Aperçu

La stratégie est un système de négociation à plusieurs niveaux basé sur la dynamique et le suivi des tendances. Il identifie les opportunités de trading à forte probabilité en combinant l’indicateur Williams Shark, l’indicateur Williams Split, l’indicateur Magic Shock (AO) et l’indicateur EMA (EMA). La stratégie utilise un mécanisme d’investissement en capital, en augmentant progressivement la position à mesure que la tendance s’intensifie.

Principe de stratégie

La stratégie utilise plusieurs mécanismes de filtrage pour assurer l’exactitude de la direction de la transaction. D’abord, les jugements de tendance à long terme sont effectués par l’EMA et ne recherchent des opportunités de trading que lorsque le prix est au-dessus de l’EMA. Ensuite, les jugements de tendance à court terme sont effectués par la combinaison de l’indicateur Williams Shark et de l’indicateur de fractionnement.

Avantages stratégiques

- Le mécanisme de filtrage multicouche réduit efficacement les fausses interférences

- La science de la gestion des fonds, avec une approche progressive de l’hypothèque

- Les caractéristiques de suivi de tendance lui permettent de capturer les grandes tendances

- Il n’y a pas de stop-loss fixe, mais la dynamique des indicateurs techniques est utilisée pour juger de la fin de la tendance

- Le système est bien configurable, permettant d’ajuster les paramètres en fonction des différentes conditions du marché

- Les résultats de l’enquête ont montré de bons facteurs de rentabilité et des rendements moyens.

Risque stratégique

- Une série de faux signaux peut être générée dans un marché en crise

- Un retracement plus important peut se produire lorsque la tendance s’inverse

- Les conditions de filtrage multiples peuvent entraîner des opportunités de transactions manquées

- En matière de gestion de fonds, une accumulation continue d’hypothèques peut présenter des risques en cas de forte volatilité.

- Le choix des paramètres EMA a une influence sur la performance de la stratégie

Pour réduire ces risques, il est recommandé de:

- Optimisation des paramètres dans différents environnements de marché

- Pensez à ajouter un filtre de fluctuation

- La mise en place de conditions plus strictes

- Limite de retrait maximale

Orientation de l’optimisation de la stratégie

- Introduction du filtrage des taux de fluctuation dans les indices ATR

- Ajoutez une analyse du volume des transactions pour améliorer la fiabilité du signal

- Développement d’un mécanisme d’adaptation des paramètres dynamiques

- Améliorer les mécanismes de freinage pour tirer profit en temps opportun de la baisse de la tendance

- Ajout d’un module de reconnaissance de l’état du marché, utilisant différents paramètres dans différents environnements de marché

Résumer

Il s’agit d’une stratégie de suivi des tendances bien conçue, qui, grâce à l’utilisation combinée de multiples indicateurs techniques, permet de réaliser de bonnes performances de revenus tout en garantissant la sécurité. L’innovation de la stratégie réside dans un mécanisme de confirmation des tendances à plusieurs niveaux et une méthode de gestion progressive des fonds.

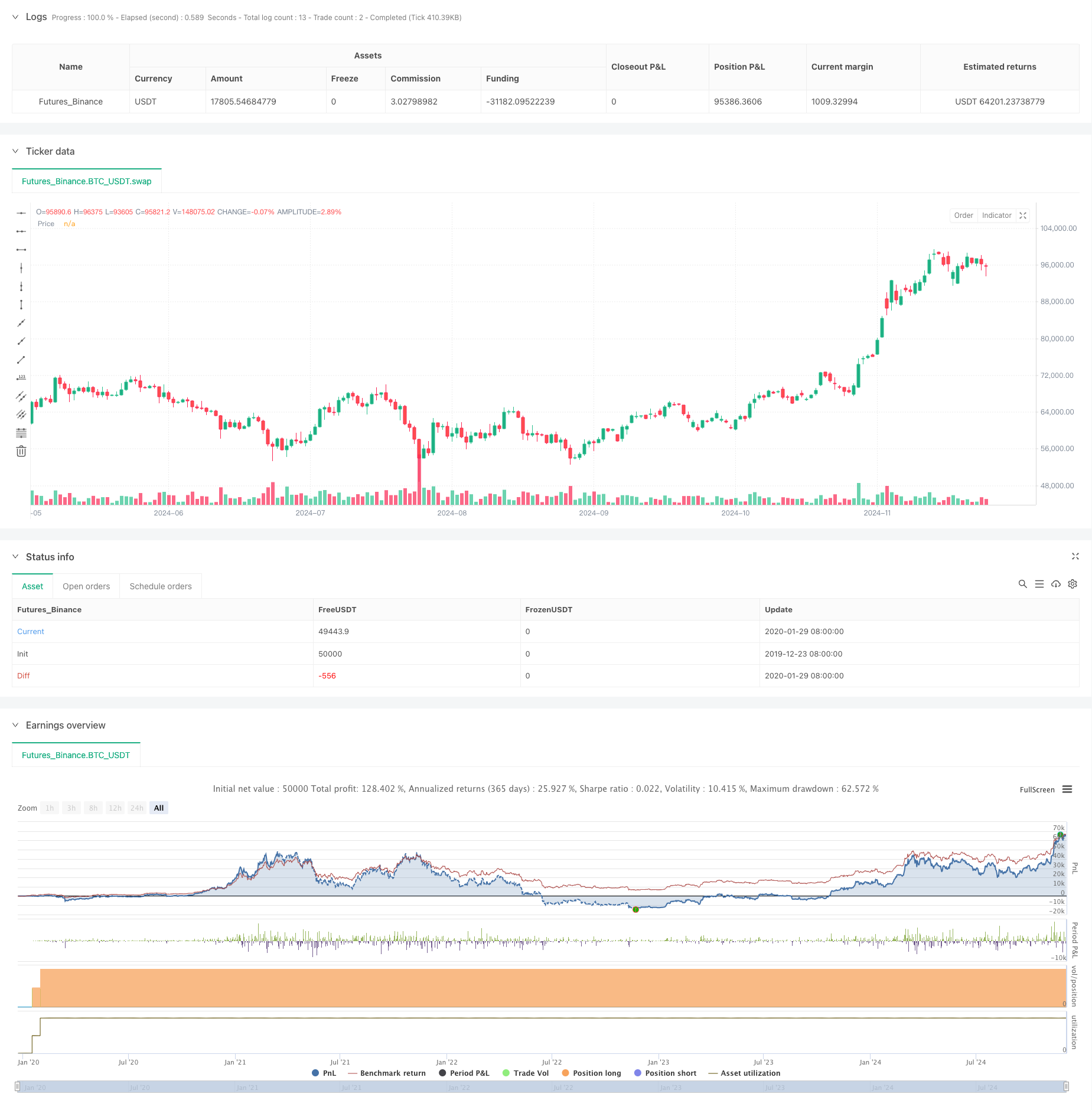

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-04 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Skyrexio

//@version=6

//_______ <licence>

strategy(title = "MultiLayer Awesome Oscillator Saucer Strategy [Skyrexio]",

shorttitle = "AO Saucer",

overlay = true,

format = format.inherit,

pyramiding = 5,

calc_on_order_fills = false,

calc_on_every_tick = false,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 10,

initial_capital = 10000,

currency = currency.NONE,

commission_type = strategy.commission.percent,

commission_value = 0.1,

slippage = 5,

use_bar_magnifier = true)

//_______ <constant_declarations>

var const color skyrexGreen = color.new(#2ECD99, 0)

var const color skyrexGray = color.new(#F2F2F2, 0)

var const color skyrexWhite = color.new(#FFFFFF, 0)

//________<variables declarations>

var int trend = 0

var float upFractalLevel = na

var float upFractalActivationLevel = na

var float downFractalLevel = na

var float downFractalActivationLevel = na

var float saucerActivationLevel = na

bool highCrossesUpfractalLevel = ta.crossover(high, upFractalActivationLevel)

bool lowCrossesDownFractalLevel = ta.crossunder(low, downFractalActivationLevel)

var int signalsQtyInRow = 0

//_______ <inputs>

// Trading bot settings

sourceUuid = input.string(title = "sourceUuid:", defval = "yourBotSourceUuid", group = "🤖Trading Bot Settings🤖")

secretToken = input.string(title = "secretToken:", defval = "yourBotSecretToken", group = "🤖Trading Bot Settings🤖")

// Trading period settings

lookBackPeriodStart = input(title = "Trade Start Date/Time", defval = timestamp('2023-01-01T00:00:00'), group = "🕐Trading Period Settings🕐")

lookBackPeriodStop = input(title = "Trade Stop Date/Time", defval = timestamp('2025-01-01T00:00:00'), group = "🕐Trading Period Settings🕐")

// Strategy settings

EMaLength = input.int(100, minval = 10, step = 10, title = "EMA Length", group = "📈Strategy settings📈")

//_______ <function_declarations>

//@function Used to calculate Simple moving average for Alligator

//@param src Sourse for smma Calculations

//@param length Number of bars to calculate smma

//@returns The calculated smma value

smma(src, length) =>

var float smma = na

sma_value = ta.sma(src, length)

smma := na(smma) ? sma_value : (smma * (length - 1) + src) / length

smma

//_______ <calculations>

//Upfractal calculation

upFractalPrice = ta.pivothigh(2, 2)

upFractal = not na(upFractalPrice)

//Downfractal calculation

downFractalPrice = ta.pivotlow(2, 2)

downFractal = not na(downFractalPrice)

//Calculating Alligator's teeth

teeth = smma(hl2, 8)[5]

//Calculating upfractal and downfractal levels

if upFractal

upFractalLevel := upFractalPrice

else

upFractalLevel := upFractalLevel[1]

if downFractal

downFractalLevel := downFractalPrice

else

downFractalLevel := downFractalLevel[1]

//Calculating upfractal activation level, downfractal activation level to approximate the trend and this current trend

if upFractalLevel > teeth

upFractalActivationLevel := upFractalLevel

if highCrossesUpfractalLevel

trend := 1

upFractalActivationLevel := na

downFractalActivationLevel := downFractalLevel

if downFractalLevel < teeth

downFractalActivationLevel := downFractalLevel

if lowCrossesDownFractalLevel

trend := -1

downFractalActivationLevel := na

upFractalActivationLevel := upFractalLevel

if trend == 1

upFractalActivationLevel := na

if trend == -1

downFractalActivationLevel := na

//Calculating filter EMA

filterEMA = ta.ema(close, EMaLength)

//Сalculating AO saucer signal

ao = ta.sma(hl2,5) - ta.sma(hl2,34)

diff = ao - ao[1]

saucerSignal = ao > ao[1] and ao[1] < ao[2] and ao > 0 and ao[1] > 0 and ao[2] > 0 and trend == 1 and close > filterEMA

//Calculating sauser activation level

if saucerSignal

saucerActivationLevel := high

else

saucerActivationLevel := saucerActivationLevel[1]

if not na(saucerActivationLevel[1]) and high < saucerActivationLevel[1] and diff > 0

saucerActivationLevel := high

saucerSignal := true

if (high > saucerActivationLevel[1] and not na(saucerActivationLevel)) or diff < 0

saucerActivationLevel := na

//Calculating number of valid saucer signal in current trading cycle

if saucerSignal and not saucerSignal[1]

signalsQtyInRow := signalsQtyInRow + 1

if not na(saucerActivationLevel[1]) and diff < 0 and na(saucerActivationLevel) and not (strategy.opentrades[1] <= strategy.opentrades - 1)

signalsQtyInRow := signalsQtyInRow - 1

if trend == -1 and trend[1] == 1

signalsQtyInRow := 0

//_______ <strategy_calls>

//Defining trade close condition

closeCondition = trend[1] == 1 and trend == -1

//Cancel stop buy order if current Awesome oscillator column lower, than prevoius

if diff < 0

strategy.cancel_all()

//Strategy entry

if (signalsQtyInRow == 1 and not na(saucerActivationLevel))

strategy.entry(id = "entry1", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry1",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 2 and not na(saucerActivationLevel))

strategy.entry(id = "entry2", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry2",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 3 and not na(saucerActivationLevel))

strategy.entry(id = "entry3", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry3",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 4 and not na(saucerActivationLevel))

strategy.entry(id = "entry4", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry4",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 5 and not na(saucerActivationLevel))

strategy.entry(id = "entry5", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry5",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

//Strategy exit

if (closeCondition)

strategy.close_all(alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "close",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

//_______ <visuals>

//Plotting shapes for adding to current long trades

gradPercent = if strategy.opentrades == 2

90

else if strategy.opentrades == 3

80

else if strategy.opentrades == 4

70

else if strategy.opentrades == 5

60

pricePlot = plot(close, title="Price", color=color.new(color.blue, 100))

teethPlot = plot(strategy.opentrades > 1 ? teeth : na, title="Teeth", color= skyrexGreen, style=plot.style_linebr, linewidth = 2)

fill(pricePlot, teethPlot, color = color.new(skyrexGreen, gradPercent))

if strategy.opentrades != 1 and strategy.opentrades[1] == strategy.opentrades - 1

label.new(bar_index, teeth, style = label.style_label_up, color = color.lime, size = size.tiny, text="Buy More", textcolor = color.black, text_formatting = text.format_bold)

//_______ <alerts>