Stratégie de tendance des nuages à la hausse et à la baisse basée sur Ichimoku Kinko Hyo

Aperçu

Cette stratégie est basée sur une amélioration de la stratégie traditionnelle de négociation linéaire, qui utilise des indicateurs de tableau d’équilibre à première vue pour aider à déterminer la direction de la polyvalence. Cette stratégie combine des signaux de rupture de prix et de croisement linéaire, pour identifier les points de retournement de tendance potentiels et capturer des opportunités de négociation à faible risque.

Principe de stratégie

La table d’équilibre contient les lignes de conversion, la ligne de référence, la ligne de retard et la ligne de tête. Elle génère un signal de décalage horaire lorsque la ligne de conversion traverse ou descend de la ligne de référence. La rupture de la tendance à la baisse dans le nuage de prix sert de signal d’entrée, et la ligne de base et la ligne de tête dans le nuage servent de ligne de stop.

Plus précisément, les signaux d’entrée à plusieurs têtes traversent la ligne de référence pour la conversion et franchissent la ligne supérieure du nuage. Après avoir fait plus, si le prix tombe sous la ligne inférieure du nuage, le stop loss sort.

Analyse des avantages

Par rapport aux stratégies traditionnelles de moyennes mobiles, cette stratégie présente les avantages suivants:

- Le tableau d’équilibre à première vue, combiné à un jugement de la tendance des prix, évite les fausses ruptures qui génèrent de faux signaux.

- Le Cloud comme arrêt mobile, arrêt en temps opportun et contrôle des risques

- Adaptable à différents cycles et environnements de marché grâce à des ajustements de paramètres

Analyse des risques

Les principaux risques liés à cette stratégie sont:

- Risque de renversement de tendance. Après une entrée de rupture, le prix peut revenir à la secousse et ne pas être rentable.

- Risque de faux signaux de rupture. Une reprise de correction à court terme du prix peut être mal interprétée comme un signal de rupture.

- Paramètres d’optimisation des risques. Différents paramètres s’appliquent à différents cycles et nécessitent des ajustements de test.

La réponse:

- La suspension mobile et la suspension partielle sont utilisées.

- La combinaison d’un jugement plus élevé sur les cycles permet d’éviter le bruit des courts-circuits

- Optimisation de paramètres de combinaisons sélectionnées

Direction d’optimisation

Cette stratégie peut être optimisée dans les domaines suivants:

- Augmenter la capacité de l’apprentissage automatique à détecter les faux signaux

- Adaptation de l’arrêt mobile pour ajuster automatiquement la distance d’arrêt

- Paramètres d’adaptation à l’optimisation

Résumer

Cette stratégie est globalement une stratégie de suivi de tendance fiable et à faible risque. Comparée à la simple stratégie de ligne moyenne, la combinaison de l’indicateur de jugement de la table d’équilibre à première vue permet de filtrer une partie du signal de bruit.

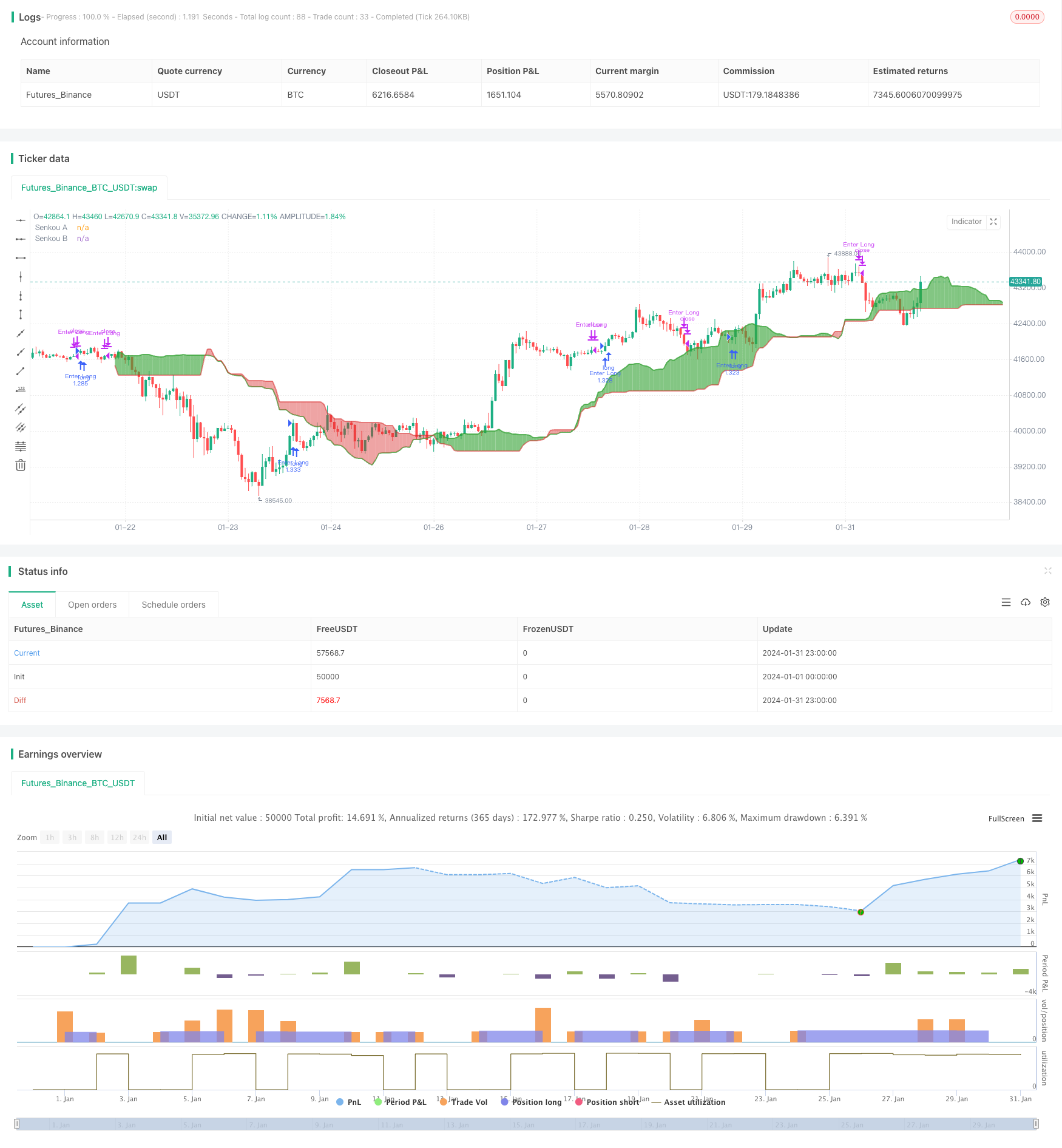

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// -----------------------------------------------------------------------------

// Copyright © 2024 Skyrex, LLC. All rights reserved.

// -----------------------------------------------------------------------------

// Version: v2

// Release: Jan 19, 2024

strategy(title = "Advanced Ichimoku Clouds Strategy Long and Short",

shorttitle = "Ichimoku Strategy Long and Short",

overlay = true,

format = format.inherit,

pyramiding = 1,

calc_on_order_fills = false,

calc_on_every_tick = true,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 10000,

currency = currency.NONE,

commission_type = strategy.commission.percent,

commission_value = 0)

// Trading Period Settings

lookBackPeriodStart = input(title="Trade Start Date/Time", defval = timestamp('2023-01-01T00:00:00'), group = "Trading Period")

lookBackPeriodStop = input(title="Trade Stop Date/Time", defval = timestamp('2025-01-01T00:00:00'), group = "Trading Period")

// Trading Mode

tradingMode = input.string("Long", "Trading Mode", options = ["Long", "Short"], group = "Position side")

// Long Mode Signal Options

entrySignalOptionsLong = input.string("Bullish All", "Select Entry Signal (Long)", options = ["None", "Bullish Strong", "Bullish Neutral", "Bullish Weak", "Bullish Strong and Neutral", "Bullish Neutral and Weak", "Bullish Strong and Weak", "Bullish All"], group = "Long Mode Signals - set up if Trading Mode: Long")

exitSignalOptionsLong = input.string("Bearish Weak", "Select Exit Signal (Long)", options = ["None", "Bearish Strong", "Bearish Neutral", "Bearish Weak", "Bearish Strong and Neutral", "Bearish Neutral and Weak", "Bearish Strong and Weak", "Bearish All"], group = "Long Mode Signals - set up if Trading Mode: Long")

// Short Mode Signal Options

entrySignalOptionsShort = input.string("None", "Select Entry Signal (Short)", options = ["None", "Bearish Strong", "Bearish Neutral", "Bearish Weak", "Bearish Strong and Neutral", "Bearish Neutral and Weak", "Bearish Strong and Weak", "Bearish All"], group = "Short Mode Signals - set up if Trading Mode: Short")

exitSignalOptionsShort = input.string("None", "Select Exit Signal (Short)", options = ["None", "Bullish Strong", "Bullish Neutral", "Bullish Weak", "Bullish Strong and Neutral", "Bullish Neutral and Weak", "Bullish Strong and Weak", "Bullish All"], group = "Short Mode Signals - set up if Trading Mode: Short")

// Risk Management Settings

takeProfitPct = input.float(7, "Take Profit, % (0 - disabled)", minval = 0, step = 0.1, group = "Risk Management")

stopLossPct = input.float(3.5, "Stop Loss, % (0 - disabled)", minval = 0, step = 0.1, group = "Risk Management")

// Indicator Settings

tenkanPeriods = input.int(9, "Tenkan", minval=1, group="Indicator Settings")

kijunPeriods = input.int(26, "Kijun", minval=1, group="Indicator Settings")

chikouPeriods = input.int(52, "Chikou", minval=1, group="Indicator Settings")

displacement = input.int(26, "Offset", minval=1, group="Indicator Settings")

// Display Settings

showTenkan = input(false, "Show Tenkan Line", group = "Display Settings")

showKijun = input(false, "Show Kijun Line", group = "Display Settings")

showSenkouA = input(true, "Show Senkou A Line", group = "Display Settings")

showSenkouB = input(true, "Show Senkou B Line", group = "Display Settings")

showChikou = input(false, "Show Chikou Line", group = "Display Settings")

// Function to convert percentage to price points based on entry price

pctToPoints(pct) =>

strategy.position_avg_price * pct / 100

// Colors and Transparency Level

transparencyLevel = 90

colorGreen = color.new(#36a336, 23)

colorRed = color.new(#d82727, 47)

colorTenkanViolet = color.new(#9400D3, 0)

colorKijun = color.new(#fdd8a0, 0)

colorLime = color.new(#006400, 0)

colorMaroon = color.new(#8b0000, 0)

colorGreenTransparent = color.new(colorGreen, transparencyLevel)

colorRedTransparent = color.new(colorRed, transparencyLevel)

// Ichimoku Calculations

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

tenkan = donchian(tenkanPeriods)

kijun = donchian(kijunPeriods)

senkouA = math.avg(tenkan, kijun)

senkouB = donchian(chikouPeriods)

displacedSenkouA = senkouA[displacement - 1]

displacedSenkouB = senkouB[displacement - 1]

// Plot Ichimoku Lines

plot(showTenkan ? tenkan : na, color=colorTenkanViolet, title = "Tenkan", linewidth=2)

plot(showKijun ? kijun : na, color=colorKijun, title = "Kijun", linewidth=2)

plot(showChikou ? close : na, offset=-displacement, color = colorLime, title = "Chikou", linewidth=1)

p1 = plot(showSenkouA ? senkouA : na, offset=displacement - 1, color=colorGreen, title = "Senkou A", linewidth=2)

p2 = plot(showSenkouB ? senkouB : na, offset=displacement - 1, color=colorRed, title = "Senkou B", linewidth=2)

fill(p1, p2, color=senkouA > senkouB ? colorGreenTransparent : colorRedTransparent)

// Signal Calculations

bullishSignal = ta.crossover(tenkan, kijun)

bearishSignal = ta.crossunder(tenkan, kijun)

bullishSignalValues = bullishSignal ? tenkan : na

bearishSignalValues = bearishSignal ? tenkan : na

strongBullishSignal = bullishSignalValues > displacedSenkouA and bullishSignalValues > displacedSenkouB

neutralBullishSignal = ((bullishSignalValues > displacedSenkouA and bullishSignalValues < displacedSenkouB) or (bullishSignalValues < displacedSenkouA and bullishSignalValues > displacedSenkouB))

weakBullishSignal = bullishSignalValues < displacedSenkouA and bullishSignalValues < displacedSenkouB

strongBearishSignal = bearishSignalValues < displacedSenkouA and bearishSignalValues < displacedSenkouB

neutralBearishSignal = ((bearishSignalValues > displacedSenkouA and bearishSignalValues < displacedSenkouB) or (bearishSignalValues < displacedSenkouA and bearishSignalValues > displacedSenkouB))

weakBearishSignal = bearishSignalValues > displacedSenkouA and bearishSignalValues > displacedSenkouB

// Functions to determine entry and exit conditions for Long and Short

isEntrySignalLong() =>

entryCondition = false

if entrySignalOptionsLong == "None"

entryCondition := false

else if entrySignalOptionsLong == "Bullish Strong"

entryCondition := strongBullishSignal

else if entrySignalOptionsLong == "Bullish Neutral"

entryCondition := neutralBullishSignal

else if entrySignalOptionsLong == "Bullish Weak"

entryCondition := weakBullishSignal

else if entrySignalOptionsLong == "Bullish Strong and Neutral"

entryCondition := strongBullishSignal or neutralBullishSignal

else if entrySignalOptionsLong == "Bullish Neutral and Weak"

entryCondition := neutralBullishSignal or weakBullishSignal

else if entrySignalOptionsLong == "Bullish Strong and Weak"

entryCondition := strongBullishSignal or weakBullishSignal

else if entrySignalOptionsLong == "Bullish All"

entryCondition := strongBullishSignal or neutralBullishSignal or weakBullishSignal

entryCondition

isExitSignalLong() =>

exitCondition = false

if exitSignalOptionsLong == "None"

exitCondition := false

else if exitSignalOptionsLong == "Bearish Strong"

exitCondition := strongBearishSignal

else if exitSignalOptionsLong == "Bearish Neutral"

exitCondition := neutralBearishSignal

else if exitSignalOptionsLong == "Bearish Weak"

exitCondition := weakBearishSignal

else if exitSignalOptionsLong == "Bearish Strong and Neutral"

exitCondition := strongBearishSignal or neutralBearishSignal

else if exitSignalOptionsLong == "Bearish Neutral and Weak"

exitCondition := neutralBearishSignal or weakBearishSignal

else if exitSignalOptionsLong == "Bearish Strong and Weak"

exitCondition := strongBearishSignal or weakBearishSignal

else if exitSignalOptionsLong == "Bearish All"

exitCondition := strongBearishSignal or neutralBearishSignal or weakBearishSignal

exitCondition

isEntrySignalShort() =>

entryCondition = false

if entrySignalOptionsShort == "None"

entryCondition := false

else if entrySignalOptionsShort == "Bearish Strong"

entryCondition := strongBearishSignal

else if entrySignalOptionsShort == "Bearish Neutral"

entryCondition := neutralBearishSignal

else if entrySignalOptionsShort == "Bearish Weak"

entryCondition := weakBearishSignal

else if entrySignalOptionsShort == "Bearish Strong and Neutral"

entryCondition := strongBearishSignal or neutralBearishSignal

else if entrySignalOptionsShort == "Bearish Neutral and Weak"

entryCondition := neutralBearishSignal or weakBearishSignal

else if entrySignalOptionsShort == "Bearish Strong and Weak"

entryCondition := strongBearishSignal or weakBearishSignal

else if entrySignalOptionsShort == "Bearish All"

entryCondition := strongBearishSignal or neutralBearishSignal or weakBearishSignal

entryCondition

isExitSignalShort() =>

exitCondition = false

if exitSignalOptionsShort == "None"

exitCondition := false

else if exitSignalOptionsShort == "Bullish Strong"

exitCondition := strongBullishSignal

else if exitSignalOptionsShort == "Bullish Neutral"

exitCondition := neutralBullishSignal

else if exitSignalOptionsShort == "Bullish Weak"

exitCondition := weakBullishSignal

else if exitSignalOptionsShort == "Bullish Strong and Neutral"

exitCondition := strongBullishSignal or neutralBullishSignal

else if exitSignalOptionsShort == "Bullish Neutral and Weak"

exitCondition := neutralBullishSignal or weakBullishSignal

else if exitSignalOptionsShort == "Bullish Strong and Weak"

exitCondition := strongBullishSignal or weakBullishSignal

else if exitSignalOptionsShort == "Bullish All"

exitCondition := strongBullishSignal or neutralBullishSignal or weakBullishSignal

exitCondition

// Strategy logic for entries and exits

if true

if tradingMode == "Long"

takeProfitLevelLong = strategy.position_avg_price * (1 + takeProfitPct / 100)

stopLossLevelLong = strategy.position_avg_price * (1 - stopLossPct / 100)

if isEntrySignalLong()

strategy.entry("Enter Long", strategy.long)

if (takeProfitPct > 0 and close >= takeProfitLevelLong) or (stopLossPct > 0 and close <= stopLossLevelLong) or (exitSignalOptionsLong != "None" and isExitSignalLong())

strategy.close("Enter Long", comment="Exit Long")

else if tradingMode == "Short"

takeProfitLevelShort = strategy.position_avg_price * (1 - takeProfitPct / 100)

stopLossLevelShort = strategy.position_avg_price * (1 + stopLossPct / 100)

if isEntrySignalShort()

strategy.entry("Enter Short", strategy.short)

if (takeProfitPct > 0 and close <= takeProfitLevelShort) or (stopLossPct > 0 and close >= stopLossLevelShort) or (exitSignalOptionsShort != "None" and isExitSignalShort())

strategy.close("Enter Short", comment="Exit Short")