Aperçu

La stratégie est un système de négociation bidirectionnel basé sur une ligne K de 30 minutes pour rechercher des opportunités de négociation en surveillant l’amplitude des fluctuations des prix. Le cœur de la stratégie est d’identifier les fluctuations importantes en définissant des seuils ponctuels et de négocier dans la direction correspondante après la confirmation de la rupture.

Principe de stratégie

La stratégie utilise un mécanisme de filtrage multiple pour identifier les signaux de négociation efficaces. Tout d’abord, la stratégie calcule l’amplitude de fluctuation de l’entité à la clôture de la ligne K toutes les 30 minutes. Lorsque l’amplitude de la fluctuation dépasse la limite prédéfinie, elle est marquée comme une opportunité de négociation potentielle.

Avantages stratégiques

- Une gestion du temps efficace: limiter les fenêtres de temps de négociation et éviter les faux signaux lors des périodes d’inactivité

- Les mécanismes de négociation bidirectionnelle: saisir les opportunités bidirectionnelles du marché et améliorer l’efficacité de l’utilisation des fonds

- Contrôle des risques: utilisation d’un stop loss à point fixe pour faciliter l’évaluation et la gestion des risques

- Automatisation élevée: automatisation du processus de reconnaissance des signaux à l’exécution des transactions, avec une intervention humaine réduite

- Réglages flexibles: les paramètres clés peuvent être ajustés pour s’adapter à différents environnements de marché

Risque stratégique

- Risque de fausse rupture: une fausse rupture peut survenir après une forte fluctuation, entraînant une rupture de la position

- Sensitivité des paramètres: un mauvais réglage des seuils peut entraîner des opportunités manquées ou des transactions excessives

- Dépendance aux conditions du marché: risque de déclenchement fréquent d’un stop loss dans un marché en crise

- Effets des points de glissement: pendant les périodes de forte volatilité, le prix de transaction réel peut être plus éloigné du prix du signal

- Risques de gestion des fonds: l’absence de mécanisme de gestion des positions peut entraîner une ouverture excessive des risques

Orientation de l’optimisation de la stratégie

- Augmentation du filtrage des tendances: amélioration de la qualité du signal en combinant des indicateurs de tendances à plus longues périodes

- Optimisation des paramètres dynamiques: ajustement automatique des paramètres de dépréciation et d’arrêt en fonction de la volatilité du marché

- Introduction de la confirmation de débit: augmentation des conditions de filtrage du débit et amélioration de la fiabilité de la percée

- Optimiser le stop loss: réaliser un stop loss dynamique et s’adapter à différents environnements de marché

- Ajouter une gestion de position: ajuster dynamiquement la position en fonction de l’intensité du signal et de la volatilité du marché

Résumer

Il s’agit d’une stratégie de trading automatisée entièrement conçue et logiquement claire. Grâce à un filtrage conditionnel et à un contrôle des risques rigoureux, la stratégie a une bonne praticité. Cependant, il est nécessaire de tester et d’optimiser suffisamment sur le terrain, en particulier en ce qui concerne le paramétrage et le contrôle des risques.

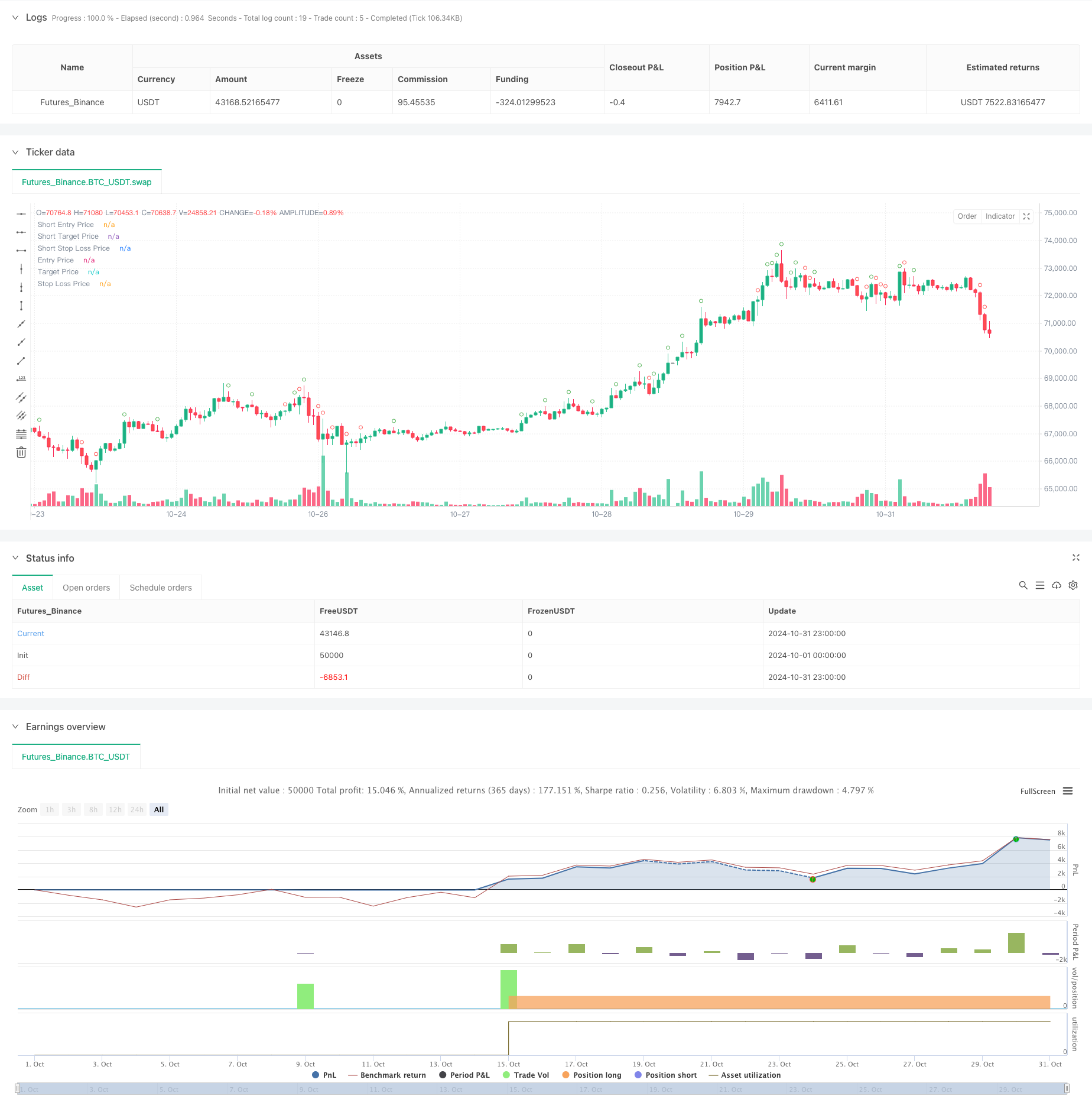

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Big Candle Breakout Strategy Both Side", overlay=true)

// Input for the point move threshold

point_move_in = input.int(100, title="Point Move Threshold")

point_target = input.int(100, title="Point Target")

point_stoploss = input.int(100, title="Point Stop Loss")

point_buffer = input.int(5, title="Point Buffer")

point_move = point_buffer + point_move_in

// Define the start and end times for trading

start_hour = 9

start_minute = 15

end_hour = 14

end_minute = 30

// Function to check if the current time is within the allowed trading window

in_time_range = (hour(time('30')) > start_hour or (hour(time('30')) == start_hour and minute(time('30')) >= start_minute)) and (hour(time('30')) < end_hour or (hour(time('30')) == end_hour and minute(time('30')) <= end_minute))

// Retrieve the open, high, low, and close prices of 30-minute candles

open_30m = request.security(syminfo.tickerid, "30", open)

high_30m = request.security(syminfo.tickerid, "30", high)

low_30m = request.security(syminfo.tickerid, "30", low)

close_30m = request.security(syminfo.tickerid, "30", close)

// Calculate the range of the candle

candle_range_long = (close_30m - open_30m)

candle_range_short = (open_30m - close_30m)

// Determine if the candle meets the criteria to be marked

big_candle_long = candle_range_long >= point_move_in

big_candle_short = candle_range_short >= point_move_in

// Variables to store the state of the trade

var float long_entry_price = na

var float long_target_price = na

var float long_stop_loss_price = na

var float short_entry_price = na

var float short_target_price = na

var float short_stop_loss_price = na

// Check if there are no active trades

no_active_trades = (strategy.opentrades == 0)

// Long entry condition

if (big_candle_long and na(long_entry_price) and in_time_range and no_active_trades)

long_entry_price := high_30m+point_buffer

long_target_price := long_entry_price + point_target

long_stop_loss_price := long_entry_price - point_stoploss

strategy.entry("Buy", strategy.long, stop=long_entry_price, limit=long_target_price)

plot(long_entry_price, style=plot.style_linebr, color=color.blue, linewidth=2, title="Entry Price")

plot(long_target_price, style=plot.style_linebr, color=color.green, linewidth=2, title="Target Price")

plot(long_stop_loss_price, style=plot.style_linebr, color=color.red, linewidth=2, title="Stop Loss Price")

// Short entry condition

if (big_candle_short and na(short_entry_price) and in_time_range and no_active_trades)

short_entry_price := low_30m - point_buffer

short_target_price := short_entry_price - point_target

short_stop_loss_price := short_entry_price + point_stoploss

strategy.entry("Sell", strategy.short, stop=short_entry_price, limit=short_target_price)

plot(short_entry_price, style=plot.style_linebr, color=color.blue, linewidth=2, title="Short Entry Price")

plot(short_target_price, style=plot.style_linebr, color=color.green, linewidth=2, title="Short Target Price")

plot(short_stop_loss_price, style=plot.style_linebr, color=color.red, linewidth=2, title="Short Stop Loss Price")

// Long exit conditions

if (not na(long_entry_price))

strategy.exit("Long Exit", from_entry="Buy", limit=long_target_price, stop=long_stop_loss_price)

// Short exit conditions

if (not na(short_entry_price))

strategy.exit("Short Exit", from_entry="Sell", limit=short_target_price, stop=short_stop_loss_price)

// Reset trade status

if (strategy.position_size == 0)

long_entry_price := na

long_target_price := na

long_stop_loss_price := na

short_entry_price := na

short_target_price := na

short_stop_loss_price := na

// Plot the big candle and entry/exit levels

plotshape(series=big_candle_long, location=location.abovebar, style=shape.circle, color=color.green)

plotshape(series=big_candle_short, location=location.abovebar, style=shape.circle, color=color.red)

//plot(long_entry_price, style=plot.style_stepline, color=color.blue, linewidth=2, title="Entry Price")

//plot(long_target_price, style=plot.style_stepline, color=color.green, linewidth=2, title="Target Price")

//plot(long_stop_loss_price, style=plot.style_stepline, color=color.red, linewidth=2, title="Stop Loss Price")