Stratégie Ripple basée sur l'intervalle de backtest de l'indicateur Coral Trend

Aperçu

Cette stratégie utilise l’indicateur de tendance des coraux de LazyBear pour déterminer la direction de la tendance des prix et les points d’entrée potentiels en identifiant le renversement de la direction de l’indicateur de tendance des coraux. Pour filtrer les fausses percées, cette stratégie utilise l’indicateur ADX ou le groupe d’indicateurs de l’histogramme de force absolue et de volume de HawkEye comme indicateur de confirmation de coopération pour une entrée plus fiable.

Le mécanisme d’exit utilise le prix le plus élevé / le prix le plus bas de la ligne N à la racine K la plus récente multiplié par le rapport de retour sur risque configurable pour définir les points de perte et d’arrêt.

Principe de stratégie

Après avoir déterminé la direction de la grande tendance sur la base de l’indicateur Coral Trend, un petit rebond dans la direction opposée se produit lorsque la couleur de l’indicateur reste inchangée. Si le rebond se termine et que le prix revient à la direction de la tendance principale indiquée par Coral Trend, alors il peut être considéré comme un meilleur moment d’entrée.

Les conditions d’entrée sont les suivantes:

La direction de l’indicateur Coral Trend correspond à la direction de la transaction (le nombre de têtes est vert, le nombre de têtes vides est rouge)

Depuis la dernière fois que le cours a complètement franchi le Coral Trend ((le sommet de la dernière barre est supérieur à la ligne de Coral Trend), il y a eu au moins 1 ligne K avec des bas qui sont tous au-dessus du Coral Trend ((multi-toits) ou des hauts qui sont tous en dessous du Coral Trend ((noir))

Un petit rebond dans la direction opposée (retrait), pendant lequel le prix de clôture est maintenu sur le côté opposé de la Coral Trend

Après un petit redressement, la clôture est revenue dans la direction de la tendance principale indiquée par la Coral Trend

Les critères principaux sont les suivants: ADX ou l’Absolute Strength Histogram et HawkEye Volume sont les critères d’admission.

L’indicateur ADX nécessite une valeur > 20 et une augmentation récente de 1 ligne K. L’ordre des lignes verte et rouge du DI est conforme à la direction de la transaction.

L’histogramme de force absolue exige que sa couleur soit conforme à la direction de la transaction ((multiple = bleu, blanc = rouge)). Le volume de HawkEye exige que sa couleur soit conforme à la direction de la transaction ((multiple = vert, blanc = rouge)).

Le mécanisme d’exit consiste à utiliser le prix le plus élevé ou le prix le plus bas de la ligne N à la racine de K la plus proche multiplié par le ratio de retour sur risque pour définir les points de perte et d’arrêt. Les valeurs N et le rapport de retour sur risque peuvent être configurés par des paramètres.

Analyse des avantages

Le plus grand avantage de cette stratégie réside dans le fait qu’après avoir utilisé l’indicateur Coral Trend pour déterminer la direction de la tendance principale, il est possible de trouver des opportunités d’entrée en identifiant leur inversion et d’éviter de suivre la vague dans un marché non tendance. En même temps, l’utilisation de l’indicateur Confirm permet de filtrer de nombreuses fausses percées, ce qui améliore le taux de réussite de l’entrée.

En outre, la stratégie offre un mécanisme complet de contrôle des risques, y compris le paramètre de la marge d’arrêt et le contrôle du pourcentage de la marge de risque, de sorte que même les pertes de transactions individuelles n’ont pas un impact majeur sur le capital global.

Analyse des risques

Le plus grand risque de cette stratégie réside dans l’utilisation d’indicateurs pour les jugements d’entrée, ce qui est susceptible de créer l’illusion qu’une dépendance totale à la configuration des paramètres peut automatiquement générer des bénéfices. En fait, l’optimisation des paramètres et la configuration des règles nécessitent une combinaison de la loi des variations de prix sous-jacentes et de l’effet intuitif de la connexion des indicateurs et des prix pour définir une configuration plus adaptée à votre style de négociation et à votre variété.

En outre, les paramètres de stop loss et de stop stop doivent être appropriés. Un nombre trop élevé de stop multiples peut entraîner l’impossibilité de s’arrêter et de quitter le terrain, tandis qu’un stop loss trop petit est trop risqué. Cela doit être ajusté en fonction de la volatilité de différentes variétés et de la tolérance au risque individuelle.

Direction d’optimisation

Les axes d’optimisation de cette stratégie sont:

Ajustement des paramètres de l’indicateur Coral Trend pour le rendre plus sensible aux variations de prix des différentes variétés

Essayez différents indicateurs de confirmation ou combinaisons d’indicateurs, tels que KDJ, MACD, etc., pour rendre le signal d’entrée plus précis

Adapter le mode de calcul des stop-loss et des stop-loss en fonction de la volatilité des différentes variétés pour une meilleure maîtrise des risques

Ajout d’un module de gestion des fonds permettant d’ajuster le volume de la commande unique en fonction du nombre de positions, afin de contrôler efficacement les pertes globales

Ajout d’un module de contrôle des heures de négociation pour que la stratégie ne fonctionne que pendant des périodes spécifiques, évitant les pertes pendant les périodes de forte volatilité

Résumer

La stratégie utilise d’abord la tendance des coraux pour déterminer la tendance des prix à la longueur moyenne, puis en déterminant leur inversion, en combinaison avec le filtre de signaux de confirmation des fausses percées, pour construire une stratégie de suivi de tendance plus fiable. En même temps, le réglage parfait du contrôle du vent permet également à la stratégie de fonctionner à long terme et de stabiliser les fonds.

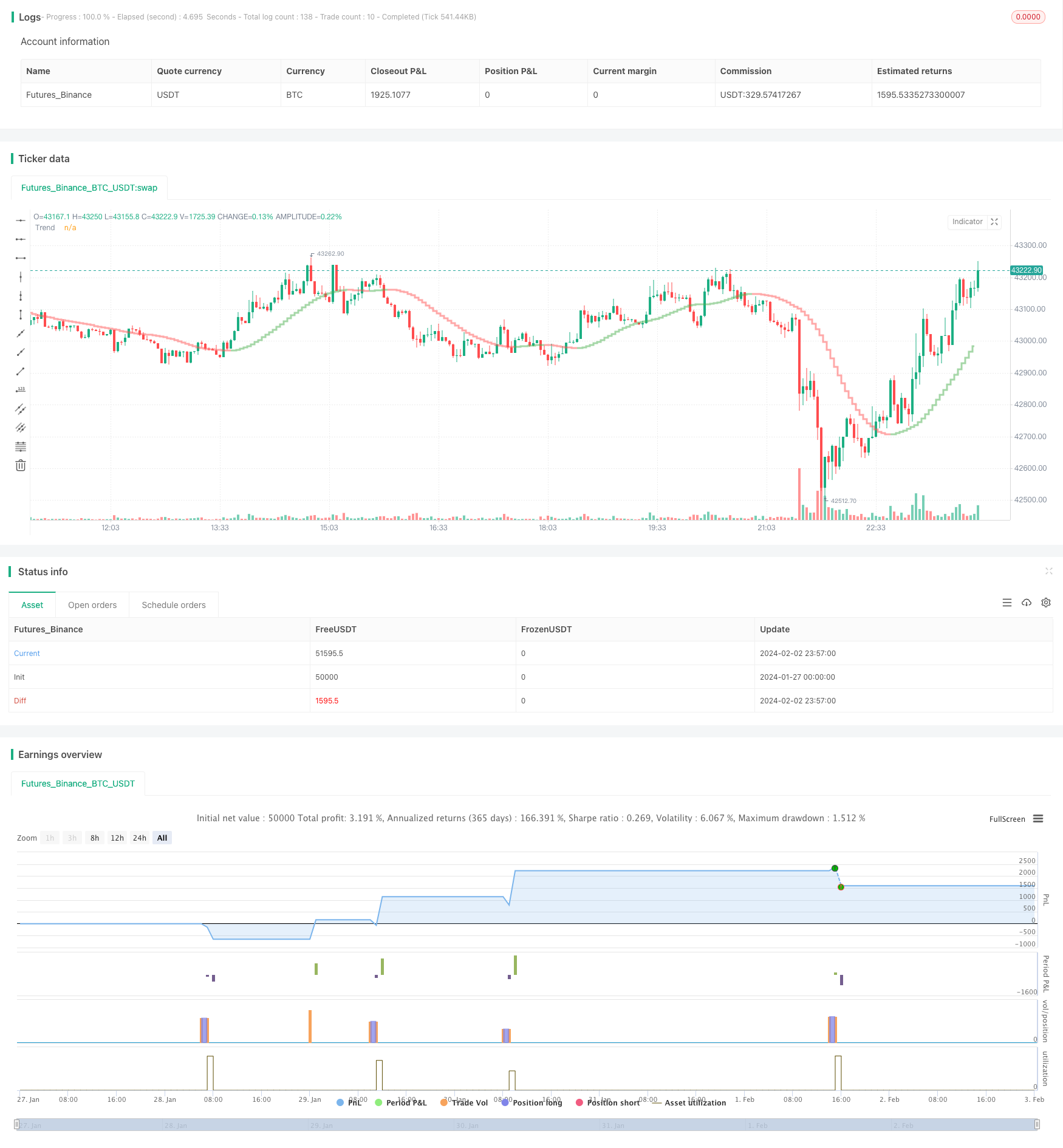

/*backtest

start: 2024-01-27 00:00:00

end: 2024-02-03 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kevinmck100

// @description

//

// Strategy is taken from the TradeIQ YouTube video called "I Finally Found 80% Win Rate Trading Strategy For Crypto"

// Check out the full video for further details/clarification on strategy entry/exit conditions.

//

// It incorporates the following features:

//

// - Risk management: Configurable X% loss per stop loss

// Configurable R:R ratio

//

// - Trade entry: Conditions outlines below

//

// - Trade exit: Conditions outlined below

//

// - Backtesting: Configurable backtesting range by date

//

// - Trade drawings: TP/SL boxes drawn for all trades (can be turned on and off)

// Trade exit information labels (can be turned on and off)

// NOTE: Trade drawings will only be applicable when using overlay strategies

//

// - Debugging: Includes section with useful debugging techniques

//

// Strategy conditions:

//

// - Trade entry: LONG: C1: Coral Trend is bullish

// C2: At least 1 candle where low is above Coral Trend since last cross above Coral Trend

// C3: Pullback happens and price closes below Coral Trend

// C4: Coral Trend colour remains bullish for duration of pullback

// C5: After valid pullback, price then closes above Coral Trend

// C6: Optional confirmation indicators (choose either C6.1 or C6.2 or NONE):

// C6.1: ADX and DI (Single indicator)

// C6.1.1: Green line is above red line

// C6.1.2: Blue line > 20

// C6.1.3: Blue trending up over last 1 candle

// C6.2: Absolute Strengeh Histogram + HawkEye Volume Indicator (Two indicators combined)

// C6.2.1: Absolute Strengeh Histogram colour is blue

// C6.2.2: HawkEye Volume Indicator colour is green

// SHORT: C1: Coral Trend is bearish

// C2: At least 1 candle where high is below Coral Trend since last cross below Coral Trend

// C3: Pullback happens and price closes above Coral Trend

// C4: Coral Trend colour remains bearish for duration of pullback

// C5: After valid pullback, price then closes below Coral Trend

// C6: Optional confirmation indicators (choose either C6.1 or C6.2 or NONE):

// C6.1: ADX and DI (Single indicator)

// C6.1.1: Red line is above green line

// C6.1.2: Blue line > 20

// C6.1.3: Blue trending up over last 1 candle

// C6.2: Absolute Strengeh Histogram + HawkEye Volume Indicator (Two indicators combined)

// C6.2.1: Absolute Strengeh Histogram colour is red

// C6.2.2: HawkEye Volume Indicator colour is red

// NOTE: All the optional confirmation indicators cannot be overlayed with Coral Trend so feel free to add each separately to the chart for visual purposes

//

//

// - Trade exit: Stop Loss: Calculated by recent swing low over previous X candles (configurable with "Local High/Low Lookback")

// Take Profit: Calculated from R:R multiplier * Stop Loss size

//

// @credits

//

// Coral Trend Indicator [LazyBear] by @LazyBear

// Absolute Strength Histogram | jh by @jiehonglim

// Indicator: HawkEye Volume Indicator by @LazyBear

// ADX and DI by @BeikabuOyaji

//@version=5

INITIAL_CAPITAL = 1000

DEFAULT_COMMISSION = 0.02

MAX_DRAWINGS = 500

IS_OVERLAY = true

strategy("Coral Trend Pullback Strategy (TradeIQ)", "Coral Trend Pullback", overlay = IS_OVERLAY, initial_capital = INITIAL_CAPITAL, currency = currency.NONE, max_labels_count = MAX_DRAWINGS, max_boxes_count = MAX_DRAWINGS, max_lines_count = MAX_DRAWINGS, default_qty_type = strategy.cash, commission_type = strategy.commission.percent, commission_value = DEFAULT_COMMISSION)

// =============================================================================

// INPUTS

// =============================================================================

// ---------------

// Risk Management

// ---------------

riskReward = input.float(1.5, "Risk : Reward 1 :", group = "Strategy: Risk Management", inline = "RM1", minval = 0, step = 0.1, tooltip = "Previous high or low (long/short dependant) is used to determine TP level. 'Risk : Reward' ratio is then used to calculate SL based of previous high/low level.\n\nIn short, the higher the R:R ratio, the smaller the SL since TP target is fixed by previous high/low price data.")

accountRiskPercent = input.float(1, "Portfolio Risk % ", group = "Strategy: Risk Management", inline = "RM2", minval = 0, step = 0.1, tooltip = "Percentage of portfolio you lose if trade hits SL.\n\nYou then stand to gain\n Portfolio Risk % * Risk : Reward\nif trade hits TP.")

localHlLookback = input.int (5, "Local High/Low Lookback ", group = "Strategy: Stop Loss Settings", inline = "SL1", minval = 1, tooltip = "This strategy calculates the Stop Loss value from the recent local high/low. This lookback period determines the number of candles to include for the local high/low.")

// ----------

// Date Range

// ----------

startYear = input.int (2010, "Start Date ", group = "Strategy: Date Range", inline = "DR1", minval = 1900, maxval = 2100)

startMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

startDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

endYear = input.int (2100, "End Date ", group = "Strategy: Date Range", inline = "DR2", minval = 1900, maxval = 2100)

endMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

endDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

// ----------------

// Drawing Settings

// ----------------

showTpSlBoxes = input.bool(true, "Show TP / SL Boxes", group = "Strategy: Drawings", inline = "D1", tooltip = "Show or hide TP and SL position boxes.\n\nNote: TradingView limits the maximum number of boxes that can be displayed to 500 so they may not appear for all price data under test.")

showLabels = input.bool(false, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "D2", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

// ------------------

// Indicator Settings

// ------------------

// Coral Trend

ctSm = input.int (25, "Smoothing Period ", group = "Leading Indicator: Coral Trand Settings", inline = "CT1")

ctCd = input.float(0.4, "Constant D ", group = "Leading Indicator: Coral Trand Settings", inline = "CT2", step = 0.1)

// Confirmation indicator inputs

confirmationInd = input.string("ADX and DI", "Entry Confirmation Method ", group = "Confirmation Indicator: Indicator Selection", inline = "IS1", options=["None", "ADX and DI", "Absolute Strength Histogram + HawkEye Volume"], tooltip = "Select one of the possible confirmation indicator(s) which can be used to confirm entry signals from the main Coral Trend indicator conditions. See strategy conditions to understand the logic behind each confirmation indicator")

// ADX and DI

adxLen = input.int(14, "ADX Length ", group = "Confirmation Indicator: ADX and DI Settings", inline = "AD1")

midLine = input.int(20, "Mid Line ", group = "Confirmation Indicator: ADX and DI Settings", inline = "AD2", tooltip = "Mid line on standard ADX and DI indicator. In this strategy the DI must be above this line for entry confirmation.")

// Absolute Strength Histogram

ashLength = input.int(9, "Period of Evaluation ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH1")

ashSmooth = input.int(6, "Period of Smoothing ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH2")

ashSrc = input.source(close, "Source ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH3")

ashMode = input.string("RSI", "Indicator Method ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH4", options=["RSI", "STOCHASTIC", "ADX"])

sahMaType = input.string("SMA", "MA ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH5", options=["ALMA", "EMA", "WMA", "SMA", "SMMA", "HMA"])

ashAlmaOffset = input.float(0.85, "* Arnaud Legoux (ALMA) Offset", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH6", minval=0, step=0.01)

ashAlmaSigma = input.int(6, "* Arnaud Legoux (ALMA) Sigma", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH7", minval=0)

// HawkEye Volume Indicator

hevLength = input.int(200, "Length ", group = "Confirmation Indicator: HawkEye Volume Settings", inline = "HV1")

hevDivisor = input.float(1.6, "Divisor ", group = "Confirmation Indicator: HawkEye Volume Settings", inline = "HV2", step=0.1)

// =============================================================================

// INDICATORS

// =============================================================================

// -----------

// Coral Trend

// -----------

src = close

di = (ctSm - 1.0) / 2.0 + 1.0

c1 = 2 / (di + 1.0)

c2 = 1 - c1

c3 = 3.0 * (ctCd * ctCd + ctCd * ctCd * ctCd)

c4 = -3.0 * (2.0 * ctCd * ctCd + ctCd + ctCd * ctCd * ctCd)

c5 = 3.0 * ctCd + 1.0 + ctCd * ctCd * ctCd + 3.0 * ctCd * ctCd

var float i1 = na

var float i2 = na

var float i3 = na

var float i4 = na

var float i5 = na

var float i6 = na

i1 := c1 * src + c2 * nz(i1[1])

i2 := c1 * i1 + c2 * nz(i2[1])

i3 := c1 * i2 + c2 * nz(i3[1])

i4 := c1 * i3 + c2 * nz(i4[1])

i5 := c1 * i4 + c2 * nz(i5[1])

i6 := c1 * i5 + c2 * nz(i6[1])

bfr = -ctCd * ctCd * ctCd * i6 + c3 * i5 + c4 * i4 + c5 * i3

bfrC = bfr > nz(bfr[1]) ? color.new(color.green, 50) : bfr < nz(bfr[1]) ? color.new(color.red, 50) : color.new(color.blue, 50)

plot(bfr, "Trend", linewidth = 3, style = plot.style_stepline, color = bfrC)

// ----------

// ADX and DI

// ----------

TrueRange = math.max(math.max(high - low, math.abs(high - nz(close[1]))), math.abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? math.max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? math.max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange = 0.0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - nz(SmoothedTrueRange[1]) / adxLen + TrueRange

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - nz(SmoothedDirectionalMovementPlus[1]) / adxLen + DirectionalMovementPlus

SmoothedDirectionalMovementMinus = 0.0

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - nz(SmoothedDirectionalMovementMinus[1]) / adxLen + DirectionalMovementMinus

DIPlus = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIMinus = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = math.abs(DIPlus - DIMinus) / (DIPlus + DIMinus) * 100

ADX = ta.sma(DX, adxLen)

// ---------------------------

// Absolute Strength Histogram

// ---------------------------

ashMa(ashType, ashSrc, ashLen) =>

float result = 0

if ashType == 'SMA' // Simple

result := ta.sma(ashSrc, ashLen)

result

if ashType == 'EMA' // Exponential

result := ta.ema(ashSrc, ashLen)

result

if ashType == 'WMA' // Weighted

result := ta.wma(ashSrc, ashLen)

result

if ashType == 'SMMA' // Smoothed

ashWma = ta.wma(ashSrc, ashLen)

ashSma = ta.sma(ashSrc, ashLen)

result := na(ashWma[1]) ? ashSma : (ashWma[1] * (ashLen - 1) + ashSrc) / ashLen

result

if ashType == 'HMA' // Hull

result := ta.wma(2 * ta.wma(ashSrc, ashLen / 2) - ta.wma(ashSrc, ashLen), math.round(math.sqrt(ashLen)))

result

if ashType == 'ALMA' // Arnaud Legoux

result := ta.alma(ashSrc, ashLen, ashAlmaOffset, ashAlmaSigma)

result

result

Price = ashSrc

Price1 = ashMa('SMA', Price, 1)

Price2 = ashMa('SMA', Price[1], 1)

//RSI

Bulls0 = 0.5 * (math.abs(Price1 - Price2) + Price1 - Price2)

Bears0 = 0.5 * (math.abs(Price1 - Price2) - (Price1 - Price2))

//STOCHASTIC

Bulls1 = Price1 - ta.lowest(Price1, ashLength)

Bears1 = ta.highest(Price1, ashLength) - Price1

//ADX

Bulls2 = 0.5 * (math.abs(high - high[1]) + high - high[1])

Bears2 = 0.5 * (math.abs(low[1] - low) + low[1] - low)

Bulls = ashMode == 'RSI' ? Bulls0 : ashMode == 'STOCHASTIC' ? Bulls1 : Bulls2

Bears = ashMode == 'RSI' ? Bears0 : ashMode == 'STOCHASTIC' ? Bears1 : Bears2

AvgBulls = ashMa(sahMaType, Bulls, ashLength)

AvgBears = ashMa(sahMaType, Bears, ashLength)

SmthBulls = ashMa(sahMaType, AvgBulls, ashSmooth)

SmthBears = ashMa(sahMaType, AvgBears, ashSmooth)

isTrendBullish = SmthBulls > SmthBears ? true : false

// ------------------------

// HawkEye Volume Indicator

// ------------------------

hevRange1 = high - low

hevRangeAvg = ta.sma(hevRange1, hevLength)

hevVolumeA = ta.sma(volume, hevLength)

hevHigh1 = high[1]

hevLow1 = low[1]

hevMid1 = hl2[1]

hevU1 = hevMid1 + (hevHigh1 - hevLow1) / hevDivisor

hevD1 = hevMid1 - (hevHigh1 - hevLow1) / hevDivisor

rEnabled1 = hevRange1 > hevRangeAvg and close < hevD1 and volume > hevVolumeA

rEnabled2 = close < hevMid1

rEnabled = rEnabled1 or rEnabled2

gEnabled1 = close > hevMid1

gEnabled2 = hevRange1 > hevRangeAvg and close > hevU1 and volume > hevVolumeA

gEnabled3 = high > hevHigh1 and hevRange1 < hevRangeAvg / 1.5 and volume < hevVolumeA

gEnabled4 = low < hevLow1 and hevRange1 < hevRangeAvg / 1.5 and volume > hevVolumeA

gEnabled = gEnabled1 or gEnabled2 or gEnabled3 or gEnabled4

grEnabled1 = hevRange1 > hevRangeAvg and close > hevD1 and close < hevU1 and volume > hevVolumeA and volume < hevVolumeA * 1.5 and volume > volume[1]

grEnabled2 = hevRange1 < hevRangeAvg / 1.5 and volume < hevVolumeA / 1.5

grEnabled3 = close > hevD1 and close < hevU1

grEnabled = grEnabled1 or grEnabled2 or grEnabled3

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// ---------

// FUNCTIONS

// ---------

percentAsPoints(pcnt) =>

math.round(pcnt / 100 * close / syminfo.mintick)

calcStopLossPrice(pointsOffset, isLong) =>

priceOffset = pointsOffset * syminfo.mintick

if isLong

close - priceOffset

else

close + priceOffset

calcProfitTrgtPrice(pointsOffset, isLong) =>

calcStopLossPrice(-pointsOffset, isLong)

printLabel(barIndex, msg) => label.new(barIndex, close, msg)

printTpSlHitBox(left, right, slHit, tpHit, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = slHit ? color.new(color.red, 60) : color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = tpHit ? color.new(color.green, 60) : color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTpSlNotHitBox(left, right, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTradeExitLabel(x, y, posSize, entryPrice, pnl) =>

if showLabels

labelStr = "Position Size: " + str.tostring(math.abs(posSize), "#.##") + "\nPNL: " + str.tostring(pnl, "#.##") + "\nCapital: " + str.tostring(strategy.equity, "#.##") + "\nEntry Price: " + str.tostring(entryPrice, "#.##")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

printVerticalLine(col) => line.new(bar_index, close, bar_index, close * 1.01, extend = extend.both, color = col)

// ----------

// CONDITIONS

// ----------

inDateRange = true

// Condition 1: Coral Trend color matches trend direction (long=green, short=red)

isCoralBullish = bfr > nz(bfr[1])

isCoralBearish = bfr < nz(bfr[1])

// Condition 2: At least 1 candle completely above/below (long/short) Coral Trend since last cross above/below (long/short) Coral Trend (could potentially try also with only close above)

sincePrePullbackBullBreakout= ta.barssince(ta.crossover(close, bfr))

sincePrePullbackBearBreakout= ta.barssince(ta.crossunder(close, bfr))

prePullbackBullBreakout = ta.barssince(low > bfr and high > bfr) < sincePrePullbackBullBreakout[1]

prePullbackBearBreakout = ta.barssince(low < bfr and high < bfr) < sincePrePullbackBearBreakout[1]

// Condition 3: Pullback closes below/above (long/short) Coral Trend

barssinceBullPullbackStart = ta.barssince(ta.crossunder(close, bfr))

barssinceBearPullbackStart = ta.barssince(ta.crossover(close, bfr))

barssincePullbackStart = isCoralBullish ? barssinceBullPullbackStart : isCoralBearish ? barssinceBearPullbackStart : na

// Condition 4: Coral Trend colour matched trend direction for duration of pullback

sinceBullish = ta.barssince(ta.crossover(bfr, nz(bfr[1])))

sinceBearish = ta.barssince(ta.crossunder(bfr, nz(bfr[1])))

barssinceCoralflip = isCoralBullish ? sinceBullish : isCoralBearish ? sinceBearish : na

isPullbackValid = barssincePullbackStart < barssinceCoralflip

// Condition 5: After valid pullback, price then closes above/below (long/short) Coral Trend

entryBreakout = (isCoralBullish and ta.crossover(close, bfr)) or (isCoralBearish and ta.crossunder(close, bfr))

// Condition 6: Confirmation indicators (6.1 or 6.2, optional depending on settings) confirms trade entry

// 6.1: ADX and DI

// 6.1.1: Green and red match trend (long=(green > red), short=(red > green))

// 6.1.2: Blue > 20

// 6.1.3: Blue trending up over last 1 candle

// 6.2: Absolute Strengeh Histogram + HawkEye Volume Indicator

// 6.2.1: Absolute Strengeh Histogram colour matches trend (long=blue, short=red)

// 6.2.2: HawkEye Volume Indicator colour matches trend (long=green, short=red)

var longTradeConfirmed = false

var shortTradeConfirmed = false

if confirmationInd == "ADX and DI"

isAdxUp = ADX > ADX [1]

isAdxValid = ADX > midLine and isAdxUp

longTradeConfirmed := DIPlus > DIMinus and isAdxValid

shortTradeConfirmed:= DIMinus > DIPlus and isAdxValid

else if confirmationInd == "Absolute Strength Histogram + HawkEye Volume"

isAshBullish = SmthBulls > SmthBears ? true : false

isHevBullish = not grEnabled and gEnabled ? true : false

isHevBearish = not grEnabled and rEnabled ? true : false

longTradeConfirmed := isAshBullish and isHevBullish

shortTradeConfirmed:= not isAshBullish and isHevBearish

else if confirmationInd == "None"

longTradeConfirmed := true

shortTradeConfirmed:= true

// Combine all entry conditions

goLong = inDateRange and isCoralBullish and prePullbackBullBreakout and isPullbackValid and entryBreakout and longTradeConfirmed

goShort = inDateRange and isCoralBearish and prePullbackBearBreakout and isPullbackValid and entryBreakout and shortTradeConfirmed

// Trade entry and exit variables

var tradeEntryBar = bar_index

var profitPoints = 0.

var lossPoints = 0.

var slPrice = 0.

var tpPrice = 0.

var inLong = false

var inShort = false

var entryPrice = 0.

// Entry decisions

openLong = (goLong and not inLong)

openShort = (goShort and not inShort)

flippingSides = (goLong and inShort) or (goShort and inLong)

enteringTrade = openLong or openShort

inTrade = inLong or inShort

// Exit calculations

entryPrice := close

longSlPrice = ta.lowest(localHlLookback)

shortSlPrice = ta.highest(localHlLookback)

slAmount = isCoralBullish ? entryPrice - longSlPrice : shortSlPrice - entryPrice

slPercent = math.abs((1 - (entryPrice - slAmount) / entryPrice) * 100)

tpPercent = slPercent * riskReward

// Risk calculations

riskAmt = strategy.equity * accountRiskPercent / 100

entryQty = math.abs(riskAmt / slPercent * 100) / close

if openLong

if strategy.position_size < 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Long", strategy.long, qty = entryQty, alert_message = "Long Entry")

enteringTrade := true

inLong := true

inShort := false

if openShort

if strategy.position_size > 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Short", strategy.short, qty = entryQty, alert_message = "Short Entry")

enteringTrade := true

inShort := true

inLong := false

if enteringTrade

profitPoints := percentAsPoints(tpPercent)

lossPoints := percentAsPoints(slPercent)

slPrice := calcStopLossPrice(lossPoints, openLong)

tpPrice := calcProfitTrgtPrice(profitPoints, openLong)

tradeEntryBar := bar_index

strategy.exit("TP/SL", profit = profitPoints, loss = lossPoints, comment_profit = "TP Hit", comment_loss = "SL Hit", alert_profit = "TP Hit Alert", alert_loss = "SL Hit Alert")

// =============================================================================

// DRAWINGS

// =============================================================================

// -----------

// TP/SL Boxes

// -----------

slHit = (inShort and high >= slPrice) or (inLong and low <= slPrice)

tpHit = (inLong and high >= tpPrice) or (inShort and low <= tpPrice)

exitTriggered = slHit or tpHit

ctEntryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

posSize = strategy.closedtrades.size (strategy.closedtrades - 1)

// Print boxes for trades closed at profit or loss

if (inTrade and exitTriggered)

inShort := false

inLong := false

// printTpSlHitBox(tradeEntryBar, bar_index, slHit, tpHit, ctEntryPrice, slPrice, tpPrice)

// printTradeExitLabel(bar_index, math.max(tpPrice, slPrice), posSize, ctEntryPrice, pnl)

// Print TP/SL box for current open trade

// if barstate.islastconfirmedhistory and strategy.position_size != 0

// printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

// // =============================================================================

// // DEBUGGING

// // =============================================================================

// Data window plots

plotchar(prePullbackBullBreakout, "prePullbackBullBreakout", "")

plotchar(prePullbackBearBreakout, "prePullbackBearBreakout", "")

plotchar(barssincePullbackStart, "barssincePullbackStart", "")

plotchar(isCoralBullish, "isCoralBullish", "")

plotchar(isCoralBearish, "isCoralBearish", "")

plotchar(barssinceCoralflip, "barssinceCoralflip", "")

plotchar(isPullbackValid, "isPullbackValid", "")

plotchar(entryBreakout, "entryBreakout", "")

plotchar(slHit, "slHit", "")

plotchar(tpHit, "tpHit", "")

plotchar(slPrice, "slPrice", "")

// Label plots

// plotDebugLabels = false

// if plotDebugLabels

// if bar_index == tradeEntryBar

// printLabel(bar_index, "Position size: " + str.tostring(entryQty * close, "#.##"))