Stratégie de gestion de position à fort effet de levier pour éviter les appels de marge

Aperçu

Cette stratégie permet de gérer les risques de prévention de l’augmentation de la garantie en mettant en place des conditions de marge élevée et de garantie additionnelle, et de réduire les positions en temps opportun en cas de forte volatilité du marché.

Principe de stratégie

- Configurer des opérations avec un levier élevé, par exemple 4 fois le ratio de levier

- Il y a une garantie supplémentaire, par exemple 25 000 $

- La stratégie d’arrêt de la position lorsque l’intérêt est inférieur à la ligne de garantie supplémentaire

- Stratégie de liquidation de toutes les positions lorsque la baisse des intérêts continue à déclencher un signal de garantie supplémentaire

Grâce à ces réglages, il est possible d’arrêter les pertes en temps opportun lorsque des fluctuations importantes du marché entraînent une baisse rapide des droits et intérêts, ce qui évite le risque de garantie supplémentaire.

Analyse des avantages

- Le ratio de levier peut être réglé de manière flexible en fonction de la capacité d’acceptation individuelle, afin de contrôler le risque de perte individuelle.

- La garantie additionnelle peut empêcher l’explosion de la position du compte

- En cas d’opérations à fort effet de levier, arrêtez les pertes en temps opportun et évitez les risques au maximum.

Analyse des risques

- Un levier élevé augmente les gains et augmente les risques

- Il est nécessaire d’établir raisonnablement des lignes de garantie supplémentaires pour correspondre aux lignes de stop-loss.

- Les stratégies de stop loss doivent être optimisées car elles sont faciles à manipuler

Il est possible de réduire le risque en ajustant le ratio de levier de manière appropriée, en configurant des lignes de garantie supplémentaires pour correspondre aux lignes de stop-loss et en optimisant les stratégies de stop-loss.

Direction d’optimisation

- L’indicateur de la tendance et la prévention de la contrepartie

- Optimiser le mode de prévention pour éviter le blocage des pertes

- Une zone de non-transaction est définie pour éviter la construction d’une position pendant une période donnée.

- Paramètres de réglage dynamique combinés à des algorithmes d’apprentissage automatique

Résumer

Cette stratégie permet de gérer le risque en utilisant un niveau élevé de levier et des montants de garantie supplémentaires, ce qui permet d’éviter l’explosion de la position du compte. Cependant, un niveau élevé de levier augmente également le risque, ce qui nécessite une réduction supplémentaire du risque par des méthodes telles que le jugement de la tendance, l’optimisation des arrêts de perte et le contrôle du temps de négociation.

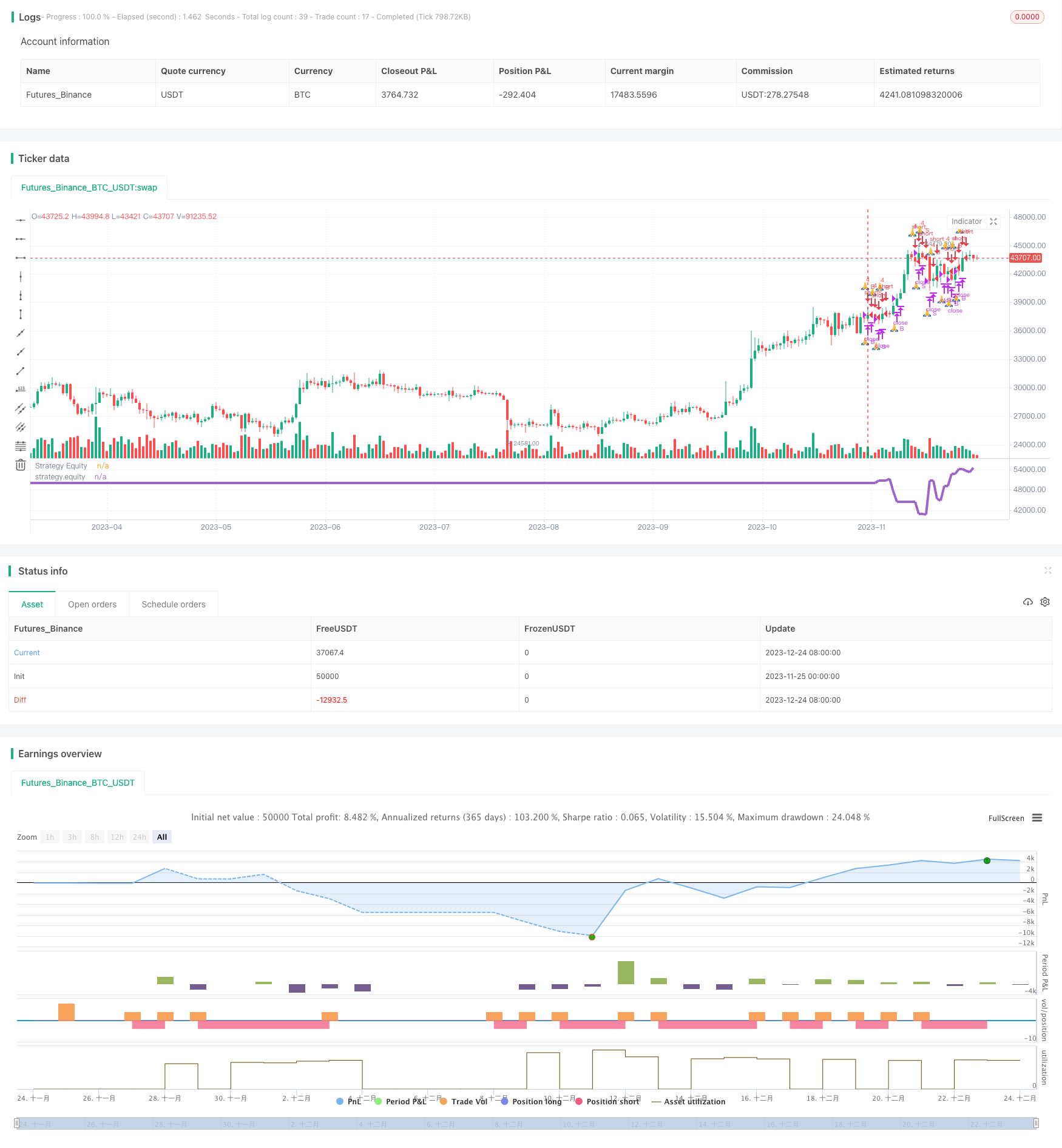

/*backtest

start: 2023-11-25 00:00:00

end: 2023-12-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=4

//@author=Daveatt

// Breakout on 2H high/low break Strategy

SystemName = "Leverage Strategy"

TradeId = "🙏"

InitCapital = 100000

InitPosition = 1

UseMarginCall = input(true, title="Use Margin Call?")

MarginValue = input(25000, title="Margin Value", type=input.float)

// use 1 for no leverage

// use 0.1 for be underleveraged and bet 1/10th of a pip value

// use any value > 1 for full-degen mode

UseLeverage = input(true, title="Use Leverage")

LeverageValue = input(4, title="Leverage mult (1 for no leverage)", minval=0.1, type=input.float)

// Risk Management

UseRiskManagement = input(true, title="Use Risk Management?")

// ticks = 1/10th of a pip value

StopLoss = input(5, title="Stop Loss in ticks value", type=input.float)

TakeProfit = input(500, title="Take Profit in ticks value", type=input.float)

InitCommission = 0.075

InitPyramidMax = 1

CalcOnorderFills = false

CalcOnTick = true

DefaultQtyType = strategy.cash

DefaultQtyValue = strategy.cash

Currency = currency.USD

Precision = 2

Overlay=false

MaxBarsBack=3000

strategy

(

title=SystemName,

shorttitle=SystemName,

overlay=Overlay

)

//////////////////////////// UTILITIES ///////////////////////////

f_print(_txt, _condition) =>

var _lbl = label(na)

label.delete(_lbl)

if _condition

// saving the candle where we got rekt :(

_index = barssince(_condition)

_lbl := label.new(bar_index - _index, highest(100), _txt, xloc.bar_index, yloc.price, size = size.normal, style=label.style_labeldown)

//////////////////////////// STRATEGY LOGIC ///////////////////////////

// Date filterigng

_Date = input(true, title="[LABEL] DATE")

FromYear = input(2019, "From Year", minval=1900), FromMonth = input(12, "From Month", minval=1, maxval=12), FromDay = input(1, "From Day", minval=1, maxval=31)

ToYear = input(2019, "To Year", minval=1900), ToMonth = input(12, "To Month", minval=1, maxval=12), ToDay = input(9, "To Day", minval=1, maxval=31)

FromDate = timestamp(FromYear, FromMonth, FromDay, 00, 00)

ToDate = timestamp(ToYear, ToMonth, ToDay, 23, 59)

TradeDateIsAllowed = true

// non-repainting security version

four_hours_H = security(syminfo.tickerid, '240', high[1], lookahead=true)

four_hours_L = security(syminfo.tickerid, '240', low[1], lookahead=true)

buy_trigger = crossover(close, four_hours_H)

sell_trigger = crossunder(close, four_hours_L)

// trend states

since_buy = barssince(buy_trigger)

since_sell = barssince(sell_trigger)

buy_trend = since_sell > since_buy

sell_trend = since_sell < since_buy

change_trend = (buy_trend and sell_trend[1]) or (sell_trend and buy_trend[1])

// plot(four_hours_H, title="4H High", linewidth=2, color=#3c91c2, style=plot.style_linebr, transp=0,

// show_last=1, trackprice=true)

// plot(four_hours_L, title="4H Low", linewidth=2, color=#3c91c2, style=plot.style_linebr, transp=0,

// show_last=1, trackprice=true)

plot(strategy.equity, color=color.blue, linewidth=3, title="Strategy Equity")

// get the entry price

entry_price = valuewhen(buy_trigger or sell_trigger, close, 0)

// SL and TP

SL_price = buy_trend ? entry_price - StopLoss : entry_price + StopLoss

is_SL_hit = buy_trend ? crossunder(low, SL_price) : crossover(high, SL_price)

TP_price = buy_trend ? entry_price + TakeProfit : entry_price - TakeProfit

is_TP_hit = buy_trend ? crossover(high, TP_price) : crossunder(low, TP_price)

// Account Margin Management:

f_account_margin_call_cross(_amount)=>

_return = crossunder(strategy.equity, _amount)

f_account_margin_call(_amount)=>

_return = strategy.equity <= _amount

is_margin_call_cross = f_account_margin_call_cross(MarginValue)

is_margin_call = f_account_margin_call(MarginValue)

plot(strategy.equity, title='strategy.equity', transp=0, linewidth=4)

//plot(barssince(is_margin_call ), title='barssince(is_margin_call)', transp=100)

can_trade = iff(UseMarginCall, not is_margin_call, true)

trade_size = InitPosition * (not UseLeverage ? 1 : LeverageValue)

// We can take the trade if not liquidated/margined called/rekt

buy_final = can_trade and buy_trigger and TradeDateIsAllowed

sell_final = can_trade and sell_trigger and TradeDateIsAllowed

close_long = buy_trend and

(UseRiskManagement and (is_SL_hit or is_TP_hit)) or sell_trigger

close_short = sell_trend and

(UseRiskManagement and (is_SL_hit or is_TP_hit)) or buy_trigger

strategy.entry(TradeId + ' B', long=true, qty=trade_size, when=buy_final)

strategy.entry(TradeId + ' S', long=false, qty=trade_size, when=sell_final)

strategy.close(TradeId + ' B', when=close_long)

strategy.close(TradeId + ' S', when=close_short)

// FULL DEGEN MODE ACTIVATED

// Margin called - Broker closing your account

strategy.close_all(when=is_margin_call)

if UseMarginCall and is_margin_call_cross

f_print("☠️REKT☠️", is_margin_call_cross)