Descripción general

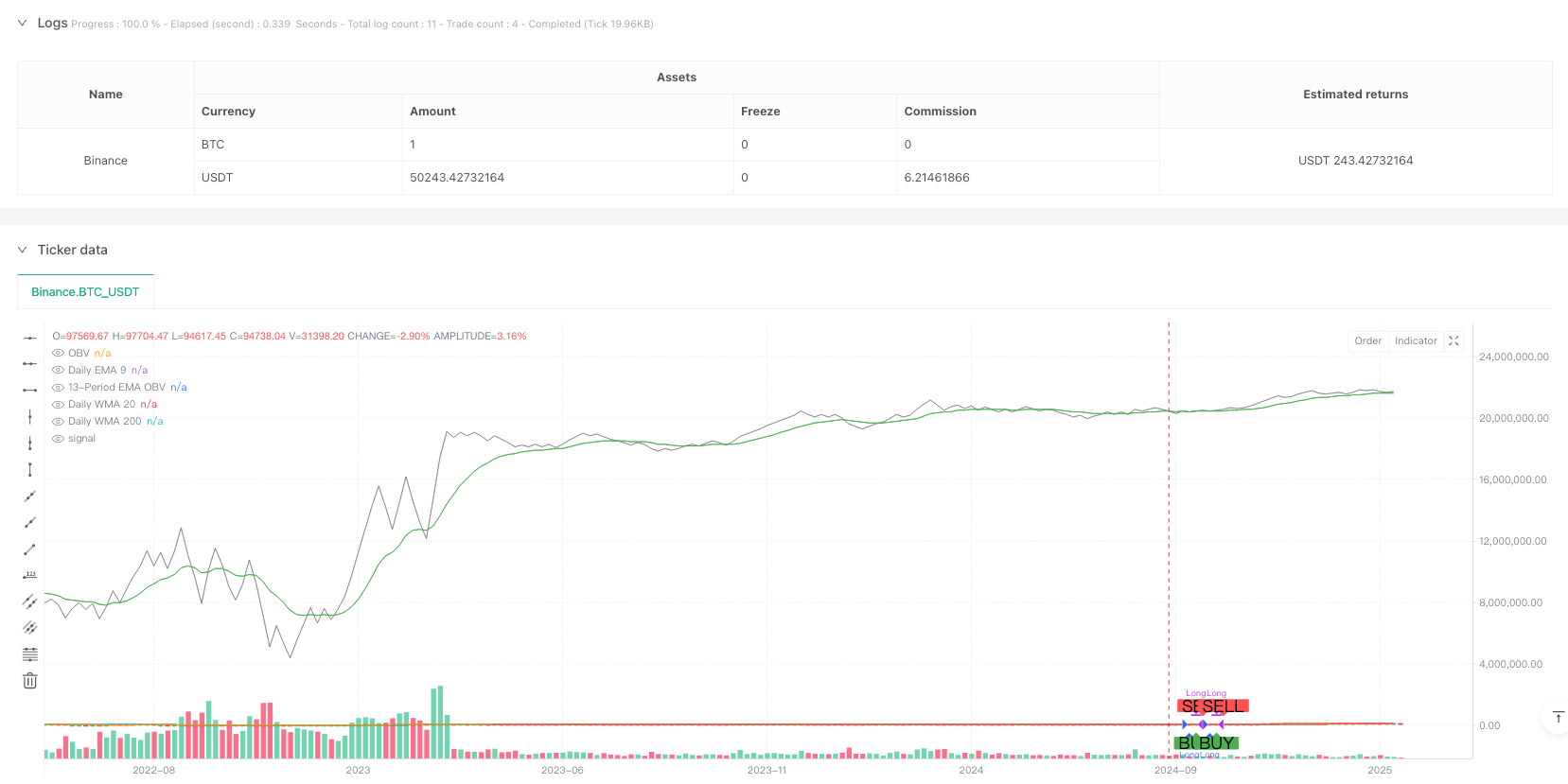

La estrategia es un sistema de seguimiento de tendencias que combina medias móviles de varios períodos y análisis de volúmenes de transacción. La estrategia confirma la tendencia general a través de las tres medias EMA9, WMA20 y WMA200 del ciclo solar, al tiempo que introduce el indicador OBV (Volumen en Balance) y su EMA para la confirmación de volúmenes de transacción, lo que permite una operación de seguimiento de tendencias más sólida.

Principio de estrategia

La estrategia se basa en dos condiciones centrales:

- Confirmación de tendencia - Confirma la dirección de la tendencia juzgando si las tres líneas diarias medias (EMA9, WMA20, WMA200) están en alza. Cuando las tres medias están inclinadas hacia arriba, indica que cada período de tiempo presenta una tendencia múltiple.

- Confirmación del volumen de transacciones - Análisis del volumen de transacciones con el indicador OBV y su EMA de 13 ciclos. Cuando el EMA del OBV está por encima del OBV, indica que el volumen de transacciones apoya el aumento de los precios y confirma la efectividad de la tendencia. La estrategia solo generará una señal múltiple si ambas condiciones se cumplen simultáneamente. Si una de las condiciones no se cumple, la estrategia se cancelará.

Ventajas estratégicas

- Análisis de múltiples marcos de tiempo - para reducir el riesgo de falsas brechas al considerar de manera integral las tendencias a corto plazo (EMA9), mediano plazo (WMA20) y largo plazo (WMA200).

- Soporte de volumen de transacción - Introducción de análisis de indicadores de OBV para asegurar que el movimiento de los precios reciba soporte de volumen de transacción.

- Control de riesgo: El porcentaje de gestión de posiciones y las comisiones se ajustan mejor al entorno de las operaciones reales.

- Apoyo visual - ayuda a los operadores a entender los tiempos de entrada y salida a través de marcas gráficas claras.

Riesgo estratégico

- Retraso en la reversión de la tendencia - debido al uso de confirmación de líneas medias múltiples, puede haber una reacción más lenta al inicio de la reversión de la tendencia.

- No se aplica en mercados convulsivos - en la fase de ordenamiento horizontal, las falsas rupturas frecuentes pueden provocar demasiadas operaciones.

- Tenga en cuenta el costo de la capital - un cargo del 0.1% puede afectar significativamente los ingresos en operaciones de alta frecuencia.

Dirección de optimización de la estrategia

- Introducción de indicadores de volatilidad - Se puede considerar la adición de indicadores de volatilidad como ATR para ajustar dinámicamente las posiciones en diferentes entornos de mercado.

- Mejora de los mecanismos de detención de pérdidas - Se recomienda la adición de la función de seguimiento de las detenciones de pérdidas para proteger mejor los beneficios.

- Filtrado de entornos de mercado - Puede agregar indicadores de juicio de entornos de mercado para reducir la frecuencia de negociación o suspender la negociación en mercados inestables.

- Selección de parámetros de optimización - Considere la optimización del ciclo de la línea media y los parámetros de OBV para diferentes mercados y variedades.

Resumir

La estrategia, combinada con análisis de tendencias de varios períodos y confirmación de volúmenes de transacciones, construye un sistema de seguimiento de tendencias relativamente completo. La lógica de la estrategia es clara, el control de riesgos es razonable, pero todavía hay espacio para la optimización. Se recomienda a los comerciantes que realicen pruebas cuidadosas en el mercado real y ajusten los parámetros según las características específicas del mercado.

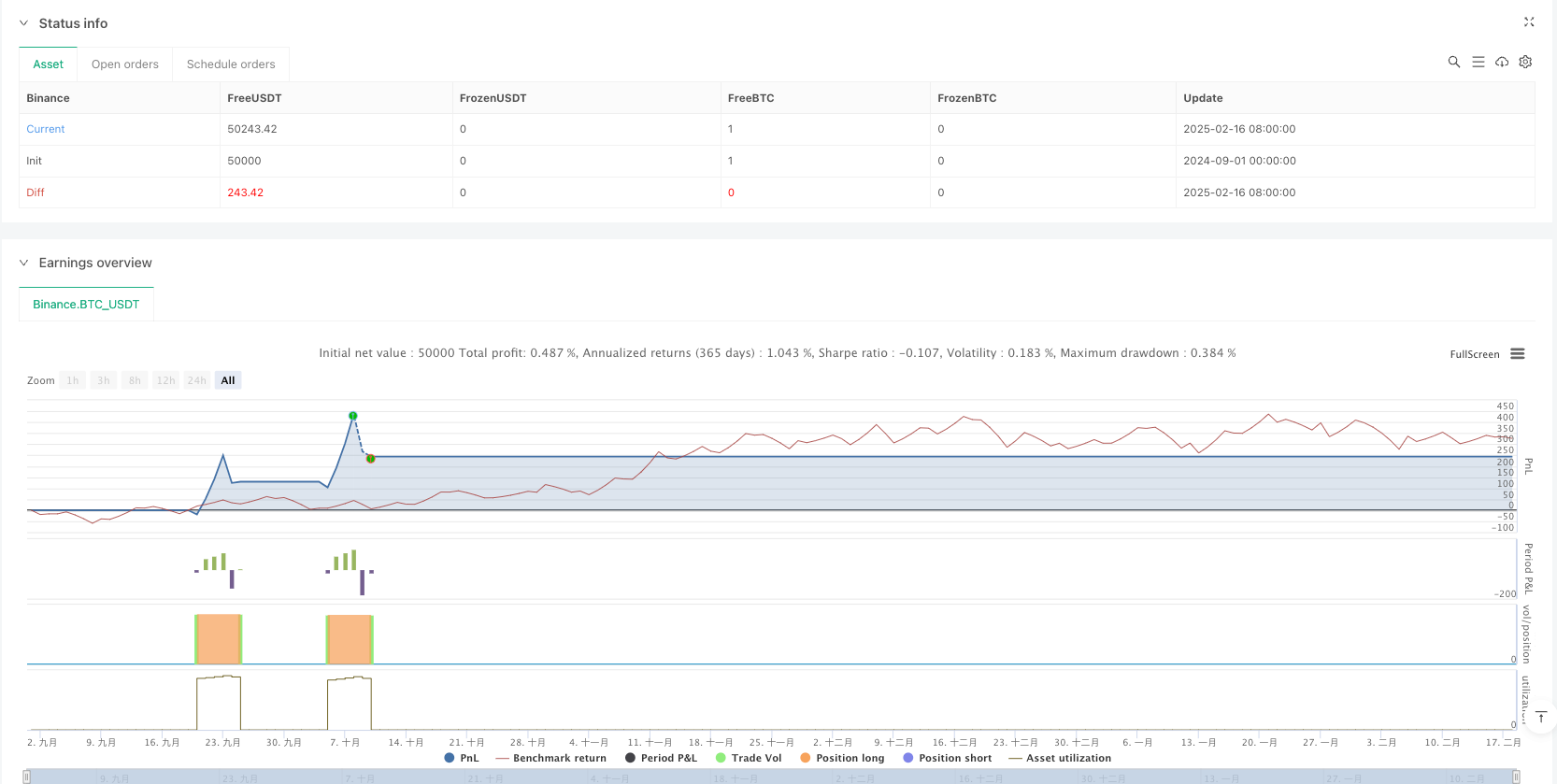

/*backtest

start: 2024-09-01 00:00:00

end: 2025-02-18 08:00:00

period: 5d

basePeriod: 5d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Strategy: Daily MAs + OBV", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=10, commission_type=strategy.commission.percent, commission_value=0.1)

//=== Daily Moving Averages Calculation =========================

// Get daily timeframe values using request.security.

dailyEMA9 = request.security(syminfo.tickerid, "D", ta.ema(close, 9))

dailyWMA20 = request.security(syminfo.tickerid, "D", ta.wma(close, 20))

dailyWMA200 = request.security(syminfo.tickerid, "D", ta.wma(close, 200))

// Check if each moving average is trending upward (current > previous).

ema9_up = dailyEMA9 > nz(dailyEMA9[1])

wma20_up = dailyWMA20 > nz(dailyWMA20[1])

wma200_up = dailyWMA200 > nz(dailyWMA200[1])

trend_condition = ema9_up and wma20_up and wma200_up

//=== OBV and its 13-period EMA Calculation ================================

// Calculate OBV manually using a cumulative sum.

obv_val = ta.cum(close > close[1] ? volume : (close < close[1] ? -volume : 0))

// 13-period EMA of the OBV.

ema13_obv = ta.ema(obv_val, 13)

// Condition: 13-period EMA of OBV must be above the OBV value.

obv_condition = ema13_obv > obv_val

//=== Entry Condition ===================================================

// Both trend and OBV conditions must be met.

buy_condition = trend_condition and obv_condition

//=== Entry and Exit Orders =============================================

// Enter a long position when the buy condition is met and no position is open.

if buy_condition and strategy.position_size <= 0

strategy.entry("Long", strategy.long)

// Exit the position when the condition is no longer met.

if not buy_condition and strategy.position_size > 0

strategy.close("Long")

//=== Explicit Entry and Exit Markers ====================================

// Determine the exact bar where entry and exit occur.

entry_signal = (strategy.position_size > 0 and (strategy.position_size[1] <= 0))

exit_signal = (strategy.position_size == 0 and (strategy.position_size[1] > 0))

plotshape(entry_signal, title="Entry Signal", location=location.belowbar, style=shape.labelup, text="BUY", color=color.new(color.green, 0), size=size.normal)

plotshape(exit_signal, title="Exit Signal", location=location.abovebar, style=shape.labeldown, text="SELL", color=color.new(color.red, 0), size=size.normal)

//=== Plots for Visualization ===============================================

// Plot daily moving averages.

plot(dailyEMA9, color=color.blue, title="Daily EMA 9")

plot(dailyWMA20, color=color.orange, title="Daily WMA 20")

plot(dailyWMA200, color=color.red, title="Daily WMA 200")

// Plot OBV and its 13-period EMA using color.new() to specify transparency.

plot(obv_val, color=color.new(color.gray, 30), title="OBV")

plot(ema13_obv, color=color.new(color.green, 0), title="13-Period EMA OBV")