¿Qué es esta estrategia de los deuses mágicos? ¡20 indicadores en juego!

¿Sabías que esta estrategia es como dotarte de una superinteligente asistente de inteligencia artificial que monitoriza 20 diferentes señales de mercado al mismo tiempo y solo te sugiere una opción cuando la mayoría de los indicadores dicen “sí”?

En lugar de una estrategia de un solo indicador, es un “sistema de resonancia multidimensional”. Imagínese que si sólo un amigo dice que una acción es buena, usted puede tener una confianza parcial; pero si 20 amigos profesionales dicen que es buena, ¿sería más confiado?

La revelación de las armas nucleares

Identificar las tendencias de los tres espadachines 🗡️

- EMA rápido ((5) vs. EMA lento ((13)): captura de un cambio de tendencia a corto plazo

- Filtro de tendencias EMA ((34): confirmación de la dirección a mediano plazo

- Tendencia principal EMA ((89): Coge la dirección general y no te dejes llevar por las pequeñas fluctuaciones

Análisis de marcos de tiempo múltiples ⏰ Esta funcionalidad es genial! La estrategia mira las tendencias de 1 hora y 4 horas al mismo tiempo, como si estuvieras conduciendo y vieras el estado de la carretera delante y la ruta general de navegación. ¡Evitando la situación embarazosa de “el marco de tiempo pequeño es positivo, el marco de tiempo grande es negativo!”

Gestión inteligente de riesgos 🛡️

- Ajuste de posición dinámico: ajuste automático del tamaño de la apuesta según las fluctuaciones del mercado

- No sea avaro, pero reciba una parte.

- El deterioro móvil: el templo de la protección de las ganancias

🔥 20 lógica de las transacciones de seguros

Para hacer múltiples señales se requiere:

- Tendencia al alza: todos los EMAs están en la línea de arriba a abajo

- El RSI, el MACD y el RSI aleatorio dan luz verde.

- La adicción al peso es la verdadera adicción

- La estructura del mercado es saludable: los puntos altos siguen subiendo

- Apoyo a la liquidez: los puntos clave están bien

¡La señal de vacío es todo lo contrario!

Guía para evitar hoyos ️: La estrategia también incluye la “detección de la presión de la banda de Brin”, que suspende el comercio cuando el mercado está demasiado tranquilo para evitar ser golpeado en un mercado convulso!

Las armas secretas para maximizar las ganancias

Estrategias para detener el brote 📈

- La primera parada: Vender una posición del 30% cuando se obtiene una ganancia de riesgo de dos veces el riesgo

- La segunda parada: vender el 40% de la posición cuando se multiplica por 3.5.

- Posiciones restantes: Protección de pérdidas móviles para que las ganancias corran

La mejora de la pérdida de inteligencia 🎯 Una vez que el precio de venta se ha multiplicado por 2,5, el stop loss se traslada automáticamente al precio de costo, lo que garantiza que la transacción no se convierta en una pérdida de dinero. ¡Es como comprar un seguro para tus ganancias!

Detener el seguimiento dinámico 🏃♂️ Cuando las ganancias alcanzan un cierto nivel, el stop loss sigue a los precios como una sombra, protegiendo las ganancias y dando espacio para que se mantengan.

¿Por qué esta estrategia es tan estúpida?

- Toda la coberturaEl análisis técnico, la gestión de fondos y el control de riesgos son algunas de ellas.

- Filtrado inteligente20 niveles de selección condicional, un gran aumento en la tasa de éxito

- Altamente adaptableAnálisis de marcos de tiempo múltiples para diferentes entornos de mercado

- El diseño humanoLa aplicación automática evita las transacciones emocionales

¡Esta estrategia es como tener un equipo de traders experimentados en el código, buscando las mejores oportunidades de trading para ti las 24 horas del día!

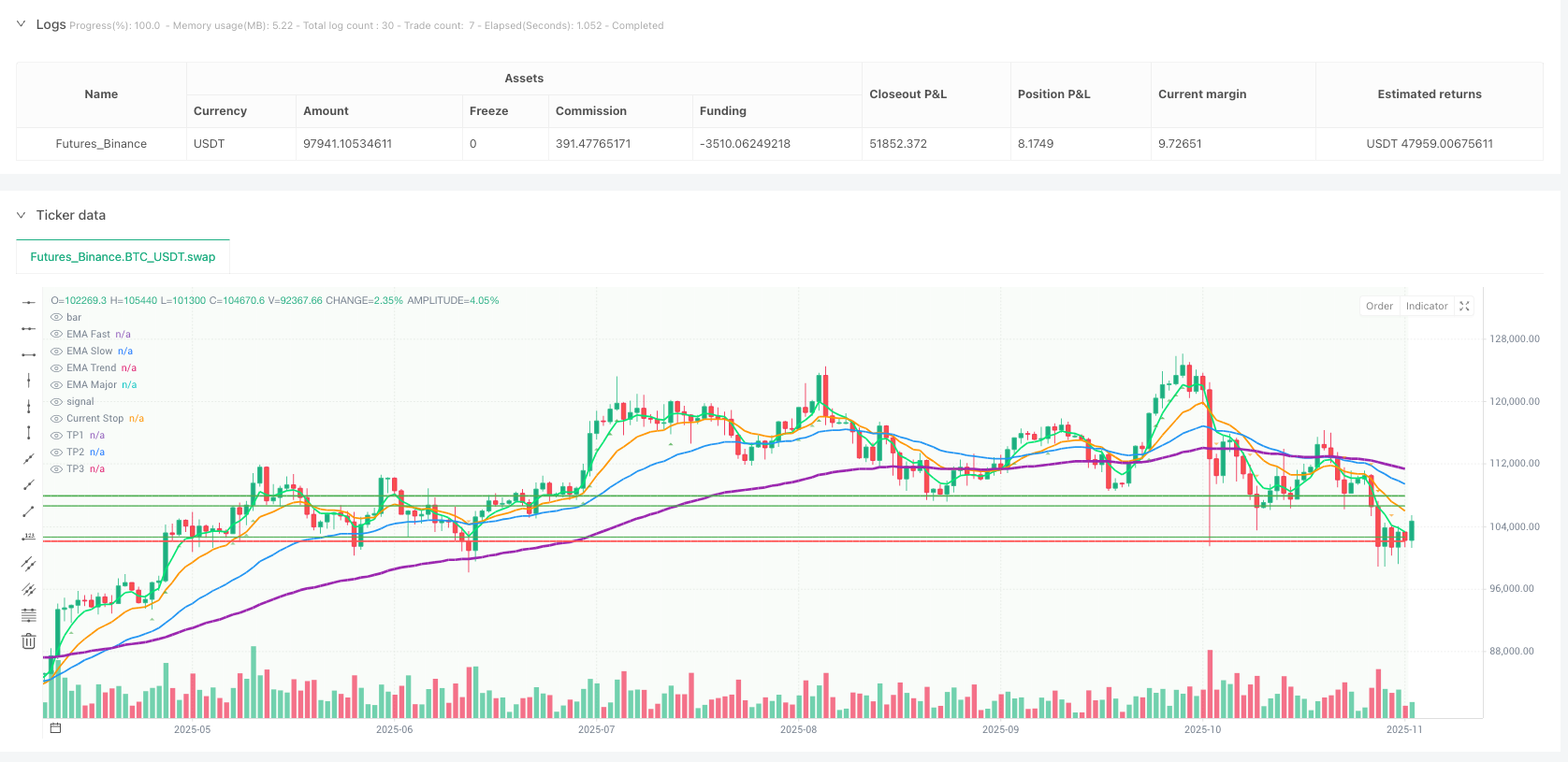

/*backtest

start: 2024-11-12 00:00:00

end: 2025-11-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy('Amir Mohammad Lor ', shorttitle='MPF', overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=15, pyramiding=0, max_bars_back=1000)

// === INPUTS ===

// Core Indicators

ema_fast_len = input.int(5, 'EMA Fast Length', minval=1, group="Core Indicators")

ema_slow_len = input.int(13, 'EMA Slow Length', minval=1, group="Core Indicators")

ema_trend_len = input.int(34, 'EMA Trend Filter', minval=1, group="Core Indicators")

ema_major_len = input.int(89, 'EMA Major Trend', minval=1, group="Core Indicators")

rsi_len = input.int(21, 'RSI Length', minval=1, group="Core Indicators")

// Multi-Timeframe Analysis

use_mtf = input.bool(true, 'Use Multi-Timeframe Analysis', group="Multi-Timeframe")

htf1 = input.timeframe("60", "1H Timeframe", group="Multi-Timeframe")

htf2 = input.timeframe("240", "4H Timeframe", group="Multi-Timeframe")

// Advanced Risk Management

initial_rr = input.float(4.0, 'Initial Risk Reward Ratio', minval=2.0, step=0.5, group="Risk Management")

atr_mult_entry = input.float(0.8, 'ATR Entry Stop Multiplier', minval=0.3, step=0.1, group="Risk Management")

use_dynamic_sizing = input.bool(true, 'Use Dynamic Position Sizing', group="Risk Management")

max_risk_per_trade = input.float(1.5, 'Max Risk Per Trade %', minval=0.5, step=0.1, group="Risk Management")

// Profit Maximization

use_partial_tp = input.bool(true, 'Use Partial Take Profits', group="Profit Management")

tp1_percent = input.float(30.0, 'First TP % of Position', minval=10, maxval=50, step=5, group="Profit Management")

tp1_rr = input.float(2.0, 'First TP R:R Ratio', minval=1.0, step=0.25, group="Profit Management")

tp2_percent = input.float(40.0, 'Second TP % of Position', minval=10, maxval=50, step=5, group="Profit Management")

tp2_rr = input.float(3.5, 'Second TP R:R Ratio', minval=2.0, step=0.25, group="Profit Management")

use_breakeven = input.bool(true, 'Move to Breakeven After TP1', group="Profit Management")

use_profit_trail = input.bool(true, 'Use Profit Trailing', group="Profit Management")

trail_activation = input.float(2.5, 'Trail Activation R:R', minval=1.5, step=0.25, group="Profit Management")

trail_distance = input.float(1.0, 'Trail Distance ATR', minval=0.5, step=0.1, group="Profit Management")

// Market Structure

use_market_structure = input.bool(true, 'Use Market Structure Analysis', group="Market Structure")

swing_length = input.int(20, 'Swing Length', minval=5, group="Market Structure")

use_liquidity_zones = input.bool(true, 'Use Liquidity Zone Detection', group="Market Structure")

// Trend Strength Filters

min_trend_strength = input.float(0.6, 'Minimum Trend Strength', minval=0.3, maxval=1.0, step=0.1, group="Filters")

use_momentum_filter = input.bool(true, 'Use Momentum Confluence', group="Filters")

min_volume_ratio = input.float(1.8, 'Minimum Volume Ratio', minval=1.0, step=0.1, group="Filters")

// Alert Settings

enable_sound_alerts = input.bool(true, 'Enable Sound Alerts', group="Alert Settings")

enable_popup_alerts = input.bool(true, 'Enable Popup Alerts', group="Alert Settings")

enable_email_alerts = input.bool(false, 'Enable Email Alerts', group="Alert Settings")

alert_frequency = input.string("Once Per Bar Close", "Alert Frequency", options=["All", "Once Per Bar", "Once Per Bar Close"], group="Alert Settings")

// === INDICATORS ===

// EMAs

ema_fast = ta.ema(close, ema_fast_len)

ema_slow = ta.ema(close, ema_slow_len)

ema_trend = ta.ema(close, ema_trend_len)

ema_major = ta.ema(close, ema_major_len)

// Crossover calculations

fast_under_slow = ta.crossunder(ema_fast, ema_slow)

fast_over_slow = ta.crossover(ema_fast, ema_slow)

// RSI with divergence detection

rsi = ta.rsi(close, rsi_len)

rsi_ma = ta.sma(rsi, 5)

// ATR for dynamic stops

atr = ta.atr(14)

atr_ma = ta.sma(atr, 14)

// Volume analysis

volume_ma = ta.sma(volume, 20)

volume_ratio = volume / volume_ma

// Market Structure Analysis

swing_high = ta.pivothigh(high, swing_length, swing_length)

swing_low = ta.pivotlow(low, swing_length, swing_length)

var float[] swing_highs = array.new<float>()

var float[] swing_lows = array.new<float>()

if not na(swing_high)

array.unshift(swing_highs, swing_high)

if array.size(swing_highs) > 5

array.pop(swing_highs)

if not na(swing_low)

array.unshift(swing_lows, swing_low)

if array.size(swing_lows) > 5

array.pop(swing_lows)

// Trend strength calculation

trend_strength = math.abs(ema_fast - ema_major) / (ema_major * 0.01)

trend_strength_norm = math.min(trend_strength / 2, 1.0)

// Multi-timeframe trend analysis

htf1_trend = request.security(syminfo.tickerid, htf1, ema_fast > ema_slow and ema_slow > ema_trend, barmerge.gaps_on)

htf1_trend_bear = request.security(syminfo.tickerid, htf1, ema_fast < ema_slow and ema_slow < ema_trend, barmerge.gaps_on)

htf2_trend = request.security(syminfo.tickerid, htf2, ema_fast > ema_trend and close > ema_major, barmerge.gaps_on)

htf2_trend_bear = request.security(syminfo.tickerid, htf2, ema_fast < ema_trend and close < ema_major, barmerge.gaps_on)

// Advanced momentum indicators

macd_line = ta.ema(close, 12) - ta.ema(close, 26)

macd_signal = ta.ema(macd_line, 9)

macd_hist = macd_line - macd_signal

// Bollinger Bands with squeeze detection

bb_length = 20

bb_mult = 2.0

[bb_upper, bb_middle, bb_lower] = ta.bb(close, bb_length, bb_mult)

bb_width = (bb_upper - bb_lower) / bb_middle

bb_squeeze = bb_width < ta.percentile_linear_interpolation(bb_width, 50, 20)

// Stochastic RSI

stoch_rsi = ta.stoch(rsi, rsi, rsi, 14)

// Money Flow Index

mfi = ta.mfi(hlc3, 14)

// Liquidity zones detection

var float liquidity_high = na

var float liquidity_low = na

var int liq_high_touches = 0

var int liq_low_touches = 0

if array.size(swing_highs) >= 2

recent_high = array.get(swing_highs, 0)

prev_high = array.get(swing_highs, 1)

if math.abs(recent_high - prev_high) / recent_high < 0.002

liquidity_high := recent_high

liq_high_touches := 2

if array.size(swing_lows) >= 2

recent_low = array.get(swing_lows, 0)

prev_low = array.get(swing_lows, 1)

if math.abs(recent_low - prev_low) / recent_low < 0.002

liquidity_low := recent_low

liq_low_touches := 2

// Advanced trend detection

uptrend_structure = array.size(swing_lows) >= 2 ? array.get(swing_lows, 0) > array.get(swing_lows, 1) : false

downtrend_structure = array.size(swing_highs) >= 2 ? array.get(swing_highs, 0) < array.get(swing_highs, 1) : false

// === CONFLUENCE SYSTEM ===

// LONG Setup Confluences (20 factors)

long_c1 = ema_fast > ema_slow and ema_slow > ema_trend and ema_trend > ema_major

long_c2 = close > ema_fast and close > ema_slow

long_c3 = rsi > 50 and rsi < 75 and rsi > rsi[1]

long_c4 = macd_line > macd_signal and macd_hist > macd_hist[1]

long_c5 = volume_ratio > min_volume_ratio

long_c6 = not use_mtf or (htf1_trend and htf2_trend)

long_c7 = trend_strength_norm > min_trend_strength

long_c8 = stoch_rsi > 20 and stoch_rsi < 80

long_c9 = mfi > 40 and mfi < 80 and mfi > mfi[1]

long_c10 = not bb_squeeze

long_c11 = close > bb_middle

long_c12 = not use_market_structure or uptrend_structure

long_c13 = fast_over_slow or (ema_fast > ema_slow and ema_fast[1] <= ema_slow[1])

long_c14 = atr > atr_ma * 0.8

long_c15 = close > high[1] or close > open

long_c16 = not use_liquidity_zones or (not na(liquidity_low) and close > liquidity_low)

long_c17 = ta.change(close, 3) > 0

long_c18 = hl2 > ema_trend

long_c19 = ta.roc(close, 5) > 0

long_c20 = close > ta.highest(close, 3)[1]

long_confluences = (long_c1 ? 1 : 0) + (long_c2 ? 1 : 0) + (long_c3 ? 1 : 0) +

(long_c4 ? 1 : 0) + (long_c5 ? 1 : 0) + (long_c6 ? 1 : 0) +

(long_c7 ? 1 : 0) + (long_c8 ? 1 : 0) + (long_c9 ? 1 : 0) +

(long_c10 ? 1 : 0) + (long_c11 ? 1 : 0) + (long_c12 ? 1 : 0) +

(long_c13 ? 1 : 0) + (long_c14 ? 1 : 0) + (long_c15 ? 1 : 0) +

(long_c16 ? 1 : 0) + (long_c17 ? 1 : 0) + (long_c18 ? 1 : 0) +

(long_c19 ? 1 : 0) + (long_c20 ? 1 : 0)

// SHORT Setup Confluences (20 factors)

short_c1 = ema_fast < ema_slow and ema_slow < ema_trend and ema_trend < ema_major

short_c2 = close < ema_fast and close < ema_slow

short_c3 = rsi < 50 and rsi > 25 and rsi < rsi[1]

short_c4 = macd_line < macd_signal and macd_hist < macd_hist[1]

short_c5 = volume_ratio > min_volume_ratio

short_c6 = not use_mtf or (htf1_trend_bear and htf2_trend_bear)

short_c7 = trend_strength_norm > min_trend_strength

short_c8 = stoch_rsi < 80 and stoch_rsi > 20

short_c9 = mfi < 60 and mfi > 20 and mfi < mfi[1]

short_c10 = not bb_squeeze

short_c11 = close < bb_middle

short_c12 = not use_market_structure or downtrend_structure

short_c13 = fast_under_slow or (ema_fast < ema_slow and ema_fast[1] >= ema_slow[1])

short_c14 = atr > atr_ma * 0.8

short_c15 = close < low[1] or close < open

short_c16 = not use_liquidity_zones or (not na(liquidity_high) and close < liquidity_high)

short_c17 = ta.change(close, 3) < 0

short_c18 = hl2 < ema_trend

short_c19 = ta.roc(close, 5) < 0

short_c20 = close < ta.lowest(close, 3)[1]

short_confluences = (short_c1 ? 1 : 0) + (short_c2 ? 1 : 0) + (short_c3 ? 1 : 0) +

(short_c4 ? 1 : 0) + (short_c5 ? 1 : 0) + (short_c6 ? 1 : 0) +

(short_c7 ? 1 : 0) + (short_c8 ? 1 : 0) + (short_c9 ? 1 : 0) +

(short_c10 ? 1 : 0) + (short_c11 ? 1 : 0) + (short_c12 ? 1 : 0) +

(short_c13 ? 1 : 0) + (short_c14 ? 1 : 0) + (short_c15 ? 1 : 0) +

(short_c16 ? 1 : 0) + (short_c17 ? 1 : 0) + (short_c18 ? 1 : 0) +

(short_c19 ? 1 : 0) + (short_c20 ? 1 : 0)

// High probability entry requirements

min_confluences_required = 14

long_entry = long_confluences >= min_confluences_required

short_entry = short_confluences >= min_confluences_required

// Signal strength classification

long_strength = long_confluences >= 18 ? "ULTRA STRONG" : long_confluences >= 16 ? "VERY STRONG" : long_confluences >= 14 ? "STRONG" : "WEAK"

short_strength = short_confluences >= 18 ? "ULTRA STRONG" : short_confluences >= 16 ? "VERY STRONG" : short_confluences >= 14 ? "STRONG" : "WEAK"

// === DYNAMIC POSITION SIZING ===

confluence_multiplier = long_entry ?

(long_confluences - min_confluences_required + 1) * 0.2 :

short_entry ?

(short_confluences - min_confluences_required + 1) * 0.2 :

1.0

volatility_factor = atr / close

normalized_vol = math.min(volatility_factor / 0.02, 2.0)

vol_multiplier = 1.0 / math.max(normalized_vol, 0.5)

dynamic_size = use_dynamic_sizing ? confluence_multiplier * vol_multiplier : 1.0

position_size = math.min(dynamic_size * 15, 25)

// === POSITION MANAGEMENT VARIABLES ===

var float entry_price = na

var float initial_stop = na

var float current_stop = na

var float tp1_price = na

var float tp2_price = na

var float tp3_price = na

var bool tp1_hit = false

var bool tp2_hit = false

var bool breakeven_moved = false

var string position_direction = na

var int bars_in_position = 0

var float max_profit = 0.0

var float trail_trigger_price = na

var float unrealized_pnl = 0.0

// Alert trigger variables

var bool long_entry_triggered = false

var bool short_entry_triggered = false

var bool tp1_alert_sent = false

var bool tp2_alert_sent = false

var bool breakeven_alert_sent = false

var bool trail_alert_sent = false

// === ENTRY LOGIC ===

if long_entry and strategy.position_size == 0

entry_price := close

initial_stop := close - (atr * atr_mult_entry)

current_stop := initial_stop

tp1_price := close + ((close - initial_stop) * tp1_rr)

tp2_price := close + ((close - initial_stop) * tp2_rr)

tp3_price := close + ((close - initial_stop) * initial_rr)

trail_trigger_price := close + ((close - initial_stop) * trail_activation)

position_direction := "LONG"

tp1_hit := false

tp2_hit := false

breakeven_moved := false

bars_in_position := 0

max_profit := 0.0

long_entry_triggered := true

tp1_alert_sent := false

tp2_alert_sent := false

breakeven_alert_sent := false

trail_alert_sent := false

if use_dynamic_sizing

strategy.entry("LONG", strategy.long, qty=position_size, comment="L:" + str.tostring(long_confluences))

else

strategy.entry("LONG", strategy.long, comment="L:" + str.tostring(long_confluences))

if short_entry and strategy.position_size == 0

entry_price := close

initial_stop := close + (atr * atr_mult_entry)

current_stop := initial_stop

tp1_price := close - ((initial_stop - close) * tp1_rr)

tp2_price := close - ((initial_stop - close) * tp2_rr)

tp3_price := close - ((initial_stop - close) * initial_rr)

trail_trigger_price := close - ((initial_stop - close) * trail_activation)

position_direction := "SHORT"

tp1_hit := false

tp2_hit := false

breakeven_moved := false

bars_in_position := 0

max_profit := 0.0

short_entry_triggered := true

tp1_alert_sent := false

tp2_alert_sent := false

breakeven_alert_sent := false

trail_alert_sent := false

if use_dynamic_sizing

strategy.entry("SHORT", strategy.short, qty=position_size, comment="S:" + str.tostring(short_confluences))

else

strategy.entry("SHORT", strategy.short, comment="S:" + str.tostring(short_confluences))

// === POSITION MANAGEMENT ===

if strategy.position_size != 0

bars_in_position += 1

if position_direction == "LONG"

current_profit = (close - entry_price) / entry_price

max_profit := math.max(max_profit, current_profit)

unrealized_pnl := (close - entry_price) * math.abs(strategy.position_size)

// Partial take profits

if use_partial_tp and not tp1_hit and close >= tp1_price

strategy.close("LONG", qty_percent=tp1_percent, comment="TP1")

tp1_hit := true

tp1_alert_sent := true

if use_partial_tp and not tp2_hit and close >= tp2_price and tp1_hit

strategy.close("LONG", qty_percent=tp2_percent, comment="TP2")

tp2_hit := true

tp2_alert_sent := true

// Move to breakeven after TP1

if use_breakeven and tp1_hit and not breakeven_moved and close >= tp1_price

current_stop := entry_price + (atr * 0.2)

breakeven_moved := true

breakeven_alert_sent := true

// Profit trailing

if use_profit_trail and close >= trail_trigger_price

trail_stop = close - (atr * trail_distance)

if trail_stop > current_stop

current_stop := trail_stop

trail_alert_sent := true

else if position_direction == "SHORT"

current_profit = (entry_price - close) / entry_price

max_profit := math.max(max_profit, current_profit)

unrealized_pnl := (entry_price - close) * math.abs(strategy.position_size)

// Partial take profits

if use_partial_tp and not tp1_hit and close <= tp1_price

strategy.close("SHORT", qty_percent=tp1_percent, comment="TP1")

tp1_hit := true

tp1_alert_sent := true

if use_partial_tp and not tp2_hit and close <= tp2_price and tp1_hit

strategy.close("SHORT", qty_percent=tp2_percent, comment="TP2")

tp2_hit := true

tp2_alert_sent := true

// Move to breakeven after TP1

if use_breakeven and tp1_hit and not breakeven_moved and close <= tp1_price

current_stop := entry_price - (atr * 0.2)

breakeven_moved := true

breakeven_alert_sent := true

// Profit trailing

if use_profit_trail and close <= trail_trigger_price

trail_stop = close + (atr * trail_distance)

if trail_stop < current_stop

current_stop := trail_stop

trail_alert_sent := true

// Exit conditions

var bool stop_loss_hit = false

var bool final_tp_hit = false

var bool trend_reversal_exit = false

var bool time_exit = false

// === EXIT LOGIC ===

if strategy.position_size > 0

if close <= current_stop

strategy.close_all(comment="SL")

stop_loss_hit := true

entry_price := na

position_direction := na

else if close >= tp3_price

strategy.close_all(comment="TP3")

final_tp_hit := true

entry_price := na

position_direction := na

else if fast_under_slow and breakeven_moved

strategy.close_all(comment="Trend Rev")

trend_reversal_exit := true

entry_price := na

position_direction := na

else if bars_in_position >= 100

strategy.close_all(comment="Time Exit")

time_exit := true

entry_price := na

position_direction := na

if strategy.position_size < 0

if close >= current_stop

strategy.close_all(comment="SL")

stop_loss_hit := true

entry_price := na

position_direction := na

else if close <= tp3_price

strategy.close_all(comment="TP3")

final_tp_hit := true

entry_price := na

position_direction := na

else if fast_over_slow and breakeven_moved

strategy.close_all(comment="Trend Rev")

trend_reversal_exit := true

entry_price := na

position_direction := na

else if bars_in_position >= 100

strategy.close_all(comment="Time Exit")

time_exit := true

entry_price := na

position_direction := na

// === PLOTTING ===

// EMAs

plot(ema_fast, color=color.lime, linewidth=2, title="EMA Fast")

plot(ema_slow, color=color.orange, linewidth=2, title="EMA Slow")

plot(ema_trend, color=color.blue, linewidth=2, title="EMA Trend")

plot(ema_major, color=color.purple, linewidth=3, title="EMA Major")

// Enhanced Entry signals with strength indication

plotshape(long_entry and long_confluences >= 18, style=shape.triangleup, location=location.belowbar,

color=color.new(color.lime, 0), size=size.large, title="ULTRA STRONG Long")

plotshape(long_entry and long_confluences >= 16 and long_confluences < 18, style=shape.triangleup, location=location.belowbar,

color=color.new(color.green, 20), size=size.normal, title="VERY STRONG Long")

plotshape(long_entry and long_confluences >= 14 and long_confluences < 16, style=shape.triangleup, location=location.belowbar,

color=color.new(color.green, 40), size=size.small, title="STRONG Long")

plotshape(short_entry and short_confluences >= 18, style=shape.triangledown, location=location.abovebar,

color=color.new(color.red, 0), size=size.large, title="ULTRA STRONG Short")

plotshape(short_entry and short_confluences >= 16 and short_confluences < 18, style=shape.triangledown, location=location.abovebar,

color=color.new(color.orange, 20), size=size.normal, title="VERY STRONG Short")

plotshape(short_entry and short_confluences >= 14 and short_confluences < 16, style=shape.triangledown, location=location.abovebar,

color=color.new(color.orange, 40), size=size.small, title="STRONG Short")

// Support and resistance

plot(liquidity_high, color=color.red, linewidth=2, style=plot.style_stepline, title="Liquidity High")

plot(liquidity_low, color=color.green, linewidth=2, style=plot.style_stepline, title="Liquidity Low")

// Position management levels

plot(strategy.position_size != 0 ? current_stop : na, color=color.red, linewidth=2, style=plot.style_linebr, title="Current Stop")

plot(strategy.position_size != 0 ? tp1_price : na, color=color.green, linewidth=1, style=plot.style_linebr, title="TP1")

plot(strategy.position_size != 0 ? tp2_price : na, color=color.green, linewidth=1, style=plot.style_linebr, title="TP2")

plot(strategy.position_size != 0 ? tp3_price : na, color=color.green, linewidth=2, style=plot.style_linebr, title="TP3")

// Background coloring

bgcolor(strategy.position_size > 0 ? color.new(color.green, 95) : strategy.position_size < 0 ? color.new(color.red, 95) : na, title="Position")