Descripción general

Se trata de un sistema de estrategia de negociación de alta frecuencia que combina Bollinger Bands, dispersión de medias móviles MACD y análisis de volúmenes de transacción. La estrategia capta oportunidades de reversión en el mercado mediante la identificación de brechas y reveses en los precios que se desvían en las bandas de Bollinger, combinadas con el indicador de movimiento MACD y la confirmación de volúmenes de transacción.

Principio de estrategia

La estrategia se basa en una combinación de tres indicadores centrales:

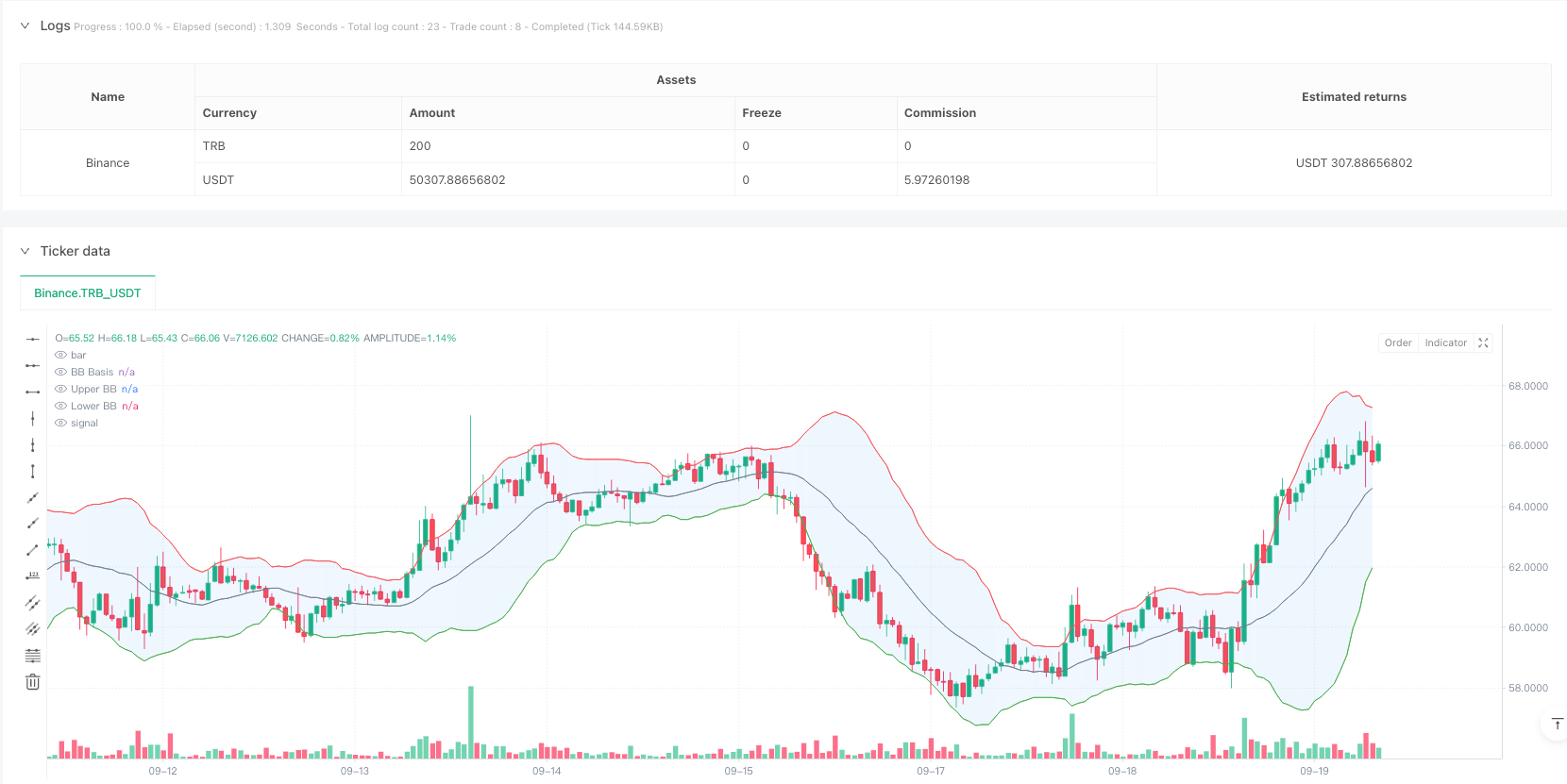

- Indicador de la banda de Brin: usa una media móvil simple de 20 ciclos (SMA) como trayectoria media, y la diferencia estándar multiplicada por 2.0 es calculada en la trayectoria ascendente y descendente. Cuando el precio rompe la banda de Brin y regresa, el sistema emite una señal de negociación potencial.

- Indicador MACD: utiliza la configuración de parámetros estándar ((12, 26, 9), para confirmar el movimiento de la tendencia de precios. Cuando la línea MACD está por encima de la línea de señal, confirme la señal de más, y cuando está por debajo de la línea de señal, confirme la señal de menos.

- Análisis del volumen de transacciones: el uso de una media móvil de 20 períodos para confirmar el volumen de transacciones, requiere que el volumen de transacciones al surgir la señal sea al menos el nivel promedio para asegurar la participación en el mercado.

Ventajas estratégicas

- Confirmación de múltiples señales: mejora significativamente la fiabilidad de las señales de negociación a través de la verificación triple de la banda de Brin, MACD y volumen de transacción.

- Diseño visual: El sistema ofrece una gran cantidad de instrucciones gráficas, incluyendo relleno de bandas de Brin, marcas de señales y cambios de color de fondo, para ayudar a los comerciantes a identificar rápidamente las oportunidades de negociación.

- Control de riesgos: Implementación de objetivos fijos de stop loss y profit, y limitación del número máximo de operaciones diarias, control eficaz de la brecha de riesgo.

- Operaciones sistematizadas: Las estrategias ofrecen condiciones claras de entrada y salida, reduciendo la incertidumbre de los juicios subjetivos.

Riesgo estratégico

- Riesgo de fluctuación del mercado: en mercados con alta volatilidad, puede haber falsas señales de ruptura, lo que lleva a pérdidas de operaciones.

- Riesgo de deslizamiento: en un entorno de alta frecuencia de operaciones, es posible que se enfrente a un mayor costo de deslizamiento que afecte a los beneficios reales.

- Riesgo de liquidez: las condiciones de volumen de transacción pueden limitar las oportunidades de negociación cuando el mercado no es líquido.

- Riesgo sistémico: los parámetros fijos pueden no adaptarse a los cambios drásticos en las condiciones del mercado.

Dirección de optimización de la estrategia

- Optimización dinámica de parámetros: Se puede introducir un mecanismo de ajuste de parámetros adaptativos, lo que permite que los parámetros de Brinband y MACD se ajusten automáticamente según las condiciones del mercado.

- Identificación del ciclo del mercado: agregar un módulo de juicio del ciclo del mercado para adoptar diferentes estrategias de negociación en diferentes ciclos del mercado.

- Optimización de la gestión de riesgos: Se puede considerar la introducción de un mecanismo de stop loss dinámico, que ajuste la posición de stop loss según la volatilidad del mercado.

- Mejora de la filtración de señales: aumenta el filtro de intensidad de tendencia para evitar que se produzcan demasiadas señales de negociación en el mercado horizontal.

Resumir

La estrategia construye un sistema de negociación completo a través de una combinación de señales de reversión de la banda de Brin, confirmación de tendencias MACD y verificación de volúmenes de transacción. El diseño visual del sistema y los estrictos controles de riesgo lo hacen especialmente adecuado para el comercio intradiario. Aunque existe cierto riesgo de mercado, la estrategia espera mantener un rendimiento estable en diferentes entornos de mercado a través de la optimización continua y el ajuste de parámetros.

/*backtest

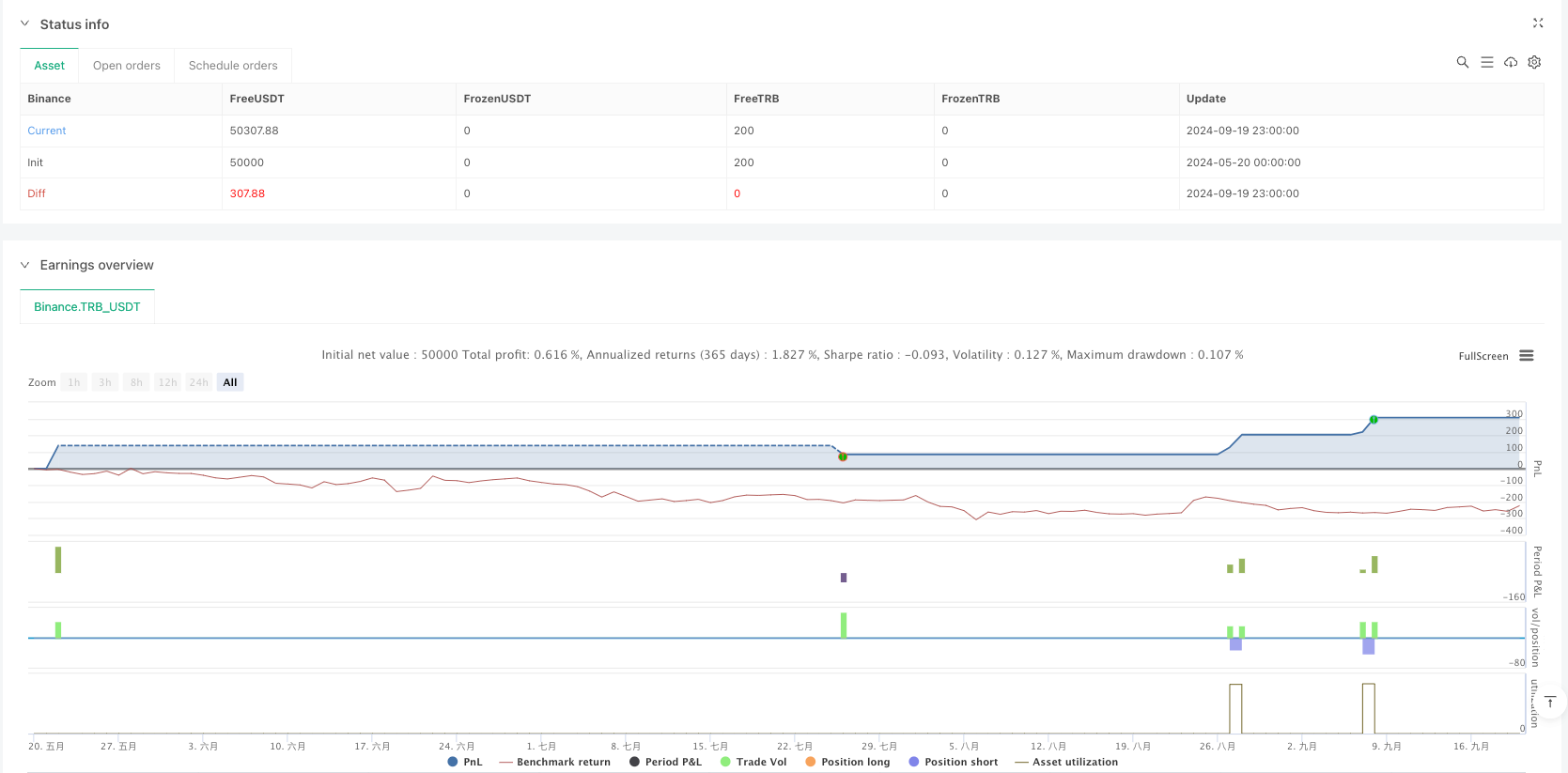

start: 2024-05-20 00:00:00

end: 2024-09-20 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"TRB_USDT"}]

*/

//@version=5

// Bollinger Bounce Reversal Strategy - Visual Edition

//

// Description:

// This strategy seeks to capture reversal moves at extreme price levels (“bounce points”) using Bollinger Bands.

// A long entry is triggered when the price, after being below the lower Bollinger Band, crosses upward above it,

// provided that the MACD line is above its signal line (indicating bullish momentum) and volume is strong.

// Conversely, a short entry is triggered when the price, after being above the upper Bollinger Band, crosses downward

// below it, with the MACD line below its signal line and high volume.

// To help avoid overtrading, the strategy limits entries to a maximum of 5 trades per day.

// Risk management is applied via fixed stop‑loss and take‑profit orders.

// This version overlays many visual cues on the chart: filled Bollinger Bands, signal markers, background colors,

// and an on‑chart information table displaying key values.

//

// Backtesting Parameters:

// • Initial Capital: $10,000

// • Commission: 0.1% per trade

// • Slippage: 1 tick per bar

//

// Disclaimer:

// Past performance is not indicative of future results. This strategy is experimental and provided solely for educational

// purposes. Please backtest and paper trade under your own conditions before live deployment.

//

// Author: [Your Name]

// Date: [Date]

strategy("Bollinger Bounce Reversal Strategy - Visual Edition", overlay=true, initial_capital=10000,

default_qty_type=strategy.percent_of_equity, default_qty_value=5,

commission_type=strategy.commission.percent, commission_value=0.1, slippage=1)

// ─── INPUTS ─────────────────────────────────────────────────────────────

bbPeriod = input.int(20, "Bollinger Bands Period", minval=1)

bbStd = input.float(2.0, "BB StdDev Multiplier", step=0.1)

macdFast = input.int(12, "MACD Fast Length", minval=1)

macdSlow = input.int(26, "MACD Slow Length", minval=1)

macdSignal = input.int(9, "MACD Signal Length", minval=1)

volAvgPeriod = input.int(20, "Volume MA Period", minval=1)

volFactor = input.float(1.0, "Volume Spike Factor", step=0.1) // Volume must be >= volAvg * factor

stopLossPerc = input.float(2.0, "Stop Loss (%)", step=0.1) * 0.01

takeProfitPerc = input.float(4.0, "Take Profit (%)", step=0.1) * 0.01

// ─── CALCULATIONS ─────────────────────────────────────────────────────────

basis = ta.sma(close, bbPeriod)

dev = bbStd * ta.stdev(close, bbPeriod)

upperBB = basis + dev

lowerBB = basis - dev

[macdLine, signalLine, _] = ta.macd(close, macdFast, macdSlow, macdSignal)

volAvg = ta.sma(volume, volAvgPeriod)

// ─── VISUALS: Bollinger Bands & Fill ───────────────────────────────────────

pBasis = plot(basis, color=color.gray, title="BB Basis")

pUpper = plot(upperBB, color=color.red, title="Upper BB")

pLower = plot(lowerBB, color=color.green, title="Lower BB")

fill(pUpper, pLower, color=color.new(color.blue, 90), title="BB Fill")

// ─── DAILY TRADE LIMIT ─────────────────────────────────────────────────────

// Reset the daily trade count at the start of each new day; limit entries to 5 per day.

var int tradesToday = 0

if ta.change(time("D"))

tradesToday := 0

// ─── SIGNAL LOGIC ─────────────────────────────────────────────────────────

// Define a "bounce" signal:

// For a long signal, require that the previous bar was below the lower band and the current bar crosses above it,

// the MACD line is above its signal, and volume is high.

longSignal = (close[1] < lowerBB and close > lowerBB) and (macdLine > signalLine) and (volume >= volFactor * volAvg)

// For a short signal, require that the previous bar was above the upper band and the current bar crosses below it,

// the MACD line is below its signal, and volume is high.

shortSignal = (close[1] > upperBB and close < upperBB) and (macdLine < signalLine) and (volume >= volFactor * volAvg)

// Plot visual signal markers on the chart.

plotshape(longSignal, title="Long Signal", style=shape.labelup, location=location.belowbar, color=color.green, text="Long", size=size.small)

plotshape(shortSignal, title="Short Signal", style=shape.labeldown, location=location.abovebar, color=color.red, text="Short", size=size.small)

// Change background color on signal bars for an extra cue.

bgcolor(longSignal ? color.new(color.green, 80) : shortSignal ? color.new(color.red, 80) : na, title="Signal BG")

// Only enter trades if fewer than 5 have been taken today.

if longSignal and (tradesToday < 5)

strategy.entry("Long", strategy.long)

tradesToday += 1

if shortSignal and (tradesToday < 5)

strategy.entry("Short", strategy.short)

tradesToday += 1

// ─── RISK MANAGEMENT: STOP-LOSS & TAKE-PROFIT ─────────────────────────────

// For long positions: set stop loss and take profit relative to the entry price.

if strategy.position_size > 0

strategy.exit("Long Exit", "Long", stop=strategy.position_avg_price*(1 - stopLossPerc), limit=strategy.position_avg_price*(1 + takeProfitPerc))

// For short positions: set stop loss and take profit relative to the entry price.

if strategy.position_size < 0

strategy.exit("Short Exit", "Short", stop=strategy.position_avg_price*(1 + stopLossPerc), limit=strategy.position_avg_price*(1 - takeProfitPerc))