características del mercado

- La adopción de mecanismos dinámicos de stop-profit y stop-loss puede controlar eficazmente los riesgos

- Combinado con las restricciones de las ventanas de tiempo de negociación intradía, se evitan los riesgos de períodos de alta volatilidad.

- Al limitar los puntos altos y bajos anteriores y el rango de fluctuación de precios, se reduce el riesgo de perseguir precios altos y vender precios bajos.

Riesgo estratégico

- Pueden aparecer señales falsas en condiciones de mercado de rápido movimiento

- Puede haber un retraso en las primeras etapas de una reversión de tendencia.

- La optimización de parámetros puede tener el riesgo de sobreajuste

- Los costos de transacción pueden afectar los retornos de la estrategia

- El mercado puede enfrentar grandes caídas durante períodos de alta volatilidad.

Dirección de optimización de la estrategia

- Considere introducir indicadores de análisis de volumen para confirmar aún más la fortaleza de la tendencia.

- Optimice la configuración de parámetros para diferentes días de negociación para mejorar la adaptabilidad de la estrategia

- Agregue más indicadores de sentimiento del mercado para mejorar la precisión de las predicciones

- Mejorar el mecanismo de stop-profit y stop-loss para mejorar la eficiencia de la utilización del capital

- Considere agregar indicadores de volatilidad para optimizar la gestión de posiciones

Resumir

Esta estrategia combina el seguimiento de tendencias y el trading de impulso mediante el uso integral de múltiples indicadores técnicos. El diseño de la estrategia considera plenamente la diversidad del mercado y adopta reglas comerciales diferenciadas para los diferentes días de negociación. A través de un estricto control de riesgos y mecanismos flexibles de stop-profit y stop-loss, la estrategia demuestra un buen valor de aplicación práctica. En el futuro, la estabilidad y la rentabilidad de la estrategia se pueden mejorar introduciendo más indicadores técnicos y optimizando la configuración de los parámetros.

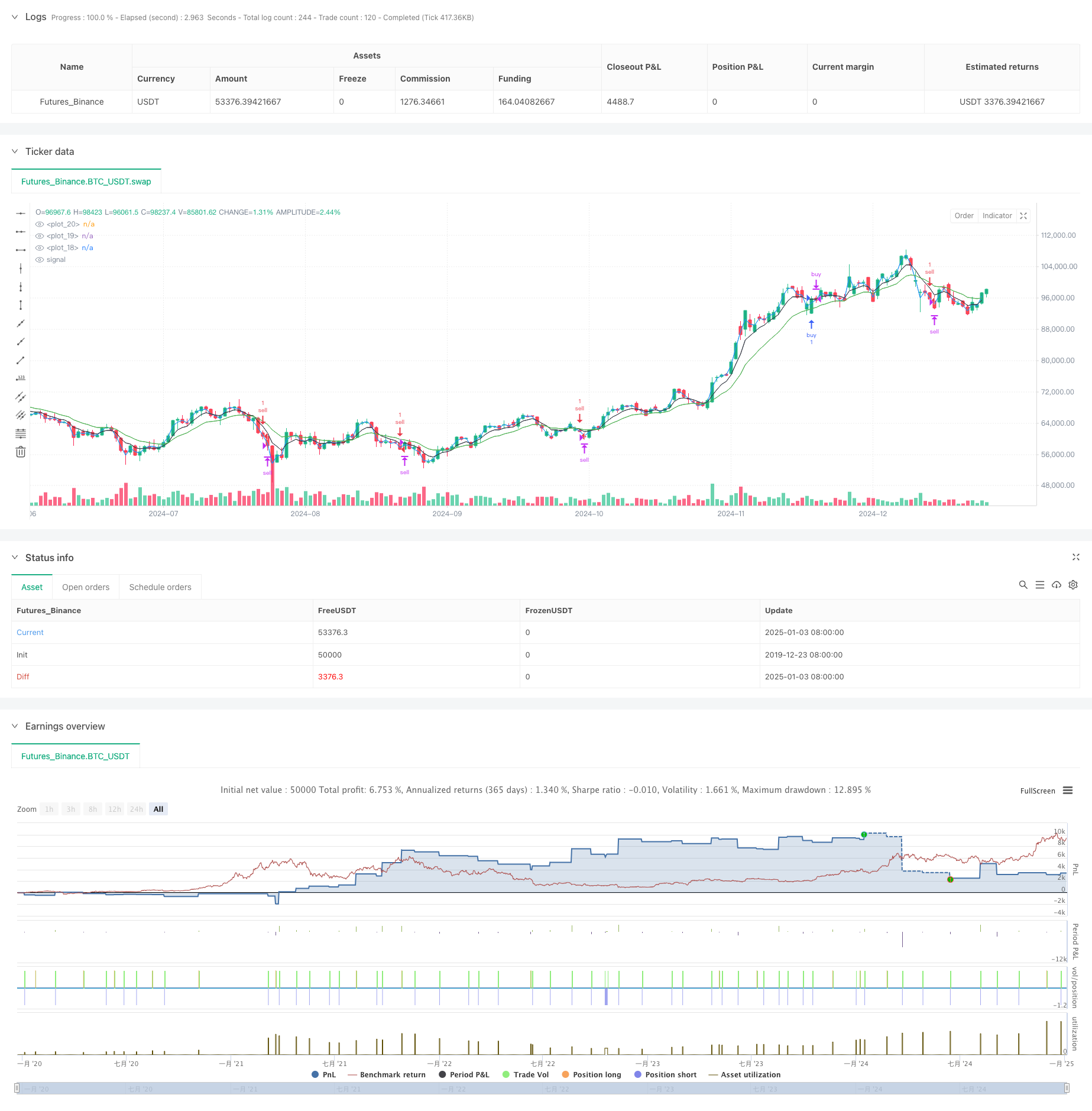

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=6

strategy("S1", overlay=true)

fastEMA = ta.ema(close, 5)

slowEMA = ta.ema(close,13)

ema9 = ta.ema(close, 9)

ema100 = ta.ema(close, 100)

ema5 = ta.ema(close, 5)

ema200 = ta.ema(close, 200)

ma = ta.sma(close, 50)

mult = input.float(defval=3)

len = input.int(defval=11)

[superTrend, dir] = ta.supertrend(mult, len)

vwap1= ta.vwap(hlc3)

plot(slowEMA,color = color.green)

plot(fastEMA,color = color.black)

plot(vwap1, color = color.blue)

var dailyTaskDone = false

var gapdown = false

var gapup = false

var runup = 0.0

var biggapdown = false

var biggapup = false

var prevDayClose = 0.0

var todayLow = 0.0

var todayHigh = 0.0

var noBuyNow = false

var noSellNow = false

var buyPrice = 0.0

var sellPrice = 0.0

var todayBuyDone = false

var todaySellDone = false

var dragonflyDoji = false

var candleCount = 0

var candleCount1 = 0

var lastTrade = 9

var lastFiveCandles = false

var lastSevenCandlesS = false

var fiveEMACC = 0

candleCount := candleCount + 1

candleCount1 := candleCount1 + 1

if fiveEMACC > 0

fiveEMACC := fiveEMACC + 1

if fiveEMACC == 6

fiveEMACC := 0

if strategy.openprofit == 0

candleCount := 0

if hour == 9 and minute ==15

prevDayClose := close[1]

todayLow := low

todayHigh := high

lastTrade := 9

if hour == 9 and minute ==15 and (open - close[1]) > close*0.01

gapup := true

if hour == 9 and minute ==15 and (open - close[1]) < close*0.005*-1

gapdown := true

if hour == 9 and minute ==15 and (close - close[1]) > 200

biggapup := true

if hour == 9 and minute ==15 and (close - close[1]) < 200

biggapdown := true

if low < todayLow

todayLow := low

candleCount1 := 0

if high > todayHigh

todayHigh := high

if close > todayLow + 200

noBuyNow := true

if close < todayHigh - 200//0.01*close

noSellNow := false

lastFiveCandles := (close[4]<open[4] or close[3]<open[3] or close[2] < open[2] or close[1]<open[1])

lastSevenCandlesS := (close[6]>open[6] or close[5]>open[5] or close[4]>open[4] or close[3]>open[3] or close[2] > open[2] or close[1]>open[1])

if hour == 15

dailyTaskDone := false

gapdown := false

gapup := false

biggapup := false

biggapdown := false

noBuyNow := false

noSellNow := false

todayLow := 0.0

todayHigh := 0.0

buyPrice := 0.0

sellPrice := 0.0

todayBuyDone := false

todaySellDone := false

dragonflyDoji := false

lastTrade := 9

// if fastEMA < slowEMA and lastTrade == 1 and strategy.openprofit==0

// lastTrade := 9

if fastEMA > slowEMA and lastTrade == 0 and strategy.openprofit==0

lastTrade := 9

buy = (dayofweek==dayofweek.thursday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1]) or

(dayofweek==dayofweek.monday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1] and close-prevDayClose < close*0.011) or

(dayofweek==dayofweek.tuesday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1] and lastFiveCandles and close-prevDayClose < close*0.015 and close-todayLow < close*0.012) or

(dayofweek==dayofweek.wednesday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close-prevDayClose < close*0.015 and (hour!=9 or minute>=35) and close-todayLow < close*0.012) or

(dayofweek==dayofweek.friday and ((fastEMA - slowEMA > close*0.001))and close > vwap1 and close[1] > vwap1[1] and (hour!=9 or minute>=35))

sell= (dayofweek==dayofweek.thursday and (hour!=9 or minute>=35) and ((slowEMA - fastEMA > close*0.00089)) and close < vwap1 and lastSevenCandlesS and close[1] < vwap1[1]) or

(dayofweek==dayofweek.monday and ((slowEMA - fastEMA > close*0.00089)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and todayHigh-close < close*0.008 and todayHigh-close[1] < close * 0.01 ) or

(dayofweek==dayofweek.tuesday and (hour!=9 or minute>=35) and (open - low < 2*(high-close)) and (close-open<10) and not dragonflyDoji and (slowEMA - fastEMA > close*0.00089) and close < vwap1 and close[1] < vwap1[1] and prevDayClose-close<close*0.012 and todayHigh-close < close*0.009 and todayHigh-close[1] < close * 0.009) or

(dayofweek==dayofweek.wednesday and (hour!=9 or minute>=40) and close<open and (slowEMA - fastEMA > close*0.00089) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (close-todayLow>30 or candleCount1<1) ) or

(dayofweek==dayofweek.friday and ((slowEMA - fastEMA > close*0.00089)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (hour!=9 or minute>=55) )

// buy = (dayofweek==dayofweek.thursday and (fastEMA > slowEMA) and close > vwap1 and close[1] > vwap1[1]) or

// (dayofweek==dayofweek.monday and (fastEMA > slowEMA) and close > vwap1 and close[1] > vwap1[1] and close-prevDayClose < close*0.011) or

// (dayofweek==dayofweek.tuesday and (fastEMA > slowEMA) and close > vwap1 and close[1] > vwap1[1] and lastFiveCandles and close-prevDayClose < close*0.015 and close-todayLow < close*0.012) or

// (dayofweek==dayofweek.wednesday and (fastEMA > slowEMA) and close > vwap1 and close-prevDayClose < close*0.015 and (hour!=9 or minute>=35) and close-todayLow < close*0.012) or

// (dayofweek==dayofweek.friday and ((fastEMA > slowEMA))and close > vwap1 and close[1] > vwap1[1] and (hour!=9 or minute>=35))

// sell= (dayofweek==dayofweek.thursday and (hour!=9 or minute>=35) and ((slowEMA > fastEMA)) and close < vwap1 and lastSevenCandlesS and close[1] < vwap1[1]) or

// (dayofweek==dayofweek.monday and ((slowEMA > fastEMA)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and todayHigh-close < close*0.008 and todayHigh-close[1] < close * 0.01 ) or

// (dayofweek==dayofweek.tuesday and (hour!=9 or minute>=35) and (open - low < 2*(high-close)) and (close-open<10) and not dragonflyDoji and (slowEMA > fastEMA) and close < vwap1 and close[1] < vwap1[1] and prevDayClose-close<close*0.012 and todayHigh-close < close*0.009 and todayHigh-close[1] < close * 0.009) or

// (dayofweek==dayofweek.wednesday and (hour!=9 or minute>=40) and close<open and (slowEMA > fastEMA) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (close-todayLow>30 or candleCount1<1) ) or

// (dayofweek==dayofweek.friday and ((slowEMA > fastEMA)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (hour!=9 or minute>=55) )

dragonflyDoji:= false

// (slowEMA - fastEMA > close*0.00089 or (slowEMA-fastEMA>close*0.00049 and (high[2]>vwap or high[1]>vwap)))

if sellPrice != 0 and runup < sellPrice - low

runup := sellPrice - low

if buyPrice != 0 and runup < high - buyPrice

//ourlabel = label.new(x=bar_index, y=na, text=tostring(runup), yloc=yloc.belowbar)

runup := high - buyPrice

NoBuySellTime = (hour == 15) or ((hour==14 and minute>=25)) or (hour==9 and minute<=35) or hour >= 14

//(fiveEMACC > 0 and low < fastEMA and close < vwap1)

buyexit = fastEMA<slowEMA or (close<superTrend and close < vwap1 and close[1] < vwap1[1]) //or strategy.openprofit > 400 or strategy.openprofit < -5000

sellexit = slowEMA<fastEMA or (close > vwap1 and close[1] > vwap1[1] and close>superTrend) //or strategy.openprofit > 400 or strategy.openprofit < -5000

exitPosition = (dayofweek==dayofweek.thursday and buyPrice!=0.0 and (high - buyPrice) > 50) or (dayofweek==dayofweek.thursday and sellPrice!=0.0 and (sellPrice - low) > 80) or (dayofweek==dayofweek.monday and buyPrice !=0.0 and high-buyPrice > 30) or (dayofweek==dayofweek.monday and sellPrice!=0.0 and (sellPrice - low) > 30) or (dayofweek!=dayofweek.thursday and dayofweek!=dayofweek.monday and buyPrice!=0.0 and (high - buyPrice) > 30) or (dayofweek!=dayofweek.thursday and dayofweek!=dayofweek.monday and sellPrice!=0.0 and (sellPrice - low) > 30)

//code such that 2 fastema is > than 2 slowema

//exitPosition = (sellPrice!=0 and runup >21 and strategy.openprofit < -2000) or (candleCount > 18 and strategy.openprofit > 50 and strategy.openprofit < 1000) or (dayofweek==dayofweek.thursday and buyPrice!=0.0 and (high - buyPrice) > buyPrice * 0.007) or (dayofweek==dayofweek.thursday and sellPrice!=0.0 and (sellPrice - low) > sellPrice * 0.007) or (dayofweek==dayofweek.monday and buyPrice !=0.0 and high-buyPrice > 30) or (dayofweek!=dayofweek.thursday and dayofweek!=dayofweek.monday and buyPrice!=0.0 and (high - buyPrice) > buyPrice * 0.002) or (dayofweek!=dayofweek.thursday and sellPrice!=0.0 and (sellPrice - low) > sellPrice * 0.002)

//(runup >21 and strategy.openprofit < -2000) or

if buy and fastEMA>vwap1 and (not todayBuyDone or lastTrade != 1) and not NoBuySellTime// and not dailyTaskDone //and (dayofweek==dayofweek.friday or (close-prevDayClose)<150)//and not biggapup

strategy.entry("buy", strategy.long)

//dailyTaskDone := true

if buyPrice == 0.0

fiveEMACC := 1

buyPrice := close

//ourlabel = label.new(x=bar_index, y=na, text=tostring(todayLow + 500), yloc=yloc.belowbar9

todayBuyDone := true

lastTrade := 1

runup := 0.0

if sell and (not todaySellDone or lastTrade != 0) and not NoBuySellTime// and not dailyTaskDone // and dayofweek!=dayofweek.friday //and (dayofweek==dayofweek.friday or (prevDayClose-close)<150)//and not biggapdown

strategy.entry("sell", strategy.short)

//dailyTaskDone := true

if sellPrice == 0.0

fiveEMACC := 1

sellPrice := close

todaySellDone := true

lastTrade := 0

runup := 0.0

// if ((fastEMA-slowEMA>18 and close>vwap and close[1]>vwap[1] and (not todayBuyDone or candleCount>12)) or (slowEMA-fastEMA>10 and close < vwap and close[1]<vwap[1] and (not todaySellDone or candleCount > 12))) and strategy.openprofit==0

// ourlabel = label.new(x=bar_index, y=na, text=tostring(abs(prevDayClose-close)), yloc=yloc.belowbar)

IntraDay_SquareOff = minute >=15 and hour >= 15

if true and (IntraDay_SquareOff or exitPosition)

strategy.close("buy")

strategy.close("sell")

buyPrice := 0

sellPrice := 0

runup := 0.0

if buyexit

strategy.close("buy")

buyPrice := 0

if sellexit

strategy.close("sell")

sellPrice := 0

buy1 = ((dayofweek==dayofweek.thursday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1]) or

(dayofweek==dayofweek.monday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1]) or

(dayofweek==dayofweek.tuesday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1] and not gapup) or

(dayofweek==dayofweek.wednesday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1] and close-prevDayClose < close*0.0085) or

(dayofweek==dayofweek.friday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1] and close - todayLow < close*0.012))

and dayofweek!=dayofweek.friday and (not todayBuyDone or lastTrade != 1) and not NoBuySellTime// and not dailyTaskDone //and (dayofweek==dayofweek.friday or (close-prevDayClose)<150)//and not biggapup

sell1= ((dayofweek==dayofweek.thursday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1]) or

(dayofweek==dayofweek.monday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and todayHigh-close < close*0.01 and todayHigh-close[1] < close * 0.01) or

(dayofweek==dayofweek.tuesday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not gapdown and not dragonflyDoji and todayHigh-close < close*0.009 and todayHigh-close[1] < close * 0.009) or

(dayofweek==dayofweek.wednesday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and prevDayClose-close < 0.005*close) or

(dayofweek==dayofweek.friday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and prevDayClose-close < 0.005*close)) and

dayofweek!=dayofweek.friday and (not todaySellDone or lastTrade != 0) and not NoBuySellTime// and not dailyTaskDone

// if buy1 and strategy.openprofit==0

// ourlabel = label.new(x=bar_index, y=na, text=tostring(fastEMA - slowEMA), yloc=yloc.belowbar)

// if sell1 and strategy.openprofit==0

// ourlabel = label.new(x=bar_index, y=na, text=tostring(slowEMA - fastEMA), yloc=yloc.belowbar)

// buy = ((fastEMA > slowEMA and fastEMA[1] < slowEMA[1]) and (fastEMA - slowEMA) > 10) or ((fastEMA > slowEMA and fastEMA[1] > slowEMA[1] and fastEMA[2] < slowEMA[2]) and (fastEMA - slowEMA) > 20)

// sell= ((fastEMA < slowEMA and fastEMA[1] > slowEMA[1] ) and (slowEMA - fastEMA) > 10) or ((fastEMA < slowEMA and fastEMA[1] < slowEMA[1] and fastEMA[2] > slowEMA[2]) and (slowEMA - fastEMA) > 20)

// buy = (fastEMA > slowEMA and fastEMA[1] < slowEMA[1])

// sell= (fastEMA < slowEMA and fastEMA[1] > slowEMA[1] )

// buy = ((fastEMA > slowEMA and fastEMA[1] < slowEMA[1]) and (fastEMA - slowEMA) > 10) or ((fastEMA > slowEMA and fastEMA[1] > slowEMA[1] and fastEMA[2] < slowEMA[2]) and (fastEMA - slowEMA) > 1)

// sell= ((fastEMA < slowEMA and fastEMA[1] > slowEMA[1] ) and (slowEMA - fastEMA) > 5)

// buy = fastEMA > slowEMA and fastEMA[1] > slowEMA[1] and fastEMA[2] < slowEMA[2]

// sell= fastEMA < slowEMA and fastEMA[1] < slowEMA[1] and fastEMA[2] > slowEMA[2]

//Daily chart

// buyexit = (close + 40 < slowEMA)//rsi > 65 and fastEMA > ema9 // fastEMA > ema9// close < fastEMA//(rsi > 65 and close < fastEMA and fastEMA > ema3 and close > ema200) //strategy.openprofit < -10000 and slowEMA > ema3 and slowEMA[1] < ema3[1] and 1==2

// sellexit = (close - 40 > slowEMA)//rsi < 35 // and close > ema200) or (rsi < 35 and close < ema200 and fastEMA < ema3) //strategy.openprofit < -10000 and fastEMA < ema3 and fastEMA[1] > ema3[1] and 1==2

// buyexit = (close < superTrend)// and (close < vwap1 and close[1] < vwap1[1] and close < close[1])//and close[2] < vwap1[2]//rsi > 65 and close < fastEMA// fastEMA > ema9// close < fastEMA//(rsi > 65 and close < fastEMA and fastEMA > ema3 and close > ema200) //strategy.openprofit < -10000 and slowEMA > ema3 and slowEMA[1] < ema3[1] and 1==2

// sellexit = (close > superTrend)// and (close > vwap1 and close[1] > vwap1[1] and close > close[1]) //and close[2] > vwap1[2]//rsi < 35// and close > ema200) or (rsi < 35 and close < ema200 and fastEMA < ema3) //strategy.openprofit < -10000 and fastEMA < ema3 and fastEMA[1] > ema3[1] and 1==2

// buyexit = (close < superTrend and close < vwap1 and close[1] < vwap1[1] and close[1] < superTrend[1]) //or strategy.openprofit > 400 or strategy.openprofit < -5000

// sellexit = (close > superTrend and close > vwap1 and close[1] > vwap1[1] and close[1] > superTrend[1]) //or strategy.openprofit > 400 or strategy.openprofit < -5000