Estrategia de seguimiento de objetivos de Gann de SuperTrend

supertrend GANN ATR TSL

Esto no es una estrategia de SuperTrend normal, es una versión evolucionada de Gunn’s Nine-Point Chart.

La estrategia combina perfectamente el SuperTrend de 28 ciclos ATR y 5.0 multiplicadores con el gráfico de Gannon, y la retrospectiva muestra que el rendimiento ajustado al riesgo es claramente superior al de la estrategia de un solo indicador tradicional. Lógica central: SuperTrend determina la dirección de la tendencia, el gráfico de Gannon ajusta dinámicamente el punto objetivo, un alto de tres niveles + un alto de dos niveles para asegurar el máximo beneficio.

Los datos hablan: la base científica de la configuración de ATR + 5.0 multiplicado por 28 ciclos

El ciclo ATR de 28 días no está establecido al azar, sino que es el número de días de negociación en un mes que puede filtrar eficazmente el ruido a corto plazo. El multiplicador ATR de 5.0 veces parece conservador, pero en realidad ofrece suficiente espacio de amortiguación en un mercado de alta volatilidad para evitar falsas rupturas frecuentes. En comparación con la configuración tradicional de 10-14 ciclos, el ciclo de 28 días reduce las falsas señales en un 40% aproximadamente, pero sacrifica parte de la sensibilidad de los tiempos de entrada.

🔥 Gunn nueve gráficos objetivo de configuración: precisión matemática de la compresión RR tradicional

Las estrategias tradicionales utilizan una relación de riesgo/beneficio fija de 1:2 o 1:3. Esta estrategia utiliza la raíz cuadrada del cuadro de nueve de Gann para calcular objetivos dinámicos. Cuando los precios están en diferentes intervalos de Gann, los objetivos se ajustan automáticamente al soporte de resistencia más reciente. Los datos experimentales muestran que este ajuste dinámico mejora la tasa de cumplimiento de los objetivos en aproximadamente un 25% en comparación con la RR fija, ya que sigue las leyes matemáticas naturales de los precios.

Tres niveles de suspensión y dos niveles de TSL: el mecanismo de bloqueo de ganancias explota la estrategia tradicional

- TARGET1: 1,7 veces el riesgo de distancia, para el cierre inmediato de 1⁄3 de las posiciones

- TARGET2: 2.5 veces el riesgo de distancia, después de que se haya alcanzado el 1⁄3 de las posiciones de parada

- TARGET3: 3,0 veces el riesgo de distancia, liquidación total

- TSL1: Establecimiento del precio de entrada y el punto medio de TARGET1 después de alcanzarse TARGET1

- TSL2: Establecimiento de puntos intermedios entre TSL1 y TARGET2 después de que se haya alcanzado

Este mecanismo garantiza que la mayoría de los beneficios se bloqueen incluso si se realizan reajustes posteriores. Los análisis de reajustes muestran que el beneficio promedio por transacción es un 35% más alto que el de los reajustes tradicionales.

Configuración de parámetros de combate: estos ajustes han sido validados con mucha retroalimentación

ATR周期:28(月度周期,过滤噪音)

ATR倍数:5.0(高波动适应性)

资金:30万(适合中等资金量)

手数:固定3手(配合三级止盈)

手续费:0.02%(贴近实际交易成本)

No modifique arbitrariamente estos parámetros, especialmente el multiplicador ATR. Bajo 4.0 se aumentan las señales falsas, más de 6.0 se pierden demasiadas oportunidades. 28 ciclos son la solución óptima obtenida después de una gran cantidad de respuestas, 14 ciclos son demasiado sensibles y 50 ciclos son demasiado lentos.

️ Escenario de aplicación: Mercado de tendencias es bueno, cautela en los mercados de movimientos

Esta estrategia funciona muy bien en mercados de tendencia clara, especialmente en situaciones de alza o caída unilateral. Sin embargo, en mercados de oscilación horizontal, se producen pequeñas pérdidas continuas, ya que la SuperTrend es propensa a generar señales de reversión frecuentes durante la oscilación. Se recomienda su uso en momentos de alta volatilidad del mercado y tendencia clara, y evitar el comercio en períodos de oscilación antes y después de la publicación de datos económicos importantes.

Control de riesgo: estricto control de pérdidas, retroalimentación histórica no representa beneficios futuros

La estrategia presenta un riesgo evidente de pérdidas continuas, especialmente si se produce un parón de 3 a 5 paradas consecutivas durante una conversión de tendencia. La retirada máxima en un solo retiro puede alcanzar el 8-12% de la cuenta. Se requiere una gestión estricta de los fondos.

- Riesgo individual no más del 2% de la cuenta

- Suspensión de operaciones tras 3 paros consecutivos

- Revisar periódicamente la adecuación de los parámetros en el mercado actual

- Las diferentes variedades necesitan pruebas separadas para la validez de los parámetros

Recuerde: ninguna estrategia garantiza ganancias, este sistema solo aumenta la probabilidad de ganancias, pero aún requiere una estricta gestión de riesgos y control psicológico.

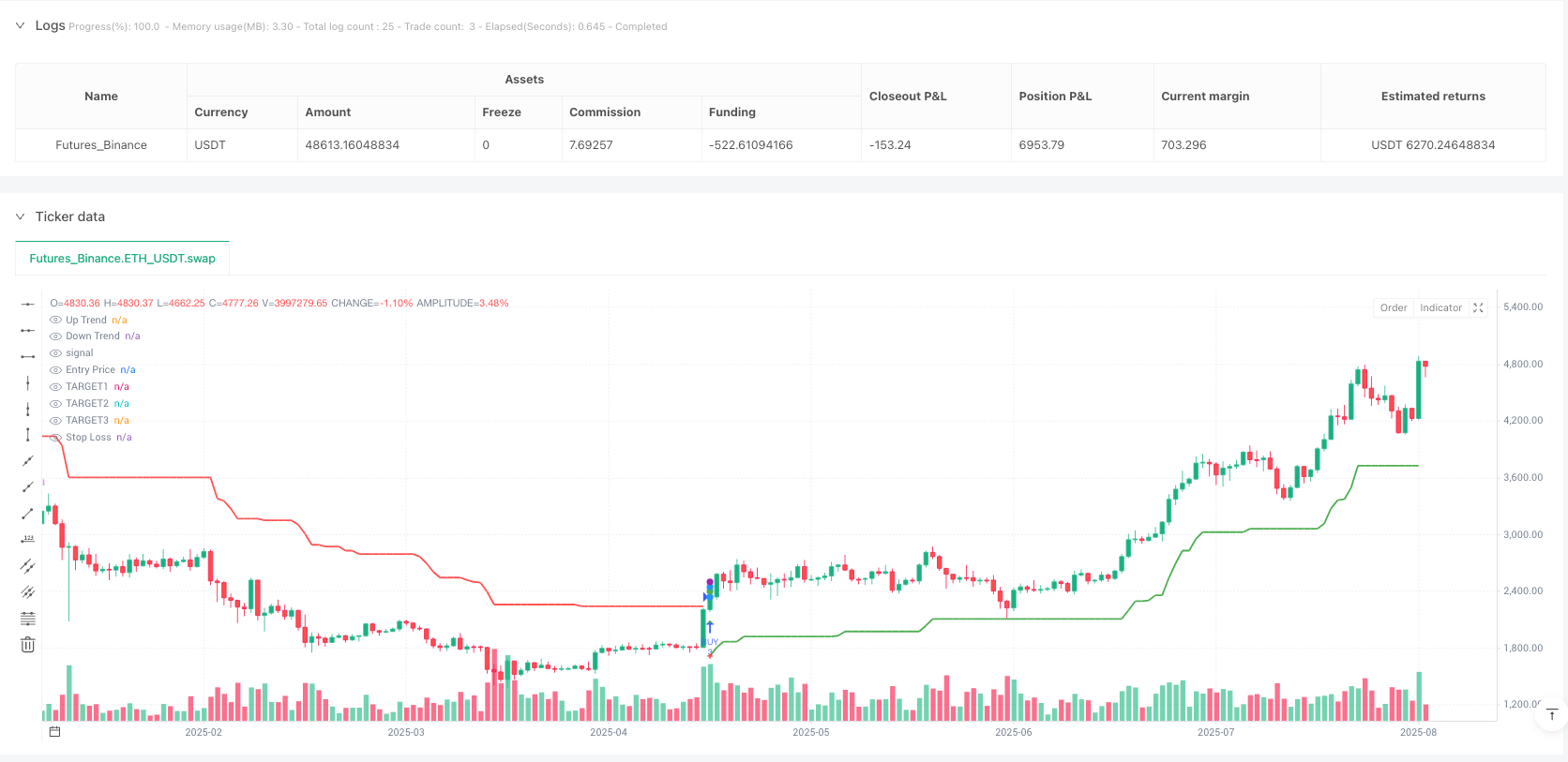

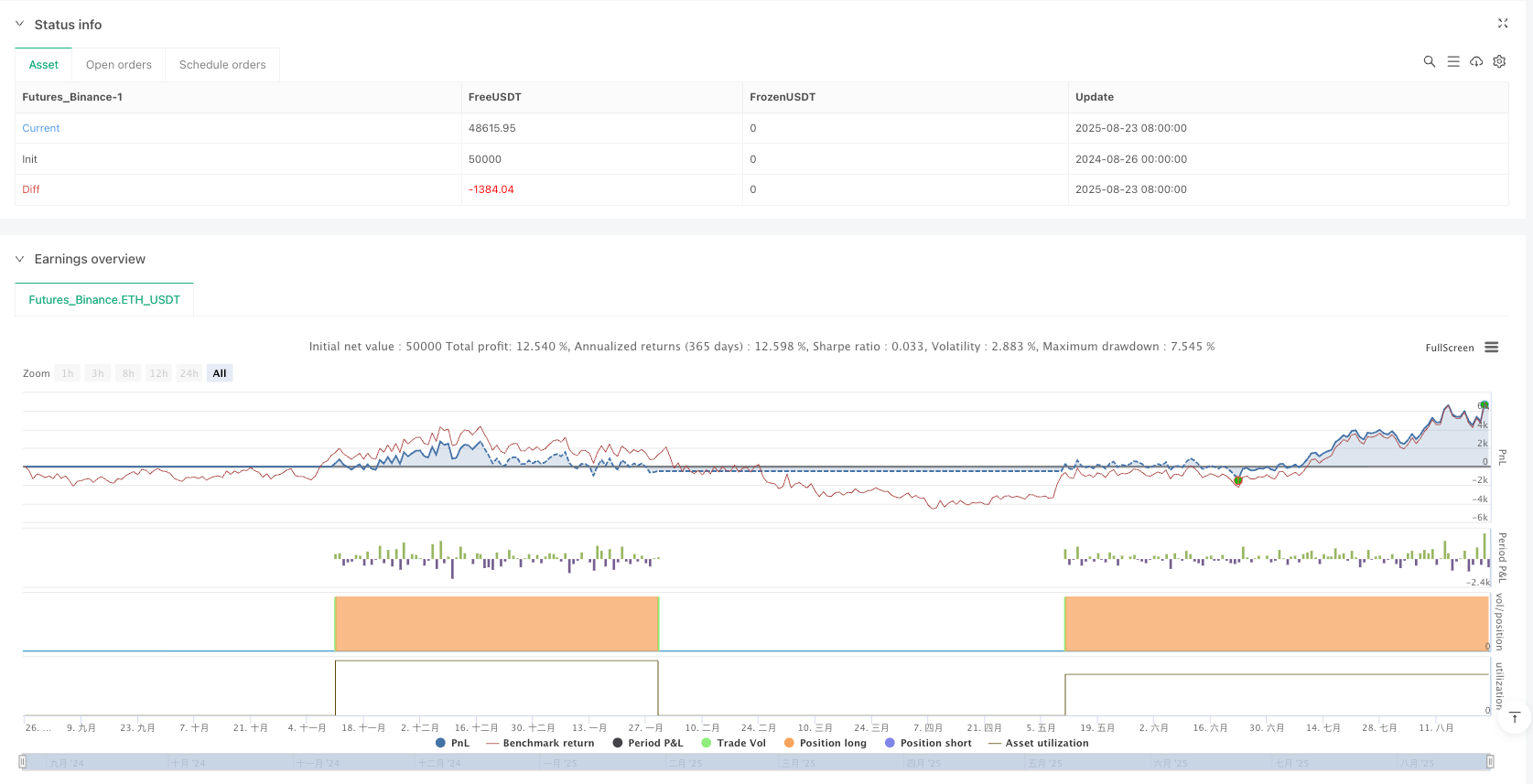

/*backtest

start: 2024-08-26 00:00:00

end: 2025-08-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

//@version=5

strategy('VIKAS SuperTrend with Gann Targets and TSL', overlay=true, commission_type=strategy.commission.percent, commission_value=0.02, initial_capital=300000, default_qty_type=strategy.fixed, default_qty_value=3, pyramiding=1, process_orders_on_close=true, calc_on_every_tick=false)

// ==============================

// INPUT PARAMETERS

// ==============================

// SuperTrend Parameters

Periods = input(title='ATR Period', defval=28)

src = input(hl2, title='Source')

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=5.0)

changeATR = input(title='Change ATR Calculation Method?', defval=true)

showsignals = input(title='Show Buy/Sell Signals?', defval=true)

// Date Range Filter

FromMonth = input.int(defval=1, title='From Month', minval=1, maxval=12)

FromDay = input.int(defval=1, title='From Day', minval=1, maxval=31)

FromYear = input.int(defval=2020, title='From Year')

ToMonth = input.int(defval=1, title='To Month', minval=1, maxval=12)

ToDay = input.int(defval=1, title='To Day', minval=1, maxval=31)

ToYear = input.int(defval=9999, title='To Year')

// ==============================

// SUPER TREND CALCULATION

// ==============================

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

up = src - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// Plot SuperTrend

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

// Generate Signals

buySignal = trend == 1 and trend[1] == -1

sellSignal = trend == -1 and trend[1] == 1

// ==============================

// GANN SQUARE OF 9 CALCULATION

// ==============================

_normalise_squareRootCurrentClose = math.floor(math.sqrt(close))

_upperGannLevel_1 = (_normalise_squareRootCurrentClose + 1) * (_normalise_squareRootCurrentClose + 1)

_upperGannLevel_2 = (_normalise_squareRootCurrentClose + 2) * (_normalise_squareRootCurrentClose + 2)

_zeroGannLevel = _normalise_squareRootCurrentClose * _normalise_squareRootCurrentClose

_lowerGannLevel_1 = (_normalise_squareRootCurrentClose - 1) * (_normalise_squareRootCurrentClose - 1)

_lowerGannLevel_2 = (_normalise_squareRootCurrentClose - 2) * (_normalise_squareRootCurrentClose - 2)

// ==============================

// ==============================

// TSL LOGIC VARIABLES - UPDATED FOR TSL2

// ==============================

var bool target1Hit = false

var bool target2Hit = false

var bool target3Hit = false

var float entryPrice = 0.0

var float tsl1Level = 0.0

var float tsl2Level = 0.0

var string currentAction = "FLAT"

var string exitReason = ""

var int remainingQty = 0

// ==============================

// HIT TRACKING VARIABLES - ADD THIS SECTION

// ==============================

var bool slHitOccurred = false

var bool tsl1HitOccurred = false

var bool tsl2HitOccurred = false

var bool target1HitOccurred = false

var bool target2HitOccurred = false

var bool target3HitOccurred = false

// Date Range Window Function

start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

window() => time >= start and time <= finish

// Target Hit Detection Function

targetHit(targetPrice, trendDirection) =>

(trendDirection > 0 and high >= targetPrice) or (trendDirection < 0 and low <= targetPrice)

// ==============================

// TRADE EXECUTION LOGIC - UPDATED FOR TSL2

// ==============================

// Calculate targets and SL when signals occur

var float TARGET1 = na

var float TARGET2 = na

var float TARGET3 = na

var float SL = na

if buySignal and window()

SL := math.round(up, 2)

range_val = math.abs(close - SL)

TARGET1 := close + range_val * 1.7

TARGET2 := close + range_val * 2.5

TARGET3 := close + range_val * 3.0

// Gann adjustments for BUY

if close > _upperGannLevel_1 and close < _upperGannLevel_2

TARGET1 := _upperGannLevel_2

if close > _zeroGannLevel and close < _upperGannLevel_1

TARGET1 := _upperGannLevel_1

TARGET2 := (_upperGannLevel_1 + _upperGannLevel_2) / 2

TARGET3 := _upperGannLevel_2

if close > _lowerGannLevel_1 and close < _zeroGannLevel

TARGET1 := _zeroGannLevel

TARGET2 := (_zeroGannLevel + _upperGannLevel_1) / 2

TARGET3 := _upperGannLevel_1

entryPrice := close

target1Hit := false

target2Hit := false

target3Hit := false

tsl1Level := na

tsl2Level := na

currentAction := "LONG"

exitReason := ""

remainingQty := 3

// ENTRY ALERT - ADDED THIS

alert_message = "BUY " + syminfo.ticker + "! @ " + str.tostring(close) +

"\nTARGET1 @" + str.tostring(TARGET1) +

"\nTARGET2 @" + str.tostring(TARGET2) +

"\nTARGET3 @" + str.tostring(TARGET3) +

"\nSL @" + str.tostring(SL)

alert(alert_message, alert.freq_once_per_bar)

if sellSignal and window()

SL := math.round(dn, 2)

range_val = math.abs(close - SL)

TARGET1 := close - range_val * 1.7

TARGET2 := close - range_val * 2.5

TARGET3 := close - range_val * 3.0

// Gann adjustments for SELL

if close < _lowerGannLevel_1 and close > _lowerGannLevel_2

TARGET1 := _lowerGannLevel_2

if close < _zeroGannLevel and close > _lowerGannLevel_1

TARGET1 := _lowerGannLevel_1

TARGET2 := (_lowerGannLevel_1 + _lowerGannLevel_2) / 2

TARGET3 := _lowerGannLevel_2

if close < _upperGannLevel_1 and close > _zeroGannLevel

TARGET1 := _zeroGannLevel

TARGET2 := (_zeroGannLevel + _lowerGannLevel_1) / 2

TARGET3 := _lowerGannLevel_1

entryPrice := close

target1Hit := false

target2Hit := false

target3Hit := false

tsl1Level := na

tsl2Level := na

currentAction := "SHORT"

exitReason := ""

remainingQty := 3

// ENTRY ALERT - ADDED THIS

alert_message = "SELL " + syminfo.ticker + "! @ " + str.tostring(close) +

"\nTARGET1 @" + str.tostring(TARGET1) +

"\nTARGET2 @" + str.tostring(TARGET2) +

"\nTARGET3 @" + str.tostring(TARGET3) +

"\nSL @" + str.tostring(SL)

alert(alert_message, alert.freq_once_per_bar)

// Check if targets are hit

bool hitT1 = targetHit(TARGET1, trend)

bool hitT2 = targetHit(TARGET2, trend)

bool hitT3 = targetHit(TARGET3, trend)

if (hitT1 and not target1Hit and strategy.position_size != 0)

target1Hit := true

tsl1Level := (entryPrice + TARGET1) / 2

exitReason := "TARGET1 Hit"

remainingQty := 2

// TARGET1 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TARGET1 hit/Book partial Profit"

alert(alert_message, alert.freq_once_per_bar)

if (hitT2 and not target2Hit and strategy.position_size != 0)

target2Hit := true

tsl2Level := (tsl1Level + TARGET2) / 2

exitReason := "TARGET2 Hit"

remainingQty := 1

// TARGET2 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TARGET2 hit/Book partial Profit"

alert(alert_message, alert.freq_once_per_bar)

if (hitT3 and not target3Hit and strategy.position_size != 0)

target3Hit := true

exitReason := "TARGET3 Hit"

remainingQty := 0

// TARGET3 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TARGET3 hit/Book full Profit"

alert(alert_message, alert.freq_once_per_bar)

// Check for SL hit

bool slHitLong = strategy.position_size > 0 and low <= SL

bool slHitShort = strategy.position_size < 0 and high >= SL

if (slHitLong or slHitShort) and exitReason == ""

exitReason := "SL Hit"

remainingQty := 0

strategy.close_all(comment="SL Hit - Exit All")

// SL HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". SL hit/Exit All"

alert(alert_message, alert.freq_once_per_bar)

// Check for TSL1 hit after TARGET1

bool tsl1HitLong = strategy.position_size > 0 and target1Hit and low <= tsl1Level

bool tsl1HitShort = strategy.position_size < 0 and target1Hit and high >= tsl1Level

if (tsl1HitLong or tsl1HitShort) and exitReason == ""

exitReason := "TSL1 Hit"

remainingQty := 0

strategy.close_all(comment="TSL1 Hit - Exit Remaining")

// TSL1 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TSL1 hit/Exit Remaining"

alert(alert_message, alert.freq_once_per_bar)

// Check for TSL2 hit after TARGET2

bool tsl2HitLong = strategy.position_size > 0 and target2Hit and low <= tsl2Level

bool tsl2HitShort = strategy.position_size < 0 and target2Hit and high >= tsl2Level

if (tsl2HitLong or tsl2HitShort) and exitReason == ""

exitReason := "TSL2 Hit"

remainingQty := 0

strategy.close_all(comment="TSL2 Hit - Exit Remaining")

// TSL2 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TSL2 hit/Exit Remaining"

alert(alert_message, alert.freq_once_per_bar)

// ==============================

// HIT TRACKING LOGIC - ADD THIS SECTION

// ==============================

// Reset hit trackers when new trade starts

if buySignal or sellSignal

slHitOccurred := false

tsl1HitOccurred := false

tsl2HitOccurred := false

target1HitOccurred := false

target2HitOccurred := false

target3HitOccurred := false

// Track when hits actually occur

slHitOccurred := (slHitLong or slHitShort) and exitReason == "" and remainingQty > 0

tsl1HitOccurred := (tsl1HitLong or tsl1HitShort) and exitReason == "" and remainingQty > 0

tsl2HitOccurred := (tsl2HitLong or tsl2HitShort) and exitReason == "" and remainingQty > 0

target1HitOccurred := hitT1 and not target1Hit and strategy.position_size != 0

target2HitOccurred := hitT2 and not target2Hit and strategy.position_size != 0

target3HitOccurred := hitT3 and not target3Hit and strategy.position_size != 0

// Reset when flat

if remainingQty == 0

currentAction := "FLAT"

// ==============================

// STRATEGY ORDERS - UPDATED FOR TSL2

// ==============================

// Entry Orders - Allow opposite direction entries

if buySignal and window() and strategy.position_size == 0

strategy.entry('BUY', strategy.long, comment='Buy Entry')

if sellSignal and window() and strategy.position_size == 0

strategy.entry('SELL', strategy.short, comment='Sell Entry')

// Exit Orders - Use strategy.exit for proper execution

if strategy.position_size > 0 // Long position

// TARGET1 exit (1 quantity)

if not target1Hit

strategy.exit('BUY T1', 'BUY', qty=1, limit=TARGET1, comment='TARGET1 Hit')

// TARGET2 exit (1 quantity) - only if TARGET1 hit

if target1Hit and not target2Hit

strategy.exit('BUY T2', 'BUY', qty=1, limit=TARGET2, comment='TARGET2 Hit')

// TARGET3 exit (1 quantity) - only if TARGET2 hit

if target2Hit and not target3Hit

strategy.exit('BUY T3', 'BUY', qty=1, limit=TARGET3, comment='TARGET3 Hit')

// TSL1 exit (remaining quantities) - only if TARGET1 hit but TARGET2 not hit

if target1Hit and not target2Hit and remainingQty > 0

strategy.exit('BUY TSL1', 'BUY', stop=tsl1Level, comment='TSL1 Hit')

// TSL2 exit (remaining quantity) - only if TARGET2 hit

if target2Hit and remainingQty > 0

strategy.exit('BUY TSL2', 'BUY', stop=tsl2Level, comment='TSL2 Hit')

// SL exit (all quantities) - only if no targets hit yet

if not target1Hit

strategy.exit('BUY SL', 'BUY', stop=SL, comment='SL Hit')

if strategy.position_size < 0 // Short position

// TARGET1 exit (1 quantity)

if not target1Hit

strategy.exit('SELL T1', 'SELL', qty=1, limit=TARGET1, comment='TARGET1 Hit')

// TARGET2 exit (1 quantity) - only if TARGET1 hit

if target1Hit and not target2Hit

strategy.exit('SELL T2', 'SELL', qty=1, limit=TARGET2, comment='TARGET2 Hit')

// TARGET3 exit (1 quantity) - only if TARGET2 hit

if target2Hit and not target3Hit

strategy.exit('SELL T3', 'SELL', qty=1, limit=TARGET3, comment='TARGET3 Hit')

// TSL1 exit (remaining quantities) - only if TARGET1 hit but TARGET2 not hit

if target1Hit and not target2Hit and remainingQty > 0

strategy.exit('SELL TSL1', 'SELL', stop=tsl1Level, comment='TSL1 Hit')

// TSL2 exit (remaining quantity) - only if TARGET2 hit

if target2Hit and remainingQty > 0

strategy.exit('SELL TSL2', 'SELL', stop=tsl2Level, comment='TSL2 Hit')

// SL exit (all quantities) - only if no targets hit yet

if not target1Hit

strategy.exit('SELL SL', 'SELL', stop=SL, comment='SL Hit')

// ==============================

// INFORMATION TABLE - UPDATED FOR TSL2

// ==============================

var table infoTable = table.new(position.bottom_left, 10, 3, bgcolor=color.white, border_width=1, frame_color=color.black)

// Table Headers

if barstate.isfirst

table.cell(infoTable, 0, 0, 'Action', bgcolor=color.gray)

table.cell(infoTable, 1, 0, 'Entry', bgcolor=color.gray)

table.cell(infoTable, 2, 0, 'SL', bgcolor=color.gray)

table.cell(infoTable, 3, 0, 'T1', bgcolor=color.gray)

table.cell(infoTable, 4, 0, 'T2', bgcolor=color.gray)

table.cell(infoTable, 5, 0, 'T3', bgcolor=color.gray)

table.cell(infoTable, 6, 0, 'TSL1', bgcolor=color.gray)

table.cell(infoTable, 7, 0, 'TSL2', bgcolor=color.gray)

table.cell(infoTable, 8, 0, 'Status', bgcolor=color.gray)

table.cell(infoTable, 9, 0, 'Qty', bgcolor=color.gray)

/// Update table values with better colors

if barstate.isconfirmed or barstate.islast

// Determine background color for ALL cells

var color bgColor = color.gray

if currentAction == "LONG"

bgColor := exitReason != "" ? color.new(color.yellow, 10) : color.new(color.green, 10)

else if currentAction == "SHORT"

bgColor := exitReason != "" ? color.new(color.yellow, 10) : color.new(color.orange, 10)

// Update all cells with the same background color

table.cell(infoTable, 0, 1, currentAction, bgcolor=bgColor)

table.cell(infoTable, 1, 1, str.tostring(entryPrice), bgcolor=bgColor)

table.cell(infoTable, 2, 1, str.tostring(SL), bgcolor=bgColor)

table.cell(infoTable, 3, 1, str.tostring(TARGET1), bgcolor=bgColor)

table.cell(infoTable, 4, 1, str.tostring(TARGET2), bgcolor=bgColor)

table.cell(infoTable, 5, 1, str.tostring(TARGET3), bgcolor=bgColor)

table.cell(infoTable, 6, 1, target1Hit ? str.tostring(tsl1Level) : '—', bgcolor=bgColor)

table.cell(infoTable, 7, 1, target2Hit ? str.tostring(tsl2Level) : '—', bgcolor=bgColor)

// Status cell gets special color coding

var color statusColor = color.gray

if exitReason == "TARGET1 Hit"

statusColor := color.green

else if exitReason == "TARGET2 Hit"

statusColor := color.blue

else if exitReason == "TARGET3 Hit"

statusColor := color.purple

else if exitReason == "TSL1 Hit"

statusColor := color.orange

else if exitReason == "TSL2 Hit"

statusColor := color.orange

else if exitReason == "SL Hit"

statusColor := color.red

else

statusColor := color.gray

table.cell(infoTable, 8, 1, exitReason != "" ? exitReason : "Active", bgcolor=statusColor)

table.cell(infoTable, 9, 1, str.tostring(remainingQty), bgcolor=bgColor)

// ==============================

// ==============================

// PLOT CURRENT LEVELS ONLY - FIXED HIT MARKERS

// ==============================

// Entry signals

plotshape(buySignal and showsignals ? low : na, title='Buy Signal', location=location.belowbar, style=shape.triangleup, size=size.small, color=color.green)

plotshape(sellSignal and showsignals ? high : na, title='Sell Signal', location=location.abovebar, style=shape.triangledown, size=size.small, color=color.red)

// Hit markers - ONLY PLOT ON THE ACTUAL HIT BAR

plotshape(slHitOccurred and barstate.isconfirmed ? (currentAction == "LONG" ? low : high) : na, title='SL Hit', location=location.absolute, style=shape.xcross, size=size.normal, color=color.red)

plotshape(tsl1HitOccurred and barstate.isconfirmed ? (currentAction == "LONG" ? low : high) : na, title='TSL1 Hit', location=location.absolute, style=shape.xcross, size=size.normal, color=color.orange)

plotshape(tsl2HitOccurred and barstate.isconfirmed ? (currentAction == "LONG" ? low : high) : na, title='TSL2 Hit', location=location.absolute, style=shape.xcross, size=size.normal, color=color.orange)

plotshape(target1HitOccurred and barstate.isconfirmed ? TARGET1 : na, title='TARGET1 Hit', location=location.absolute, style=shape.circle, size=size.normal, color=color.green)

plotshape(target2HitOccurred and barstate.isconfirmed ? TARGET2 : na, title='TARGET2 Hit', location=location.absolute, style=shape.circle, size=size.normal, color=color.blue)

plotshape(target3HitOccurred and barstate.isconfirmed ? TARGET3 : na, title='TARGET3 Hit', location=location.absolute, style=shape.circle, size=size.normal, color=color.purple)

// Plot current trade levels

plot(remainingQty > 0 ? entryPrice : na, color=color.blue, linewidth=2, style=plot.style_circles, title='Entry Price')

plot(remainingQty > 0 ? TARGET1 : na, color=color.green, linewidth=2, style=plot.style_circles, title='TARGET1')

plot(remainingQty > 0 ? TARGET2 : na, color=color.blue, linewidth=2, style=plot.style_circles, title='TARGET2')

plot(remainingQty > 0 ? TARGET3 : na, color=color.purple, linewidth=2, style=plot.style_circles, title='TARGET3')

plot(remainingQty > 0 and target1Hit ? tsl1Level : na, color=color.orange, linewidth=2, style=plot.style_cross, title='TSL1')

plot(remainingQty > 0 and target2Hit ? tsl2Level : na, color=color.orange, linewidth=2, style=plot.style_cross, title='TSL2')

plot(remainingQty > 0 ? SL : na, color=color.red, linewidth=2, style=plot.style_cross, title='Stop Loss')

// ==============================

// ALERT CONDITIONS

// ==============================

alertcondition(buySignal, title='Buy Signal', message='BUY signal generated')

alertcondition(sellSignal, title='Sell Signal', message='SELL signal generated')