Stratégie de trading de divergence anormale RSI

Nom de la stratégie

RSI Bullish/Bearish Divergence Trading Strategy

Aperçu

La stratégie utilise l’indicateur RSI pour identifier les signaux de déviation des polyèdres et des vacants réguliers et cachés, et décide de faire plus de vacance en fonction des anomalies du signal.

Principe de stratégie

Lorsque le prix innove un prix élevé, le RSI n’innove pas un sommet qui constitue un écart anormal de plusieurs têtes, considéré comme un signal de vente. Lorsque le prix innove un bas, le RSI n’innove pas un bas qui constitue un écart anormal de la tête vide, considéré comme un signal d’achat.

Analyse des avantages

- Les anomalies déviant du signal ont une plus grande fiabilité et un taux de réussite plus élevé.

- Il est également possible d’identifier des déviations de tête blanche régulières et dissimulées, et de couvrir une grande surface.

- Les paramètres de l’indicateur RSI sont adaptables et s’appliquent à différents environnements de marché.

Analyse des risques

- Il y a plus de chances de mal interpréter les signaux cachés.

- Il est nécessaire d’effectuer une révision manuelle pour filtrer les signaux de faux jugement.

- L’effet est lié à la définition des paramètres RSI.

Direction d’optimisation

- Optimiser les paramètres du RSI pour trouver la meilleure combinaison de paramètres

- L’ajout d’algorithmes d’apprentissage automatique pour identifier automatiquement les signaux authentiques.

- La fiabilité du signal est vérifiée par la combinaison de plusieurs indicateurs.

Résumer

La stratégie identifie les RSI anormalement éloignés des signaux de négociation et décide de faire plus de trading en fonction des courants et des courants cachés. L’optimisation des paramètres RSI et l’ajout d’autres indicateurs de vérification améliorent encore l’efficacité de la stratégie.

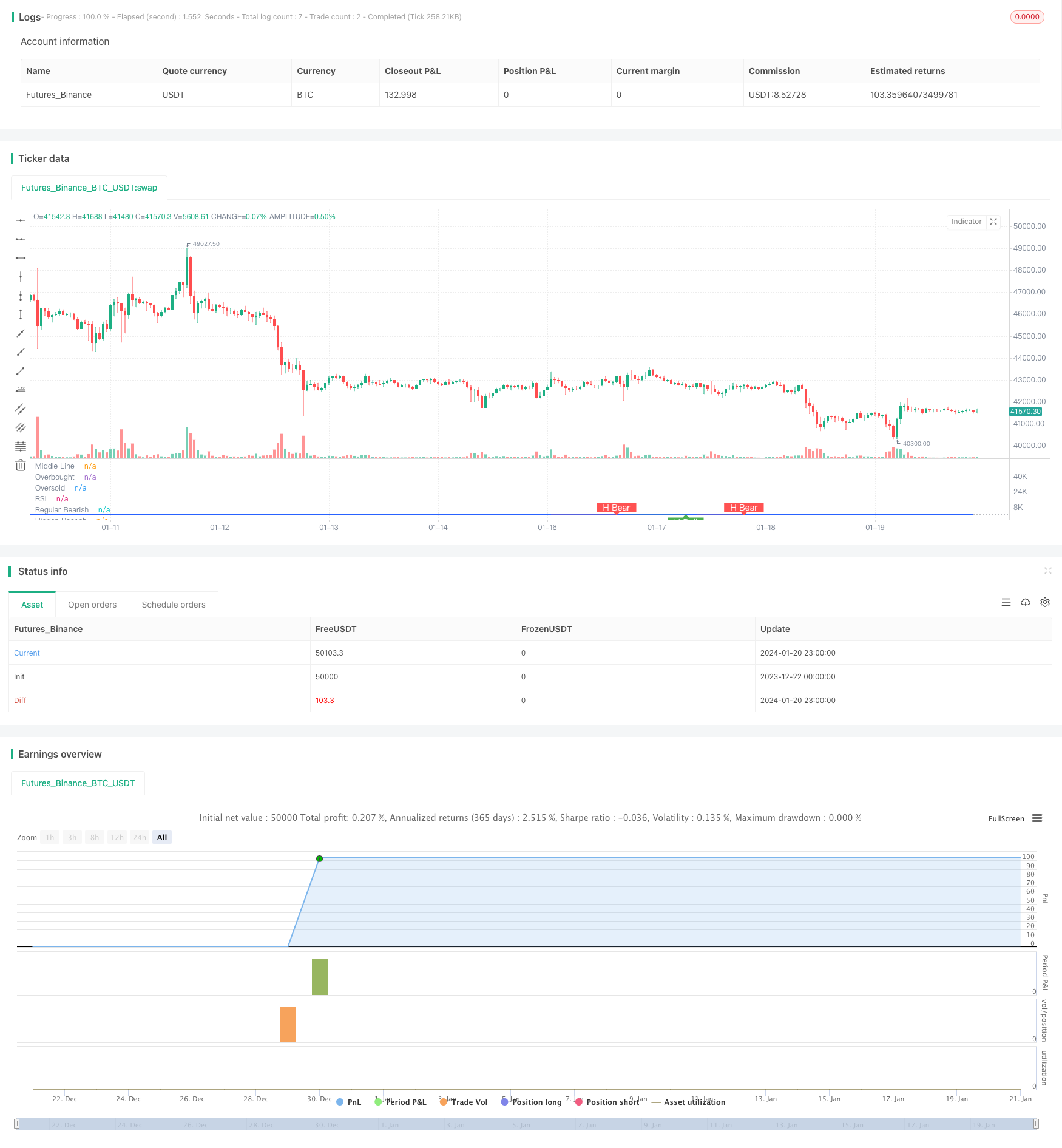

/*backtest

start: 2023-12-22 00:00:00

end: 2024-01-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Divergence Indicator")

len = input.int(title="RSI Period", minval=1, defval=14)

src = input(title="RSI Source", defval=close)

lbR = input(title="Pivot Lookback Right", defval=5)

lbL = input(title="Pivot Lookback Left", defval=5)

rangeUpper = input(title="Max of Lookback Range", defval=60)

rangeLower = input(title="Min of Lookback Range", defval=5)

plotBull = input(title="Plot Bullish", defval=true)

plotHiddenBull = input(title="Plot Hidden Bullish", defval=true)

plotBear = input(title="Plot Bearish", defval=true)

plotHiddenBear = input(title="Plot Hidden Bearish", defval=true)

bearColor = color.red

bullColor = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

osc = ta.rsi(src, len)

plot(osc, title="RSI", linewidth=2, color=#2962FF)

hline(50, title="Middle Line", color=#787B86, linestyle=hline.style_dotted)

obLevel = hline(70, title="Overbought", color=#787B86, linestyle=hline.style_dotted)

osLevel = hline(30, title="Oversold", color=#787B86, linestyle=hline.style_dotted)

fill(obLevel, osLevel, title="Background", color=color.rgb(33, 150, 243, 90))

plFound = na(ta.pivotlow(osc, lbL, lbR)) ? false : true

phFound = na(ta.pivothigh(osc, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = ta.barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// Osc: Higher Low

oscHL = osc[lbR] > ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < ta.valuewhen(plFound, low[lbR], 1)

// bull : 상승 Condition : 조건

bullCond = plotBull and priceLL and oscHL and plFound // 상승다이버전스?

strategy.entry("상승 다이버전스 진입", strategy.long, when = bullCond)

strategy.close("상승 다이버전스 진입", when = ta.crossover(osc, 50))

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor)

)

plotshape(

bullCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Hidden Bullish

// Osc: Lower Low

oscLL = osc[lbR] < ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > ta.valuewhen(plFound, low[lbR], 1)

hiddenBullCond = plotHiddenBull and priceHL and oscLL and plFound

// strategy.entry("히든 상승 다이버전스 진입", strategy.long, when = hiddenBullCond)

// strategy.close("히든 상승 다이버전스 진입", when = ta.crossover(osc, 50))

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor)

)

plotshape(

hiddenBullCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish Label",

text=" H Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Regular Bearish

// Osc: Lower High

oscLH = osc[lbR] < ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > ta.valuewhen(phFound, high[lbR], 1)

// bear : 하락

bearCond = plotBear and priceHH and oscLH and phFound

// strategy.entry("하락 다이버전스 진입", strategy.short, when = bearCond)

// strategy.close("하락 다이버전스 진입", when = ta.crossunder(osc, 50))

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor)

)

plotshape(

bearCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Hidden Bearish

// Osc: Higher High

oscHH = osc[lbR] > ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < ta.valuewhen(phFound, high[lbR], 1)

hiddenBearCond = plotHiddenBear and priceLH and oscHH and phFound

// strategy.entry("히든 하락 다이버전스 진입", strategy.short, when = hiddenBearCond)

// strategy.close("히든 하락 다이버전스 진입", when = ta.crossunder(osc, 50))

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor)

)

plotshape(

hiddenBearCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish Label",

text=" H Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor

)