Descripción general

La estrategia se basa en el análisis de la emoción del mercado en forma de gráficos para cuantificar la psicología del mercado a través de tres osciladores centrales: los osciladores de renuencia, los osciladores de miedo y los osciladores de avaricia. La estrategia integra indicadores de dinámica y tendencia, al tiempo que combina la confirmación de la transacción para construir un sistema de negociación completo. La estrategia es adecuada para los operadores que desean identificar oportunidades de negociación de alta probabilidad a través del análisis de la emoción del mercado.

Principio de estrategia

El núcleo de la estrategia es la construcción de tres oscilladores emocionales a través del análisis de las diferentes formas de los gráficos:

- Osciladores de indecisión - Medir la incertidumbre del mercado a través de las formas de las estrellas cruzadas y los giros

- Osciladores de miedo - para rastrear la emoción de la cabeza a través de los meteoritos, las líneas de suspensión y las formas de absorción de la caída

- Los oscilantes de la codicia - detección de la emoción múltiple a través de rayos de sol en la cabeza desnuda, cordones de cuello, tragos de avestruz y tres soldados blancos

El promedio de estos tres osciladores constituye el índice de emoción de los precios (CEI). Cuando el CEI supera diferentes valores, se activa una señal de negociación de más de un hueco y se confirma mediante el volumen de transacciones.

Ventajas estratégicas

- Análisis de la emoción sistematizado - Transformación del análisis subjetivo en indicadores objetivos a través de la forma de gráficos de coordenadas cuantitativas

- Mejora en la gestión de riesgos - incluye mecanismos como plazos máximos de tenencia, paradas de pérdidas y períodos de enfriamiento

- Mecanismo de recuperación flexible - cuando las operaciones se pierden, la estrategia intenta recuperarse mediante la ruptura del punto de equilibrio

- Aplicabilidad en varios mercados, como acciones, divisas y criptomonedas

- Alta fiabilidad de la señal - mejora la precisión mediante la confirmación de la cantidad de transacciones y la verificación de múltiples indicadores técnicos

Riesgo estratégico

- Sensibilidad de los parámetros - los ajustes de las diferentes clases de valores límite deben ser bien probados y optimizados

- Dependencia del entorno del mercado - puede generar señales erróneas en mercados convulsionados

- Riesgo de deslizamiento - riesgo de ejecución en mercados con poca liquidez

- Riesgo de exceso de transacciones - Se requiere un período de enfriamiento razonable para evitar transacciones frecuentes

- Riesgo sistémico - la posibilidad de sufrir grandes pérdidas en eventos importantes en el mercado

Dirección de optimización de la estrategia

- Las pérdidas dinámicas - ajuste automático de las pérdidas en función de la volatilidad del mercado

- Clasificación del estado del mercado - Mecanismo de identificación de mercados con aumento de tendencias y movimientos

- Optimización de aprendizaje automático - combinación de parámetros optimizados con algoritmos de aprendizaje automático

- Mejoras en la gestión de riesgos - agregado módulo de gestión de fondos y control de posiciones

- Filtración de señales - Integración de más indicadores técnicos para filtrar señales falsas

Resumir

Se trata de una estrategia innovadora que combina análisis técnico con operaciones cuantitativas. A través de un análisis de sentimiento sistematizado y una estricta gestión de riesgos, la estrategia es capaz de proporcionar señales de negociación confiables a los operadores. Si bien existe cierto espacio de optimización, el marco básico de la estrategia es sólido y adecuado para el desarrollo posterior y la aplicación en el mercado.

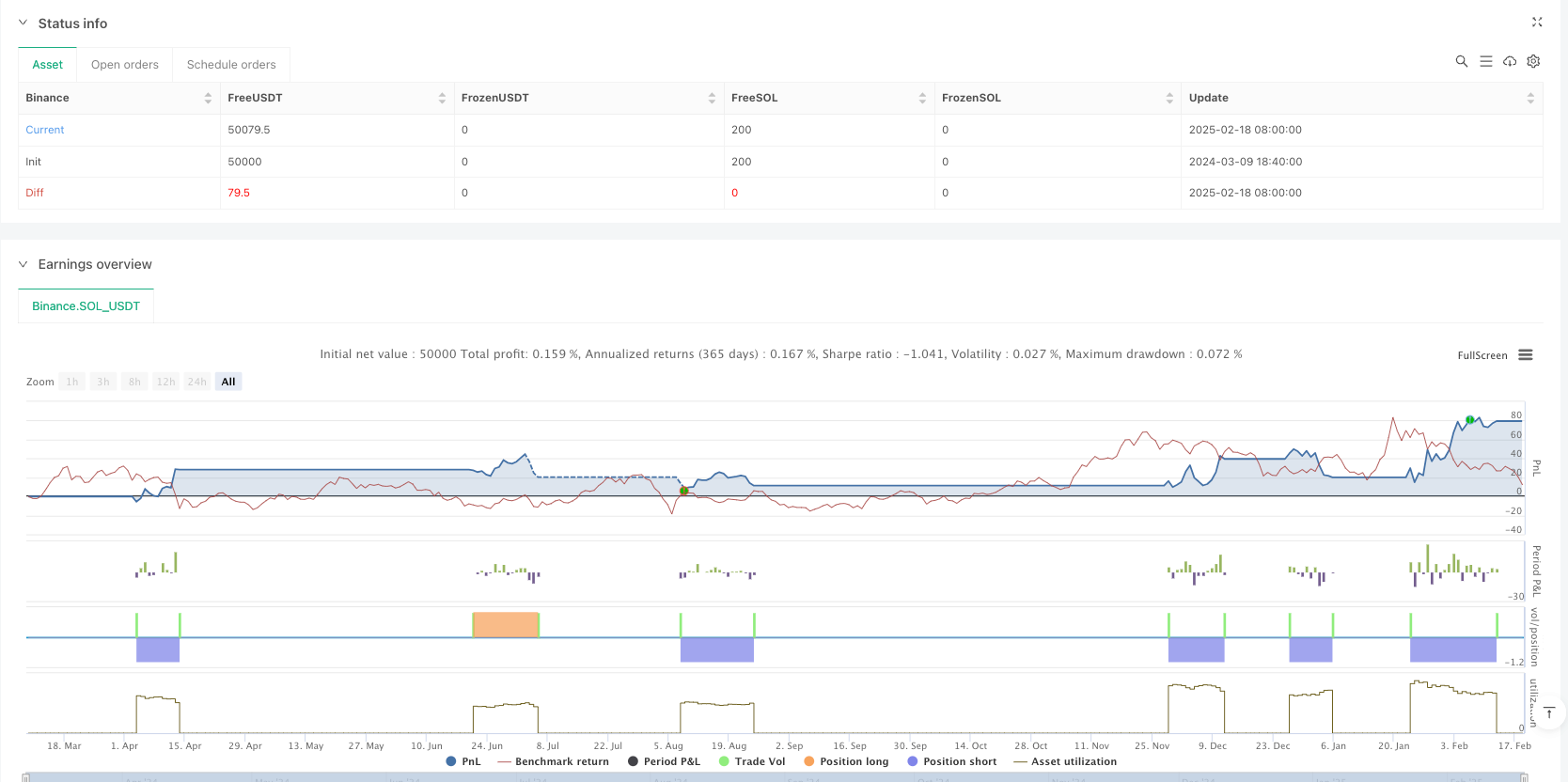

/*backtest

start: 2024-03-09 18:40:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=6

strategy("Candle Emotion Index Strategy", shorttitle="CEI Strategy", overlay=true)

// User Inputs

length = input.int(14, title="Lookback Period", minval=1)

dojiThreshold = input.float(0.1, title="Doji Threshold", minval=0.01, maxval=0.5)

spinningTopThreshold = input.float(0.3, title="Spinning Top Threshold", minval=0.1, maxval=0.5)

shootingStarThreshold = input.float(0.5, title="Shooting Star Threshold", minval=0.1, maxval=1.0)

hangingManThreshold = input.float(0.5, title="Hanging Man Threshold", minval=0.1, maxval=1.0)

engulfingThreshold = input.float(0.5, title="Engulfing Threshold", minval=0.1, maxval=1.0)

marubozuThreshold = input.float(0.9, title="Marubozu Threshold", minval=0.5, maxval=1.0)

hammerThreshold = input.float(0.5, title="Hammer Threshold", minval=0.1, maxval=1.0)

threeWhiteSoldiersThreshold = input.float(0.5, title="Three White Soldiers Threshold", minval=0.1, maxval=1.0)

// Volume Multiplier Input

volumeMultiplier = input.float(1.5, title="Volume Multiplier", minval=1.0)

// Cooldown Period Input

cooldownPeriod = input.int(10, title="Cooldown Period (Candles)", minval=1)

// Maximum Holding Period Inputs

maxHoldingPeriod = input.int(20, title="Maximum Holding Period (Candles)", minval=1)

lossHoldingPeriod = input.int(10, title="Loss Exit Holding Period (Candles)", minval=1)

lossThreshold = input.float(0.02, title="Loss Threshold (as % of Entry Price)", minval=0.01, maxval=1.0)

// --- Indecision Oscillator Functions ---

isDoji(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

rangeSize = high - low

bodySize / rangeSize < threshold

isSpinningTop(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

rangeSize = high - low

bodySize / rangeSize < threshold and bodySize / rangeSize >= dojiThreshold

indecisionOscillator() =>

var float dojiScore = 0.0

var float spinningTopScore = 0.0

for i = 1 to length

if isDoji(open[i], close[i], high[i], low[i], dojiThreshold)

dojiScore := dojiScore + 1.0

if isSpinningTop(open[i], close[i], high[i], low[i], spinningTopThreshold)

spinningTopScore := spinningTopScore + 1.0

dojiScore := dojiScore / length

spinningTopScore := spinningTopScore / length

(dojiScore + spinningTopScore) / 2

// --- Fear Oscillator Functions ---

isShootingStar(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

upperWick = high - math.max(open, close)

lowerWick = math.min(open, close) - low

upperWick / bodySize > threshold and lowerWick < bodySize

isHangingMan(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

upperWick = high - math.max(open, close)

lowerWick = math.min(open, close) - low

lowerWick / bodySize > threshold and upperWick < bodySize

isBearishEngulfing(open, close, openPrev, closePrev, threshold) =>

bodySize = math.abs(close - open)

prevBodySize = math.abs(closePrev - openPrev)

close < openPrev and open > closePrev and bodySize / prevBodySize > threshold

fearOscillator() =>

var float shootingStarScore = 0.0

var float hangingManScore = 0.0

var float engulfingScore = 0.0

for i = 1 to length

if isShootingStar(open[i], close[i], high[i], low[i], shootingStarThreshold)

shootingStarScore := shootingStarScore + 1.0

if isHangingMan(open[i], close[i], high[i], low[i], hangingManThreshold)

hangingManScore := hangingManScore + 1.0

if isBearishEngulfing(open[i], close[i], open[i+1], close[i+1], engulfingThreshold)

engulfingScore := engulfingScore + 1.0

shootingStarScore := shootingStarScore / length

hangingManScore := hangingManScore / length

engulfingScore := engulfingScore / length

(shootingStarScore + hangingManScore + engulfingScore) / 3

// --- Greed Oscillator Functions ---

isMarubozu(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

totalRange = high - low

bodySize / totalRange > threshold

isHammer(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

lowerWick = math.min(open, close) - low

upperWick = high - math.max(open, close)

lowerWick / bodySize > threshold and upperWick < bodySize

isBullishEngulfing(open, close, openPrev, closePrev, threshold) =>

bodySize = math.abs(close - open)

prevBodySize = math.abs(closePrev - openPrev)

close > openPrev and open < closePrev and bodySize / prevBodySize > threshold

isThreeWhiteSoldiers(open, close, openPrev, closePrev, openPrev2, closePrev2, threshold) =>

close > open and closePrev > openPrev and closePrev2 > openPrev2 and close > closePrev and closePrev > closePrev2

greedOscillator() =>

var float marubozuScore = 0.0

var float hammerScore = 0.0

var float engulfingScore = 0.0

var float soldiersScore = 0.0

for i = 1 to length

if isMarubozu(open[i], close[i], high[i], low[i], marubozuThreshold)

marubozuScore := marubozuScore + 1.0

if isHammer(open[i], close[i], high[i], low[i], hammerThreshold)

hammerScore := hammerScore + 1.0

if isBullishEngulfing(open[i], close[i], open[i+1], close[i+1], engulfingThreshold)

engulfingScore := engulfingScore + 1.0

if isThreeWhiteSoldiers(open[i], close[i], open[i+1], close[i+1], open[i+2], close[i+2], threeWhiteSoldiersThreshold)

soldiersScore := soldiersScore + 1.0

marubozuScore := marubozuScore / length

hammerScore := hammerScore / length

engulfingScore := engulfingScore / length

soldiersScore := soldiersScore / length

(marubozuScore + hammerScore + engulfingScore + soldiersScore) / 4

// --- Final Calculations ---

indecision = indecisionOscillator()

fear = fearOscillator()

greed = greedOscillator()

// Calculate the average of the three oscillators

averageOscillator = (indecision + fear + greed) / 3

// --- Combined Strategy Logic ---

var float entryPriceLong = na

var float entryPriceShort = na

var int holdingPeriodLong = 0

var int holdingPeriodShort = 0

var int cooldownCounter = 0

// Buy Signal Logic for Long and Short

longBuySignal = ta.crossover(averageOscillator, 0.1)

shortBuySignal = ta.crossover(averageOscillator, 0.2)

// Calculate average volume over the lookback period

avgVolume = ta.sma(volume, length)

// Take Profit Conditions

longTakeProfitCondition = close > open and volume > avgVolume * volumeMultiplier

shortTakeProfitCondition = close < open and volume > avgVolume * volumeMultiplier

// Buy Logic for Long Positions

if longBuySignal and strategy.position_size == 0 and cooldownCounter <= 0

entryPriceLong := close

strategy.entry("Long Entry", strategy.long)

cooldownCounter := cooldownPeriod

holdingPeriodLong := 0

// Increment holding period if in a long position

if strategy.position_size > 0

holdingPeriodLong := holdingPeriodLong + 1

// Sell Logic for Long Positions

if longTakeProfitCondition and strategy.position_size > 0 and close > entryPriceLong

strategy.close_all()

cooldownCounter := cooldownPeriod

if holdingPeriodLong >= maxHoldingPeriod and strategy.position_size > 0 and close >= entryPriceLong

strategy.close_all()

cooldownCounter := cooldownPeriod

if holdingPeriodLong >= lossHoldingPeriod and strategy.position_size > 0 and close < entryPriceLong * (1 - lossThreshold)

strategy.close_all()

cooldownCounter := cooldownPeriod

// Short Logic for Short Positions

if shortBuySignal and strategy.position_size == 0 and cooldownCounter <= 0

entryPriceShort := close

strategy.entry("Short Entry", strategy.short)

cooldownCounter := cooldownPeriod

holdingPeriodShort := 0

// Increment holding period if in a short position

if strategy.position_size < 0

holdingPeriodShort := holdingPeriodShort + 1

// Cover Logic for Short Positions

if shortTakeProfitCondition and strategy.position_size < 0 and close < entryPriceShort

strategy.close_all()

cooldownCounter := cooldownPeriod

if holdingPeriodShort >= maxHoldingPeriod and strategy.position_size < 0 and close <= entryPriceShort

strategy.close_all()

cooldownCounter := cooldownPeriod

if holdingPeriodShort >= lossHoldingPeriod and strategy.position_size < 0 and close > entryPriceShort * (1 + lossThreshold)

strategy.close_all()

cooldownCounter := cooldownPeriod

// Decrement the cooldown counter each candle

if cooldownCounter > 0

cooldownCounter := cooldownCounter - 1