Descripción general

Se trata de una estrategia de negociación intradiaria basada en un promedio móvil ponderado por volumen de transacción (VWMA) que permite el manejo de binarios de múltiples espacios a través de una cartera de opciones combinadas. El núcleo de la estrategia está en el indicador VWMA recalculado cada día de negociación, que genera una señal de negociación en función de la posición relativa del precio con respecto al VWMA, y que automáticamente se liquida antes del cierre.

Principio de estrategia

La lógica central de la estrategia se basa en los siguientes puntos:

- Utiliza VWMA reajustado diariamente como indicador de tendencias dinámicas

- Cuando el precio rompa el VWMA por encima, construye una cartera de opciones de pérdida (comprar opciones de pérdida + vender opciones de pérdida)

- Cuando el precio cae por debajo de la VWMA, se construye una cartera bajista (comprar una opción bajista + vender una opción de venta)

- En las 15:29 (IST) se obligará a todos los tenedores a cerrar sus posiciones

- Introducción de la variable hasExited para controlar la frecuencia de las adquisiciones y evitar el exceso de operaciones

- El apoyo a la subida de posiciones en forma de pirámide en el momento de la ruptura de la misma dirección

Ventajas estratégicas

- Dinámica y adaptabilidad: la reajuste diaria del VWMA asegura que los indicadores reflejen siempre la situación actual del mercado

- Equilibrio de riesgo-beneficio - limita el riesgo y mantiene el potencial de ganancias a través de una cartera de opciones sintéticas

- Estricta disciplina de negociación - con un claro mecanismo de entrada, alza y baja obligatoria de posiciones

- Flexibilidad en el tamaño de posición - admite la administración de posiciones porcentuales

- La lógica de operación es clara - las condiciones de generación de la señal son simples e intuitivas

Riesgo estratégico

- Riesgo de un mercado convulso - la ruptura de la VWMA podría generar falsas señales frecuentes en el mercado horizontal

- Riesgo de brecha: las fluctuaciones masivas durante la noche pueden causar grandes pérdidas

- Riesgo de la cartera de opciones - Opciones sintéticas con desviación delta neutral

- Punto de deslizamiento de ejecución - las operaciones de alta frecuencia pueden enfrentar un punto de deslizamiento mayor

- Eficiencia de capital - El cierre diario obligatorio aumenta el costo de las transacciones

Dirección de optimización de la estrategia

- Introducción de filtros de fluctuación para ajustar los parámetros de la política en un entorno de alta fluctuación

- Aumentar los indicadores de confirmación de tendencias y reducir las pérdidas de brechas falsas

- Optimizar la estructura de la cartera de opciones, como considerar la introducción de una estrategia de diferencia de precio vertical

- Realizar un ciclo VWMA adaptativo, ajustado a la dinámica de las condiciones del mercado

- Aumentar los indicadores de control de riesgo, como el límite máximo de retirada

Resumir

Se trata de una estrategia de negociación intradiaria estructurada, rigurosa y lógica. Captura las tendencias a corto plazo a través de indicadores VWMA, opera en combinación con una cartera de opciones sintéticas y tiene un buen mecanismo de control de riesgo. El espacio de optimización de la estrategia se basa principalmente en la reducción de falsas señales, la mejora de la eficiencia de ejecución y la mejora del sistema de gestión de riesgos.

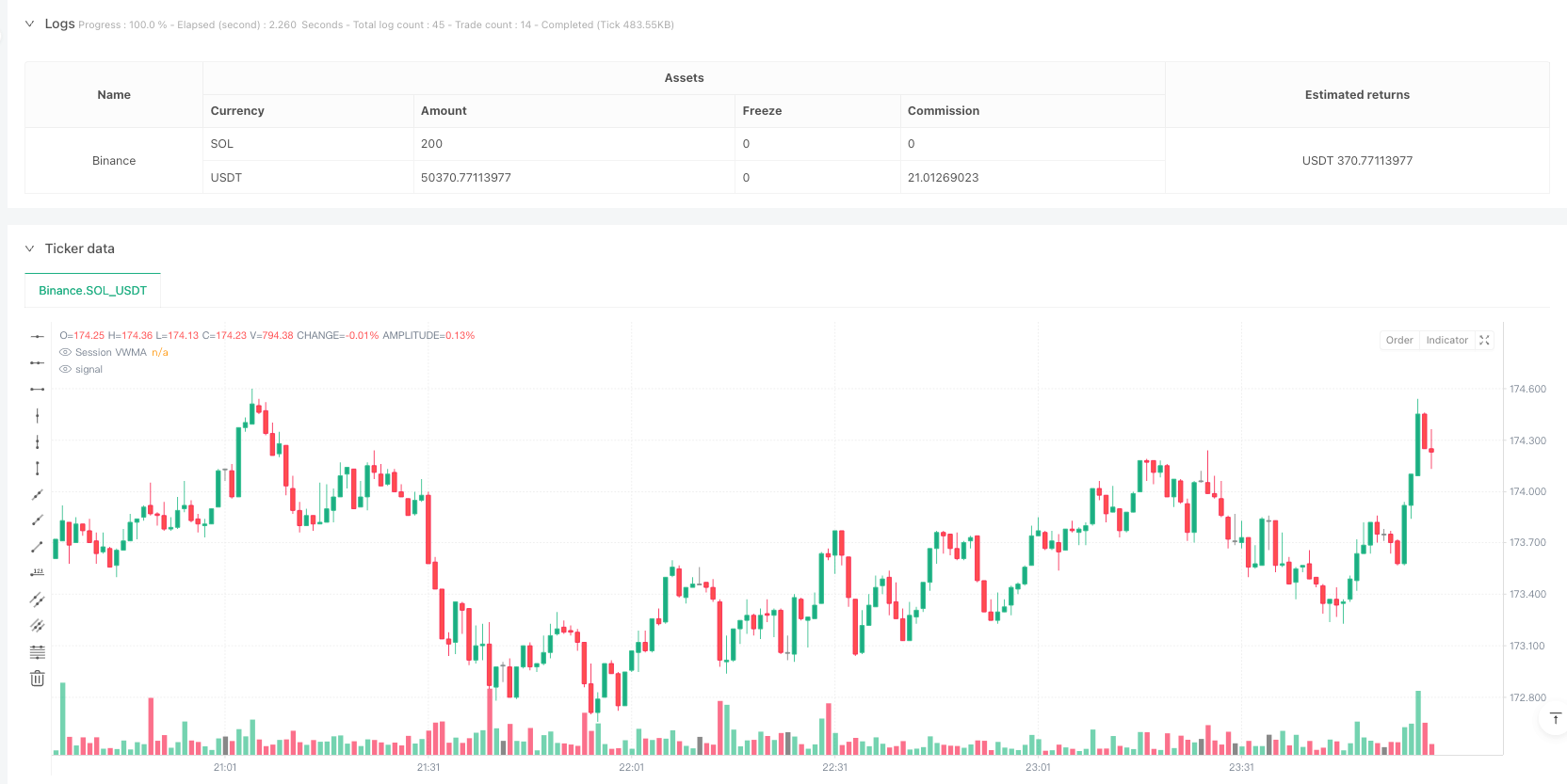

/*backtest

start: 2025-02-16 00:00:00

end: 2025-02-23 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Session VWMA Synthetic Options Strategy", overlay=true, initial_capital=100000,

default_qty_type=strategy.percent_of_equity, default_qty_value=10, pyramiding=10, calc_on_every_tick=true)

//──────────────────────────────

// Session VWMA Inputs

//──────────────────────────────

vwmaLen = input.int(55, title="VWMA Length", inline="VWMA", group="Session VWMA")

vwmaColor = input.color(color.orange, title="VWMA Color", inline="VWMA", group="Session VWMA", tooltip="VWMA resets at the start of each session (at the opening of the day).")

//──────────────────────────────

// Session VWMA Calculation Function

//──────────────────────────────

day_vwma(_start, s, l) =>

bs_nd = ta.barssince(_start)

v_len = math.max(1, bs_nd < l ? bs_nd : l)

ta.vwma(s, v_len)

//──────────────────────────────

// Determine Session Start

//──────────────────────────────

// newSession becomes true on the first bar of a new day.

newSession = ta.change(time("D")) != 0

//──────────────────────────────

// Compute Session VWMA

//──────────────────────────────

vwmaValue = day_vwma(newSession, close, vwmaLen)

plot(vwmaValue, color=vwmaColor, title="Session VWMA")

//──────────────────────────────

// Define Signal Conditions (only on transition)

//──────────────────────────────

bullCond = low > vwmaValue // Bullish: candle low above VWMA

bearCond = high < vwmaValue // Bearish: candle high below VWMA

// Trigger signal only on the bar where the condition first becomes true

bullSignal = bullCond and not bullCond[1]

bearSignal = bearCond and not bearCond[1]

//──────────────────────────────

// **Exit Condition at 15:29 IST**

//──────────────────────────────

sessionEnd = hour == 15 and minute == 29

// Exit all positions at 15:29 IST

if sessionEnd

strategy.close_all(comment="Closing all positions at session end")

//──────────────────────────────

// **Trade Control Logic**

//──────────────────────────────

var bool hasExited = true // Track if an exit has occurred since last entry

// Reset exit flag when a position is exited

if strategy.position_size == 0

hasExited := true

//──────────────────────────────

// **Position Management: Entry & Exit**

//──────────────────────────────

if newSession

hasExited := true // Allow first trade of the day

// On a bullish signal:

// • If currently short, close the short position and then enter long

// • Otherwise, add to any existing long position **only if an exit happened before**

if bullSignal and (hasExited or newSession)

if strategy.position_size < 0

strategy.close("Short", comment="Exit Short on Bull Signal")

strategy.entry("Long", strategy.long, comment="Enter Long: Buy Call & Sell Put at ATM")

else

strategy.entry("Long", strategy.long, comment="Add Long: Buy Call & Sell Put at ATM")

hasExited := false // Reset exit flag

// On a bearish signal:

// • If currently long, close the long position and then enter short

// • Otherwise, add to any existing short position **only if an exit happened before**

if bearSignal and (hasExited or newSession)

if strategy.position_size > 0

strategy.close("Long", comment="Exit Long on Bear Signal")

strategy.entry("Short", strategy.short, comment="Enter Short: Buy Put & Sell Call at ATM")

else

strategy.entry("Short", strategy.short, comment="Add Short: Buy Put & Sell Call at ATM")

hasExited := false // Reset exit flag

//──────────────────────────────

// **Updated Alert Conditions**

//──────────────────────────────

// Alerts for valid trade entries

alertcondition(bullSignal and (hasExited or newSession),

title="Long Entry Alert",

message="Bullish signal: BUY CALL & SELL PUT at ATM. Entry allowed.")

alertcondition(bearSignal and (hasExited or newSession),

title="Short Entry Alert",

message="Bearish signal: BUY PUT & SELL CALL at ATM. Entry allowed.")