Aperçu

Il s’agit d’une stratégie de trading à plusieurs niveaux qui intègre le calcul de l’amplitude réelle moyenne (ATR) auto-adaptative et la détection de tendances basée sur la dynamique. La stratégie est la plus notable pour son mécanisme de profit unique en 7 étapes, qui combine 4 niveaux d’exit basés sur l’ATR et 3 niveaux de pourcentage fixes.

Principe de stratégie

Au cœur de la stratégie se trouvent les éléments clés suivants:

- Augmentation de la marge réelle: mesure de la volatilité du marché en tenant compte des mouvements de prix les plus importants.

- Intégration des facteurs de dynamique: Ajuster l’ATR en fonction des variations récentes des prix pour le rendre plus adaptable.

- Calcul de l’ATR adaptatif: Adaptation de l’ATR traditionnel en fonction du facteur de dynamique pour le rendre plus sensible pendant les fluctuations.

- La quantification de la force de la tendance: évaluer la force de la tendance à l’aide d’algorithmes complexes

- Mécanisme de bénéfices en sept étapes: comprend quatre niveaux d’exit basés sur l’ATR et trois niveaux de pourcentage fixes.

Avantages stratégiques

- Adaptabilité: Adaptation aux différentes conditions du marché grâce au calcul dynamique de l’ATR.

- La gestion des risques est améliorée: un mécanisme de rémunération à plusieurs niveaux fournit un contrôle systématique des risques.

- Haute flexibilité: peut fonctionner avec une efficacité égale dans les marchés aériens.

- Paramètres réglables: offre plusieurs paramètres réglables pour s’adapter à différents styles de négociation.

- Une mise en œuvre systématique: des règles claires d’entrée et de sortie réduisent les transactions émotionnelles.

Risque stratégique

- Sensitivité des paramètres: une mauvaise configuration des paramètres peut entraîner des transactions excessives ou des opportunités manquées.

- Dépendance sur les conditions du marché: peut être faible dans des marchés très volatils ou horizontaux.

- Risque de complexité: les mécanismes de profit à plusieurs niveaux peuvent rendre la mise en œuvre plus difficile.

- Effets des points de glissement: plusieurs bénéficiaires peuvent être affectés de manière significative par les points de glissement.

- Exigences de gestion des fonds: suffisamment de fonds sont nécessaires pour exécuter une stratégie de profit à plusieurs niveaux.

Orientation de l’optimisation de la stratégie

- Ajustement dynamique des paramètres: Ajustement automatique des paramètres en fonction des conditions du marché.

- Le filtrage des environnements de marché: ajout d’un mécanisme d’identification des environnements de marché.

- Amélioration de la gestion des risques: mise en place d’un mécanisme dynamique d’arrêt des pertes.

- Optimisation de l’exécution: simplifier les mécanismes de profit pour réduire l’impact des points de glissement.

- Le cadre de rétroaction a été amélioré: plus de facteurs de transaction réels ont été ajoutés.

Résumer

Cette stratégie offre aux traders un système de trading complet en combinant l’ATR auto-adaptatif et un mécanisme de profit à plusieurs niveaux. Son avantage réside dans sa capacité à s’adapter aux différentes conditions du marché tout en gérant les risques par une approche systématique. Bien qu’il existe des risques potentiels, la stratégie peut devenir un outil de trading efficace avec une optimisation et une gestion appropriée des risques.

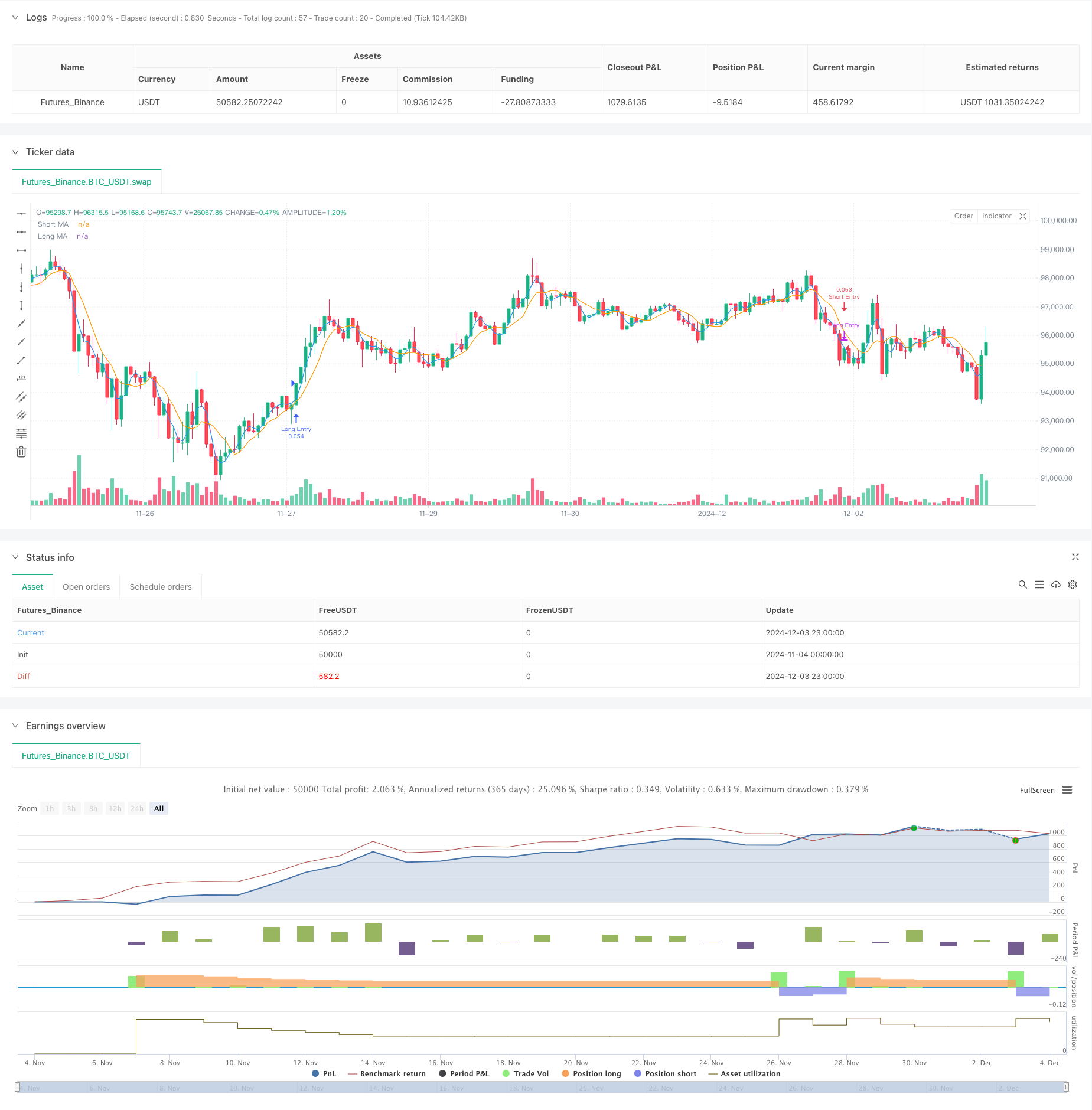

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// The SuperATR 7-Step Profit Strategy is a multi-layered trading strategy that combines adaptive ATR and momentum-based trend detection

// with a sophisticated 7-step take-profit mechanism. This approach utilizes four ATR-based exit levels and three fixed percentage levels,

// enabling flexible and dynamic profit-taking in both long and short market positions.

//@version=5

strategy("SuperATR 7-Step Profit - Strategy [presentTrading] ", overlay=true, precision=3, commission_value= 0.1, commission_type=strategy.commission.percent, slippage= 1, currency=currency.USD, default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital=10000)

// ————————

// User Inputs

// ————————

short_period = input.int(3, minval=1, title="Short Period")

long_period = input.int(7, minval=1, title="Long Period")

momentum_period = input.int(7, minval=1, title="Momentum Period")

atr_sma_period = input.int(7, minval=1, title="ATR SMA Period for Confirmation")

trend_strength_threshold = input.float(1.618, minval=0.0, title="Trend Strength Threshold", step=0.1)

// ————————

// Take Profit Inputs

// ————————

useMultiStepTP = input.bool(true, title="Enable Multi-Step Take Profit")

// ATR-based Take Profit Inputs

atrLengthTP = input.int(14, minval=1, title="ATR Length for Take Profit")

atrMultiplierTP1 = input.float(2.618, minval=0.1, title="ATR Multiplier for TP Level 1")

atrMultiplierTP2 = input.float(5.0, minval=0.1, title="ATR Multiplier for TP Level 2")

atrMultiplierTP3 = input.float(10.0, minval=0.1, title="ATR Multiplier for TP Level 3")

atrMultiplierTP4 = input.float(13.82, minval=0.1, title="ATR Multiplier for TP Level 4")

// Fixed Percentage Take Profit Inputs

tp_level_percent1 = input.float(3.0, minval=0.1, title="Fixed TP Level 1 (%)")

tp_level_percent2 = input.float(8.0, minval=0.1, title="Fixed TP Level 2 (%)")

tp_level_percent3 = input.float(17.0, minval=0.1, title="Fixed TP Level 3 (%)")

// Take Profit Percentages for Each Level

tp_percent_atr = input.float(10.0, minval=0.1, maxval=100, title="Percentage to Exit at Each ATR TP Level")

tp_percent_fixed = input.float(10.0, minval=0.1, maxval=100, title="Percentage to Exit at Each Fixed TP Level")

// —————————————

// Helper Functions

// —————————————

// Function to calculate True Range with enhanced volatility detection

calculate_true_range() =>

prev_close = close[1]

tr1 = high - low

tr2 = math.abs(high - prev_close)

tr3 = math.abs(low - prev_close)

true_range = math.max(tr1, tr2, tr3)

true_range

// ———————————————

// Indicator Calculations

// ———————————————

// Calculate True Range

true_range = calculate_true_range()

// Calculate Momentum Factor

momentum = close - close[momentum_period]

stdev_close = ta.stdev(close, momentum_period)

normalized_momentum = stdev_close != 0 ? (momentum / stdev_close) : 0

momentum_factor = math.abs(normalized_momentum)

// Calculate Short and Long ATRs

short_atr = ta.sma(true_range, short_period)

long_atr = ta.sma(true_range, long_period)

// Calculate Adaptive ATR

adaptive_atr = (short_atr * momentum_factor + long_atr) / (1 + momentum_factor)

// Calculate Trend Strength

price_change = close - close[momentum_period]

atr_multiple = adaptive_atr != 0 ? (price_change / adaptive_atr) : 0

trend_strength = ta.sma(atr_multiple, momentum_period)

// Calculate Moving Averages

short_ma = ta.sma(close, short_period)

long_ma = ta.sma(close, long_period)

// Determine Trend Signal

trend_signal = (short_ma > long_ma and trend_strength > trend_strength_threshold) ? 1 :

(short_ma < long_ma and trend_strength < -trend_strength_threshold) ? -1 : 0

// Calculate Adaptive ATR SMA for Confirmation

adaptive_atr_sma = ta.sma(adaptive_atr, atr_sma_period)

// Determine if Trend is Confirmed with Price Action

trend_confirmed = (trend_signal == 1 and close > short_ma and adaptive_atr > adaptive_atr_sma) or (trend_signal == -1 and close < short_ma and adaptive_atr > adaptive_atr_sma)

// —————————————

// Trading Logic

// —————————————

// Entry Conditions

long_entry = trend_confirmed and trend_signal == 1

short_entry = trend_confirmed and trend_signal == -1

// Exit Conditions

long_exit = strategy.position_size > 0 and short_entry

short_exit = strategy.position_size < 0 and long_entry

// Execute Long Trades

if long_entry

strategy.entry("Long Entry", strategy.long)

if long_exit

strategy.close("Long Entry")

// Execute Short Trades

if short_entry

strategy.entry("Short Entry", strategy.short)

if short_exit

strategy.close("Short Entry")

// ————————————————

// Multi-Step Take Profit Logic

// ————————————————

if useMultiStepTP

// Calculate ATR for Take Profit Levels

atrValueTP = ta.atr(atrLengthTP)

// Long Position Take Profit Levels

if strategy.position_size > 0

// ATR-based Take Profit Prices

tp_priceATR1_long = strategy.position_avg_price + atrMultiplierTP1 * atrValueTP

tp_priceATR2_long = strategy.position_avg_price + atrMultiplierTP2 * atrValueTP

tp_priceATR3_long = strategy.position_avg_price + atrMultiplierTP3 * atrValueTP

tp_priceATR4_long = strategy.position_avg_price + atrMultiplierTP4 * atrValueTP

// Fixed Percentage Take Profit Prices

tp_pricePercent1_long = strategy.position_avg_price * (1 + tp_level_percent1 / 100)

tp_pricePercent2_long = strategy.position_avg_price * (1 + tp_level_percent2 / 100)

tp_pricePercent3_long = strategy.position_avg_price * (1 + tp_level_percent3 / 100)

// Set ATR-based Take Profit Exits

strategy.exit("TP ATR 1 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR1_long)

strategy.exit("TP ATR 2 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR2_long)

strategy.exit("TP ATR 3 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR3_long)

strategy.exit("TP ATR 4 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR4_long)

// Set Fixed Percentage Take Profit Exits

strategy.exit("TP Percent 1 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent1_long)

strategy.exit("TP Percent 2 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent2_long)

strategy.exit("TP Percent 3 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent3_long)

// Short Position Take Profit Levels

if strategy.position_size < 0

// ATR-based Take Profit Prices

tp_priceATR1_short = strategy.position_avg_price - atrMultiplierTP1 * atrValueTP

tp_priceATR2_short = strategy.position_avg_price - atrMultiplierTP2 * atrValueTP

tp_priceATR3_short = strategy.position_avg_price - atrMultiplierTP3 * atrValueTP

tp_priceATR4_short = strategy.position_avg_price - atrMultiplierTP4 * atrValueTP

// Fixed Percentage Take Profit Prices

tp_pricePercent1_short = strategy.position_avg_price * (1 - tp_level_percent1 / 100)

tp_pricePercent2_short = strategy.position_avg_price * (1 - tp_level_percent2 / 100)

tp_pricePercent3_short = strategy.position_avg_price * (1 - tp_level_percent3 / 100)

// Set ATR-based Take Profit Exits

strategy.exit("TP ATR 1 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR1_short)

strategy.exit("TP ATR 2 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR2_short)

strategy.exit("TP ATR 3 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR3_short)

strategy.exit("TP ATR 4 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR4_short)

// Set Fixed Percentage Take Profit Exits

strategy.exit("TP Percent 1 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent1_short)

strategy.exit("TP Percent 2 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent2_short)

strategy.exit("TP Percent 3 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent3_short)

// ——————————

// Plotting

// ——————————

plot(short_ma, color=color.blue, title="Short MA")

plot(long_ma, color=color.orange, title="Long MA")

// Plot Buy and Sell Signals

//plotshape(long_entry, title="Long Entry", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, text="Buy")

//plotshape(short_entry, title="Short Entry", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, text="Sell")

// Optional: Plot Trend Strength for analysis

// Uncomment the lines below to display Trend Strength on a separate chart pane

// plot(trend_strength, title="Trend Strength", color=color.gray)

// hline(trend_strength_threshold, title="Trend Strength Threshold", color=color.gray, linestyle=hline.style_dashed)

// hline(-trend_strength_threshold, title="Trend Strength Threshold", color=color.gray, linestyle=hline.style_dashed)