Aperçu

La stratégie combine un graphique de volume et des prix en temps réel pour générer des signaux d’achat et de vente en analysant les prix et la distribution du volume d’achat sur une période donnée. La stratégie calcule d’abord plusieurs niveaux de prix en fonction du prix actuel et du pourcentage de la fourchette de prix définie.

Principe de stratégie

- Plusieurs niveaux de prix sont calculés en fonction du prix actuel et du pourcentage de la fourchette de prix définie.

- Calculer le volume d’achats et de ventes pour chaque niveau de prix sur une période donnée et calculer le volume d’achats et de ventes cumulé.

- Déterminez la couleur des étiquettes en fonction du volume cumulé d’achats et de ventes et affichez les étiquettes ou dessinez des graphiques.

- La courbe des prix en temps réel.

- Calculer les indicateurs tels que l’EMA, le VWAP.

- Le rapport entre le prix et des indicateurs tels que l’EMA, le VWAP et les conditions de quantité de transaction permettent de déterminer si les conditions d’achat sont remplies. Si elles sont remplies et que le signal n’a pas été généré auparavant, un signal d’achat est généré.

- Si les conditions de vente sont remplies et qu’aucun signal n’a été généré auparavant, un signal de vente est généré. Si deux lignes négatives consécutives et aucun signal n’ont été générés auparavant, un signal de vente est également généré.

- Enregistre l’état actuel des conditions d’achat et de vente et met à jour l’état de la génération du signal.

Analyse des avantages

- La combinaison de graphiques thermiques de volumes de transactions et de prix en temps réel permet de visualiser la répartition des prix et des volumes de transactions et de fournir une référence pour les décisions de transaction.

- L’introduction d’indicateurs tels que l’EMA et le VWAP a enrichi le jugement conditionnel de la stratégie et amélioré la fiabilité de la stratégie.

- Les signaux d’achat et de vente sont plus complets et plus solides en tenant compte de facteurs tels que les prix, les indicateurs et le volume de transactions.

- Les conditions de restriction de la production de signaux sont définies pour éviter la production de signaux répétitifs en continu et réduire les signaux trompeurs.

Analyse des risques

- La performance de la stratégie peut être influencée par des paramètres tels que le pourcentage de la fourchette de prix, la période de rétrocession, etc. et doit être ajustée et optimisée en fonction des circonstances.

- Les indicateurs EMA, VWAP et autres ont eux-mêmes une certaine retardation et des limites qui peuvent être invalides dans certaines conditions de marché.

- Cette stratégie s’applique principalement aux marchés à forte tendance, où les faux signaux sont plus susceptibles de se produire en cas de choc.

- Les mesures de contrôle des risques de la stratégie sont relativement simples et il n’y a pas de moyens de gestion des risques tels que le stop-loss et la gestion des positions.

Direction d’optimisation

- L’introduction de plus d’indicateurs techniques et d’indicateurs de sentiment du marché, tels que le RSI, le MACD, les bandes de Brent, etc., pour enrichir le jugement stratégique.

- Optimiser les conditions de génération des signaux d’achat et de vente, améliorer l’exactitude et la fiabilité des signaux. L’analyse de plusieurs périodes peut être envisagée pour confirmer la direction de la tendance.

- Ajouter des mesures de contrôle des risques telles que la gestion des arrêts et des positions, définir des arrêts et des positions raisonnables, contrôler les seuils de risque pour les transactions individuelles.

- Optimiser et retester les paramètres de la stratégie pour trouver la combinaison optimale de paramètres et la portée du marché.

- Envisager de combiner cette stratégie avec d’autres stratégies pour tirer parti des avantages des différentes stratégies et améliorer la stabilité et la rentabilité globales.

Résumer

Cette stratégie a pour avantage de pouvoir visualiser la distribution des prix et des volumes de transactions et de prendre en compte de multiples facteurs pour générer des signaux. Cependant, la stratégie présente également des limites et des risques, tels que l’impact des paramètres, le retard des indicateurs, la dépendance à la tendance du marché. Par conséquent, dans la pratique, il est nécessaire d’optimiser et de perfectionner davantage la stratégie, comme l’introduction de plus d’indicateurs, l’optimisation des conditions de signal, le renforcement des contrôles de risque, etc.

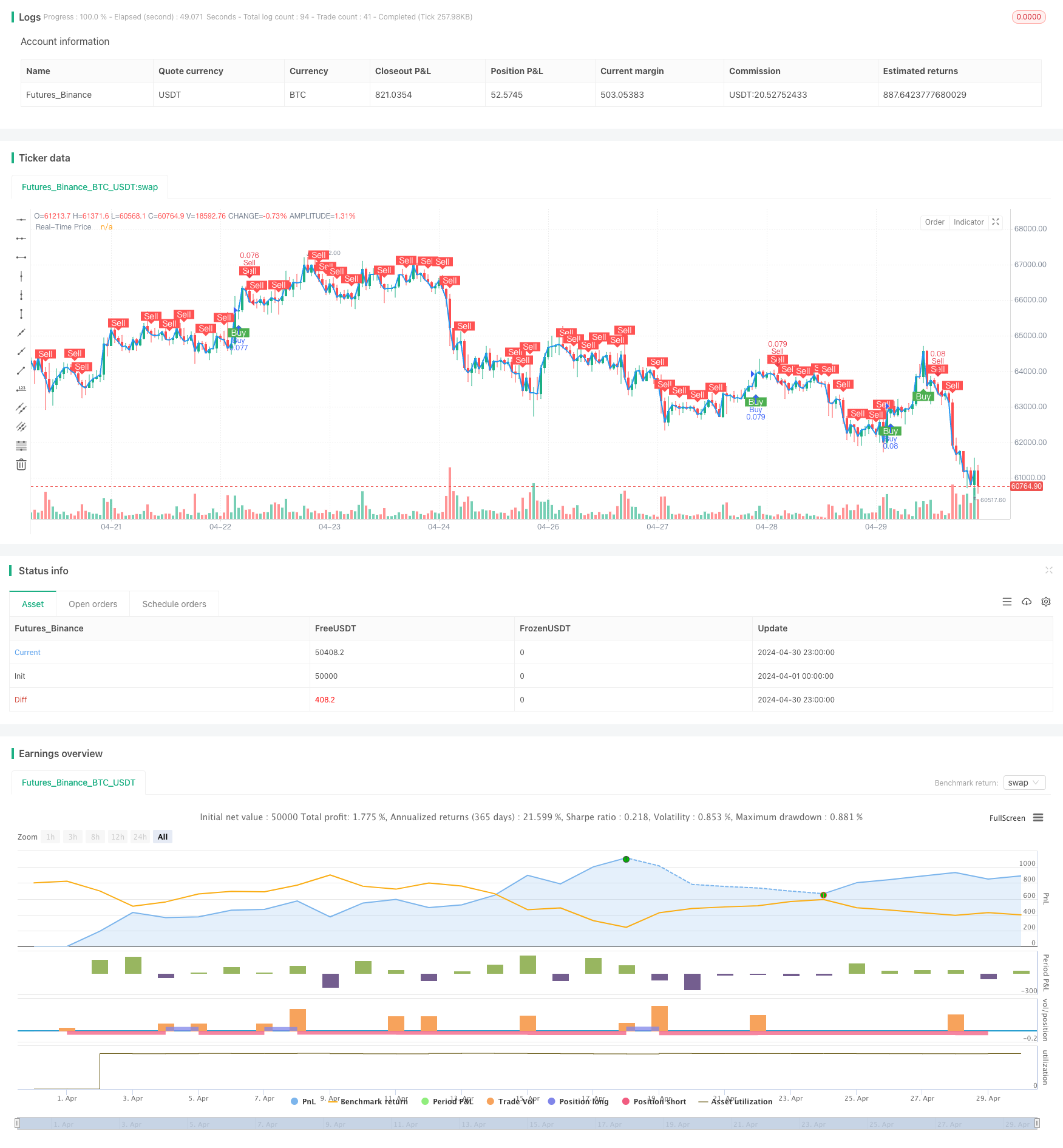

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Buy and Sell Volume Heatmap with Real-Time Price Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Settings for Volume Heatmap

lookbackPeriod = input.int(100, title="Lookback Period")

baseGreenColor = input.color(color.green, title="Buy Volume Color")

baseRedColor = input.color(color.red, title="Sell Volume Color")

priceLevels = input.int(10, title="Number of Price Levels")

priceRangePct = input.float(0.01, title="Price Range Percentage")

labelSize = input.string("small", title="Label Size", options=["tiny", "small", "normal", "large"])

showLabels = input.bool(true, title="Show Volume Labels")

// Initialize arrays to store price levels, buy volumes, and sell volumes

var float[] priceLevelsArr = array.new_float(priceLevels)

var float[] buyVolumes = array.new_float(priceLevels)

var float[] sellVolumes = array.new_float(priceLevels)

// Calculate price levels around the current price

for i = 0 to priceLevels - 1

priceLevel = close * (1 + (i - priceLevels / 2) * priceRangePct) // Adjust multiplier for desired spacing

array.set(priceLevelsArr, i, priceLevel)

// Calculate buy and sell volumes for each price level

for i = 0 to priceLevels - 1

level = array.get(priceLevelsArr, i)

buyVol = 0.0

sellVol = 0.0

for j = 1 to lookbackPeriod

if close[j] > open[j]

if close[j] >= level and low[j] <= level

buyVol := buyVol + volume[j]

else

if close[j] <= level and high[j] >= level

sellVol := sellVol + volume[j]

array.set(buyVolumes, i, buyVol)

array.set(sellVolumes, i, sellVol)

// Determine the maximum volumes for normalization

maxBuyVolume = array.max(buyVolumes)

maxSellVolume = array.max(sellVolumes)

// Initialize cumulative buy and sell volumes for the current bar

cumulativeBuyVol = 0.0

cumulativeSellVol = 0.0

// Calculate colors based on the volumes and accumulate volumes for the current bar

for i = 0 to priceLevels - 1

buyVol = array.get(buyVolumes, i)

sellVol = array.get(sellVolumes, i)

cumulativeBuyVol := cumulativeBuyVol + buyVol

cumulativeSellVol := cumulativeSellVol + sellVol

// Determine the label color based on which volume is higher

labelColor = cumulativeBuyVol > cumulativeSellVol ? baseGreenColor : baseRedColor

// Initialize variables for plotshape

var float shapePosition = na

var color shapeColor = na

if cumulativeBuyVol > 0 or cumulativeSellVol > 0

if showLabels

labelText = "Buy: " + str.tostring(cumulativeBuyVol) + "\nSell: " + str.tostring(cumulativeSellVol)

label.new(x=bar_index, y=high + (high - low) * 0.02, text=labelText, color=color.new(labelColor, 0), textcolor=color.white, style=label.style_label_down, size=labelSize)

else

shapePosition := high + (high - low) * 0.02

shapeColor := labelColor

// Plot the shape outside the local scope

plotshape(series=showLabels ? na : shapePosition, location=location.absolute, style=shape.circle, size=size.tiny, color=shapeColor)

// Plot the real-time price on the chart

plot(close, title="Real-Time Price", color=color.blue, linewidth=2, style=plot.style_line)

// Mpullback Indicator Settings

a = ta.ema(close, 9)

b = ta.ema(close, 20)

e = ta.vwap(close)

volume_ma = ta.sma(volume, 20)

// Calculate conditions for buy and sell signals

buy_condition = close > a and close > e and volume > volume_ma and close > open and low > a and low > e // Ensure close, low are higher than open, EMA, and VWAP

sell_condition = close < a and close < b and close < e and volume > volume_ma

// Store the previous buy and sell conditions

var bool prev_buy_condition = na

var bool prev_sell_condition = na

// Track if a buy or sell signal has occurred

var bool signal_occurred = false

// Generate buy and sell signals based on conditions

buy_signal = buy_condition and not prev_buy_condition and not signal_occurred

sell_signal = sell_condition and not prev_sell_condition and not signal_occurred

// Determine bearish condition (close lower than the bottom 30% of the candle's range)

bearish = close < low + (high - low) * 0.3

// Add sell signal when there are two consecutive red candles and no signal has occurred

two_consecutive_red_candles = close[1] < open[1] and close < open

sell_signal := sell_signal or (two_consecutive_red_candles and not signal_occurred)

// Remember the current conditions for the next bar

prev_buy_condition := buy_condition

prev_sell_condition := sell_condition

// Update signal occurred status

signal_occurred := buy_signal or sell_signal

// Plot buy and sell signals

plotshape(buy_signal, title="Buy", style=shape.labelup, location=location.belowbar, color=color.green, text="Buy", textcolor=color.white)

plotshape(sell_signal, title="Sell", style=shape.labeldown, location=location.abovebar, color=color.red, text="Sell", textcolor=color.white)

// Strategy entry and exit

if buy_signal

strategy.entry("Buy", strategy.long)

if sell_signal

strategy.entry("Sell", strategy.short)