Aperçu

L’idée principale de cette stratégie est de rechercher une ligne K de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe de la courbe

Principe de stratégie

- Déterminer si la ligne K actuelle est une ligne K baissière (le cours de clôture est supérieur au cours d’ouverture)

- Calculer le rapport entre la longueur de la ligne K actuelle et la longueur de l’entité K

- Si le ratio de pointe est inférieur à 5%, il est considéré comme efficace de ne pas mettre de pointe sur la ligne K, émettant un signal d’achat

- Enregistrer le prix le plus bas de la ligne K précédente après l’achat en tant que stop loss

- La position est levée lorsque le prix atteint son point de rupture.

Avantages stratégiques

- La ligne K de l’indicateur de l’introduction sans pointeur est plus forte et a un taux de réussite plus élevé.

- Le risque peut être maîtrisé en utilisant le premier point bas de la ligne K comme point d’arrêt.

- Une logique simple, facile à mettre en œuvre et à optimiser

- Convient pour une utilisation dans des contextes de tendance

Risque stratégique

- Il est possible que le retrait immédiat du signal d’achat déclenche un stop loss.

- Pour les variétés à forte volatilité, le stop loss peut être fixé trop près du prix d’achat, ce qui entraîne un stop loss prématuré.

- Le manque d’objectifs de rentabilité et la difficulté à saisir le meilleur moment pour faire des soldes

Orientation de l’optimisation de la stratégie

- Il peut être combiné avec d’autres indicateurs tels que MA, MACD, etc. pour confirmer la force de la tendance et améliorer l’efficacité du signal d’entrée

- Pour les variétés à haute volatilité, il est possible de placer le point d’arrêt à un endroit plus éloigné, comme le point le plus bas de la ligne K de la racine N avant, pour réduire la fréquence d’arrêt.

- L’introduction d’objectifs de profit, tels que le N-fold ATR ou le pourcentage de profit, et le blocage des bénéfices en temps opportun

- Considérer l’ajout de la gestion de position, par exemple en ajustant la taille de la position en fonction de l’intensité du signal

Résumer

Cette stratégie peut être améliorée en introduisant des signaux de filtrage d’autres indicateurs, en optimisant les positions de stop loss et en définissant des objectifs de profit.

Overview

The main idea of this strategy is to find bullish candles without upper wicks as buy signals and close positions when the price breaks below the low of the previous candle. The strategy utilizes the characteristic of bullish candles with very small upper wicks, indicating strong bullish momentum and a higher probability of continued price increases. At the same time, using the low of the previous candle as a stop-loss level can effectively control risk.

Strategy Principles

- Determine if the current candle is a bullish candle (close price higher than open price)

- Calculate the ratio of the current candle’s upper wick length to its body length

- If the upper wick ratio is less than 5%, consider it a valid bullish candle without an upper wick and generate a buy signal

- Record the lowest price of the previous candle after buying as the stop-loss level

- When the price breaks below the stop-loss level, close the position and exit

Strategy Advantages

- Selecting bullish candles without upper wicks for entry, the trend strength is greater and the success rate is higher

- Using the low of the previous candle as the stop-loss level, risks are controllable

- Simple logic, easy to implement and optimize

- Suitable for use in trending markets

Strategy Risks

- There may be cases where a buy signal is followed by an immediate pullback triggering the stop-loss

- For highly volatile instruments, the stop-loss level may be set too close to the buy price, leading to premature stop-outs

- Lack of profit targets, making it difficult to grasp the optimal exit timing

Strategy Optimization Directions

- Combine with other indicators such as MA, MACD, etc., to confirm trend strength and improve the effectiveness of entry signals

- For highly volatile instruments, set the stop-loss level at a further position, such as the lowest point of the previous N candles, to reduce the stop-loss frequency

- Introduce profit targets, such as N times ATR or percentage gains, to lock in profits in a timely manner

- Consider adding position management, such as adjusting position size based on signal strength

Summary

This strategy captures profits effectively in trending markets by selecting bullish candles without upper wicks for entry and using the low of the previous candle for stop-loss. However, the strategy also has certain limitations, such as inflexible stop-loss placement and lack of profit targets. Improvements can be made by introducing other indicators to filter signals, optimizing stop-loss positions, and setting profit targets to make the strategy more robust and effective.

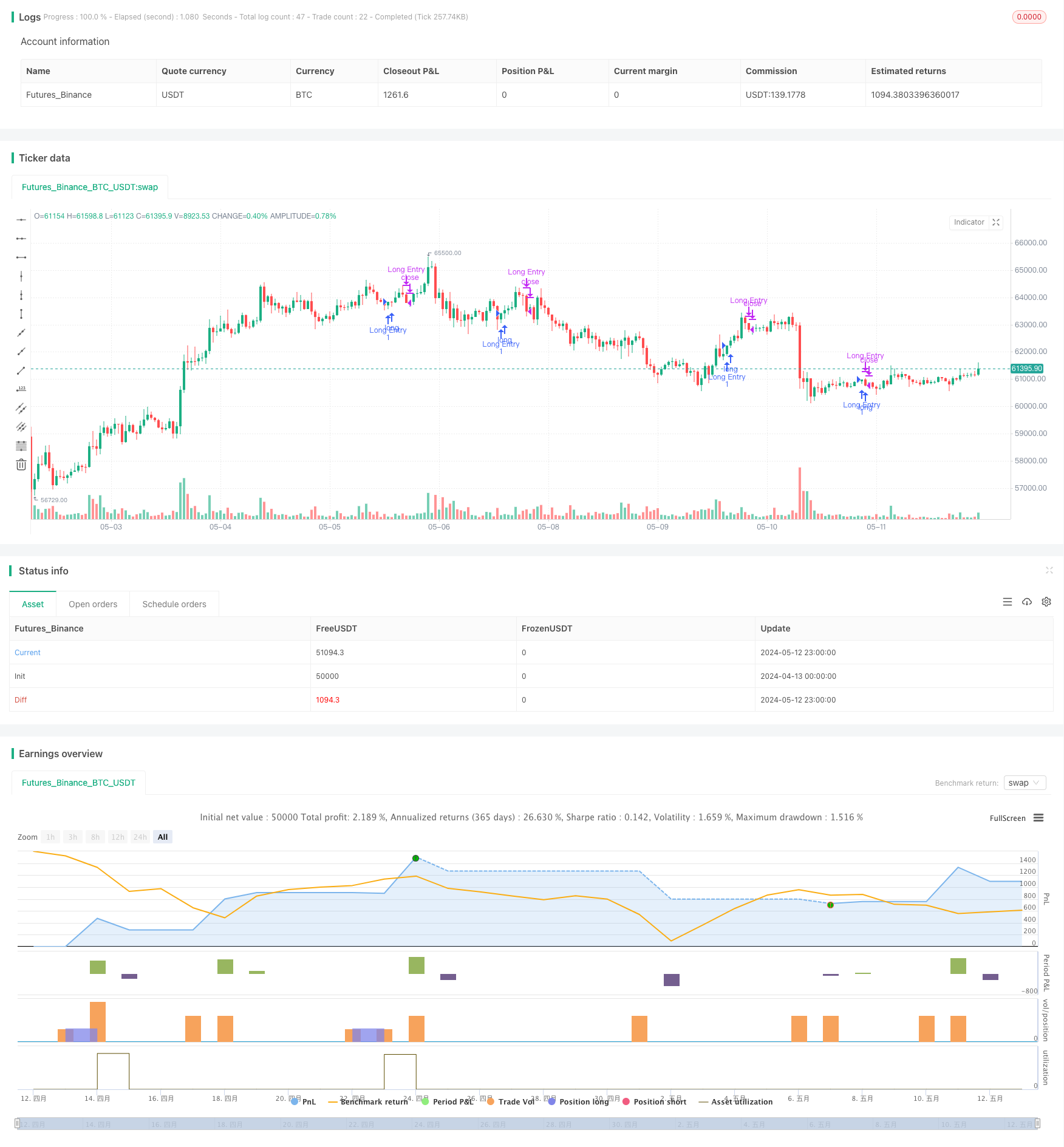

/*backtest

start: 2024-04-13 00:00:00

end: 2024-05-13 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © nagpha

//@version=5

strategy("My strategy", overlay=true, margin_long=100, margin_short=100)

candleBodySize = math.abs(open - close)

// Calculate candle wick size

candleWickSize = high - close

// Calculate percentage of wick to candle body

wickPercentage = (candleWickSize / candleBodySize) * 100

// Check if candle is bullish and wick is less than 1% of the body

isBullish = close > open

isWickLessThan5Percent = wickPercentage < 5

longCondition = isBullish and isWickLessThan5Percent

if (longCondition)

// log.info("long position taken")

strategy.entry("Long Entry", strategy.long)

float prevLow = 0.0

prevLow := request.security(syminfo.tickerid, timeframe.period, low[1], lookahead=barmerge.lookahead_on)

float closingPrice = close

//plot(closingPrice, "Close Price", color.purple, 3)

//plot(prevLow, "Previous Low", color.red, 3)

//log.info("Outside: {0,number,#}",closingPrice)

//log.info("Outside: {0,number,#}",prevLow)

if closingPrice < prevLow and strategy.position_size > 0

//log.info("inside close: {0,number} : {0,number}",closingPrice,prevLow)

// log.info("position exited")

strategy.close("Long Entry")

longCondition := false

prevLow := 0

isBullish := false

//plot(series=strategy.position_size > 0 ? prevLow : na, color = color.new(#40ccfb,0), style=plot.style_cross,linewidth = 5)