Cette stratégie est un système de trading intelligent qui combine volume d’échange, dynamique des prix et plusieurs arrêts et arrêts. Il identifie les opportunités de trading potentielles en surveillant les fluctuations anormales du volume d’échange, les hausses des prix et la combinaison des indicateurs de dynamique, et utilise une gestion de stop-loss à plusieurs niveaux pour optimiser le rapport risque-rendement.

Principe de stratégie

La stratégie est basée sur trois signaux de trading centraux: 1) rupture de volume - le volume de transactions actuelles est supérieur au double de la moyenne des transactions des 20 derniers cycles; 2) hausse des prix - la hausse des prix récents est supérieure au seuil fixé; 3) confirmation de la dynamique - le RSI est supérieur à 55 et le prix est au-dessus de la moyenne des 50 cycles. Lorsque ces trois conditions sont réunies, le système émet plus de signaux.

Avantages stratégiques

- La confirmation de signaux multiples améliore la précision des transactions

- Les plans de stop-loss à couches permettent de verrouiller les bénéfices tout en contrôlant les risques

- Les paramètres sont réglables pour s’adapter à différents environnements de marché

- Les signaux sont plus fiables grâce à la combinaison d’indicateurs techniques et d’analyses des volumes de transactions

- Une fonction d’alerte en temps réel pour saisir les opportunités

Risque stratégique

- Une mauvaise configuration des paramètres peut entraîner des transactions excessives

- Les pertes fréquentes peuvent être déclenchées en cas de fortes fluctuations du marché

- Les marchés à faible liquidité peuvent être difficiles à gérer et les arrêts de perte peuvent être temporaires.

- Les facteurs fondamentaux ne sont pas pris en compte et peuvent avoir des conséquences importantes

- Une dépendance excessive à l’égard des indicateurs techniques risque de faire défaut sur le marché horizontal

Orientation de l’optimisation de la stratégie

- Introduire des jugements sur les conditions du marché et utiliser différents paramètres dans différents contextes

- Augmentation de l’analyse de la qualité des échanges et filtrage des signaux de fausses émissions

- Ajout d’indicateurs de force de tendance pour améliorer la capacité de suivi des tendances

- Optimiser l’intervalle de stop-loss pour le rendre plus adapté aux caractéristiques de volatilité du marché

- Considérer l’ajout d’un contrôle de retrait pour améliorer la stabilité de la courbe des fonds

Résumer

Il s’agit d’une stratégie de trading mature qui intègre plusieurs éléments d’analyse technique. Le risque est bien maîtrisé tout en saisissant les opportunités de tendance grâce à un filtrage de signal rigoureux et une gestion de position flexible. Bien qu’il y ait encore de la place pour l’optimisation, la conception globale est raisonnable et mérite d’être vérifiée et utilisée dans le monde réel.

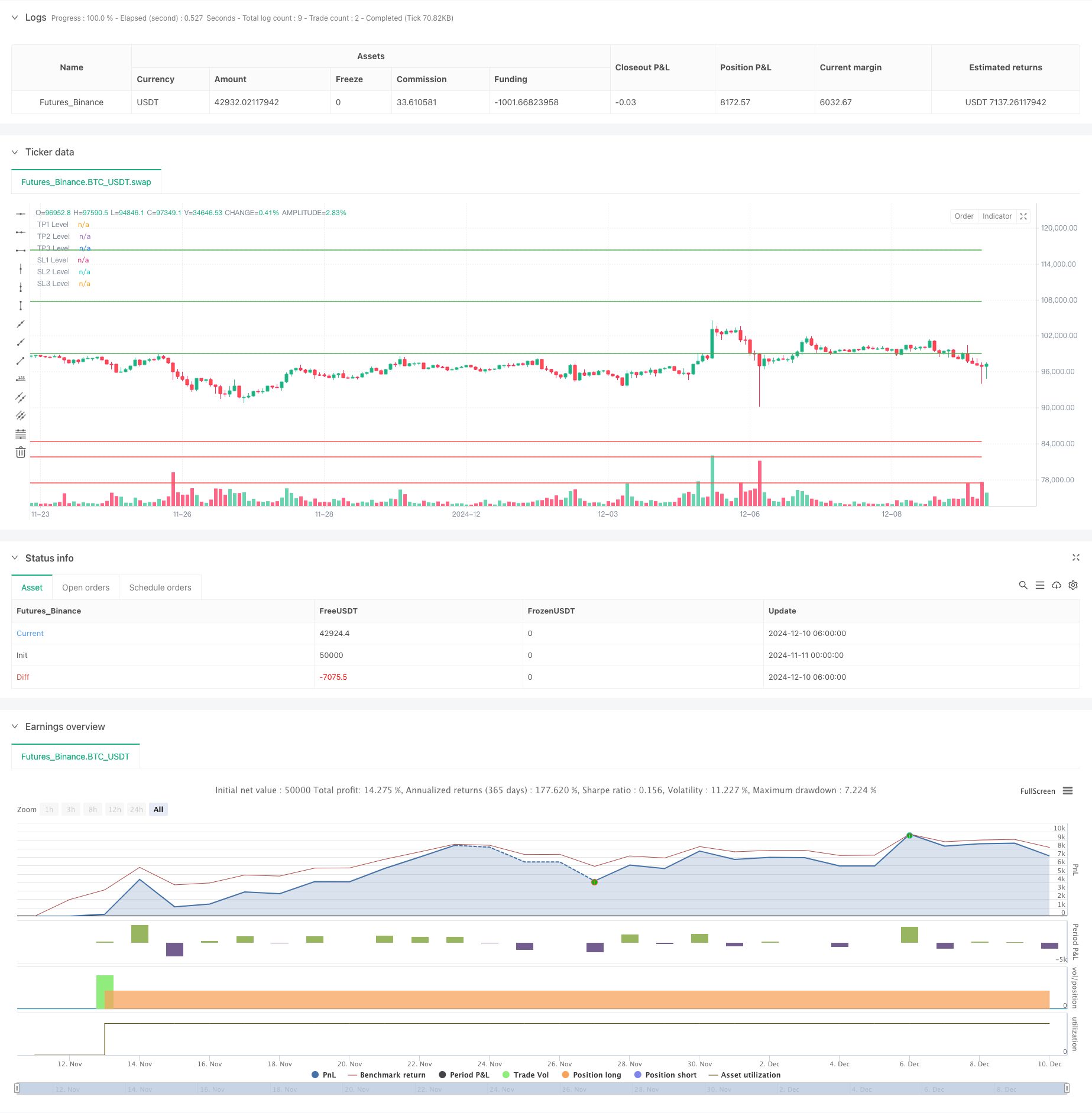

/*backtest

start: 2024-11-11 00:00:00

end: 2024-12-10 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Volume Spike & Momentum Strategy with Alerts", overlay=true)

// Inputs for customization

priceGainPercent = input.float(5, title="Minimum Price Gain (%)", minval=1)

volumeLookback = input.int(20, title="Volume Lookback Period (Bars)", minval=1)

momentumSmaLength = input.int(50, title="SMA Length for Momentum (Bars)", minval=1)

rsiThreshold = input.float(55, title="RSI Threshold for Momentum", minval=1)

// Take Profit percentages

tp1Percent = input.float(15, title="Take Profit 1 (%)", minval=1)

tp2Percent = input.float(25, title="Take Profit 2 (%)", minval=1)

tp3Percent = input.float(35, title="Take Profit 3 (%)", minval=1)

// Percentage of position to close at each take-profit

tp1ClosePercent = input.float(30, title="Close % at TP1", minval=1, maxval=100)

tp2ClosePercent = input.float(40, title="Close % at TP2", minval=1, maxval=100)

tp3ClosePercent = input.float(30, title="Close % at TP3", minval=1, maxval=100)

// Stop-loss percentages

sl1Percent = input.float(2, title="Stop Loss 1 (%)", minval=0.1)

sl2Percent = input.float(5, title="Stop Loss 2 (%)", minval=0.1)

sl3Percent = input.float(10, title="Stop Loss 3 (%)", minval=0.1)

// Percentage of position to close at each stop-loss

sl1ClosePercent = input.float(30, title="Close % at SL1", minval=1, maxval=100)

sl2ClosePercent = input.float(40, title="Close % at SL2", minval=1, maxval=100)

sl3ClosePercent = input.float(30, title="Close % at SL3", minval=1, maxval=100)

// Detect volume spikes

avgVolume = ta.sma(volume, volumeLookback) // Average volume over the last X bars (customizable)

volumeSpike = volume > avgVolume * 2 // Spike in volume if current volume is 2x the average

// Detect price gain over the recent period (e.g., 5-10% gain over the last X bars)

priceChangePercent = (close - ta.lowest(close, 5)) / ta.lowest(close, 5) * 100

priceGainCondition = priceChangePercent >= priceGainPercent

// Check for overall momentum using an SMA and RSI

longTermSma = ta.sma(close, momentumSmaLength)

rsi = ta.rsi(close, 14)

momentumCondition = close > longTermSma and rsi >= rsiThreshold

// Store the entry price on a new trade

var float entryPrice = na

if (strategy.opentrades == 0 and (volumeSpike and priceGainCondition and momentumCondition))

entryPrice := close // Capture the entry price on a new trade

// Calculate take-profit levels based on the entry price

tp1Price = entryPrice * (1 + tp1Percent / 100)

tp2Price = entryPrice * (1 + tp2Percent / 100)

tp3Price = entryPrice * (1 + tp3Percent / 100)

// Calculate stop-loss levels based on the entry price

sl1Price = entryPrice * (1 - sl1Percent / 100)

sl2Price = entryPrice * (1 - sl2Percent / 100)

sl3Price = entryPrice * (1 - sl3Percent / 100)

// Exit conditions for multiple take-profits

tp1Condition = high >= tp1Price // Exit partial if price hits take-profit 1

tp2Condition = high >= tp2Price // Exit partial if price hits take-profit 2

tp3Condition = high >= tp3Price // Exit full if price hits take-profit 3

// Exit conditions for multiple stop-losses

sl1Condition = low <= sl1Price // Exit partial if price hits stop-loss 1

sl2Condition = low <= sl2Price // Exit partial if price hits stop-loss 2

sl3Condition = low <= sl3Price // Exit full if price hits stop-loss 3

// Buy Condition: When volume spike, price gain, and momentum conditions are met

if (volumeSpike and priceGainCondition and momentumCondition)

strategy.entry("Buy", strategy.long)

// Alerts for conditions

alertcondition(volumeSpike and priceGainCondition and momentumCondition, title="Entry Alert", message="Entry conditions met: Volume spike, price gain, and momentum detected!")

alertcondition(tp1Condition, title="Take Profit 1", message="Take Profit 1 hit!")

alertcondition(tp2Condition, title="Take Profit 2", message="Take Profit 2 hit!")

alertcondition(tp3Condition, title="Take Profit 3", message="Take Profit 3 hit!")

alertcondition(sl1Condition, title="Stop Loss 1", message="Stop Loss 1 hit!")

alertcondition(sl2Condition, title="Stop Loss 2", message="Stop Loss 2 hit!")

alertcondition(sl3Condition, title="Stop Loss 3", message="Stop Loss 3 hit!")

// Exit conditions: Multiple take-profits and stop-losses

if (tp1Condition)

strategy.exit("Take Profit 1", "Buy", limit=tp1Price, qty_percent=tp1ClosePercent)

if (tp2Condition)

strategy.exit("Take Profit 2", "Buy", limit=tp2Price, qty_percent=tp2ClosePercent)

if (tp3Condition)

strategy.exit("Take Profit 3", "Buy", limit=tp3Price, qty_percent=tp3ClosePercent)

// Stop-loss exits

if (sl1Condition)

strategy.exit("Stop Loss 1", "Buy", stop=sl1Price, qty_percent=sl1ClosePercent)

if (sl2Condition)

strategy.exit("Stop Loss 2", "Buy", stop=sl2Price, qty_percent=sl2ClosePercent)

if (sl3Condition)

strategy.exit("Stop Loss 3", "Buy", stop=sl3Price, qty_percent=sl3ClosePercent)

// Plotting take-profit and stop-loss levels on the chart

plot(tp1Price, color=color.green, style=plot.style_linebr, title="TP1 Level")

plot(tp2Price, color=color.green, style=plot.style_linebr, title="TP2 Level")

plot(tp3Price, color=color.green, style=plot.style_linebr, title="TP3 Level")

plot(sl1Price, color=color.red, style=plot.style_linebr, title="SL1 Level")

plot(sl2Price, color=color.red, style=plot.style_linebr, title="SL2 Level")

plot(sl3Price, color=color.red, style=plot.style_linebr, title="SL3 Level")