¿Es esta la estrategia de FVG más sencilla de la leyenda?

No te dejes engañar por el nombre de “Estrategia de la Abuela”. Aunque se llama estrategia de la abuela, la técnica no es inferior.50 EMA de ciclo para determinar la dirección de la tendencia + brecha de valor justo (FVG) para capturar oportunidades de reversión + 2 veces el riesgo de retorno en comparación con el bloqueo de ganancias。 El análisis muestra un buen desempeño en mercados con claras tendencias, pero con estrictas condiciones de ingreso.。

Las principales características de la estrategia:4 líneas K para ubicar el tiempo de entrada❚C0-C1 forma el hueco de FVG, C2 limpia la retroalimentación de la fluidez y C3 confirma la señal de reversión. Este diseño es más preciso que las estrategias de ruptura tradicionales y evita una gran cantidad de trampas de falsa ruptura.

El filtro de tendencia de la EMA: las tendencias son tu mejor amigo

El EMA de 50 ciclos no es una disposición, es una línea de vida o muerteLa estrategia requiere que las señales de más cabeza estén por encima de la EMA y las señales de cabeza vacía por debajo de la misma. Este diseño filtra directamente el 70% de las operaciones contravaloradas, lo que aumenta considerablemente la tasa de éxito.

Lo más inteligente es que puede elegir el precio de cierre de cualquier línea K para determinar la tendencia de la EMA. Por defecto, se establece la verificación de C0 (la línea K más temprana) para asegurarse de que toda la forma está en la dirección correcta de la tendencia. Si desea ser más radical, puede elegir C3, lo que permite más oportunidades de entrada pero con un mayor riesgo.

Gestión de riesgos: objetivo 2R + mecanismo de garantía dinámica

La configuración de stop loss es muy precisa.El stop multiples se establece en el punto bajo de C1, el stop en blanco en el punto alto de C1. Se puede agregar un desvío de tick adicional para evitar un barrido instantáneo. El RRR por defecto de 2 veces el riesgo significa un stop de 10 puntos y un objetivo de 20 puntos.

La función de libreta dinámica es el punto fuerte.: Cuando el precio alcanza 1R o 2R, el stop loss se traslada automáticamente al precio de entrada. Este diseño le permite mantenerse más tiempo en la tendencia, mientras protege los beneficios. Los datos históricos muestran que el retiro máximo se reduce en un 35% después de activar el mecanismo de garantía.

Clasificación de las condiciones de ingreso: 4 líneas K perfectamente combinadas

La lógica estricta de la configuración múltiple:

- C1 tiene que ser la línea que trae la sombra (la trampa de liquidez)

- Existen huecos de FVG entre C0 y C2[2] > Punto más alto[0])

- C2 barrido C1 bajo y cerrado por encima de C1 bajo (confirmación de falsa ruptura)

- C3 Invertir la brecha de FVG y cerrarla por debajo del precio de apertura de C1 (Confirmación de inversión)

Esta lógica es mucho más que una simple resistencia de soporte a la ruptura de Gauss. No espera que la ruptura ocurra, sino queLa oportunidad de revertir el fallo de la brecha de prejuicio。

Espacio para la optimización de la estrategia: 5 excepciones para liberar el potencial

El código ofrece cinco interruptores de excepción para que puedas ajustar tu estrategia a las características del mercado:

- Desactivar el filtro EMAEn un mercado convulsionado, es posible que se considere la posibilidad de abrir.

- Permitir que el C3 se encuentre dentro del FVGEl problema es que la mayoría de los usuarios de Internet no tienen acceso a Internet.

- Permite que C3 supere el precio de apertura de C1Las condiciones de ingreso son más radicales:

- Permite el cierre inverso de C2La liberación de las direcciones de C2:

- Filtro de ventana de tiempoEl objetivo es limitar las horas de transacción y evitar las horas de mala liquidez.

Consejos de combate: cuándo usar y cuándo evitar

El mejor entorno de mercadoEn este entorno, la tasa de éxito de la estrategia puede ser superior al 65%, con una tasa de ganancias / pérdidas promedio cercana a 2.5.

Las situaciones que hay que evitar: Mercado de oscilación horizontal. Cuando los precios fluctúan repetidamente cerca de la EMA, las señales FVG son frecuentes pero de muy mala calidad. Se recomienda suspender el uso cuando el ATR está por debajo de la media de 20 ciclos.

Consejos de riesgoEl retorno histórico no representa ganancias futuras, y la estrategia presenta el riesgo de pérdidas continuas. Se recomienda que el riesgo individual se controle en el 1-2% de la cuenta, y se aplique estrictamente la disciplina de stop loss. El rendimiento varía enormemente en diferentes entornos de mercado y requiere un monitoreo y ajuste continuos.

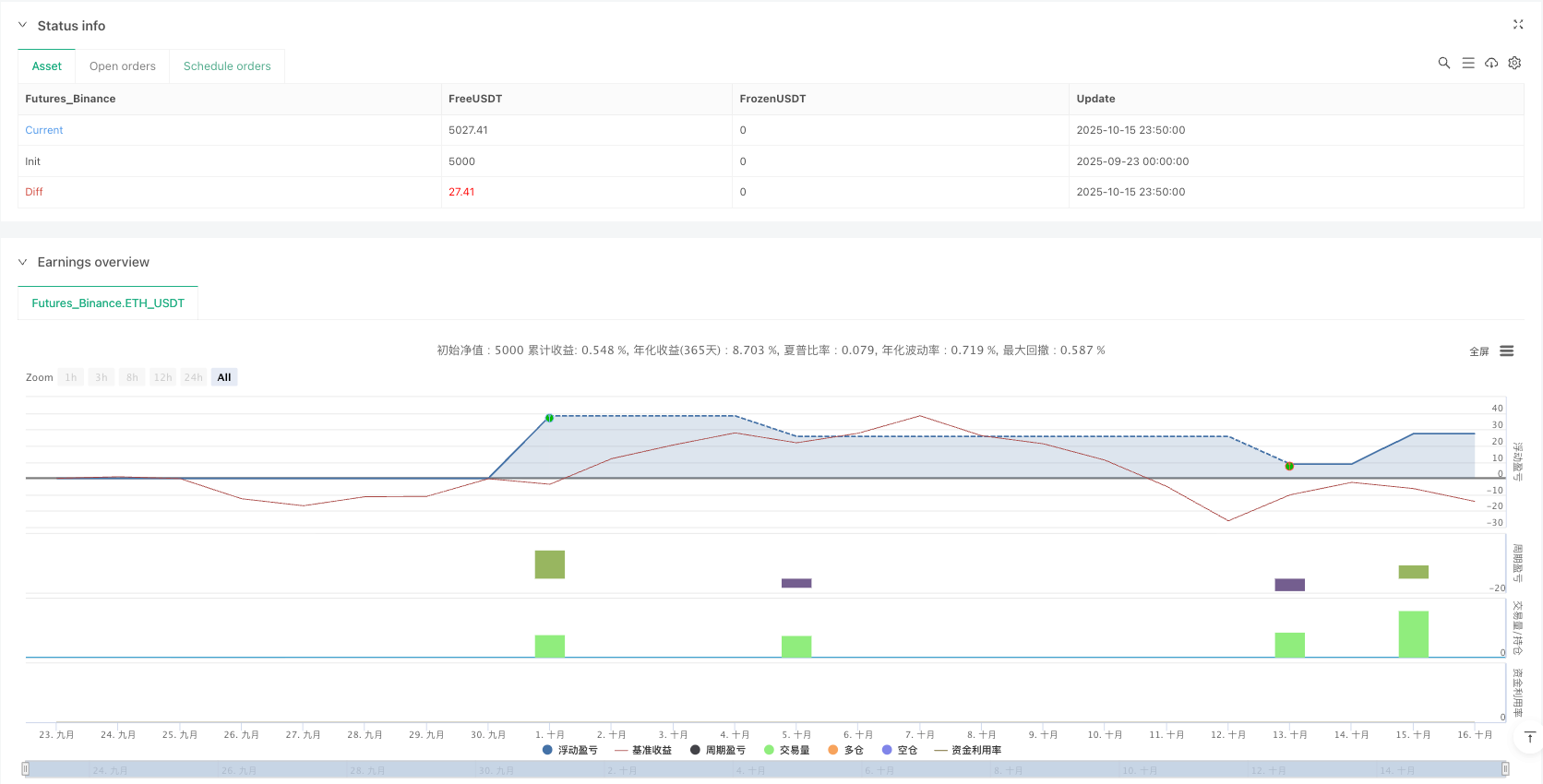

/*backtest

start: 2025-09-23 00:00:00

end: 2025-10-16 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":5000}]

*/

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © rdjxyz

//@version=5

strategy("Granny Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// ============================================================================

// INPUTS

// ============================================================================

// Display

showCandleNumbers = input.bool(false, "Show Candle Numbers (0, 1, 2, 3)", group="Display")

// Time Filter

useTimeFilter = input.bool(false, "Use Time Window Filter", group="Time Filter")

timeZone = input.string("America/New_York", "Timezone", options=["America/New_York", "America/Chicago", "America/Los_Angeles", "Europe/London", "Europe/Paris", "Europe/Berlin", "Asia/Tokyo", "Asia/Hong_Kong", "Asia/Shanghai", "Australia/Sydney", "UTC"], group="Time Filter")

sessionTime = input("0930-1600", "Trading Hours (Start-End)", group="Time Filter", tooltip="Set the start and end time for the trading window. Format: HHMM-HHMM")

// EMA

showEMA = input.bool(true, "Show EMA", group="EMA")

emaLength = input.int(50, "EMA Length", minval=1, group="EMA")

// Risk/Reward

stopLossTicks = input.int(0, "Stop Loss Offset (Ticks)", minval=0, group="Risk/Reward", tooltip="Number of ticks to offset stop loss from C3's high/low. 0 = exact high/low, positive = further away")

riskRewardRatio = input.float(2.0, "Risk:Reward Ratio", minval=0.1, step=0.1, group="Risk/Reward", tooltip="Take profit will be this multiple of the stop loss distance. E.g., 2.0 = 2R, 1.5 = 1.5R")

breakEvenAtRR = input.float(0, "Move SL to Break Even at R:R", minval=0, step=0.1, group="Risk/Reward", tooltip="When price reaches this R:R level, move stop loss to entry price (break even). Set to 0 to disable. E.g., 1.0 = break even at 1R, 2.0 = break even at 2R")

// Exceptions

emaBiasCandle = input.string("C0", "Check EMA Bias on Candle", options=["C0", "C1", "C2", "C3"], group="Exceptions", tooltip="Select which candle's close should be checked against the EMA for bias")

disableEMAFilter = input.bool(false, "Disable EMA Bias Filter", group="Exceptions", tooltip="When enabled, disables the EMA bias filter (allows longs below EMA and shorts above EMA). When disabled (default), only look for longs above EMA and shorts below EMA")

allowC3InsideFVG = input.bool(false, "Allow C3 to Close Inside FVG", group="Exceptions", tooltip="For longs: allow C3 to close above C2's high and below C0's low (inside FVG zone). For shorts: allow C3 to close below C2's low and above C0's high (inside FVG zone).")

allowC3OutsideC1Open = input.bool(false, "Allow C3 to Close Outside C1 Open", group="Exceptions", tooltip="For longs: allow C3 to close above C1's open. For shorts: allow C3 to close below C1's open.")

allowC2OppositeDirection = input.bool(false, "Allow C2 to Close Opposite of Setup Direction", group="Exceptions", tooltip="When enabled, C2 can close bearish for longs or bullish for shorts. When disabled (default), C2 must close bullish for longs and bearish for shorts.")

// Debugging

// showDebug = input.bool(false, "Show Debug Markers", group="Debugging")

// ============================================================================

// INDICATORS

// ============================================================================

ema50 = ta.ema(close, emaLength)

// ============================================================================

// TIME WINDOW CHECK

// ============================================================================

// Check if current bar is within the trading window

inTimeWindow = not useTimeFilter or not na(time(timeframe.period, sessionTime, timeZone))

// ============================================================================

// HELPER FUNCTIONS

// ============================================================================

// Check if candle is bullish

isBullish(index) =>

close[index] > open[index]

// Check if candle is bearish

isBearish(index) =>

close[index] < open[index]

// Check if candle has bottom wick

hasBottomWick(index) =>

low[index] < math.min(open[index], close[index])

// Check if candle has top wick

hasTopWick(index) =>

high[index] > math.max(open[index], close[index])

// ============================================================================

// LONG SETUP DETECTION

// ============================================================================

// Detection happens progressively as candles form:

// - C0 and C1 are marked when we're on C2 (can confirm FVG exists)

// - C2 is marked when it forms (current bar meets sweep criteria)

// - C3 is marked when it forms (current bar inverts FVG)

// Check for C2 (current bar): Sweeps C1 low, closes bullish inside C1 range

// When on C2: C0 is at [2], C1 is at [1], C2 is at [0]

// The pattern is: C0 -> C1 (bearish, creates FVG) -> C2 (sweeps and recovers)

// C1 checks (the bar at [1])

c1_is_bearish = close[1] < open[1]

c1_has_wick = low[1] < math.min(open[1], close[1])

// FVG check: gap between C0 and C2 after the bearish move

// The bearish FVG is the gap between C0's low and C2's high (current bar)

fvg_gap_exists = low[2] > high[0]

// C2 checks (current bar at [0])

c2_sweeps_c1_low = low < low[1]

c2_closes_above_c1_low = close > low[1]

c2_closes_below_c0_low = close < low[2]

c2_direction_ok_long = allowC2OppositeDirection or close > open

// EMA bias check for C2 detection (C0, C1, or C2)

ema_check_c2_long = disableEMAFilter or (emaBiasCandle == "C0" ? close[2] > ema50[2] : emaBiasCandle == "C1" ? close[1] > ema50[1] : emaBiasCandle == "C2" ? close > ema50 : true)

isC2Long = c1_is_bearish and c1_has_wick and fvg_gap_exists and c2_sweeps_c1_low and c2_closes_above_c1_low and c2_closes_below_c0_low and c2_direction_ok_long and ema_check_c2_long

// Store that C2 formed (for detecting C3 on the very next bar)

var bool c2LongFormed = false

if isC2Long

c2LongFormed := true

else

c2LongFormed := false // Reset if not C2 - ensures C3 must be the immediate next bar

// Check for C3 (current bar): Inverts FVG and closes below C1 open

// IMPORTANT: C3 must be the bar immediately after C2 (no gaps allowed)

// When on C3: C0 is at [3], C1 is at [2], C2 is at [1]

// "Invert" means price closes back below C1's open (reversing back toward the FVG)

// Must also close above C0's low (staying within the reversal zone)

c2_formed_prev_long = c2LongFormed[1]

c3_c1_open_condition_long = allowC3OutsideC1Open or close < open[2]

c3_range_condition_long = allowC3InsideFVG ? (close > high[1] and close < low[3]) : close > low[3]

isC3Long = c2_formed_prev_long and c3_c1_open_condition_long and c3_range_condition_long

// Debug for C3 conditions

// if showDebug and c2_formed_prev_long

// debugC3 = "C3: "

// debugC3 += c2_formed_prev_long ? "C2✓ " : "C2✗ "

// debugC3 += c3_c1_open_condition_long ? "OPEN✓ " : "OPEN✗ "

// debugC3 += c3_range_condition_long ? "RANGE✓" : "RANGE✗"

// debugC3 += " | C1open:" + str.tostring(open[2]) + " C0low:" + str.tostring(low[3]) + " Close:" + str.tostring(close)

// label.new(bar_index, high, debugC3, color=color.new(color.orange, 70), textcolor=color.white, style=label.style_label_down, size=size.small)

// EMA bias check for C3 (if user selected C3)

ema_check_c3_long = disableEMAFilter or emaBiasCandle != "C3" or close > ema50

// Overall long setup condition

longSetup = isC3Long and ema_check_c3_long

// Candle markers - visible when showCandleNumbers is enabled

// Mark C0 when on C2

plotchar(showCandleNumbers and isC2Long, "C0 Long", "0", location.abovebar, color.white, size=size.tiny, offset=-2)

// Mark C1 when on C2

plotchar(showCandleNumbers and isC2Long, "C1 Long", "1", location.belowbar, color.white, size=size.tiny, offset=-1)

// Mark C2 on current bar

plotchar(showCandleNumbers and isC2Long, "C2 Long", "2", location.belowbar, color.white, size=size.tiny)

// Mark C3 - number (when showCandleNumbers enabled) + emoji on C2 (always)

invalidC3Long = c2_formed_prev_long and not isC3Long

plotchar(showCandleNumbers and (isC3Long or invalidC3Long), "C3 Long", "3", location.belowbar, color.white, size=size.tiny)

plotchar(isC3Long, "Valid Long Setup", "👵🏻", location.belowbar, color.green, size=size.tiny, offset=-1)

plotchar(invalidC3Long, "Invalid Long Setup", "🤡", location.belowbar, color.red, size=size.tiny, offset=-1)

// Variables to store active trade lines for longs

var line longEntryLine = na

var line longSLLine = na

var line longTPLine = na

var label longEntryLabel = na

var label longSLLabel = na

var label longTPLabel = na

// Variables to track break even for longs

var bool longBreakEvenTriggered = false

var float longEntryPrice = na

var float longOneRLevel = na

var float longTPLevel = na

// Draw entry, stop loss, and take profit lines when C3 forms - always visible

if isC3Long

slLevel = low - (stopLossTicks * syminfo.mintick) // Stop loss level with tick offset

// Take profit line

slDistance = close - slLevel // Stop loss distance

tpLevel = close + (slDistance * riskRewardRatio) // Take profit level

// ============================================================================

// SHORT SETUP DETECTION

// ============================================================================

// Check for C2 (current bar): Sweeps C1 high, closes bearish inside C1 range

// C1 would be at [1], C0 at [2]

c1_is_bullish = close[1] > open[1]

c1_has_top_wick = high[1] > math.max(open[1], close[1])

// FVG check: gap between C0 and C2 after the bullish move

// The bullish FVG is the gap between C0's high and C2's low (current bar)

fvg_gap_exists_short = high[2] < low[0]

c2_sweeps_c1_high = high > high[1]

c2_closes_below_c1_high = close < high[1]

c2_closes_above_c0_high = close > high[2]

c2_direction_ok_short = allowC2OppositeDirection or close < open

// EMA bias check for C2 detection (C0, C1, or C2)

ema_check_c2_short = disableEMAFilter or (emaBiasCandle == "C0" ? close[2] < ema50[2] : emaBiasCandle == "C1" ? close[1] < ema50[1] : emaBiasCandle == "C2" ? close < ema50 : true)

isC2Short = c1_is_bullish and c1_has_top_wick and fvg_gap_exists_short and c2_sweeps_c1_high and c2_closes_below_c1_high and c2_closes_above_c0_high and c2_direction_ok_short and ema_check_c2_short

// Store that C2 formed (for detecting C3 on the very next bar)

var bool c2ShortFormed = false

if isC2Short

c2ShortFormed := true

else

c2ShortFormed := false // Reset if not C2 - ensures C3 must be the immediate next bar

// Check for C3 (current bar): Inverts FVG and closes above C1 open

// IMPORTANT: C3 must be the bar immediately after C2 (no gaps allowed)

// When on C3: C0 is at [3], C1 is at [2], C2 is at [1]

// "Invert" means price closes back above C1's open (reversing back toward the FVG)

// Must also close below C0's high (staying within the reversal zone)

c2_formed_prev_short = c2ShortFormed[1]

c3_c1_open_condition_short = allowC3OutsideC1Open or close > open[2]

c3_range_condition_short = allowC3InsideFVG ? (close < low[1] and close > high[3]) : close < high[3]

isC3Short = c2_formed_prev_short and c3_c1_open_condition_short and c3_range_condition_short

// EMA bias check for C3 (if user selected C3)

ema_check_c3_short = disableEMAFilter or emaBiasCandle != "C3" or close < ema50

// Overall short setup condition

shortSetup = isC3Short and ema_check_c3_short

// Candle markers - visible when showCandleNumbers is enabled

// Mark C0 when on C2

plotchar(showCandleNumbers and isC2Short, "C0 Short", "0", location.belowbar, color.white, size=size.tiny, offset=-2)

// Mark C1 when on C2

plotchar(showCandleNumbers and isC2Short, "C1 Short", "1", location.abovebar, color.white, size=size.tiny, offset=-1)

// Mark C2 on current bar

plotchar(showCandleNumbers and isC2Short, "C2 Short", "2", location.abovebar, color.white, size=size.tiny)

// Mark C3 - number (when showCandleNumbers enabled) + emoji on C2 (always)

invalidC3Short = c2_formed_prev_short and not isC3Short

plotchar(showCandleNumbers and (isC3Short or invalidC3Short), "C3 Short", "3", location.abovebar, color.white, size=size.tiny)

plotchar(isC3Short, "Valid Short Setup", "👵🏻", location.abovebar, color.green, size=size.tiny, offset=-1)

plotchar(invalidC3Short, "Invalid Short Setup", "🤡", location.abovebar, color.red, size=size.tiny, offset=-1)

// Variables to store active trade lines for shorts

var line shortEntryLine = na

var line shortSLLine = na

var line shortTPLine = na

var label shortEntryLabel = na

var label shortSLLabel = na

var label shortTPLabel = na

// Variables to track break even for shorts

var bool shortBreakEvenTriggered = false

var float shortEntryPrice = na

var float shortOneRLevel = na

var float shortTPLevel = na

// Draw entry, stop loss, and take profit lines when C3 forms - always visible

if isC3Short

slLevelShort = high + (stopLossTicks * syminfo.mintick) // Stop loss level with tick offset

// Take profit line

slDistanceShort = slLevelShort - close // Stop loss distance

tpLevelShort = close - (slDistanceShort * riskRewardRatio) // Take profit level

// ============================================================================

// ENTRY & EXIT LOGIC

// ============================================================================

// Long entry

if longSetup and strategy.position_size == 0 and inTimeWindow

slLevel = low - (stopLossTicks * syminfo.mintick) // Stop loss level with tick offset

slDistance = close - slLevel // Stop loss distance

tpLevel = close + (slDistance * riskRewardRatio) // Take profit level

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", "Long", stop=slLevel, limit=tpLevel)

// Initialize break even tracking

if breakEvenAtRR > 0

longBreakEvenTriggered := false

longEntryPrice := close

longOneRLevel := close + (slDistance * breakEvenAtRR) // R:R trigger level

longTPLevel := tpLevel

// Check for break even trigger on long trades

if strategy.position_size > 0 and breakEvenAtRR > 0 and not longBreakEvenTriggered

// Check if price has reached the specified R:R level

if high >= longOneRLevel

// Move stop loss to break even (entry price)

strategy.exit("Long Exit", "Long", stop=longEntryPrice, limit=longTPLevel)

longBreakEvenTriggered := true

// Short entry

if shortSetup and strategy.position_size == 0 and inTimeWindow

slLevelShort = high + (stopLossTicks * syminfo.mintick) // Stop loss level with tick offset

slDistanceShort = slLevelShort - close // Stop loss distance

tpLevelShort = close - (slDistanceShort * riskRewardRatio) // Take profit level

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", "Short", stop=slLevelShort, limit=tpLevelShort)

// Initialize break even tracking

if breakEvenAtRR > 0

shortBreakEvenTriggered := false

shortEntryPrice := close

shortOneRLevel := close - (slDistanceShort * breakEvenAtRR) // R:R trigger level

shortTPLevel := tpLevelShort

// Check for break even trigger on short trades

if strategy.position_size < 0 and breakEvenAtRR > 0 and not shortBreakEvenTriggered

// Check if price has reached the specified R:R level

if low <= shortOneRLevel

// Move stop loss to break even (entry price)

strategy.exit("Short Exit", "Short", stop=shortEntryPrice, limit=shortTPLevel)

shortBreakEvenTriggered := true

// ============================================================================

// VISUALIZATION

// ============================================================================

// Plot EMA

plot(showEMA ? ema50 : na, "EMA", color=color.white, linewidth=2)

// Background color for bias

bgcolor(close > ema50 ? color.new(color.green, 95) : close < ema50 ? color.new(color.red, 95) : na)