Descripción general

La estrategia es un sistema de trading compuesto basado en el canal de Keltner y niveles dinámicos de soporte y resistencia. Forma un marco completo para la toma de decisiones comerciales analizando múltiples períodos de tiempo y combinando promedios móviles e indicadores de volatilidad. El núcleo de la estrategia es capturar oportunidades comerciales de alta probabilidad identificando el momento en que los precios rompen niveles técnicos clave, teniendo en cuenta las tendencias y la volatilidad del mercado.

Principio de estrategia

La estrategia utiliza un sistema de indicadores técnicos multicapa para el análisis:

- Utilice el canal Kenny de 21 períodos como la principal herramienta de determinación de tendencia, y el ancho del canal está determinado por el valor ATR.

- Calcule los niveles clave de soporte y resistencia utilizando 21 velas a la izquierda y 8 velas a la derecha

- Introducción de promedios móviles de períodos de tiempo de alto nivel como filtros de tendencia

- Combinación de promedios móviles de corto plazo (5 períodos) y largo plazo (30 períodos) para determinar el momento de entrada

- Utilice ATR para ajustar dinámicamente la posición de stop loss

Ventajas estratégicas

- Los indicadores técnicos multidimensionales se verifican entre sí y reducen eficazmente las señales falsas.

- Los niveles dinámicos de soporte y resistencia se actualizan en tiempo real para adaptarse a los cambios del mercado.

- Filtrar las tendencias del mercado secundario a través de un análisis de períodos de tiempo de alto nivel

- Ajuste de forma flexible los parámetros de stop loss según diferentes períodos de tiempo

- Utilice la gestión de posiciones porcentuales para controlar eficazmente los riesgos

Riesgo estratégico

- Se pueden generar señales comerciales frecuentes en un mercado volátil

- La verificación de múltiples indicadores puede provocar la pérdida de algunas oportunidades comerciales

- La optimización de parámetros tiene el riesgo de sobreajuste

- Los stops pueden ser demasiado amplios en entornos de alta volatilidad

- Los niveles de soporte y resistencia pueden volverse inválidos cuando el mercado cambia drásticamente.

Dirección de optimización de la estrategia

- Introducción de indicadores de volumen para ayudar a evaluar la eficacia de los avances

- Agregue un módulo de análisis de volatilidad del mercado y ajuste dinámicamente los parámetros

- Optimizar el método de cálculo de los niveles de soporte y resistencia para mejorar la precisión

- Agregue juicios sobre la fuerza de la tendencia y refine las condiciones de entrada

- Mejorar el sistema de gestión de posiciones para lograr un control de riesgos más sofisticado

Resumir

Se trata de una estrategia de trading cuantitativa con una estructura completa y una lógica rigurosa. Mediante el uso coordinado de múltiples capas de indicadores técnicos, se garantiza la confiabilidad de las señales comerciales y se logra un control efectivo del riesgo. La estrategia tiene una fuerte escalabilidad y se espera que mantenga un rendimiento estable en diferentes entornos de mercado a través de la optimización y mejora continuas.

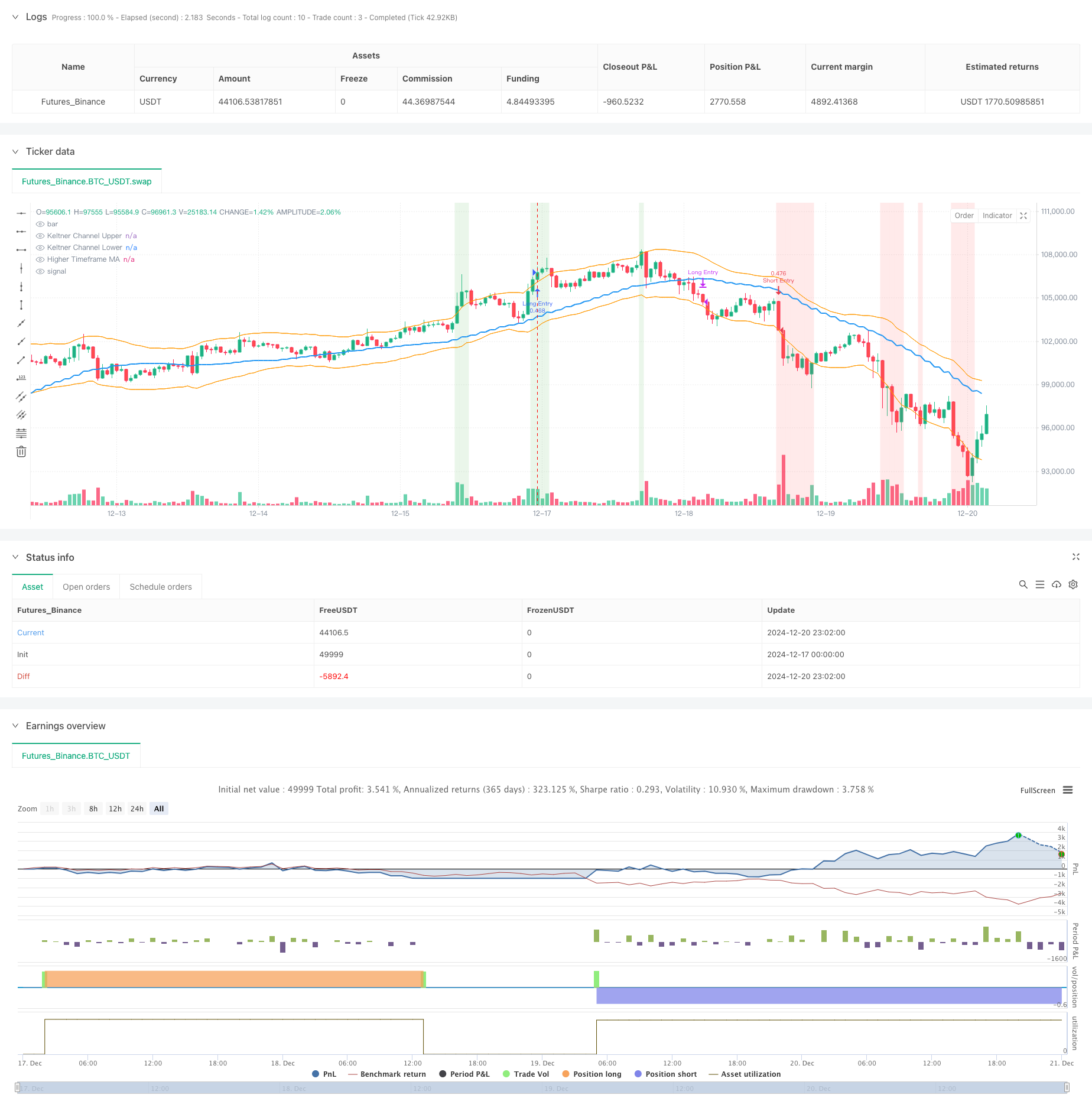

/*backtest

start: 2024-12-17 00:00:00

end: 2024-12-21 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sathcm

//@version=5

strategy("KMS", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.05, slippage=3)

// Inputs for Keltner Channels

kcLength = input.int(21, title="Keltner Channel Length", minval=1) // Length for Keltner Channel calculation

kcMultiplier = input.float(2.0, title="Keltner Channel Multiplier", minval=0.1) // Multiplier for Keltner Channel width

// Calculate Keltner Channels using best practices

kcBasis = ta.ema(close, kcLength) // Use EMA for a smoother basis line

atrValue = ta.atr(kcLength) // Use ATR for channel width calculation

kcUpper = kcBasis + kcMultiplier * atrValue // Upper Keltner Channel

kcLower = kcBasis - kcMultiplier * atrValue // Lower Keltner Channel

// Inputs for Pivot Point Calculation

leftBars = input.int(21, title="Left Bars", minval=1) // Number of bars to the left for pivot calculation

rightBars = input.int(8, title="Right Bars", minval=1, tooltip="Number of bars to the right for pivot calculation") // Number of bars to the right for pivot calculation

// Calculate Smoothed Pivot Highs and Lows using Weighted Moving Average

pivotHigh = ta.pivothigh(high, leftBars, rightBars) // Apply WMA for smoothing

pivotLow = ta.pivotlow(low, leftBars, rightBars) // Apply WMA for smoothing

// Convert Pivot Highs and Lows to Boolean Conditions

isPivotHigh = not na(pivotHigh) // True when a pivot high exists

isPivotLow = not na(pivotLow) // True when a pivot low exists

// Get Recent Support and Resistance Levels

recentResistance = ta.valuewhen(isPivotHigh, high, 0) // Most recent resistance level

recentSupport = ta.valuewhen(isPivotLow, low, 0) // Most recent support level

// Plot Smoothed Support and Resistance Levels

//plot(recentResistance, color=color.red, title="Recent Resistance", linewidth=2, style=plot.style_line)

//plot(recentSupport, color=color.green, title="Recent Support", linewidth=2, style=plot.style_line)

// Store Entry Price into a Variable

var float entryPrice = na // Declare a variable to store the entry price

// Input for Higher Timeframe

higherTimeframeInput = input.timeframe('W', title="Higher Timeframe for MA Calculation")

if (timeframe.period == "240") or (timeframe.period == "120")

higherTimeframeInput := "D"

if (timeframe.period == "60") or (timeframe.period == "30") or (timeframe.period == "15")

higherTimeframeInput := "120"

if (timeframe.period == "10") or (timeframe.period == "5")

higherTimeframeInput := "30"

if (timeframe.period == "1")

higherTimeframeInput := "10"

prd = input.int(defval=10, title='Pivot Period', minval=4, maxval=30, group='Settings 🔨', tooltip='Used while calculating Pivot Points, checks left&right bars')

ppsrc = input.string(defval='High/Low', title='Source', options=['High/Low', 'Close/Open'], group='Settings 🔨', tooltip='Source for Pivot Points')

ChannelW = input.int(defval=5, title='Maximum Channel Width %', minval=1, maxval=8, group='Settings 🔨', tooltip='Calculated using Highest/Lowest levels in 300 bars')

minstrength = input.int(defval=1, title='Minimum Strength', minval=1, group='Settings 🔨', tooltip='Channel must contain at least 2 Pivot Points')

maxnumsr = input.int(defval=4, title='Maximum Number of S/R', minval=1, maxval=10, group='Settings 🔨', tooltip='Maximum number of Support/Resistance Channels to Show') - 1

loopback = input.int(defval=150, title='Loopback Period', minval=100, maxval=400, group='Settings 🔨', tooltip='While calculating S/R levels it checks Pivots in Loopback Period')

res_col = input.color(defval=color.new(color.red, 75), title='Resistance Color', group='Colors 🟡🟢🟣')

sup_col = input.color(defval=color.new(color.lime, 75), title='Support Color', group='Colors 🟡🟢🟣')

inch_col = input.color(defval=color.new(color.gray, 75), title='Color When Price in Channel', group='Colors 🟡🟢🟣')

// Get Pivot High/Low

src1 = ppsrc == 'High/Low' ? high : math.max(close, open)

src2 = ppsrc == 'High/Low' ? low : math.min(close, open)

ph = ta.pivothigh(src1, prd, prd)

pl = ta.pivotlow(src2, prd, prd)

// Calculate maximum S/R channel width

prdhighest = ta.highest(300)

prdlowest = ta.lowest(300)

cwidth = (prdhighest - prdlowest) * ChannelW / 100

// Get/keep Pivot levels

var pivotvals = array.new_float(0)

var pivotlocs = array.new_float(0)

if ph or pl

array.unshift(pivotvals, ph ? ph : pl)

array.unshift(pivotlocs, bar_index)

for x = array.size(pivotvals) - 1 to 0 by 1

if bar_index - array.get(pivotlocs, x) > loopback // remove old pivot points

array.pop(pivotvals)

array.pop(pivotlocs)

continue

break

// Find/create SR channel of a pivot point

get_sr_vals(ind) =>

float lo = array.get(pivotvals, ind)

float hi = lo

int numpp = 0

for y = 0 to array.size(pivotvals) - 1 by 1

float cpp = array.get(pivotvals, y)

float wdth = cpp <= hi ? hi - cpp : cpp - lo

if wdth <= cwidth // fits the max channel width?

if cpp <= hi

lo := math.min(lo, cpp)

else

hi := math.max(hi, cpp)

numpp += 20 // each pivot point added as 20

[hi, lo, numpp]

// Keep old SR channels and calculate/sort new channels if we met new pivot point

var suportresistance = array.new_float(20, 0) // min/max levels

changeit(x, y) =>

tmp = array.get(suportresistance, y * 2)

array.set(suportresistance, y * 2, array.get(suportresistance, x * 2))

array.set(suportresistance, x * 2, tmp)

tmp := array.get(suportresistance, y * 2 + 1)

array.set(suportresistance, y * 2 + 1, array.get(suportresistance, x * 2 + 1))

array.set(suportresistance, x * 2 + 1, tmp)

if ph or pl

supres = array.new_float(0) // number of pivot, strength, min/max levels

stren = array.new_float(10, 0)

// Get levels and strengths

for x = 0 to array.size(pivotvals) - 1 by 1

[hi, lo, strength] = get_sr_vals(x)

array.push(supres, strength)

array.push(supres, hi)

array.push(supres, lo)

// Add each HL to strength

for x = 0 to array.size(pivotvals) - 1 by 1

h = array.get(supres, x * 3 + 1)

l = array.get(supres, x * 3 + 2)

s = 0

for y = 0 to loopback by 1

if high[y] <= h and high[y] >= l or low[y] <= h and low[y] >= l

s += 1

array.set(supres, x * 3, array.get(supres, x * 3) + s)

// Reset SR levels

array.fill(suportresistance, 0)

// Get strongest SRs

src = 0

for x = 0 to array.size(pivotvals) - 1 by 1

stv = -1. // value

stl = -1 // location

for y = 0 to array.size(pivotvals) - 1 by 1

if array.get(supres, y * 3) > stv and array.get(supres, y * 3) >= minstrength * 20

stv := array.get(supres, y * 3)

stl := y

if stl >= 0

// Get SR level

hh = array.get(supres, stl * 3 + 1)

ll = array.get(supres, stl * 3 + 2)

array.set(suportresistance, src * 2, hh)

array.set(suportresistance, src * 2 + 1, ll)

array.set(stren, src, array.get(supres, stl * 3))

// Make included pivot points' strength zero

for y = 0 to array.size(pivotvals) - 1 by 1

if array.get(supres, y * 3 + 1) <= hh and array.get(supres, y * 3 + 1) >= ll or array.get(supres, y * 3 + 2) <= hh and array.get(supres, y * 3 + 2) >= ll

array.set(supres, y * 3, -1)

src += 1

if src >= 10

break

for x = 0 to 8 by 1

for y = x + 1 to 9 by 1

if array.get(stren, y) > array.get(stren, x)

tmp = array.get(stren, y)

array.set(stren, y, array.get(stren, x))

changeit(x, y)

get_level(ind) =>

float ret = na

if ind < array.size(suportresistance)

if array.get(suportresistance, ind) != 0

ret := array.get(suportresistance, ind)

ret

get_color(ind) =>

color ret = na

if ind < array.size(suportresistance)

if array.get(suportresistance, ind) != 0

ret := array.get(suportresistance, ind) > close and array.get(suportresistance, ind + 1) > close ? res_col : array.get(suportresistance, ind) < close and array.get(suportresistance, ind + 1) < close ? sup_col : inch_col

ret

// var srchannels = array.new_box(10)

// for x = 0 to math.min(9, maxnumsr) by 1

// box.delete(array.get(srchannels, x))

// srcol = get_color(x * 2)

// if not na(srcol)

// array.set(srchannels, x, box.new(left=bar_index, top=get_level(x * 2), right=bar_index + 1, bottom=get_level(x * 2 + 1), border_color=srcol, border_width=1, extend=extend.both, bgcolor=srcol))

// Improved dynamic support detection

float recentSupport1 = na

float previousSupport = na

float currentsupport = na

if na(previousSupport) or currentsupport != previousSupport

if array.size(suportresistance) > 1

for i = 0 to math.floor(array.size(suportresistance) / 2) - 1 // Iterate through support levels

currentsupport := array.get(suportresistance, i * 2 + 1) // Support is stored at odd indices

if currentsupport < close and (na(recentSupport1) or math.abs(close - currentsupport) < math.abs(close - recentSupport1))

previousSupport := currentsupport // Store the newly detected support

// Set the most recent support to the new support

recentSupport1 := na(recentSupport1) ? ta.lowest(low, 10) : currentsupport

// Moving averages for entry and exit

maShort = ta.sma(close, 5)

maLong = ta.sma(close, 30) + ta.atr(14)

// Track entry price

entryPrice1 = strategy.position_avg_price // Get the price of the currently open position

currentTimeFrame = timeframe.period

exitPrice = entryPrice1 * 0.99

if currentTimeFrame == "1H" or currentTimeFrame == "30" or currentTimeFrame == "15" or currentTimeFrame == "5"

exitPrice := entryPrice1 * 0.99 // Set the exit price at 99% of the entry price

if currentTimeFrame == "120" or currentTimeFrame == "180" or currentTimeFrame == "240" or currentTimeFrame == "D"

exitPrice := entryPrice1 * 0.98 // Set the exit price at 95% of the entry price

// Calculate Moving Average based on higher timeframe for length of 20 bars

higherTimeframeMA = request.security(syminfo.tickerid, higherTimeframeInput, ta.sma(close, 20), barmerge.gaps_off, barmerge.lookahead_on) // Calculate MA with adjusted timeframe

// Entry and Exit Conditions for Long

entryLong = (close > kcUpper) and (close > recentResistance) and (close > higherTimeframeMA) // Long entry when price breaks above KC upper, recent resistance, and higher timeframe MA

exitLong = (close < recentResistance - 1.5*atrValue) // Long exit when price falls below recent resistance with cushion of one ATR

// Entry and Exit Conditions for Short

entryShort = (close < kcLower) and (close < recentSupport) and (close < higherTimeframeMA+atrValue) // Add RSI filter to reduce false signals by confirming momentum // Short entry when price breaks below KC lower, recent support, and higher timeframe MA

exitShort = (close > recentSupport + atrValue) // Short exit when price rises above recent support with cushion of one ATR(close > recentSupport + atrValue) // Short exit when price rises above recent support with cushion of one ATR(close > recentSupport + atrValue) // Short exit when price rises above recent support with cushion of one ATR

// Strategy Execution for Long

if not na(recentSupport1) and (close <= recentSupport1 +(close*0.01) or close >= recentSupport1 - (close*0.0075)) and (maShort > maLong) and entryLong

strategy.entry("Long Entry", strategy.long)

//entryPrice := strategy.position_avg_price // Store the entry price when a position is opened

if ((maShort < maLong + 3*ta.atr(14)) or close < exitPrice) and exitLong

strategy.close("Long Entry")

// Strategy Execution for Short

if entryShort

strategy.entry("Short Entry", strategy.short)

entryPrice := strategy.position_avg_price // Store the entry price when a position is opened

if exitShort

strategy.close("Short Entry")

// Plot Keltner Channels

plot(kcUpper, color=color.orange, title="Keltner Channel Upper", linewidth=1)

plot(kcLower, color=color.orange, title="Keltner Channel Lower", linewidth=1)

// Plot Moving Averages

plot(higherTimeframeMA, color=color.blue, title="Higher Timeframe MA", linewidth=2)

//plot(recentSupport1, color=#04313f, title="Recent Support1")

//plot(recentResistance, color=color.purple, title="Recent Resistance")

//plot(entryPrice1, color=color.lime, title="Entry Price 1")

//plot(exitPrice, color=color.maroon, title="Exit Price")

//plot(maShort, color=color.green, title="MA Short")

//plot(maLong, color=color.blue, title="MA Long Plus ATR")

// Highlight Entry Zones

bgcolor(entryLong ? color.new(color.green, 85) : na, title="Long Entry Zone")

bgcolor(entryShort ? color.new(color.red, 85) : na, title="Short Entry Zone")

// Alerts

alertcondition(entryLong, title="Long Entry", message="Price broke above the Keltner Channel and recent resistance for Long Entry")

alertcondition(exitLong, title="Long Exit", message="Price fell below recent resistance with cushion of one ATR - Long Exit")

alertcondition(entryShort, title="Short Entry", message="Price broke below the Keltner Channel and recent support for Short Entry")

alertcondition(exitShort, title="Short Exit", message="Price rose above recent support with cushion of one ATR - Short Exit")