Aperçu

La stratégie est une stratégie de trading quantitative basée sur plusieurs indicateurs techniques et une gestion dynamique des risques. Elle combine plusieurs dimensions, telles que le suivi des tendances EMA, la volatilité ATR, les surachats et les surventeurs RSI et la reconnaissance de la forme de la ligne K, pour équilibrer le risque de rendement en s’adaptant à la réorganisation et au stop-loss dynamique.

Principe de stratégie

La stratégie consiste principalement à réaliser des transactions dans les domaines suivants:

- Le croisement de l’EMA moyen à 5 et 10 cycles est utilisé pour déterminer la direction de la tendance

- Les indices RSI permettent d’évaluer les zones de survente et d’éviter les pertes

- Utilisation de l’indicateur ATR pour ajuster dynamiquement la position de stop et la taille de la position

- Combination de formes de ligne K (swallows, pigeons, étoiles) comme signal d’entrée auxiliaire

- Le système de compensation des points de glissement dynamique basé sur l’ATR

- Filtrer les signaux faux par confirmation de volume

Avantages stratégiques

- La vérification croisée de signaux multiples améliore la fiabilité des transactions

- Gestion dynamique des risques, adaptée aux fluctuations du marché

- Une stratégie de blocage des lots et un verrouillage raisonnable de la partie des bénéfices

- Le stop-loss mobile protège les profits

- Définir un seuil de perte journalière et contrôler l’exposition au risque

- La compensation dynamique des points de glissement et le taux d’achèvement des commandes

Risque stratégique

- Plusieurs indicateurs peuvent entraîner un décalage du signal

- Les transactions fréquentes peuvent entraîner des coûts plus élevés

- Des arrêts fréquents dans des marchés en crise

- La reconnaissance de la forme K est subjective.

- L’optimisation des paramètres peut conduire à un surapprentissage

Orientation de l’optimisation de la stratégie

- Introduction de critères de cycles de fluctuation du marché et de paramètres d’ajustement dynamique

- Augmentation des filtres d’intensité de tendance pour réduire les fausses signaux

- Optimisation des algorithmes de gestion des positions et amélioration de l’efficacité de l’utilisation des fonds

- Ajout de plus d’indicateurs de sentiment du marché

- Développement d’un système d’optimisation adaptative des paramètres

Résumer

Il s’agit d’un système de stratégie mature qui intègre plusieurs indicateurs techniques pour améliorer la stabilité des transactions grâce à la gestion dynamique des risques et à la vérification de signaux multiples. Le principal avantage de la stratégie réside dans sa capacité d’adaptation et son système de contrôle des risques parfait, mais elle nécessite toujours une vérification complète et une optimisation continue sur le terrain.

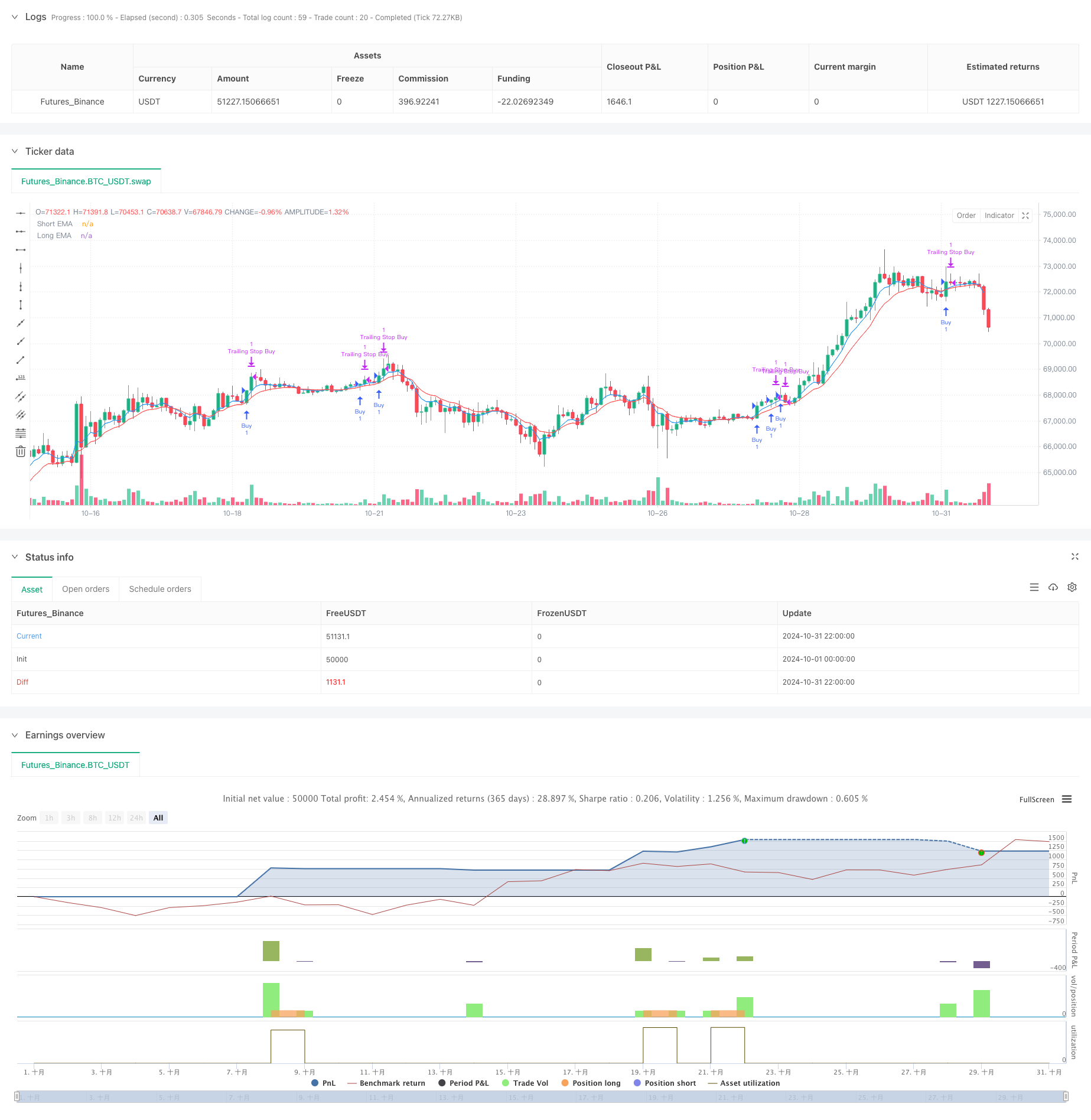

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimized Scalping with High Risk-Reward", overlay=true)

// Input for EMA periods

shortEMA_length = input(5, title="Short EMA Length")

longEMA_length = input(10, title="Long EMA Length")

// ATR for dynamic stop-loss

atrPeriod = input(14, title="ATR Period")

atrMultiplier = input(1.5, title="ATR Multiplier for Stop Loss")

// Calculate EMAs

shortEMA = ta.ema(close, shortEMA_length)

longEMA = ta.ema(close, longEMA_length)

// ATR calculation for dynamic stop loss

atr = ta.atr(atrPeriod)

// RSI for overbought/oversold conditions

rsi = ta.rsi(close, 14)

// Plot EMAs

plot(shortEMA, color=color.blue, title="Short EMA")

plot(longEMA, color=color.red, title="Long EMA")

// Dynamic Slippage based on ATR

dynamic_slippage = math.max(5, atr * 0.5)

// Candlestick pattern recognition

bullish_engulfing = close[1] < open[1] and close > open and close > open[1] and close > close[1]

hammer = close > open and (high - close) / (high - low) > 0.6 and (open - low) / (high - low) < 0.2

bearish_engulfing = open[1] > close[1] and open > close and open > open[1] and close < close[1]

shooting_star = close < open and (high - open) / (high - low) > 0.6 and (close - low) / (high - low) < 0.2

// Enhanced conditions with volume and RSI check

buy_condition = (bullish_engulfing or hammer) and close > shortEMA and shortEMA > longEMA and volume > ta.sma(volume, 20) and rsi < 70

sell_condition = (bearish_engulfing or shooting_star) and close < shortEMA and shortEMA < longEMA and volume > ta.sma(volume, 20) and rsi > 30

// Dynamic ATR multiplier based on recent volatility

volatility = atr

adaptiveMultiplier = atrMultiplier + (volatility - ta.sma(volatility, 50)) / ta.sma(volatility, 50) * 0.5

// Execute buy trades with slippage consideration

if (buy_condition)

strategy.entry("Buy", strategy.long)

stop_loss_buy = strategy.position_avg_price - atr * adaptiveMultiplier - dynamic_slippage

take_profit_buy = strategy.position_avg_price + atr * adaptiveMultiplier * 3 + dynamic_slippage

strategy.exit("Exit Buy", "Buy", stop=stop_loss_buy, limit=take_profit_buy)

// Execute sell trades with slippage consideration

if (sell_condition)

strategy.entry("Sell", strategy.short)

stop_loss_sell = strategy.position_avg_price + atr * adaptiveMultiplier + dynamic_slippage

take_profit_sell = strategy.position_avg_price - atr * adaptiveMultiplier * 3 - dynamic_slippage

strategy.exit("Exit Sell", "Sell", stop=stop_loss_sell, limit=take_profit_sell)

// Risk Management

maxLossPerTrade = input.float(0.01, title="Max Loss Per Trade (%)", minval=0.01, maxval=1, step=0.01) // 1% max loss per trade

dailyLossLimit = input.float(0.03, title="Daily Loss Limit (%)", minval=0.01, maxval=1, step=0.01) // 3% daily loss limit

maxLossAmount_buy = strategy.position_avg_price * maxLossPerTrade

maxLossAmount_sell = strategy.position_avg_price * maxLossPerTrade

if (strategy.position_size > 0)

strategy.exit("Max Loss Buy", "Buy", stop=strategy.position_avg_price - maxLossAmount_buy - dynamic_slippage)

if (strategy.position_size < 0)

strategy.exit("Max Loss Sell", "Sell", stop=strategy.position_avg_price + maxLossAmount_sell + dynamic_slippage)

// Daily loss limit logic

var float dailyLoss = 0.0

if (dayofweek != dayofweek[1])

dailyLoss := 0.0 // Reset daily loss tracker at the start of a new day

if (strategy.closedtrades > 0)

dailyLoss := dailyLoss + strategy.closedtrades.profit(strategy.closedtrades - 1)

if (dailyLoss < -strategy.initial_capital * dailyLossLimit)

strategy.close_all("Daily Loss Limit Hit")

// Breakeven stop after a certain profit with a delay

if (strategy.position_size > 0 and close > strategy.position_avg_price + atr * 1.5 and bar_index > strategy.opentrades.entry_bar_index(0) + 5)

strategy.exit("Breakeven Buy", from_entry="Buy", stop=strategy.position_avg_price)

if (strategy.position_size < 0 and close < strategy.position_avg_price - atr * 1.5 and bar_index > strategy.opentrades.entry_bar_index(0) + 5)

strategy.exit("Breakeven Sell", from_entry="Sell", stop=strategy.position_avg_price)

// Partial Profit Taking

if (strategy.position_size > 0 and close > strategy.position_avg_price + atr * 1.5)

strategy.close("Partial Close Buy", qty_percent=50) // Use strategy.close for partial closure at market price

if (strategy.position_size < 0 and close < strategy.position_avg_price - atr * 1.5)

strategy.close("Partial Close Sell", qty_percent=50) // Use strategy.close for partial closure at market price

// Trailing Stop with ATR type

if (strategy.position_size > 0)

strategy.exit("Trailing Stop Buy", from_entry="Buy", trail_offset=atr * 1.5, trail_price=strategy.position_avg_price)

if (strategy.position_size < 0)

strategy.exit("Trailing Stop Sell", from_entry="Sell", trail_offset=atr * 1.5, trail_price=strategy.position_avg_price)