Aperçu

La stratégie est un système de trading avancé basé sur l’analyse des pivots, qui permet de prédire un potentiel renversement de tendance en identifiant les points de basculement clés du marché. La stratégie utilise une approche innovante “pivot de l’axe pivot”, combinée à l’indicateur de volatilité ATR pour la gestion des positions, formant un système de trading complet. La stratégie est applicable à plusieurs marchés et peut être optimisée en fonction des paramètres des caractéristiques des différents marchés.

Principe de stratégie

Le cœur de la stratégie est d’identifier les opportunités de retournement du marché par une analyse des pivots à deux niveaux. Les pivots de premier niveau sont les hauts et les bas fondamentaux, tandis que les pivots de deuxième niveau sont les points de retournement marquants sélectionnés parmi les pivots de premier niveau.

Avantages stratégiques

- Adaptabilité: la stratégie peut s’adapter à différents environnements de marché en ajustant les paramètres pour s’adapter à différents niveaux de volatilité.

- Gestion des risques: l’ATR est utilisé pour les paramètres d’arrêt de perte dynamiques, permettant d’ajuster automatiquement les mesures de protection en fonction de la volatilité du marché.

- Confirmation à plusieurs niveaux: réduction du risque de fausses percées grâce à une analyse à deux niveaux.

- Gestion flexible des positions: la taille des positions est ajustée en fonction de la taille du compte et de la dynamique de la volatilité du marché.

- Des règles d’entrée claires: un mécanisme de reconnaissance des signaux clairement défini pour réduire les jugements subjectifs.

Risque stratégique

- Risque de glissement: un risque de glissement plus important dans un marché à forte volatilité.

- Le risque d’une fausse percée: le marché risque de donner de faux signaux en cas de choc.

- Risque de sur-effet de levier: une mauvaise utilisation du levier peut entraîner des pertes importantes.

- Risque d’optimisation des paramètres: une optimisation excessive peut entraîner une suradaptation.

Orientation de l’optimisation de la stratégie

- Filtrage des signaux: un filtre de tendance peut être ajouté, permettant de négocier uniquement dans la direction de la tendance principale.

- Paramètres dynamiques: Ajustez automatiquement les paramètres de pivot en fonction de l’état du marché.

- Plusieurs périodes: ajouter plusieurs périodes de confirmation pour améliorer la précision.

- L’arrêt intelligent: développer des stratégies d’arrêt plus intelligentes, comme le suivi des arrêts.

- Contrôle des risques: ajouter plus de mesures de contrôle des risques, telles que l’analyse de la corrélation.

Résumer

Il s’agit d’une stratégie de trading de retour de tendance parfaitement conçue, qui construit un système de trading robuste grâce à l’analyse des pivots à deux niveaux et à la gestion de la volatilité ATR. L’avantage de la stratégie réside dans sa grande adaptabilité et sa gestion des risques, mais elle nécessite toujours que les traders utilisent prudemment le levier et optimisent continuellement les paramètres.

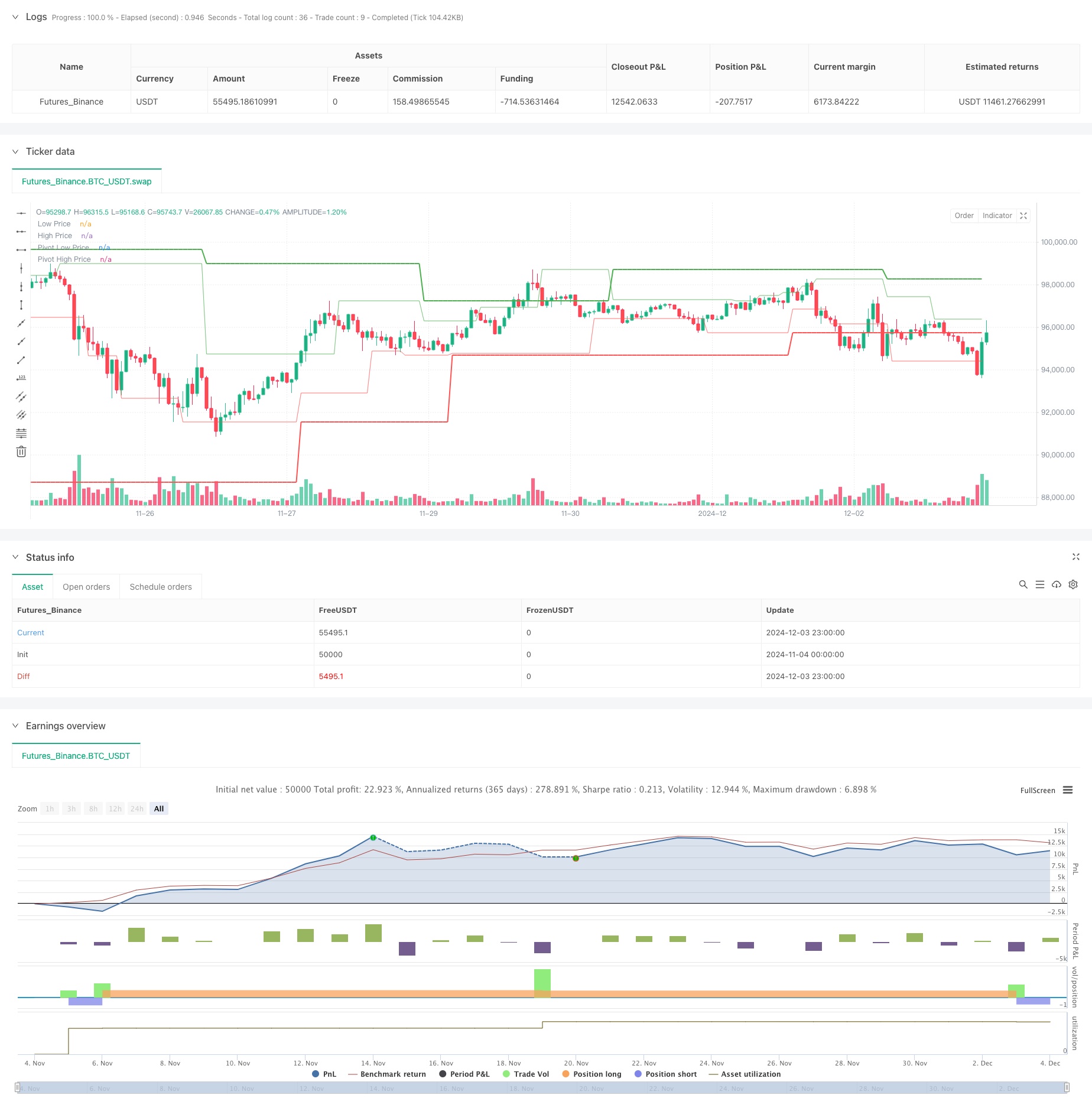

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Pivot of Pivot Reversal Strategy [MAD]", shorttitle="PoP Reversal Strategy", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3)

// Inputs with Tooltips

leftBars = input.int(4, minval=1, title='PP Left Bars', tooltip='Number of bars to the left of the pivot point. Increasing this value makes the pivot more significant.')

rightBars = input.int(2, minval=1, title='PP Right Bars', tooltip='Number of bars to the right of the pivot point. Increasing this value delays the pivot detection but may reduce false signals.')

atr_length = input.int(14, minval=1, title='ATR Length', tooltip='Length for ATR calculation. ATR is used to assess market volatility.')

atr_mult = input.float(0.1, minval=0.0, step=0.1, title='ATR Multiplier', tooltip='Multiplier applied to ATR for pivot significance. Higher values require greater price movement for pivots.')

allowLongs = input.bool(true, title='Allow Long Positions', tooltip='Enable or disable long positions.')

allowShorts = input.bool(true, title='Allow Short Positions', tooltip='Enable or disable short positions.')

margin_amount = input.float(1.0, minval=1.0, maxval=100.0, step=1.0, title='Margin Amount (Leverage)', tooltip='Set the leverage multiplier (e.g., 3x, 5x, 10x). Note: Adjust leverage in strategy properties for accurate results.')

risk_reward_enabled = input.bool(false, title='Enable Risk/Reward Ratio', tooltip='Enable or disable the use of a fixed risk/reward ratio for trades.')

risk_reward_ratio = input.float(1.0, minval=0.1, step=0.1, title='Risk/Reward Ratio', tooltip='Set the desired risk/reward ratio (e.g., 1.0 for 1:1).')

risk_percent = input.float(1.0, minval=0.1, step=0.1, title='Risk Percentage per Trade (%)', tooltip='Percentage of entry price to risk per trade.')

trail_stop_enabled = input.bool(false, title='Enable Trailing Stop Loss', tooltip='Enable or disable the trailing stop loss.')

trail_percent = input.float(0.5, minval=0.0, step=0.1, title='Trailing Stop Loss (%)', tooltip='Percentage for trailing stop loss.')

start_year = input.int(2018, title='Start Year', tooltip='Backtest start year.')

start_month = input.int(1, title='Start Month', tooltip='Backtest start month.')

start_day = input.int(1, title='Start Day', tooltip='Backtest start day.')

end_year = input.int(2100, title='End Year', tooltip='Backtest end year.')

end_month = input.int(1, title='End Month', tooltip='Backtest end month.')

end_day = input.int(1, title='End Day', tooltip='Backtest end day.')

date_start = timestamp(start_year, start_month, start_day, 00, 00)

date_end = timestamp(end_year, end_month, end_day, 00, 00)

time_cond = time >= date_start and time <= date_end

// Pivot High Significant Function

pivotHighSig(left, right) =>

pp_ok = true

atr = ta.atr(atr_length)

for i = 1 to left

if high[right] < high[right + i] + atr * atr_mult

pp_ok := false

for i = 0 to right - 1

if high[right] < high[i] + atr * atr_mult

pp_ok := false

pp_ok ? high[right] : na

// Pivot Low Significant Function

pivotLowSig(left, right) =>

pp_ok = true

atr = ta.atr(atr_length)

for i = 1 to left

if low[right] > low[right + i] - atr * atr_mult

pp_ok := false

for i = 0 to right - 1

if low[right] > low[i] - atr * atr_mult

pp_ok := false

pp_ok ? low[right] : na

swh = pivotHighSig(leftBars, rightBars)

swl = pivotLowSig(leftBars, rightBars)

swh_cond = not na(swh)

var float hprice = 0.0

hprice := swh_cond ? swh : nz(hprice[1])

le = false

le := swh_cond ? true : (le[1] and high > hprice ? false : le[1])

swl_cond = not na(swl)

var float lprice = 0.0

lprice := swl_cond ? swl : nz(lprice[1])

se = false

se := swl_cond ? true : (se[1] and low < lprice ? false : se[1])

// Pivots of pivots

var float ph1 = 0.0

var float ph2 = 0.0

var float ph3 = 0.0

var float pl1 = 0.0

var float pl2 = 0.0

var float pl3 = 0.0

var float pphprice = 0.0

var float pplprice = 0.0

ph3 := swh_cond ? nz(ph2[1]) : nz(ph3[1])

ph2 := swh_cond ? nz(ph1[1]) : nz(ph2[1])

ph1 := swh_cond ? hprice : nz(ph1[1])

pl3 := swl_cond ? nz(pl2[1]) : nz(pl3[1])

pl2 := swl_cond ? nz(pl1[1]) : nz(pl2[1])

pl1 := swl_cond ? lprice : nz(pl1[1])

pphprice := swh_cond and ph2 > ph1 and ph2 > ph3 ? ph2 : nz(pphprice[1])

pplprice := swl_cond and pl2 < pl1 and pl2 < pl3 ? pl2 : nz(pplprice[1])

// Entry and Exit Logic

if time_cond

// Calculate order quantity based on margin amount

float order_qty = na

if margin_amount > 0

order_qty := (strategy.equity * margin_amount) / close

// Long Position

if allowLongs and le and not na(pphprice) and pphprice != 0

float entry_price_long = pphprice + syminfo.mintick

strategy.entry("PivRevLE", strategy.long, qty=order_qty, comment="PivRevLE", stop=entry_price_long)

if risk_reward_enabled or (trail_stop_enabled and trail_percent > 0.0)

float stop_loss_price = na

float take_profit_price = na

float trail_offset_long = na

float trail_points_long = na

if risk_reward_enabled

float risk_amount = entry_price_long * (risk_percent / 100)

stop_loss_price := entry_price_long - risk_amount

float profit_target = risk_amount * risk_reward_ratio

take_profit_price := entry_price_long + profit_target

if trail_stop_enabled and trail_percent > 0.0

trail_offset_long := (trail_percent / 100.0) * entry_price_long

trail_points_long := trail_offset_long / syminfo.pointvalue

strategy.exit("PivRevLE Exit", from_entry="PivRevLE",

stop=stop_loss_price, limit=take_profit_price,

trail_points=trail_points_long, trail_offset=trail_points_long)

// Short Position

if allowShorts and se and not na(pplprice) and pplprice != 0

float entry_price_short = pplprice - syminfo.mintick

strategy.entry("PivRevSE", strategy.short, qty=order_qty, comment="PivRevSE", stop=entry_price_short)

if risk_reward_enabled or (trail_stop_enabled and trail_percent > 0.0)

float stop_loss_price = na

float take_profit_price = na

float trail_offset_short = na

float trail_points_short = na

if risk_reward_enabled

float risk_amount = entry_price_short * (risk_percent / 100)

stop_loss_price := entry_price_short + risk_amount

float profit_target = risk_amount * risk_reward_ratio

take_profit_price := entry_price_short - profit_target

if trail_stop_enabled and trail_percent > 0.0

trail_offset_short := (trail_percent / 100.0) * entry_price_short

trail_points_short := trail_offset_short / syminfo.pointvalue

strategy.exit("PivRevSE Exit", from_entry="PivRevSE",

stop=stop_loss_price, limit=take_profit_price,

trail_points=trail_points_short, trail_offset=trail_points_short)

// Plotting

plot(lprice, color=color.new(color.red, 55), title='Low Price')

plot(hprice, color=color.new(color.green, 55), title='High Price')

plot(pplprice, color=color.new(color.red, 0), linewidth=2, title='Pivot Low Price')

plot(pphprice, color=color.new(color.green, 0), linewidth=2, title='Pivot High Price')