Stratégie de trading de cassure des bandes de Bollinger

Aperçu

La stratégie est basée sur la conception de l’indicateur de la ceinture de Brin. Elle consiste à faire plus lorsque le prix franchit la ceinture de Brin et à faire moins lorsque le prix franchit la ceinture de Brin et à suivre la tendance.

Principe de stratégie

- Calcul de la moyenne, de la hauteur et de la basse de la bande de Brin

- Il y a un risque que le cours de la bourse s’effondre et que le cours de la bourse s’effondre.

- Faire une entrée blanche lorsque le cours de clôture est en baisse

- Conditions d’équilibrage: équilibre des billets en cas de rupture de la voie médiane et des billets vides en cas de rupture de la voie médiane

La stratégie utilise la zone de Boehringer pour déterminer la zone de fluctuation et la direction de la tendance du marché. Lorsqu’un prix franchit la zone de Boehringer pour descendre, il est considéré comme un signal de renversement de tendance.

Analyse des avantages

- Utilisation de l’indicateur de la ceinture de Brin pour déterminer les tendances du marché et les points de résistance de soutien

- Les chances de percer la ceinture de Brin sont plus élevées

- Des règles claires d’entrée et de sortie

Analyse des risques

- Le risque d’une fausse alerte de Brin pourrait être une onde de choc à court terme

- Le risque de dommages est plus élevé en cas d’événements majeurs.

Comment gérer les risques:

- Tendances de jugement combinées à d’autres indicateurs

- Ajustement des paramètres pour étendre la portée de la bande Brin

Direction d’optimisation

- Combiner les indicateurs de tendance pour éviter les retournements inutiles

- Modifier dynamiquement les paramètres de la bande de Bryn, optimiser la taille des paramètres

Résumer

La stratégie utilise les indicateurs de la ceinture de Brin pour déterminer la tendance des prix et les niveaux de résistance des supports. Le point d’entrée est le point de rupture en bas de la ceinture de Brin et le point d’arrêt est le milieu de la ceinture de Brin. La logique de la stratégie est simple et claire.

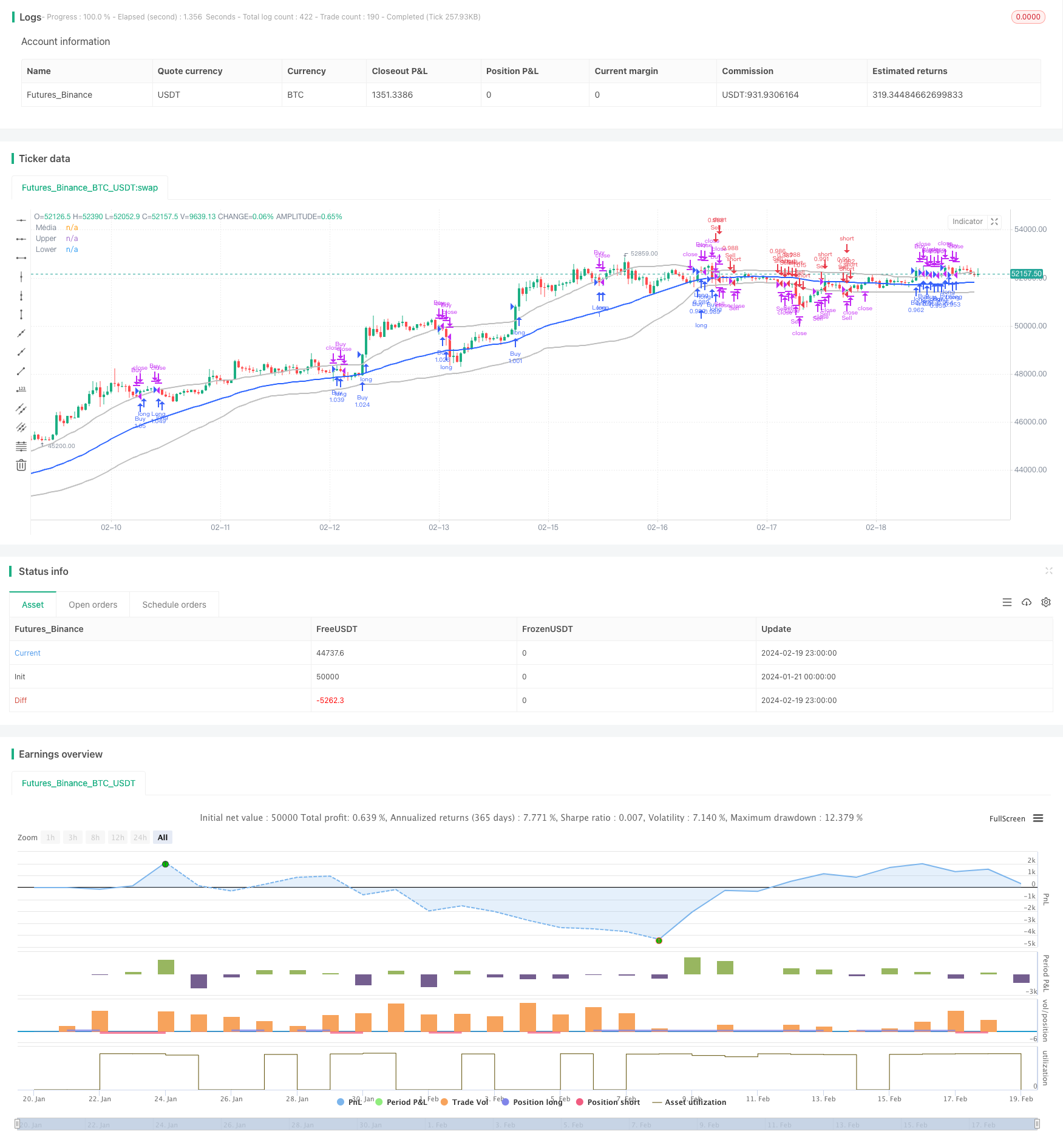

/*backtest

start: 2024-01-21 00:00:00

end: 2024-02-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("FFFDBTC", overlay=true,initial_capital = 100,commission_type =strategy.commission.percent,commission_value= 0.15,default_qty_value = 100,default_qty_type = strategy.percent_of_equity)

// === INPUT BACKTEST RANGE ===

FromMonth = input.int(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input.int(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input.int(defval=1972, title="From Year", minval=1972)

ToMonth = input.int(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input.int(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input.int(defval=9999, title="To Year", minval=2010)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true

// Definindo tamanho da posição

position_size = strategy.equity

// Definir parâmetros das Bandas de Bollinger

length = input.int(51, "Comprimento")

mult = input.float(1.1, "Multiplicador")

// Calcular as Bandas de Bollinger

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

// Definir condições de entrada e saída

entrada_na_venda = low < lower

saida_da_venda = high > lower and strategy.position_size < 0

entrada_na_compra = high > upper

saida_da_compra = low < upper and strategy.position_size > 0

shortCondition = close[1] < lower[1] and close > lower and close < basis

longCondition = close[1] > upper[1] and close < upper and close > basis

// Entrar na posição longa se a condição longCondition for verdadeira

if ((entrada_na_compra) and window() )

strategy.entry("Buy", strategy.long)

//saida da compra

if (saida_da_compra)

strategy.close("Buy")

//entrada na venda

if ((entrada_na_venda) and window() )

strategy.entry("Sell", strategy.short)

//saida da venda

if (saida_da_venda)

strategy.close("Sell")

if ((longCondition) and window())

strategy.entry("Long", strategy.long)

// Entrar na posição curta se a condição shortCondition for verdadeira

if ((shortCondition) and window())

strategy.entry("Short", strategy.short)

// Definir a saída da posição

strategy.exit("Exit_Long", "Long", stop=ta.sma(close, length), when = close >= basis)

strategy.exit("Exit_Short", "Short", stop=ta.sma(close, length), when = close <= basis)

// Desenhar as Bandas de Bollinger no gráfico

plot(basis, "Média", color=#2962FF, linewidth=2)

plot(upper, "Upper", color=#BEBEBE, linewidth=2)

plot(lower, "Lower", color=#BEBEBE, linewidth=2)