Estrategia de retroceso de Trend River

EMA RSI ATR CHANDELIER

¿Qué es un “río de tendencia”? ¡Qué metáfora!

¿Sabías que esta estrategia imagina a los 5 EMA como un “río”? Al igual que los ríos reales tienen un lecho y un río, cuando los 5 EMA están alineados, la zona que se forma entre ellos es nuestro “río de tendencia”.

Es tan sencillo como ver la dirección de la corriente: a donde va el río, vamos nosotros.

La estrategia central: esperar a que los peces vuelvan a nadar al río para echar las redes

¿Cuál es la parte más inteligente de esta estrategia? ¡No es subir cuando los precios están en alza, sino esperar pacientemente a que se “reajusten”!

¿Cómo funciona esto?

- Señales múltiples: tendencia al alza + RSI≥60 + Precio reajustado a la profundidad del río del 40% + Nueva ruptura de la EMA rápida

- Señales de cabeza hueca: tendencia a la baja + RSI≤40 + precio rebota a la altura del río 40% + recaída de la rápida EMA

Como los tiburones, no bajan cuando están en su punto más alto, sino que esperan a que vuelvan a nadar en aguas conocidas.

Gestión de riesgos: solo arriesga el 1% de su capital

¡La guía para evitar cavidades ya está aquí! La parte más familiar de esta estrategia es el cálculo automático del tamaño de la posición:

- El riesgo de cada transacción está controlado en el 1% del capital

- Se establece el Stop Loss con el indicador ATR ((2 veces el ATR)

- La proporción de ganancias y pérdidas se establece en 2: 1 (se arriesga a perder 1 para 2 libras)

- Y Chandler está siguiendo los beneficios de la protección de la pérdida.

¡Es como el cinturón de seguridad en un auto - no para tener un accidente, sino para estar seguro y disfrutar de la conducción!

¿Por qué es tan importante esta estrategia?

La solución a los tres problemas de los comerciantes:

- La búsqueda de la muerteEl equipo de la Liga de Campeones de la Liga de Campeones de la Liga de Campeones de la Liga de Campeones de la Liga de Campeones.

- No sé cuánto.Las posiciones se calculan automáticamente, los riesgos se controlan

- No sé cuándo correr.El problema es que la mayoría de los usuarios no tienen acceso a la información.

Esta estrategia es especialmente adecuada para los comerciantes que quieren “ganar de manera estable”. No busca la riqueza de la noche a la mañana, pero puede ayudarlo a ganar dinero de manera estable en la tendencia! Recuerde: en el río del comercio, lo más importante no es nadar más rápido, sino nadar más estable.

||

🌊 What is “Trend River”? This Analogy is Brilliant!

You know what? This strategy imagines 5 EMA lines as a “river”! Just like a real river has riverbed and surface, when 5 EMAs align properly, the area between them forms our “trend river”. Key point! When the river direction is clear (bullish: fast line above, bearish: fast line below), that’s when our money-making opportunities arrive!

It’s as simple as watching water flow direction - wherever the river flows, that’s where we profit! 💰

🎯 Core Strategy: Wait for Fish to Return Before Casting the Net

What’s the smartest part of this strategy? It doesn’t chase prices during rallies, but patiently waits for “pullbacks”!

How does it work exactly?

- Long signal: Uptrend + RSI≥60 + Price pulls back to 40% river depth + Re-breaks above fast EMA

- Short signal: Downtrend + RSI≤40 + Price bounces to 40% river height + Re-breaks below fast EMA

It’s like fishing - you don’t cast when fish jump highest, but wait for them to return to familiar waters! 🎣

💡 Risk Management: Only Risk 1% Capital Each Time

Here’s the pitfall guide! The most thoughtful part of this strategy is automatic position sizing:

- Each trade risks only 1% of capital

- Uses ATR indicator for stop loss (2x ATR)

- Risk-reward ratio set at 2:1 (earn 2 to risk 1)

- Plus Chandelier trailing stop to protect profits

It’s like wearing a seatbelt while driving - not because you expect an accident, but to enjoy the ride with peace of mind! 🚗

🚀 Why is This Strategy Worth Attention?

Solves three major trader pain points:

- FOMO trading: Wait for pullbacks instead of buying tops

- Position sizing confusion: Auto-calculates position size with controlled risk

- Exit uncertainty: Has stop loss, take profit, and trailing stop

This strategy is perfect for traders who want “steady wins”. It doesn’t promise overnight riches, but helps you profit steadily in trends! Remember: In the river of trading, the most important thing isn’t swimming fastest, but swimming most steadily 🏊♀️

[/trans]

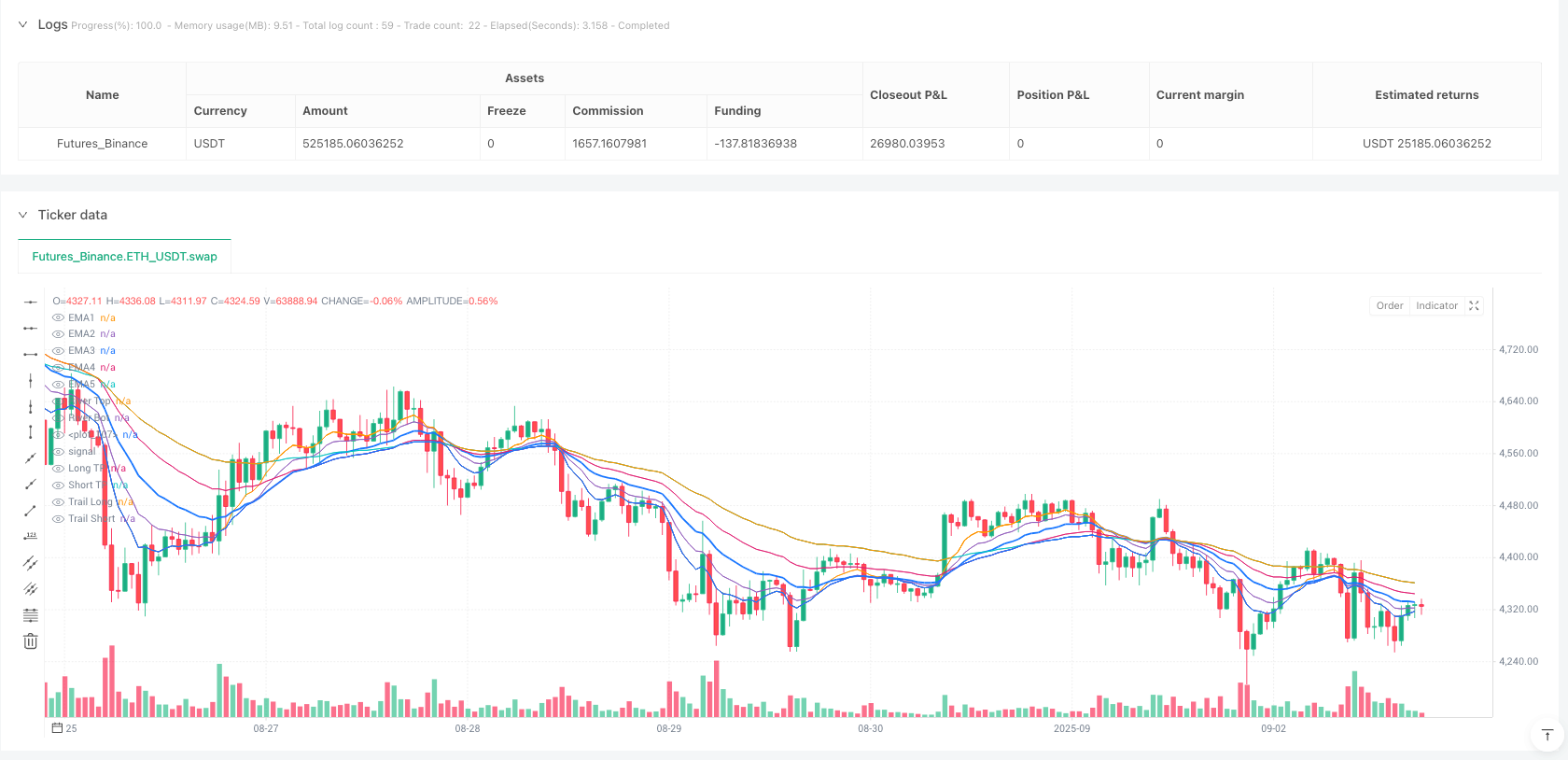

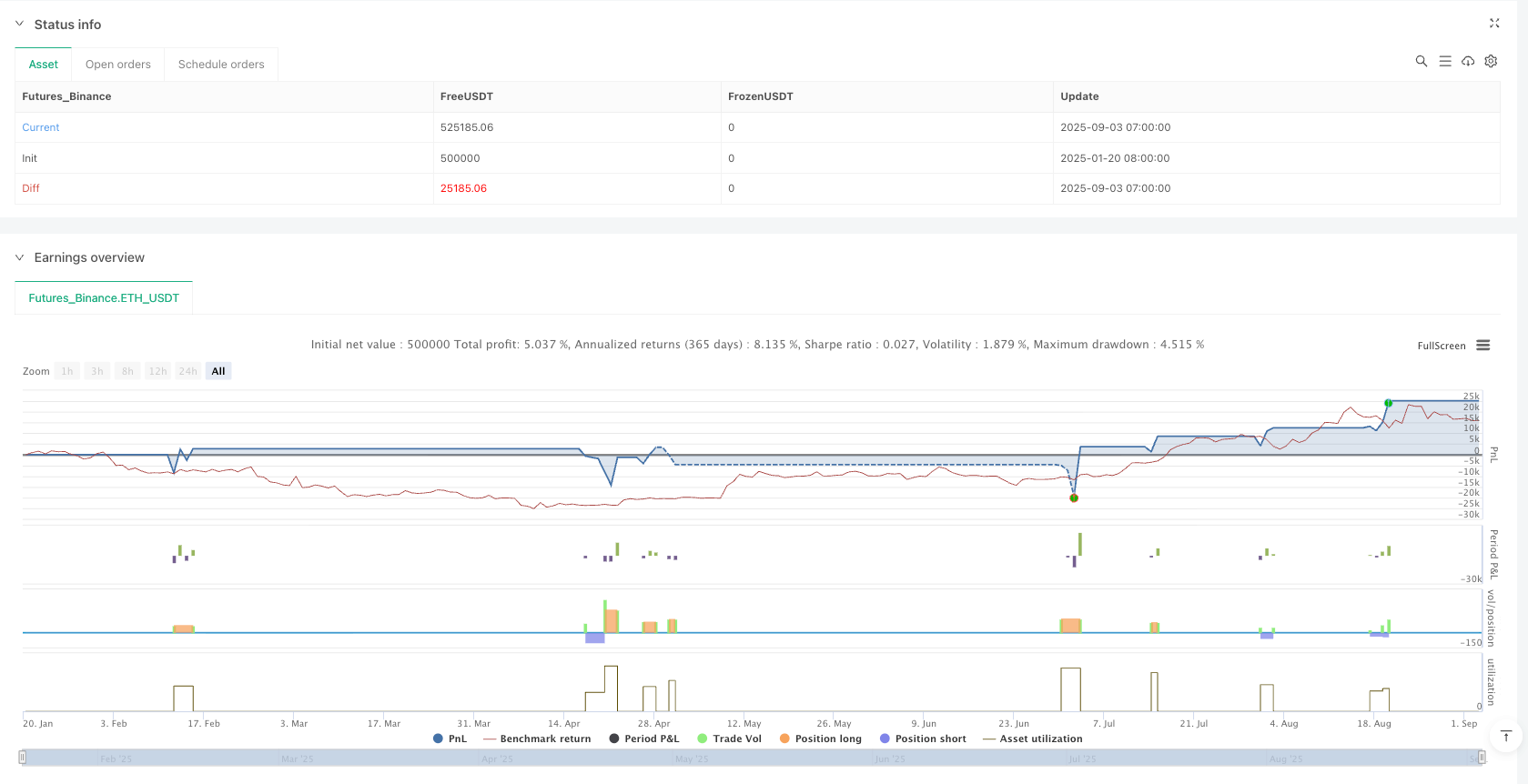

/*backtest

start: 2025-01-20 08:00:00

end: 2025-09-03 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

strategy("Trend River Pullback Strategy v1",

overlay=true, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.02,

pyramiding=0, calc_on_order_fills=true, calc_on_every_tick=true, margin_long=1, margin_short=1)

// ===== Inputs

// EMA river

emaFastLen = input.int(8, "EMA1 (fast)")

ema2Len = input.int(13, "EMA2")

emaMidLen = input.int(21, "EMA3 (middle)")

ema4Len = input.int(34, "EMA4")

emaSlowLen = input.int(55, "EMA5 (slow)")

// Pullback and momentum

rsiLen = input.int(14, "RSI length")

rsiOB = input.int(60, "RSI trend threshold (long)")

rsiOS = input.int(40, "RSI trend threshold (short)")

pullbackPct = input.float(40.0, "Pullback depth % of river width", minval=0, maxval=100)

// Risk management

riskPct = input.float(1.0, "Risk per trade % of capital", step=0.1, minval=0.1)

atrLen = input.int(14, "ATR length (stop/trailing)")

atrMultSL = input.float(2.0, "ATR multiplier for stop", step=0.1)

tpRR = input.float(2.0, "Take profit R-multiple", step=0.1)

// Trailing stop

useTrail = input.bool(true, "Enable trailing stop (Chandelier)")

trailMult = input.float(3.0, "ATR multiplier for trailing", step=0.1)

// ===== Calculations

ema1 = ta.ema(close, emaFastLen)

ema2 = ta.ema(close, ema2Len)

ema3 = ta.ema(close, emaMidLen)

ema4 = ta.ema(close, ema4Len)

ema5 = ta.ema(close, emaSlowLen)

// River: top/bottom as envelope of averages

riverTop = math.max(math.max(ema1, ema2), math.max(ema3, math.max(ema4, ema5)))

riverBot = math.min(math.min(ema1, ema2), math.min(ema3, math.min(ema4, ema5)))

riverMid = (riverTop + riverBot) / 2.0

riverWidth = riverTop - riverBot

// Trend conditions: EMA alignment

bullAligned = ema1 > ema2 and ema2 > ema3 and ema3 > ema4 and ema4 > ema5

bearAligned = ema1 < ema2 and ema2 < ema3 and ema3 < ema4 and ema4 < ema5

// Momentum

rsi = ta.rsi(close, rsiLen)

// Pullback into river

pullbackLevelBull = riverTop - riverWidth * (pullbackPct/100.0)

pullbackLevelBear = riverBot + riverWidth * (pullbackPct/100.0)

pullbackOkBull = bullAligned and rsi >= rsiOB and low <= pullbackLevelBull

pullbackOkBear = bearAligned and rsi <= rsiOS and high >= pullbackLevelBear

// Entry trigger: return to momentum (fast EMA crossover)

longTrig = pullbackOkBull and ta.crossover(close, ema1)

shortTrig = pullbackOkBear and ta.crossunder(close, ema1)

// ATR for stops

atr = ta.atr(atrLen)

// ===== Position sizing by risk

capital = strategy.equity

riskMoney = capital * (riskPct/100.0)

// Preliminary stop levels

longSL = close - atrMultSL * atr

shortSL = close + atrMultSL * atr

// Tick value and size

tickValue = syminfo.pointvalue

// Avoid division by zero

slDistLong = math.max(close - longSL, syminfo.mintick)

slDistShort = math.max(shortSL - close, syminfo.mintick)

// Number of contracts/lots

qtyLong = riskMoney / (slDistLong * tickValue)

qtyShort = riskMoney / (slDistShort * tickValue)

// Limit: not less than 0

qtyLong := math.max(qtyLong, 0)

qtyShort := math.max(qtyShort, 0)

// ===== Entries

if longTrig and strategy.position_size <= 0

strategy.entry("Long", strategy.long, qty=qtyLong)

if shortTrig and strategy.position_size >= 0

strategy.entry("Short", strategy.short, qty=qtyShort)

// ===== Exits: fixed TP by R and stop

// Store entry price

var float entryPrice = na

if strategy.position_size != 0 and na(entryPrice)

entryPrice := strategy.position_avg_price

if strategy.position_size == 0

entryPrice := na

// Targets

longTP = na(entryPrice) ? na : entryPrice + tpRR * (entryPrice - longSL)

shortTP = na(entryPrice) ? na : entryPrice - tpRR * (shortSL - entryPrice)

// Trailing: Chandelier

trailLong = close - trailMult * atr

trailShort = close + trailMult * atr

// Final exit levels

useTrailLong = useTrail and strategy.position_size > 0

useTrailShort = useTrail and strategy.position_size < 0

// For long

if strategy.position_size > 0

stopL = math.max(longSL, na)

tStop = useTrailLong ? trailLong : longSL

strategy.exit("L-Exit", from_entry="Long", stop=tStop, limit=longTP)

// For short

if strategy.position_size < 0

stopS = math.min(shortSL, na)

tStopS = useTrailShort ? trailShort : shortSL

strategy.exit("S-Exit", from_entry="Short", stop=tStopS, limit=shortTP)

// ===== Visuals

plot(ema1, "EMA1", display=display.all, linewidth=1)

plot(ema2, "EMA2", display=display.all, linewidth=1)

plot(ema3, "EMA3", display=display.all, linewidth=2)

plot(ema4, "EMA4", display=display.all, linewidth=1)

plot(ema5, "EMA5", display=display.all, linewidth=1)

plot(riverTop, "River Top", style=plot.style_linebr, linewidth=1)

plot(riverBot, "River Bot", style=plot.style_linebr, linewidth=1)

fill(plot1=plot(riverTop, display=display.none), plot2=plot(riverBot, display=display.none), title="River Fill", transp=80)

plot(longTP, "Long TP", style=plot.style_linebr)

plot(shortTP, "Short TP", style=plot.style_linebr)

plot(useTrailLong ? trailLong : na, "Trail Long", style=plot.style_linebr)

plot(useTrailShort ? trailShort : na, "Trail Short", style=plot.style_linebr)

// Signal markers

plotshape(longTrig, title="Long Trigger", style=shape.triangleup, location=location.belowbar, size=size.tiny, text="L")

plotshape(shortTrig, title="Short Trigger", style=shape.triangledown, location=location.abovebar, size=size.tiny, text="S")

// ===== Alerts

alertcondition(longTrig, title="Long Signal", message="Long signal: trend aligned + pullback + momentum")

alertcondition(shortTrig, title="Short Signal", message="Short signal: trend aligned + pullback + momentum")