Modèle de cassure à double fond pour la stratégie de momentum

Aperçu

La stratégie est basée sur un modèle à double fond d’indicateurs techniques, pour effectuer des opérations d’achat lorsque le marché est en survente. La stratégie combine plusieurs indicateurs pour juger de la survente et de la survente du marché et envoie un signal d’achat lorsque le double fond est formé.

Principe de stratégie

La stratégie consiste à déterminer si le prix a formé un double fond près des points de support critiques et si le marché est en survente. Plus précisément, la stratégie utilise les indicateurs suivants:

Indicateur RSI: Lorsque l’indicateur RSI indique que le marché est en survente, il est considéré comme un signal d’achat

Indicateur RVI: Lorsque l’indicateur RVI indique que le marché est en survente, il est considéré comme un signal d’achat

Indicateur MFI: Lorsque l’indicateur MFI indique que le marché est en survente, il est considéré comme un signal d’achat.

Indicateur SAR: une hausse du prix au-delà de l’indicateur SAR est considérée comme un signal d’achat

Indicateur SMA500: une hausse du prix au-delà du SMA500 est considérée comme un signal d’achat.

La stratégie prend en compte les jugements de plusieurs indicateurs ci-dessus et émet un signal d’achat lorsque des formes de double fond se forment à proximité des supports critiques.

Avantages stratégiques

Cette stratégie présente les avantages suivants:

Les signaux sont plus fiables lorsqu’ils sont combinés avec plusieurs indicateurs pour évaluer l’état du marché.

Les signaux d’achat émis lors de la formation du double fond ont une probabilité de gain plus élevée.

Il est important de ne pas rater le moment de l’achat en utilisant une combinaison d’indicateurs pour juger de l’état de survente.

Le modèle de rupture à double fond est combiné à une stratégie d’indicateurs, avec les avantages du suivi de la tendance et du trading inversé.

Les paramètres de la stratégie peuvent être modifiés en fonction du marché.

Risque stratégique

La stratégie présente également les risques suivants:

La probabilité que l’indicateur émet un faux signal, entraînant un risque de perte de l’achat. Le faux signal peut être réduit par l’optimisation des paramètres.

Le risque d’une rupture sans succès du double fond. Vous pouvez définir un point de rupture pour réduire les pertes individuelles.

L’optimisation des paramètres de haute dimension est très difficile et nécessite une grande quantité de données historiques. L’optimisation progressive peut être réalisée à l’aide d’algorithmes progressifs.

L’efficacité du disque dur peut varier en fonction des résultats des tests de données historiques. Il est nécessaire de vérifier dans différents marchés.

Direction d’optimisation

Les principaux axes d’optimisation de la stratégie sont les suivants:

Optimiser les pondérations des indicateurs d’achat afin de déterminer la meilleure combinaison de pondérations.

Optimiser les paramètres de l’indicateur et déterminer la meilleure combinaison de paramètres.

Ajouter des stratégies de stop-loss pour réduire les pertes individuelles.

L’ajout d’un module de gestion des positions a permis une plus grande stabilité des bénéfices.

L’optimisation des paramètres adaptatifs est développée en combinaison avec des algorithmes d’apprentissage automatique.

Résumer

La stratégie intègre le modèle de rupture à deux niveaux et le jugement sur les indicateurs de survente, émettant un signal d’achat lorsque les deux niveaux se forment près des supports critiques. L’espace d’optimisation est plus grand, les poids, les paramètres, les arrêts et les positions peuvent être ajustés, ce qui rend la stratégie plus stable et fiable.

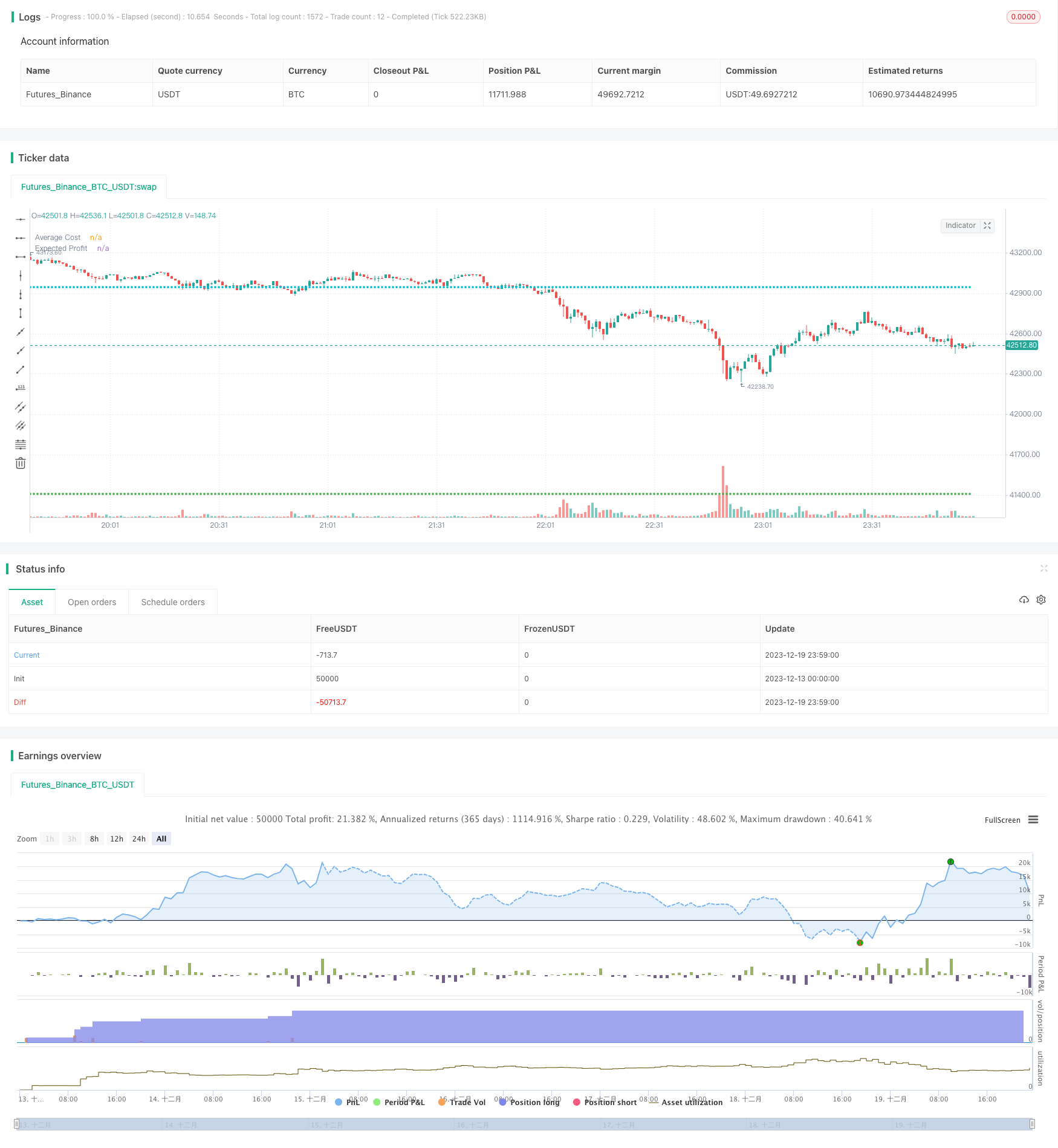

/*backtest

start: 2023-12-13 00:00:00

end: 2023-12-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("UP & DOWN - BNB/USDT 15min", shorttitle="U&D - BNB 15min", overlay=true, calc_on_order_fills=true, calc_on_every_tick=true, initial_capital = 1000,pyramiding = 40,backtest_fill_limits_assumption = 1, process_orders_on_close=true, currency = currency.USD, default_qty_type = strategy.cash, default_qty_value = 25, commission_type = strategy.commission.percent, commission_value = 0.1)

// This startergy optimized to BNB 15 min standerd candlestic chart and buy & sell signals were based on technical analysis.

UP_DOWN = input.string( title='Trade in', options=['Only on Up Trends', 'Uptrend and down trend'], defval='Uptrend and down trend')

var profit_cal = input.float( defval = 3.7, title = "Expected profit %", minval = 0.2, step = 0.1)

//Backtest dates

fromMonth = input.int(defval = 10,title = "From Month", minval = 1, maxval = 12, group = 'Time Period Values')

fromDay = input.int(defval = 1, title = "From Day", minval = 1, maxval = 31, group = 'Time Period Values')

fromYear = input.int(defval = 2021, title = "From Year", minval = 1970, group = 'Time Period Values')

thruMonth = input.int(defval = 1, title = "Thru Month", minval = 1, maxval = 12, group = 'Time Period Values')

thruDay = input.int(defval = 1, title = "Thru Day", minval = 1, maxval = 31, group = 'Time Period Values')

thruYear = input.int(defval = 2112, title = "Thru Year", minval = 1970, group = 'Time Period Values')

//showDate = input(defval = true, title = "Show Date Range", group = 'Time Period Values')

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

// inputs

//Inputs of SAR Indicator

sar1 = input.float(defval=0.0002, title='SAR value 1',step=0.0001, group = 'SAR Values')

sar2 = input.float(defval=0.0004, title='SAR value 2',step=0.0001, group = 'SAR Values')

sar3 = input.float(defval=0.1, title='SAR value 3',step=0.1, group = 'SAR Values')

src_close = input(close, "SAR Source - close", group = 'SAR Values')

src_open = input(open, "SAR Source - open", group = 'SAR Values')

bool sar_visible = input(false, "Show SAR",group = 'SAR Values' )

// Inputs of Super trend indicator

ST_T = input.int(defval=16, title = 'Supertrend - Trend', step =1, group = 'Super Trend')

ST_D = input.int(defval=7, title = 'Supertrend - Direction', step =1, group = 'Super Trend')

ST_SMA = input.int(defval=1, title = 'Supertrend - SMA', step = 1, group = 'Super Trend')

bool ST_visible = input(false, "Show Super Trend",group = 'Super Trend' )

//Inputs of SMA500 indicator

src_sma500 = input(high, 'SMA500 - Source', group = 'SMA500')

lb_sma500 = input.int(defval = 143, title = 'SMA500 - Look back period', step=10, group = 'SMA500')

bool sma500_visible = input(false, "Show SMA500",group = 'SMA500' )

// Calculations

// SMA500 Indicator

SMA500 = ta.sma(src_sma500,lb_sma500)

SMA700 = ta.sma(close,700)

SMA_Open = ta.sma(open,9)

//SMA9 Indicator

SMA9 = ta.sma((high+low)/2,5)

risingSMA9 = ta.rising(SMA9,1)

fallingSMA9 = ta.falling(SMA9,1)

color plotcolor1 = color.black

if risingSMA9

plotcolor1 := color.green

// SAR Indicator

sar = ta.sar(sar1, sar2, sar3)

sma2_close = ta.sma(src_close,1)

sma2_open = ta.sma(src_open,1)

//Supertrend

[supertrend, direction] = ta.supertrend(ST_T, ST_D)

up_trend = ta.sma(direction < 0 ? supertrend : na,ST_SMA)

down_trend = ta.sma(direction < 0? na : supertrend, ST_SMA)

// Color change

color plotcolor2 = color.green

if open>down_trend or close>down_trend

plotcolor2 := color.lime

if open<down_trend or close<down_trend

plotcolor2 := color.red

color plotcolor3 = color.green

if open>up_trend or close>up_trend

plotcolor3 := color.yellow

if open<up_trend or close<up_trend

plotcolor3 := color.red

color plotcolor4 = color.black

if (open>sar or close>sar)

plotcolor4 := color.white

if (open<sar or close<sar)

plotcolor4 := color.red

color plotcolor5 = color.black

if (open>SMA500 or close>SMA500)

plotcolor5 := color.green

if (open<SMA500 or close<SMA500)

plotcolor5 := color.red

color plotcolor6 = color.green

rising_taalma = ta.rising (ta.alma(open,10,.99,1),1)

falling_taalma = ta.falling (ta.alma(open,10,.99,1),1)

if rising_taalma

plotcolor6 := color.green

if falling_taalma

plotcolor6 := color.red

// buy and sell conditions for uptrend

longCondition1 = (open >= down_trend or high>= down_trend or ta.crossover(open,down_trend)or ta.crossover(high,down_trend))

longCondition2 = (open >= up_trend or high>= up_trend or ta.crossover(open,up_trend)or ta.crossover(high,up_trend))

longCondition3 = (open >= SMA500 or high>= SMA500 or ta.crossover(open,SMA500)or ta.crossover(high,SMA500))

longCondition4 = (open >= sar or high>= sar or ta.crossover(open,sar)or ta.crossover(high,sar))

longCondition5 = rising_taalma

shortCondition1 = (close < down_trend or low< down_trend or ta.crossunder(close,down_trend)or ta.crossunder(low,down_trend))

shortCondition2 = (close < up_trend or low< up_trend or ta.crossunder(close,up_trend)or ta.crossunder(low,up_trend))

shortCondition3 = (close < SMA500 or low< SMA500 or ta.crossunder(close,SMA500)or ta.crossunder(low,SMA500))

shortCondition4 = (close < sar or low< sar or ta.crossunder(close,sar)or ta.crossunder(low,sar))

shortCondition5 = falling_taalma

comp_buy1 = longCondition1 and longCondition2 and longCondition3 and longCondition4 and longCondition5

op_buy1 = shortCondition3 and longCondition1 and longCondition2 and longCondition4

op_buy2 = shortCondition1 and shortCondition2 and longCondition3 and longCondition4 and longCondition5

comp_sell1 = shortCondition1 and shortCondition2 and shortCondition3 and shortCondition4 and shortCondition5

op_sell1 = shortCondition3 and shortCondition4 and longCondition1 and longCondition2

op_sell2 = shortCondition4 and longCondition1 and longCondition2 and longCondition3

op_sell3 = longCondition2 and shortCondition1 and shortCondition4 and shortCondition3

op_sell4 = longCondition2 and shortCondition1 and shortCondition4

var b1 = 0

var b2 = 0

var b3 = 0

if comp_buy1 == true and comp_buy1[1] == false

b1 := 1

else

b1 := 0

if op_buy1 == true and op_buy1[1] == false

b2 := 1

else

b2 := 0

if op_buy2 == true and op_buy2[1] == false

b3 := 1

else

b3 := 0

// DCA method based on indicators

//RSI Indicator

len_rsi_10 = input.int(10, title="Length", group = "RSI Indicator - 10", minval=1, maxval = 10, step = 1)

src_rsi_10 = input(ohlc4, "Source", group = "RSI Indicator - 10")

up_rsi_10 = ta.rma(math.max(ta.change(src_rsi_10), 0), len_rsi_10)

down_rsi_10 = ta.rma(-math.min(ta.change(src_rsi_10), 0), len_rsi_10)

rsi_10 = down_rsi_10 == 0 ? 100 : up_rsi_10 == 0 ? 0 : 100 - (100 / (1 + up_rsi_10 / down_rsi_10))

var p_rsi = 0

if rsi_10>= 0 and rsi_10<10

p_rsi := 0

else if rsi_10>= 10 and rsi_10<20

p_rsi := 10

else if rsi_10>= 20 and rsi_10<30

p_rsi := 20

else if rsi_10>= 30 and rsi_10<40

p_rsi := 30

else if rsi_10>= 40 and rsi_10<50

p_rsi := 40

else if rsi_10>= 50 and rsi_10<60

p_rsi := 50

else if rsi_10>= 60 and rsi_10<70

p_rsi := 60

else if rsi_10>= 70 and rsi_10<80

p_rsi := 70

else if rsi_10>= 80 and rsi_10<90

p_rsi := 80

else if rsi_10>= 90 and rsi_10<100

p_rsi := 90

len_rsi_50 = input.int(50, title="Length", group = "RSI Indicator - 50", minval=11, maxval = 50, step = 1)

src_rsi_50 = input(high, "Source", group = "RSI Indicator - 50")

up_rsi_50 = ta.rma(math.max(ta.change(src_rsi_50), 0), len_rsi_50)

down_rsi_50 = ta.rma(-math.min(ta.change(src_rsi_50), 0), len_rsi_50)

rsi_50 = down_rsi_50 == 0 ? 100 : up_rsi_50 == 0 ? 0 : 100 - (100 / (1 + up_rsi_50 / down_rsi_50))

var p_rsi_50 = 0

if rsi_50>= 0 and rsi_50<10

p_rsi_50 := 0

else if rsi_50>= 10 and rsi_50<20

p_rsi_50 := 10

else if rsi_50>= 20 and rsi_50<30

p_rsi_50 := 20

else if rsi_50>= 30 and rsi_50<40

p_rsi_50 := 30

else if rsi_50>= 40 and rsi_50<50

p_rsi_50 := 40

else if rsi_50>= 50 and rsi_50<60

p_rsi_50 := 50

else if rsi_50>= 60 and rsi_50<70

p_rsi_50 := 60

else if rsi_50>= 70 and rsi_50<80

p_rsi_50 := 70

else if rsi_50>= 80 and rsi_50<90

p_rsi_50 := 80

else if rsi_50>= 90 and rsi_50<100

p_rsi_50 := 90

len_rsi_100 = input.int(100, title="Length", group = "RSI Indicator - 100", minval=51, maxval = 200, step = 10)

src_rsi_100 = input(ohlc4, "Source", group = "RSI Indicator - 100")

up_rsi_100 = ta.rma(math.max(ta.change(src_rsi_100), 0), len_rsi_100)

down_rsi_100 = ta.rma(-math.min(ta.change(src_rsi_100), 0), len_rsi_100)

rsi_100 = down_rsi_100 == 0 ? 100 : up_rsi_100 == 0 ? 0 : 100 - (100 / (1 + up_rsi_100 / down_rsi_100))

var p_rsi_100 = 0

if rsi_100>= 0 and rsi_100<10

p_rsi_100 := 0

else if rsi_100>= 10 and rsi_100<20

p_rsi_100 := 10

else if rsi_100>= 20 and rsi_100<30

p_rsi_100 := 20

else if rsi_100>= 30 and rsi_100<40

p_rsi_100 := 30

else if rsi_100>= 40 and rsi_100<50

p_rsi_100 := 40

else if rsi_100>= 50 and rsi_100<60

p_rsi_100 := 50

else if rsi_100>= 60 and rsi_100<70

p_rsi_100 := 60

else if rsi_100>= 70 and rsi_100<80

p_rsi_100 := 70

else if rsi_100>= 80 and rsi_100<90

p_rsi_100 := 80

else if rsi_100>= 90 and rsi_100<100

p_rsi_100 := 90

// Relative Volatility Indicator

length_rvi_10 = input.int(defval = 10, minval=1, maxval = 10, step = 1, title="Length - RVI", group = "RVI Indicator - 10")

len_rvi_10 = input.int(defval = 10, minval=1, maxval = 10, step = 1, title="Length - EMA", group = "RVI Indicator - 10")

src_rvi_10 = input(high, title = "Source", group = "RVI Indicator - 10")

stddev_rvi_10 = ta.stdev(src_rvi_10, length_rvi_10)

upper_rvi_10 = ta.ema(ta.change(src_rvi_10) <= 0 ? 0 : stddev_rvi_10, len_rvi_10)

lower_rvi_10 = ta.ema(ta.change(src_rvi_10) > 0 ? 0 : stddev_rvi_10, len_rvi_10)

rvi_10 = upper_rvi_10 / (upper_rvi_10 + lower_rvi_10) * 100

var p_rvi_10 = 0

if rvi_10 >= 0 and rvi_10 <10

p_rvi_10 := 0

else if rvi_10 >= 10 and rvi_10 <20

p_rvi_10 := 10

else if rvi_10 >= 20 and rvi_10 <30

p_rvi_10 := 20

else if rvi_10 >= 30 and rvi_10 <40

p_rvi_10 := 30

else if rvi_10 >= 40 and rvi_10 <50

p_rvi_10 := 40

else if rvi_10 >= 50 and rvi_10 <60

p_rvi_10 := 50

else if rvi_10 >= 60 and rvi_10 <70

p_rvi_10 := 60

else if rvi_10 >= 70 and rvi_10 <80

p_rvi_10 := 70

else if rvi_10 >= 80 and rvi_10 <90

p_rvi_10 := 80

else if rvi_10 >= 90 and rvi_10 <100

p_rvi_10 := 90

length_rvi_50 = input.int(defval = 50, minval=11, maxval = 50, step = 1, title="Length - RVI", group = "RVI Indicator - 50")

len_rvi_50 = input.int(defval = 50, minval=11, maxval = 50, step = 1, title="Length - EMA", group = "RVI Indicator - 50")

src_rvi_50 = input(close, title = "source", group = "RVI Indicator - 50")

stddev_rvi_50 = ta.stdev(src_rvi_50, length_rvi_50)

upper_rvi_50 = ta.ema(ta.change(src_rvi_50) <= 0 ? 0 : stddev_rvi_50, len_rvi_50)

lower_rvi_50 = ta.ema(ta.change(src_rvi_50) > 0 ? 0 : stddev_rvi_50, len_rvi_50)

rvi_50 = upper_rvi_50 / (upper_rvi_50 + lower_rvi_50) * 100

var p_rvi_50 = 0

if rvi_50 >= 0 and rvi_50 <10

p_rvi_50 := 0

else if rvi_50 >= 10 and rvi_50 <20

p_rvi_50 := 10

else if rvi_50 >= 20 and rvi_50 <30

p_rvi_50 := 20

else if rvi_50 >= 30 and rvi_50 <40

p_rvi_50 := 30

else if rvi_50 >= 40 and rvi_50 <50

p_rvi_50 := 40

else if rvi_50 >= 50 and rvi_50 <60

p_rvi_50 := 50

else if rvi_50 >= 60 and rvi_50 <70

p_rvi_50 := 60

else if rvi_50 >= 70 and rvi_50 <80

p_rvi_50 := 70

else if rvi_50 >= 80 and rvi_50 <90

p_rvi_50 := 80

else if rvi_50 >= 90 and rvi_50 <100

p_rvi_50 := 90

length_rvi_100 = input.int(defval = 100, minval=51, maxval = 200, step = 10, title="Length - RVI", group = "RVI Indicator - 100")

len_rvi_100 = input.int(defval = 100, minval=51, maxval = 200, step = 10, title="Length - EMA", group = "RVI Indicator - 100")

src_rvi_100 = input(close, title = "Source", group = "RVI Indicator - 100")

stddev_rvi_100 = ta.stdev(src_rvi_100, length_rvi_100)

upper_rvi_100 = ta.ema(ta.change(src_rvi_100) <= 0 ? 0 : stddev_rvi_100, len_rvi_100)

lower_rvi_100 = ta.ema(ta.change(src_rvi_100) > 0 ? 0 : stddev_rvi_100, len_rvi_100)

rvi_100 = upper_rvi_100 / (upper_rvi_100 + lower_rvi_100) * 100

var p_rvi_100 = 0

if rvi_100 >= 0 and rvi_100 <10

p_rvi_100 := 0

else if rvi_100 >= 10 and rvi_100 <20

p_rvi_100 := 10

else if rvi_100 >= 20 and rvi_100 <30

p_rvi_100 := 20

else if rvi_100 >= 30 and rvi_100 <40

p_rvi_100 := 30

else if rvi_100 >= 40 and rvi_100 <50

p_rvi_100 := 40

else if rvi_100 >= 50 and rvi_100 <60

p_rvi_100 := 50

else if rvi_100 >= 60 and rvi_100 <70

p_rvi_100 := 60

else if rvi_100 >= 70 and rvi_100 <80

p_rvi_100 := 70

else if rvi_100 >= 80 and rvi_100 <90

p_rvi_100 := 80

else if rvi_100 >= 90 and rvi_100 <100

p_rvi_100 := 90

// Money flow index

len_mfi_10 = input.int(defval = 10, minval=1, maxval = 10, step = 1, title="Length - MFI", group = "MFI Indicator - 10")

src_mfi_10 = input(high, title = "source", group = "MFI Indicator - 10")

mf_10 = ta.mfi(src_mfi_10, len_mfi_10)

var p_mfi_10 = 0

if mf_10>= 0 and mf_10<10

p_mfi_10 := 0

else if mf_10>= 10 and mf_10<20

p_mfi_10 := 10

else if mf_10>= 20 and mf_10<30

p_mfi_10 := 20

else if mf_10>= 30 and mf_10<40

p_mfi_10 := 30

else if mf_10>= 40 and mf_10<50

p_mfi_10 := 40

else if mf_10>= 50 and mf_10<60

p_mfi_10 := 50

else if mf_10>= 60 and mf_10<70

p_mfi_10 := 60

else if mf_10>= 70 and mf_10<80

p_mfi_10 := 70

else if mf_10>= 80 and mf_10<90

p_mfi_10 := 80

else if mf_10>= 90 and mf_10<100

p_mfi_10 := 90

len_mfi_50 = input.int(defval = 50, minval=11, maxval = 50, step = 1, title="Length - MFI", group = "MFI Indicator - 50")

src_mfi_50 = input(high, title = "source", group = "MFI Indicator - 50")

mf_50 = ta.mfi(src_mfi_50, len_mfi_50)

var p_mfi_50 = 0

if mf_50>= 0 and mf_50<10

p_mfi_50 := 0

else if mf_50>= 10 and mf_50<20

p_mfi_50 := 10

else if mf_50>= 20 and mf_50<30

p_mfi_50 := 20

else if mf_50>= 30 and mf_50<40

p_mfi_50 := 30

else if mf_50>= 40 and mf_50<50

p_mfi_50 := 40

else if mf_50>= 50 and mf_50<60

p_mfi_50 := 50

else if mf_50>= 60 and mf_50<70

p_mfi_50 := 60

else if mf_50>= 70 and mf_50<80

p_mfi_50 := 70

else if mf_50>= 80 and mf_50<90

p_mfi_50 := 80

else if mf_50>= 90 and mf_50<100

p_mfi_50 := 90

len_mfi_100 = input.int(defval = 100, minval=51, maxval = 200, step = 10, title="Length - MFI", group = "MFI Indicator - 100")

src_mfi_100 = input(high, title = "source", group = "MFI Indicator - 100")

mf_100 = ta.mfi(src_mfi_100, len_mfi_100)

var p_mfi_100 = 0

if mf_100>= 0 and mf_100<10

p_mfi_100 := 0

else if mf_100>= 10 and mf_100<20

p_mfi_100 := 10

else if mf_100>= 20 and mf_100<30

p_mfi_100 := 20

else if mf_100>= 30 and mf_100<40

p_mfi_100 := 30

else if mf_100>= 40 and mf_100<50

p_mfi_100 := 40

else if mf_100>= 50 and mf_100<60

p_mfi_100 := 50

else if mf_100>= 60 and mf_100<70

p_mfi_100 := 60

else if mf_100>= 70 and mf_100<80

p_mfi_100 := 70

else if mf_100>= 80 and mf_100<90

p_mfi_100 := 80

else if mf_100>= 90 and mf_100<100

p_mfi_100 := 90

//Balance of power indicator

bop = ((((close - open) / (high - low))*100)+50)

bop_sma_100 = ta.sma(bop,100)

// Buy and Sell lavels based on Indicators

l_val_rsi = input.int (defval = 40, title = "Lower value of RSI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

l_val_rvi = input.int (defval = 40, title = "Lower value of RVI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

l_val_mfi = input.int (defval = 40, title = "Lower value of MFI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

//h_val_rsi = input.int (defval = 60, title = "Higher value of RSI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

//h_val_rvi = input.int (defval = 50, title = "Higher value of RVI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

//h_val_mfi = input.int (defval = 50, title = "Higher value of MFI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

buy_rsi = p_rsi_100 <= l_val_rsi and p_rsi_50<p_rsi_100 and p_rsi<=p_rsi_50

buy_rvi = p_rvi_100 <= l_val_rvi and p_rvi_50<=p_rvi_100 and p_rvi_10<=p_rvi_50

buy_mfi = p_mfi_100 <= l_val_mfi and p_mfi_50<=p_mfi_100 and p_mfi_10<=p_mfi_50

buy_compound = buy_rsi and buy_rvi and buy_mfi ? 100 : 0

var float buy_compound_f = na

if (buy_compound[1] == 100 and buy_compound == 0) //and open > close

buy_compound_f := 1

else

buy_compound_f := na

ma_9 = ta.ema(close,2)

co_l1 = strategy.position_avg_price*0.95

co_l2 = strategy.position_avg_price*0.90

co_l3 = strategy.position_avg_price*0.85

co_l4 = strategy.position_avg_price*0.80

//Take profit in Market bottoms

profit_f = 1.0 + (profit_cal/100)

// Trading

var final_option = UP_DOWN == 'Uptrend and down trend' ? 1 : 2

if final_option == 1

if ((buy_compound_f ==1 or ta.crossover(ma_9, co_l1) or ta.crossover(ma_9, co_l2) or ta.crossover(ma_9, co_l3) or ta.crossover(ma_9, co_l4)) and window())

strategy.entry("long", strategy.long,comment = "BUY")

else if ( comp_sell1 and window()) and strategy.position_avg_price * profit_f < close

strategy.close("long", qty_percent = 100, comment = "SELL")

else if final_option == 2

if (b1 or b2 or b3) and window()

strategy.entry("long", strategy.long, comment = "BUY")

else if (comp_sell1 or op_sell1 or op_sell2 or op_sell3 or op_sell4 ) and window()

strategy.close("long", qty_percent = 100, comment = "SELL")

bool PM_visible = input(false, "Show Profit marjin and average price", group = 'Safty Margins')

bool SM_visible = input(false, "Show Safty Grids", group = 'Safty Margins' )

//Graphs

plot(PM_visible or final_option == 1 ? strategy.position_avg_price : na, color = color.green, title = "Average Cost", style = plot.style_circles)

plot(PM_visible or final_option == 1 ? strategy.position_avg_price* profit_f :na, color = color.aqua, title = "Expected Profit", style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.95 : na, color = color.gray, title = "SAFTY MARGIN - 95%", linewidth = 1, style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.90 : na, color = color.gray, title = "SAFTY MARGIN - 90%", linewidth = 1, style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.85 : na, color = color.gray, title = "SAFTY MARGIN - 85%", linewidth = 1, style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.80 : na, color = color.gray, title = "SAFTY MARGIN - 80%", linewidth = 1, style = plot.style_circles)

plot(ST_visible or final_option == 2 ? down_trend:na, "Down trend", color = plotcolor2, linewidth=2)

plot(ST_visible or final_option == 2 ? up_trend: na , "Up direction", color = plotcolor3, linewidth=2)

plot(sar_visible or final_option == 2 ? sar:na, title='SAR', color=plotcolor4, linewidth=2)

plot(sma500_visible or final_option == 2 ? SMA500:na,title='SMA500', color=plotcolor5, linewidth=3)