Stratégie de trading de sortie de ligne en porte-à-faux avec moyenne mobile superposée à décalage nul

Aperçu

L’idée principale de cette stratégie est de combiner les indices ZLSMA pour déterminer la direction de la tendance, et les indices de sortie des lignes en suspension pour trouver des moments d’entrée et d’exit plus précis. ZLSMA est un indicateur de tendance qui permet de déterminer plus tôt les changements de tendance.

Principe de stratégie

Pour la section ZLSMA:

- Les lignes LMA de longueur de 130 cycles sont calculées séparément par la méthode de régression linéaire.

- Les deux lignes LMA sont ensuite superposées pour obtenir la différence attribuée à eq.

- Finalement, le différentiel d’eq est ajouté via la ligne LMA initiale pour former une moyenne mobile superposée à zéro retard ZLSMA .

Partie CE:

- Calculer l’indicateur ATR et multiplier par le coefficient ((par défaut 2) pour déterminer la distance dynamique du point le plus élevé ou le point le plus bas le plus proche.

- Lorsque le prix de clôture dépasse la plus récente ligne de stop multiple ou ligne de stop vide, ajustez la ligne de stop en conséquence.

- Faire plus de courte distance en fonction de la variation de la position du cours de clôture par rapport à la ligne de stop-loss.

Les heures d’ouverture:

- Le ZLSMA détermine la direction de la tendance, et le CE intervient quand le signal est donné.

Les pertes de sortie:

- Les fils longs sont équipés d’un arrêt et d’un arrêt fixes.

- Le stop fixe est remplacé par l’export dynamique de la CE.

Analyse des avantages

- Le ZLSMA permet de détecter les tendances plus tôt et d’éviter les fausses ruptures.

- Le CE peut adapter ses points d’exportation en fonction des fluctuations du marché.

- Le ratio risque/bénéfice de la stratégie est personnalisable.

- La méthode d’arrêt de perte est différente de la méthode d’arrêt de perte de la ligne longue et courte, ce qui permet de contrôler les risques.

Analyse des risques

- Une mauvaise configuration des paramètres peut augmenter le débit ou élargir la portée du stop loss.

- Si la tendance se retourne rapidement, il y a toujours un risque que le seuil de dégradation soit franchi.

Direction d’optimisation

- L’optimisation des paramètres peut être testée pour différents marchés et périodes.

- On peut envisager d’ajuster le paramètre de stop-loss en fonction de la volatilité ou d’une période spécifique.

- On peut essayer de combiner avec d’autres indicateurs ou modèles pour augmenter le taux de rentabilité.

Résumer

La stratégie utilise principalement des moyennes mobiles superposées à zéro décalage pour déterminer la direction de la tendance, en combinaison avec des indicateurs de sortie de la ligne de pente pour rechercher un moment d’entrée et de sortie plus précis. L’avantage de la stratégie réside dans le fait que le taux de stop-loss peut être personnalisé et que la dynamique de la sortie de la ligne de pente peut être ajustée pour contrôler les risques en fonction des conditions du marché.

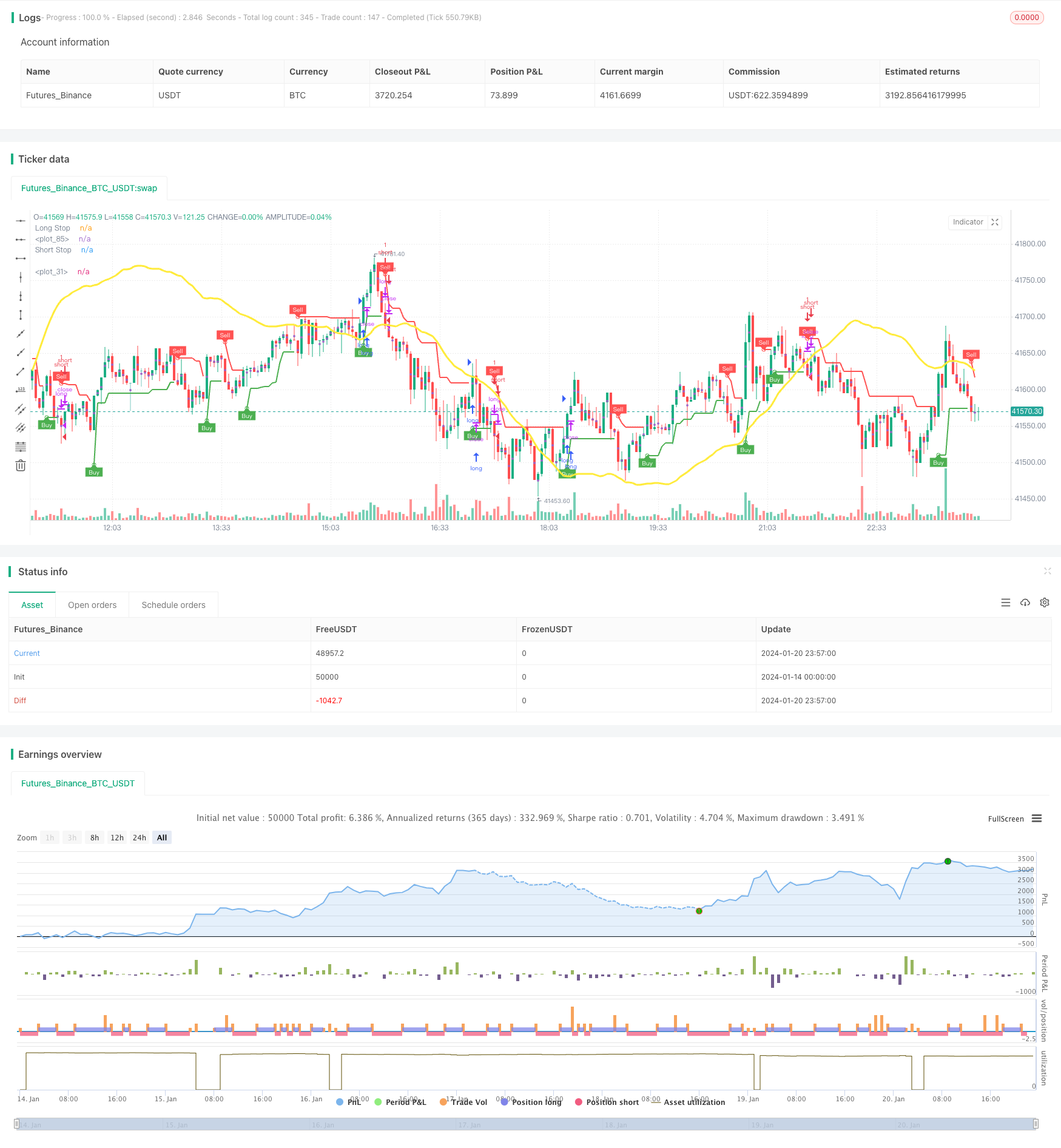

/*backtest

start: 2024-01-14 00:00:00

end: 2024-01-21 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © GGkurg

//@version=5

strategy(title = "ZLSMA + Chandelier Exit", shorttitle="ZLSMA + CE", overlay=true)

var GRP1 = "take profit / stop loss"

TP = input(title='long TP%', defval=2.0, inline = "1", group = GRP1)

SL = input(title='long SL%', defval=2.0, inline = "1", group = GRP1)

TP2 = input(title='short TP', defval=2.0, inline = "2", group = GRP1)

SL2 = input(title='short SL', defval=2.0, inline = "2", group = GRP1)

//-------------------------------------------------calculations

takeProfitPrice = strategy.position_avg_price * (1+(TP/100))

stopLossPrice = strategy.position_avg_price * (1-(SL/100))

takeProfitPrice2 = strategy.position_avg_price * (1-(TP2/100))

stopLossPrice2 = strategy.position_avg_price * (1+(SL2/100))

//---------------------------------------ZLSMA - Zero Lag LSMA

var GRP2 = "ZLSMA settings"

length1 = input(title='Length', defval=130, inline = "1", group = GRP2)

offset1 = input(title='Offset', defval=0, inline = "2", group = GRP2)

src = input(close, title='Source', inline = "3", group = GRP2)

lsma = ta.linreg(src, length1, offset1)

lsma2 = ta.linreg(lsma, length1, offset1)

eq = lsma - lsma2

zlsma = lsma + eq

plot(zlsma, color=color.new(color.yellow, 0), linewidth=3)

//---------------------------------------ZLSMA conditisions

//---------long

longc1 = close > zlsma

longclose1 = close < zlsma

//---------short

shortc1 = close < zlsma

shortclose1 = close > zlsma

//---------------------------------------Chandelier Exit

var string calcGroup = 'Chandelier exit settings'

length = input.int(title='ATR Period', defval=1, group=calcGroup)

mult = input.float(title='ATR Multiplier', step=0.1, defval=2.0, group=calcGroup)

useClose = input.bool(title='Use Close Price for Extremums', defval=true, group=calcGroup)

var string visualGroup = 'Visuals'

showLabels = input.bool(title='Show Buy/Sell Labels', defval=true, group=visualGroup)

highlightState = input.bool(title='Highlight State', defval=true, group=visualGroup)

var string alertGroup = 'Alerts'

awaitBarConfirmation = input.bool(title="Await Bar Confirmation", defval=true, group=alertGroup)

atr = mult * ta.atr(length)

longStop = (useClose ? ta.highest(close, length) : ta.highest(length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(close, length) : ta.lowest(length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := close > shortStopPrev ? 1 : close < longStopPrev ? -1 : dir

var color longColor = color.green

var color shortColor = color.red

var color longFillColor = color.new(color.green, 90)

var color shortFillColor = color.new(color.red, 90)

var color textColor = color.new(color.white, 0)

longStopPlot = plot(dir == 1 ? longStop : na, title='Long Stop', style=plot.style_linebr, linewidth=2, color=color.new(longColor, 0))

buySignal = dir == 1 and dir[1] == -1

plotshape(buySignal ? longStop : na, title='Long Stop Start', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(longColor, 0))

plotshape(buySignal and showLabels ? longStop : na, title='Buy Label', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(longColor, 0), textcolor=textColor)

shortStopPlot = plot(dir == 1 ? na : shortStop, title='Short Stop', style=plot.style_linebr, linewidth=2, color=color.new(shortColor, 0))

sellSignal = dir == -1 and dir[1] == 1

plotshape(sellSignal ? shortStop : na, title='Short Stop Start', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(shortColor, 0))

plotshape(sellSignal and showLabels ? shortStop : na, title='Sell Label', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(shortColor, 0), textcolor=textColor)

midPricePlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, display=display.none, editable=false)

longStateFillColor = highlightState ? dir == 1 ? longFillColor : na : na

shortStateFillColor = highlightState ? dir == -1 ? shortFillColor : na : na

fill(midPricePlot, longStopPlot, title='Long State Filling', color=longStateFillColor)

fill(midPricePlot, shortStopPlot, title='Short State Filling', color=shortStateFillColor)

await = awaitBarConfirmation ? barstate.isconfirmed : true

alertcondition(dir != dir[1] and await, title='Alert: CE Direction Change', message='Chandelier Exit has changed direction!')

alertcondition(buySignal and await, title='Alert: CE Buy', message='Chandelier Exit Buy!')

alertcondition(sellSignal and await, title='Alert: CE Sell', message='Chandelier Exit Sell!')

//---------------------------------------Chandelier Exit conditisions

//---------long

longc2 = buySignal

longclose2 = sellSignal

//---------short

shortc2 = sellSignal

shortclose2 = buySignal

//---------------------------------------Long entry and exit

if longc1 and longc2

strategy.entry("long", strategy.long)

if strategy.position_avg_price > 0

strategy.exit("close long", "long", limit = takeProfitPrice, stop = stopLossPrice, alert_message = "close all orders")

if longclose1 and longclose2 and strategy.opentrades == 1

strategy.close("long","ema long cross", alert_message = "close all orders")

//---------------------------------------Short entry and exit

if shortc1 and shortc2

strategy.entry("short", strategy.short)

if strategy.position_avg_price > 0

strategy.exit("close short", "short", limit = takeProfitPrice2, stop = stopLossPrice2, alert_message = "close all orders")

if shortclose1 and shortclose2 and strategy.opentrades == 1

strategy.close("close short","short", alert_message = "close all orders")