Stratégie de trading à triple moyenne mobile

Aperçu

Cette stratégie est une stratégie de trading de suivi de tendance basée sur trois moyennes mobiles. Elle utilise simultanément trois moyennes mobiles de différentes périodes pour prendre des décisions à plusieurs intervalles, ce qui est typique de la stratégie de suivi de tendance.

Principe de stratégie

La stratégie utilise 3 moyennes mobiles: MA1, MA2 et MA3. La période de la moyenne mobile est définie par l’utilisateur et est généralement définie comme MA1 < MA2 < MA3, par exemple, MA1 est de 50 cycles, MA2 de 100 cycles et MA3 de 200 cycles.

La stratégie utilise la MA1 comme principale ligne de référence pour la prise de décision de négociation. Lorsque la courte période MA1 traverse la longue période MA2 ou MA3, faites plus; lorsque la courte période MA1 traverse la MA2 ou MA3, faites moins.

La stratégie peut choisir de ne négocier que des croisements de MA1 et MA2, ou seulement des croisements de MA1 et MA3, ou de négocier deux croisements en même temps.

Lorsque le signal de croisement apparaît, ouvrez une position en utilisant le prix du marché. Le stop loss est défini comme un certain pourcentage de close, par exemple 30% de stop loss et 15% de stop loss.

Pour optimiser la stratégie, il est possible d’ajuster les paramètres de cycle de la ligne MA, d’ajuster le pourcentage de stop loss, d’ajouter d’autres indicateurs de filtrage.

Analyse des avantages

L’utilisation d’un ensemble de moyennes mobiles pour la prise de décision permet de filtrer efficacement les fausses percées.

La combinaison de MA de différentes périodes permet de modifier dynamiquement la position dans la tendance et de suivre la tendance.

Il est possible de choisir de négocier uniquement avec la Croix d’Or, la Croix de la Mort ou les deux.

Le blocage des pertes permet de contrôler efficacement les pertes individuelles.

Analyse des risques

Les investisseurs ont tendance à suivre les tendances et à s’arrêter facilement en cas de choc.

Si le cycle MA n’est pas correctement réglé, il peut y avoir des transactions fréquentes, ce qui réduit le taux de victoire.

Après l’échec de la percée, il peut y avoir des pertes plus importantes si les pertes ne sont pas arrêtées à temps.

Si le Stop Loss est trop lâche, la perte individuelle peut être trop élevée.

Direction d’optimisation

Optimiser les paramètres de MA pour trouver la meilleure combinaison de paramètres

Ajouter d’autres indicateurs pour filtrer et optimiser le temps d’entrée. Par exemple, MACD, KDJ, etc.

Optimiser le point d’arrêt et de perte afin d’optimiser le ratio de risque/bénéfice de la stratégie.

Augmentation de la gestion des positions, par exemple en ouvrant des positions à un nombre fixe ou en gérant des fonds.

Augmentation des points de glissement de la ligne de stop-loss et optimisation des stratégies de stop-loss pour les ruptures.

Résumer

La stratégie dans son ensemble est une stratégie de suivi de tendance typique, jugée par le croisement de plusieurs groupes de MA, qui appartient à une stratégie de suivi de tendance relativement stable. Elle peut être améliorée par des méthodes d’optimisation des paramètres, de filtrage des indicateurs, de gestion de la position, etc. Mais l’idée centrale est simple et claire, adaptée à l’apprentissage et à la pratique des débutants.

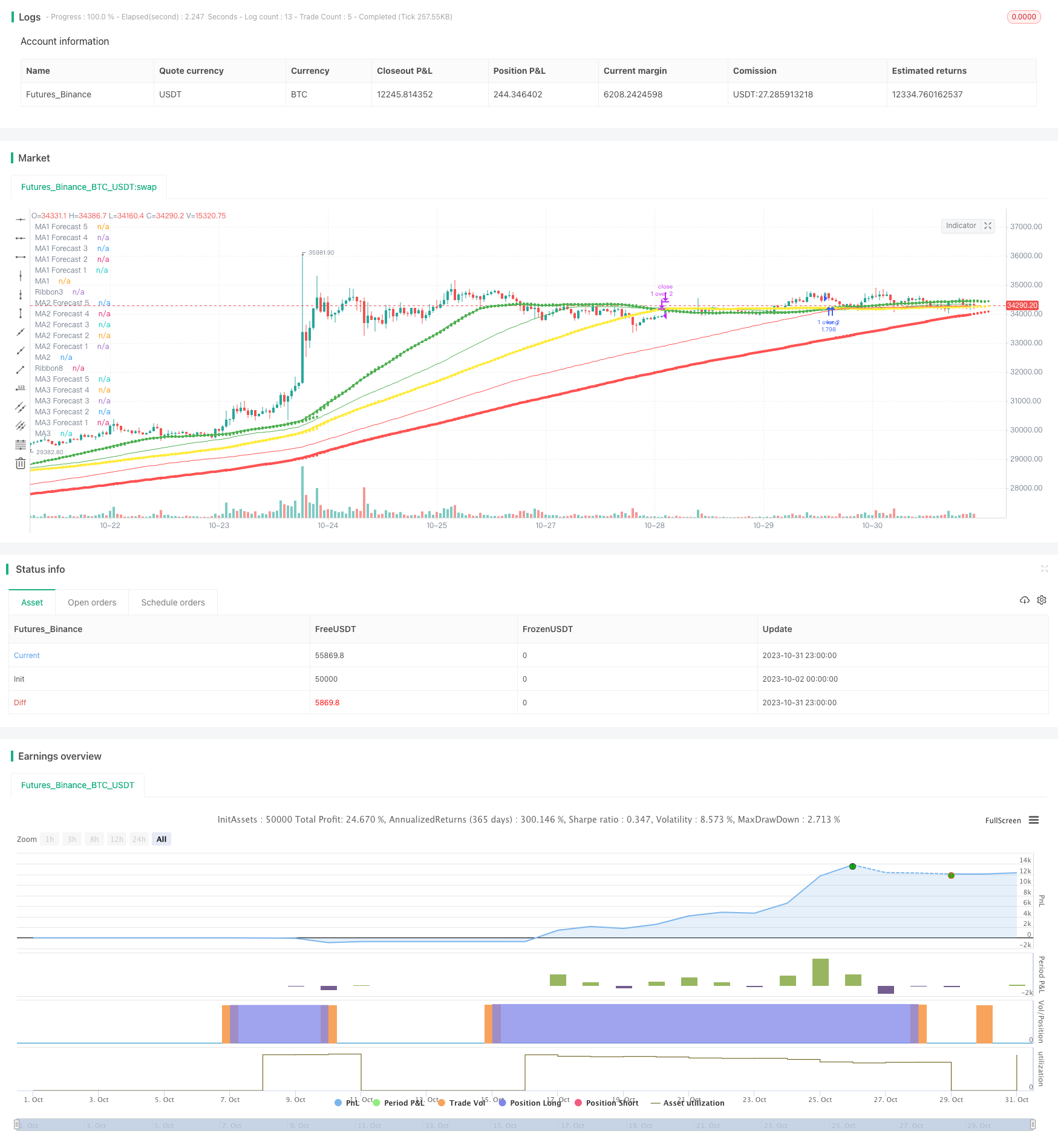

/*backtest

start: 2023-10-02 00:00:00

end: 2023-11-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// Pine Script v4

// @author BigBitsIO

// Script Library: https://www.tradingview.com/u/BigBitsIO/#published-scripts

//

// study(title, shorttitle, overlay, format, precision)

// https://www.tradingview.com/pine-script-reference/#fun_strategy

strategy(shorttitle = "TManyMA Strategy - STA - Stops", title="Triple Many Moving Averages", overlay=true, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// MA#Period is a variable used to store the indicator lookback period. In this case, from the input.

// input - https://www.tradingview.com/pine-script-docs/en/v4/annotations/Script_inputs.html

MA1Period = input(50, title="MA1 Period", minval=1, step=1)

MA1Type = input(title="MA1 Type", defval="SMA", options=["RMA", "SMA", "EMA", "WMA", "HMA", "DEMA", "TEMA", "VWMA"])

MA1Source = input(title="MA1 Source", type=input.source, defval=close)

MA1Resolution = input(title="MA1 Resolution", defval="00 Current", options=["00 Current", "01 1m", "02 3m", "03 5m", "04 15m", "05 30m", "06 45m", "07 1h", "08 2h", "09 3h", "10 4h", "11 1D", "12 1W", "13 1M"])

MA1Visible = input(title="MA1 Visible", type=input.bool, defval=true) // Will automatically hide crossBovers containing this MA

MA2Period = input(100, title="MA2 Period", minval=1, step=1)

MA2Type = input(title="MA2 Type", defval="SMA", options=["RMA", "SMA", "EMA", "WMA", "HMA", "DEMA", "TEMA", "VWMA"])

MA2Source = input(title="MA2 Source", type=input.source, defval=close)

MA2Resolution = input(title="MA2 Resolution", defval="00 Current", options=["00 Current", "01 1m", "02 3m", "03 5m", "04 15m", "05 30m", "06 45m", "07 1h", "08 2h", "09 3h", "10 4h", "11 1D", "12 1W", "13 1M"])

MA2Visible = input(title="MA2 Visible", type=input.bool, defval=true) // Will automatically hide crossovers containing this MA

MA3Period = input(200, title="MA3 Period", minval=1, step=1)

MA3Type = input(title="MA3 Type", defval="SMA", options=["RMA", "SMA", "EMA", "WMA", "HMA", "DEMA", "TEMA", "VWMA"])

MA3Source = input(title="MA3 Source", type=input.source, defval=close)

MA3Resolution = input(title="MA3 Resolution", defval="00 Current", options=["00 Current", "01 1m", "02 3m", "03 5m", "04 15m", "05 30m", "06 45m", "07 1h", "08 2h", "09 3h", "10 4h", "11 1D", "12 1W", "13 1M"])

MA3Visible = input(title="MA3 Visible", type=input.bool, defval=true) // Will automatically hide crossovers containing this MA

ShowCrosses = input(title="Show Crosses", type=input.bool, defval=false)

ForecastBias = input(title="Forecast Bias", defval="Neutral", options=["Neutral", "Bullish", "Bearish"])

ForecastBiasPeriod = input(14, title="Forecast Bias Period")

ForecastBiasMagnitude = input(1, title="Forecast Bias Magnitude", minval=0.25, maxval=20, step=0.25)

ShowForecasts = input(title="Show Forecasts", type=input.bool, defval=true)

ShowRibbons = input(title="Show Ribbons", type=input.bool, defval=true)

TradeMA12Crosses = input(title="Trade MA 1-2 Crosses", type=input.bool, defval=true)

TradeMA13Crosses = input(title="Trade MA 1-3 Crosses", type=input.bool, defval=true)

TradeMA23Crosses = input(title="Trade MA 2-3 Crosses", type=input.bool, defval=true)

TakeProfitPercent = input(30, title="Take Profit Percent", minval=0.01, step=0.5)

StopLossPercent = input(15, title="Stop Loss Percent", minval=0.01, step=0.5)

// MA# is a variable used to store the actual moving average value.

// if statements - https://www.tradingview.com/pine-script-reference/#op_if

// MA functions - https://www.tradingview.com/pine-script-reference/ (must search for appropriate MA)

// custom functions in pine - https://www.tradingview.com/wiki/Declaring_Functions

ma(MAType, MASource, MAPeriod) =>

if MAType == "SMA"

sma(MASource, MAPeriod)

else

if MAType == "EMA"

ema(MASource, MAPeriod)

else

if MAType == "WMA"

wma(MASource, MAPeriod)

else

if MAType == "RMA"

rma(MASource, MAPeriod)

else

if MAType == "HMA"

wma(2*wma(MASource, MAPeriod/2)-wma(MASource, MAPeriod), round(sqrt(MAPeriod)))

else

if MAType == "DEMA"

e = ema(MASource, MAPeriod)

2 * e - ema(e, MAPeriod)

else

if MAType == "TEMA"

e = ema(MASource, MAPeriod)

3 * (e - ema(e, MAPeriod)) + ema(ema(e, MAPeriod), MAPeriod)

else

if MAType == "VWMA"

vwma(MASource, MAPeriod)

res(MAResolution) =>

if MAResolution == "00 Current"

timeframe.period

else

if MAResolution == "01 1m"

"1"

else

if MAResolution == "02 3m"

"3"

else

if MAResolution == "03 5m"

"5"

else

if MAResolution == "04 15m"

"15"

else

if MAResolution == "05 30m"

"30"

else

if MAResolution == "06 45m"

"45"

else

if MAResolution == "07 1h"

"60"

else

if MAResolution == "08 2h"

"120"

else

if MAResolution == "09 3h"

"180"

else

if MAResolution == "10 4h"

"240"

else

if MAResolution == "11 1D"

"1D"

else

if MAResolution == "12 1W"

"1W"

else

if MAResolution == "13 1M"

"1M"

// https://www.tradingview.com/pine-script-reference/#fun_request.security

MA1 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period))

MA2 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period))

MA3 = request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period))

// Plotting crossover/unders for all combinations of crosses

// Crossovers no longer detected in label code, they need to be re-used for strategy - crosses and visibility must be set

MA12Crossover = MA1Visible and MA2Visible and crossover(MA1, MA2)

MA12Crossunder = MA1Visible and MA2Visible and crossunder(MA1, MA2)

MA13Crossover = MA1Visible and MA3Visible and crossover(MA1, MA3)

MA13Crossunder = MA1Visible and MA3Visible and crossunder(MA1, MA3)

MA23Crossover = MA2Visible and MA3Visible and crossover(MA2, MA3)

MA23Crossunder = MA2Visible and MA3Visible and crossunder(MA2, MA3)

// https://www.tradingview.com/pine-script-reference/v4/#fun_label%7Bdot%7Dnew

if ShowCrosses and MA12Crossunder

lun1 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed under '+tostring(MA2Period)+' '+MA2Type,

color=color.red,

textcolor=color.red,

style=label.style_xcross, size=size.small)

label.set_y(lun1, MA1)

if ShowCrosses and MA12Crossover

lup1 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed over '+tostring(MA2Period)+' '+MA2Type,

color=color.green,

textcolor=color.green,

style=label.style_xcross, size=size.small)

label.set_y(lup1, MA1)

if ShowCrosses and MA13Crossunder

lun2 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed under '+tostring(MA3Period)+' '+MA3Type,

color=color.red,

textcolor=color.red,

style=label.style_xcross, size=size.small)

label.set_y(lun2, MA1)

if ShowCrosses and MA13Crossover

lup2 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed over '+tostring(MA3Period)+' '+MA3Type,

color=color.green,

textcolor=color.green,

style=label.style_xcross, size=size.small)

label.set_y(lup2, MA1)

if ShowCrosses and MA23Crossunder

lun3 = label.new(bar_index, na, tostring(MA2Period)+' '+MA2Type+' crossed under '+tostring(MA3Period)+' '+MA3Type,

color=color.red,

textcolor=color.red,

style=label.style_xcross, size=size.small)

label.set_y(lun3, MA2)

if ShowCrosses and MA23Crossover

lup3 = label.new(bar_index, na, tostring(MA2Period)+' '+MA2Type+' crossed over '+tostring(MA3Period)+' '+MA3Type,

color=color.green,

textcolor=color.green,

style=label.style_xcross, size=size.small)

label.set_y(lup3, MA2)

// plot - This will draw the information on the chart

// plot - https://www.tradingview.com/pine-script-docs/en/v4/annotations/plot_annotation.html

plot(MA1Visible ? MA1 : na, color=color.green, linewidth=2, title="MA1")

plot(MA2Visible ? MA2 : na, color=color.yellow, linewidth=3, title="MA2")

plot(MA3Visible ? MA3 : na, color=color.red, linewidth=4, title="MA3")

// Forecasting - forcasted prices are calculated using our MAType and MASource for the MAPeriod - the last X candles.

// it essentially replaces the oldest X candles, with the selected source * X candles

// Bias - We'll add an "adjustment" for each additional candle being forecasted based on ATR of the previous X candles

// custom functions in pine - https://www.tradingview.com/wiki/Declaring_Functions

bias(Bias, BiasPeriod) =>

if Bias == "Neutral"

0

else

if Bias == "Bullish"

(atr(BiasPeriod) * ForecastBiasMagnitude)

else

if Bias == "Bearish"

((atr(BiasPeriod) * ForecastBiasMagnitude) * -1) // multiplying by -1 to make it a negative, bearish bias

// Note - Can not show forecasts on different resolutions at the moment, x-axis is an issue

Bias = bias(ForecastBias, ForecastBiasPeriod) // 14 is default atr period

MA1Forecast1 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 1)) * (MA1Period - 1) + ((MA1Source * 1) + (Bias * 1))) / MA1Period

MA1Forecast2 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 2)) * (MA1Period - 2) + ((MA1Source * 2) + (Bias * 2))) / MA1Period

MA1Forecast3 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 3)) * (MA1Period - 3) + ((MA1Source * 3) + (Bias * 3))) / MA1Period

MA1Forecast4 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 4)) * (MA1Period - 4) + ((MA1Source * 4) + (Bias * 4))) / MA1Period

MA1Forecast5 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 5)) * (MA1Period - 5) + ((MA1Source * 5) + (Bias * 5))) / MA1Period

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast1 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 1", offset=1, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast2 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 2", offset=2, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast3 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 3", offset=3, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast4 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 4", offset=4, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast5 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 5", offset=5, show_last=1)

MA2Forecast1 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 1)) * (MA2Period - 1) + ((MA1Source * 1) + (Bias * 1))) / MA2Period

MA2Forecast2 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 2)) * (MA2Period - 2) + ((MA1Source * 2) + (Bias * 2))) / MA2Period

MA2Forecast3 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 3)) * (MA2Period - 3) + ((MA1Source * 3) + (Bias * 3))) / MA2Period

MA2Forecast4 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 4)) * (MA2Period - 4) + ((MA1Source * 4) + (Bias * 4))) / MA2Period

MA2Forecast5 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 5)) * (MA2Period - 5) + ((MA1Source * 5) + (Bias * 5))) / MA2Period

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast1 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 1", offset=1, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast2 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 2", offset=2, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast3 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 3", offset=3, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast4 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 4", offset=4, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast5 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 5", offset=5, show_last=1)

MA3Forecast1 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 1)) * (MA3Period - 1) + ((MA1Source * 1) + (Bias * 1))) / MA3Period

MA3Forecast2 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 2)) * (MA3Period - 2) + ((MA1Source * 2) + (Bias * 2))) / MA3Period

MA3Forecast3 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 3)) * (MA3Period - 3) + ((MA1Source * 3) + (Bias * 3))) / MA3Period

MA3Forecast4 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 4)) * (MA3Period - 4) + ((MA1Source * 4) + (Bias * 4))) / MA3Period

MA3Forecast5 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 5)) * (MA3Period - 5) + ((MA1Source * 5) + (Bias * 5))) / MA3Period

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast1 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 1", offset=1, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast2 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 2", offset=2, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast3 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 3", offset=3, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast4 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 4", offset=4, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast5 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 5", offset=5, show_last=1)

// Ribbon related code

// For Ribbons to work - they must use the same MAType, MAResolution and MASource. This is to ensure the ribbons are fair between one to the other.

// Ribbons also will usually look better if MA1Period < MA2Period and MA2Period < MA3Period

// custom functions in pine - https://www.tradingview.com/wiki/Declaring_Functions

// This function is used to calculate the period to be used on a ribbon based on existing MAs

rperiod(P1, P2, Step, Ribbons) =>

((abs(P1 - P2)) / (Ribbons + 1) * Step) + min(P1, P2)

// divide by +1 so that 5 lines can show. Divide by 5 and one line shows up on another MA

// MA1-MA2

Ribbon1 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 1, 5)))

Ribbon2 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 2, 5)))

Ribbon3 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 3, 5)))

Ribbon4 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 4, 5)))

Ribbon5 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 5, 5)))

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon1 : na, color=color.green, linewidth=1, style=plot.style_line, title="Ribbon1", transp=90)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon2 : na, color=color.green, linewidth=1, style=plot.style_line, title="Ribbon2", transp=85)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon3 : na, color=color.green, linewidth=1, style=plot.style_line, title="Ribbon3", transp=80)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon4 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon4", transp=75)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon5 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon5", transp=70)

// MA2-MA3

Ribbon6 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 1, 5)))

Ribbon7 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 2, 5)))

Ribbon8 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 3, 5)))

Ribbon9 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 4, 5)))

Ribbon10 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 5, 5)))

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon6 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon6", transp=70)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon7 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon7", transp=75)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon8 : na, color=color.red, linewidth=1, style=plot.style_line, title="Ribbon8", transp=80)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon9 : na, color=color.red, linewidth=1, style=plot.style_line, title="Ribbon9", transp=85)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon10 : na, color=color.red, linewidth=1, style=plot.style_line, title="Ribbon10", transp=90)

// Strategy Specific

ProfitTarget = (close * (TakeProfitPercent / 100)) / syminfo.mintick

LossTarget = (close * (StopLossPercent / 100)) / syminfo.mintick

if MA12Crossover and TradeMA12Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}entry

strategy.entry("1 over 2", true) // buy by market

strategy.exit("profit or loss", "1 over 2", profit = ProfitTarget, loss = LossTarget)

if MA12Crossunder and TradeMA12Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}close

strategy.close("1 over 2") // sell by market

if MA13Crossover and TradeMA13Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}entry

strategy.entry("1 over 3", true) // buy by market

strategy.exit("profit or loss", "1 over 3", profit = ProfitTarget, loss = LossTarget)

if MA13Crossunder and TradeMA13Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}close

strategy.close("1 over 3") // sell by market

if MA23Crossover and TradeMA23Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}entry

strategy.entry("2 over 3", true) // buy by market

strategy.exit("profit or loss", "2 over 3", profit = ProfitTarget, loss = LossTarget)

if MA23Crossunder and TradeMA23Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}close

strategy.close("2 over 3") // sell by market