1

Suivre

1664

Abonnés

Aperçu

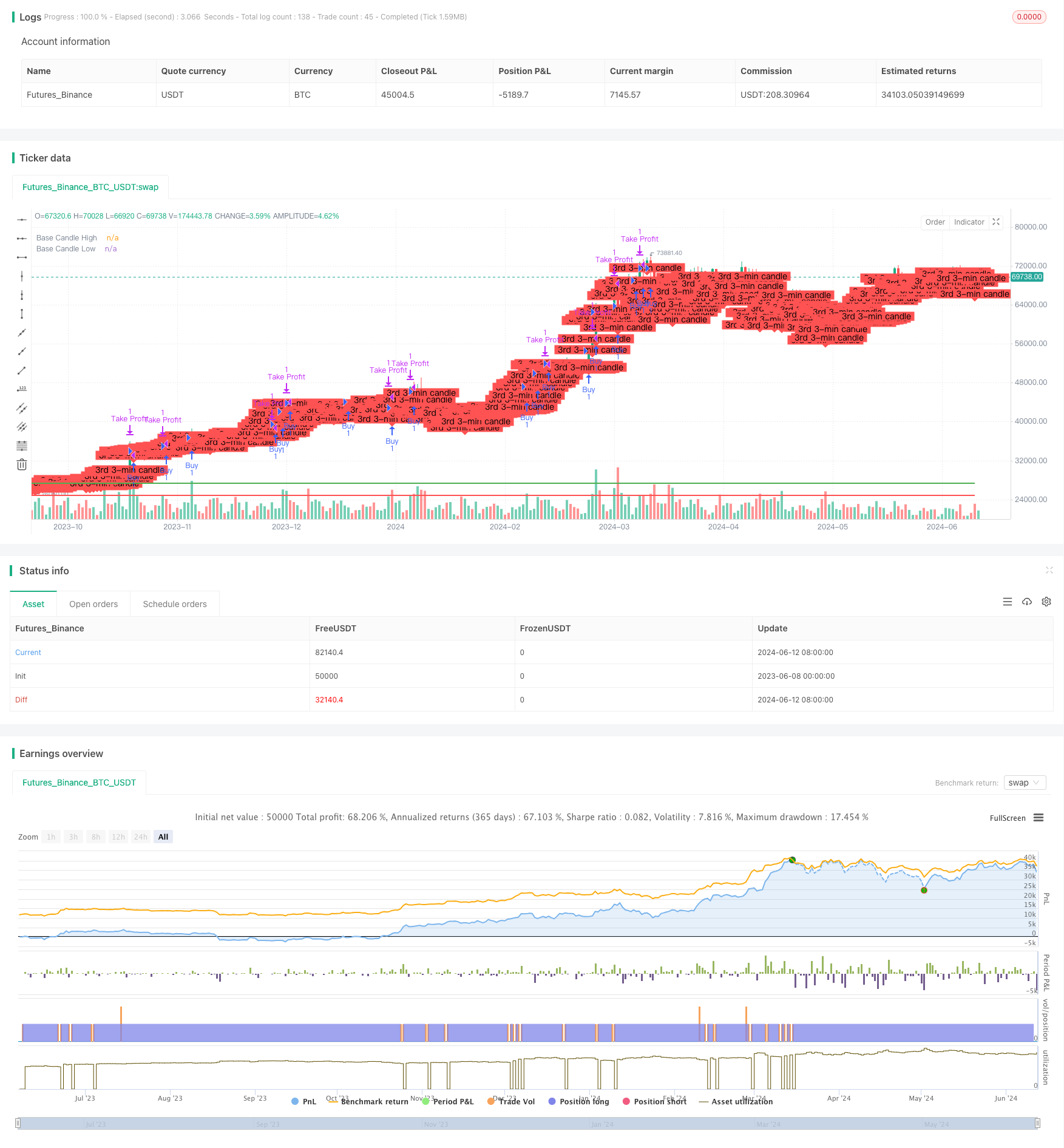

L’idée principale de cette stratégie est d’utiliser les hauts et les bas de la ligne K de trois minutes comme point de rupture, de faire plus lorsque le prix franchit les hauts de la ligne K de trois minutes et de faire court lorsqu’il franchit les bas. La stratégie s’applique aux transactions sur la journée, à la clôture de la liquidation quotidienne et à la poursuite de la négociation le lendemain.

Principe de stratégie

- Obtenir les données de la ligne K des trois premières minutes après le début de la journée, en enregistrant le prix le plus élevé et le prix le plus bas de la troisième ligne K.

- Lorsque le prix atteint le sommet de la troisième ligne K, le cours de l’option est augmenté de 100 points par rapport au cours de la position d’ouverture jusqu’à la clôture ou l’équilibre du cours de la position cible.

- Lorsque le prix franchit le seuil de la troisième ligne K, le cours est ouvert, le cours cible étant déduit de 100 points du cours d’ouverture, jusqu’à la clôture ou l’atteinte du cours cible.

- Le lendemain, les traders continuent à négocier.

Avantages stratégiques

- Il est facile à comprendre et facile à mettre en œuvre.

- Il s’agit d’une méthode de négociation qui s’applique aux transactions intra-journalières, avec un taux d’utilisation élevé.

- Le risque est relativement faible et la position de stop loss est claire.

- Pour les marchés à forte tendance:

Risque stratégique

- Les plus fortes fluctuations du marché peuvent entraîner des retraits plus importants.

- Les prix sont plus volatiles pendant les heures d’ouverture et les risques sont plus élevés.

- Le point de rupture est mal défini et peut être mal interprété.

Orientation de l’optimisation de la stratégie

- L’ajout d’indicateurs tels que les moyennes mobiles peut être envisagé pour filtrer les signaux de bruit dans les marchés de choc.

- Vous pouvez envisager d’optimiser le temps d’ouverture des positions et d’éviter les périodes d’ouverture.

- On peut envisager d’optimiser les points de stop-loss pour améliorer la stabilité de la stratégie.

- Il est possible d’envisager d’intégrer la gestion de position pour contrôler le risque de retrait.

Résumer

La stratégie est basée sur la rupture des hauts et des bas de la ligne K de trois minutes et s’applique aux transactions intra-journées. L’avantage est qu’elle est simple et facile à comprendre, facile à mettre en œuvre et relativement peu risquée.

Code source de la stratégie

/*backtest

start: 2023-06-08 00:00:00

end: 2024-06-13 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Banknifty Strategy", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1)

// Parameters

start_date = input(timestamp("2024-01-01 00:00"), title="Start Date")

end_date = input(timestamp("2024-06-07 23:59"), title="End Date")

// Time settings

var startTime = timestamp("2024-06-09 09:15")

var endTime = timestamp("2024-06-09 09:24")

// Variables to store the 3rd 3-minute candle

var bool isCandleFound = false

var float thirdCandleHigh = na

var float thirdCandleLow = na

var float baseCandleHigh = na

var float baseCandleLow = na

var float entryPrice = na

var float targetPrice = na

// Check if the current time is within the specified date range

inDateRange = true

// Capture the 3rd 3-minute candle

if (inDateRange and not isCandleFound)

var int candleCount = 0

if (true)

candleCount := candleCount + 1

if (candleCount == 3)

thirdCandleHigh := high

thirdCandleLow := low

isCandleFound := true

// Wait for a candle to close above the high of the 3rd 3-minute candle

if (isCandleFound and na(baseCandleHigh) and close > thirdCandleHigh)

baseCandleHigh := close

baseCandleLow := low

// Strategy logic for buying and selling

if (not na(baseCandleHigh))

// Buy condition

if (high > baseCandleHigh and strategy.opentrades == 0)

entryPrice := high

targetPrice := entryPrice + 100

strategy.entry("Buy", strategy.long, limit=entryPrice)

// Sell condition

if (low < baseCandleLow and strategy.opentrades == 0)

entryPrice := low

targetPrice := entryPrice - 100

strategy.entry("Sell", strategy.short, limit=entryPrice)

// Exit conditions

if (strategy.opentrades > 0)

// Exit BUY trade when profit is 100 points or carry forward to next day

if (strategy.position_size > 0 and high >= targetPrice)

strategy.exit("Take Profit", from_entry="Buy", limit=targetPrice)

// Exit SELL trade when profit is 100 points or carry forward to next day

if (strategy.position_size < 0 and low <= targetPrice)

strategy.exit("Take Profit", from_entry="Sell", limit=targetPrice)

// Close trades at the end of the day

if (time == timestamp("2024-06-09 15:30"))

strategy.close("Buy", comment="Market Close")

strategy.close("Sell", comment="Market Close")

// Plotting for visualization

plotshape(series=isCandleFound, location=location.belowbar, color=color.red, style=shape.labeldown, text="3rd 3-min candle")

plot(baseCandleHigh, title="Base Candle High", color=color.green, linewidth=2, style=plot.style_line)

plot(baseCandleLow, title="Base Candle Low", color=color.red, linewidth=2, style=plot.style_line)