Aperçu

La stratégie est un système de suivi de tendance dynamique basé sur l’indicateur ATR (Average True Range), combinant des fonctionnalités d’analyse multi-cycle et de gestion de portefeuille. La stratégie capture les changements de tendance sur différentes périodes de temps en suivant la position relative des prix par rapport au canal ATR, tout en gérant dynamiquement les positions en fonction du nombre de transactions que l’utilisateur définit. La stratégie a été conçue en tenant compte à la fois de la stabilité du suivi des tendances et de la flexibilité du moment des transactions.

Principe de stratégie

La logique fondamentale de la stratégie repose sur les éléments clés suivants :

- Création d’un canal d’arrêt dynamique à l’aide de l’indicateur ATR, dont la largeur est déterminée conjointement par le cycle ATR et les paramètres de sensibilité

- Détermination des signaux d’achat et de vente par le croisement des canaux EMA et ATR

- Prise en charge de plusieurs périodes de temps allant de 5 minutes à 2 heures

- Adaptation des volumes d’achat et de vente en fonction de la dynamique actuelle du portefeuille, combinée à un mécanisme de suivi du portefeuille

- Il est possible de réduire le faux signal en utilisant une ligne K lisse (Heikin Ashi)

Avantages stratégiques

- Adaptabilité - Adaptation dynamique de la largeur des canaux par l’ATR pour s’adapter à différents environnements de marché

- Risque maîtrisé - mécanisme de stop-loss intégré, avec stop-loss dynamique via le canal ATR

- Flexibilité d’utilisation - analyse multi-cycles et sélection des périodes appropriées en fonction des caractéristiques des différentes variétés

- Gestion des positions - Gestion dynamique des positions grâce au suivi du portefeuille

- Stabilité du signal - Sélectionnez une ligne K lisse pour réduire le bruit et améliorer la qualité du signal

Risque stratégique

- La dépendance à la tendance - des transactions fréquentes peuvent survenir dans un marché en crise

- Lagueur - L’utilisation de la ligne moyenne et de l’ATR entraîne un certain retard de signal

- Sensitivité des paramètres - le choix des paramètres ATR et de la sensibilité a un impact significatif sur les performances de la stratégie

- Gestion des fonds - il est nécessaire d’établir un nombre raisonnable de transactions pour éviter les positions excessives

- Adaptabilité du marché - les performances peuvent varier selon les environnements de marché

Orientation de l’optimisation de la stratégie

- Filtrage du signal

- Indicateurs de confirmation de la force de la tendance à la hausse

- Introduction à l’analyse du trafic

- Considérer l’ajout d’un filtre de fluctuation

- Gestion des positions

- Amélioration dynamique de la taille de la position en fonction de la volatilité

- Réalisation de la construction et de la réduction des stocks par lots

- Joignez-vous au contrôle de retrait maximal

- Optimisation des pertes

- Arrêt de perte combiné avec le réglage de la résistance au support

- Réalisation de la coupe mobile

- Optimisation de la méthode de calcul de la distance de rupture

Résumer

La stratégie est un système complet de négociation combinant l’analyse technique et la gestion de portefeuille. Elle offre une capacité de suivi de tendance stable via les canaux ATR dynamiques et l’analyse multi-cycle, tout en tenant compte des besoins de gestion de position dans les transactions réelles. L’accent sur l’optimisation de la stratégie devrait être mis sur l’amélioration de la qualité du signal et l’amélioration du contrôle des risques.

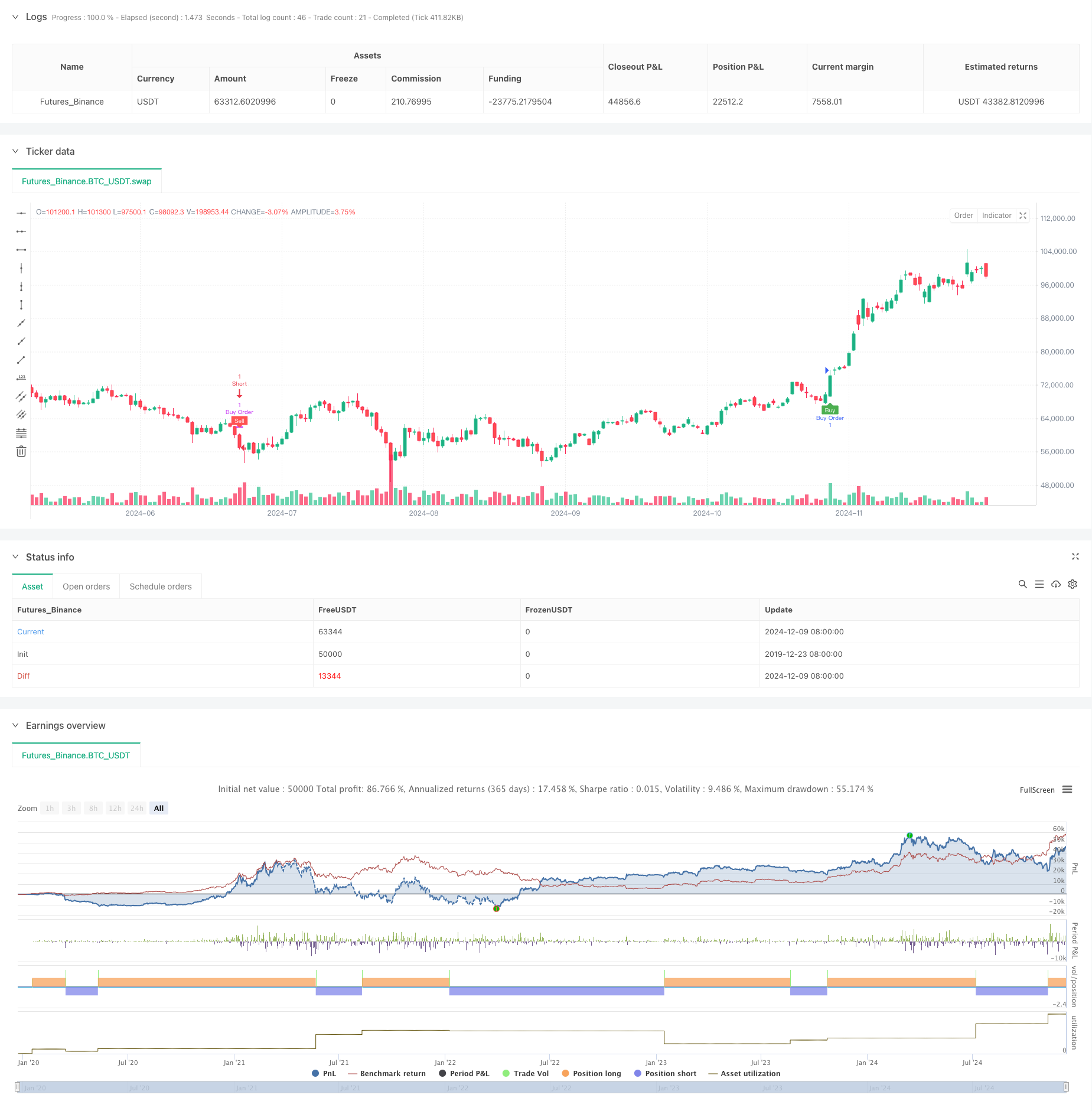

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='ADET GİRMELİ Trend İz Süren Stop Strategy', overlay=true, overlay=true,default_qty_type = strategy.fixed, default_qty_value = 1)

// Inputs

a = input(9, title='Key Value. "This changes the sensitivity"')

c = input(3, title='ATR Period')

h = input(false, title='Signals from Heikin Ashi Candles')

xATR = ta.atr(c)

nLoss = a * xATR

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop = 0.0

iff_1 = src > nz(xATRTrailingStop[1], 0) ? src - nLoss : src + nLoss

iff_2 = src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), src + nLoss) : iff_1

xATRTrailingStop := src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), src - nLoss) : iff_2

pos = 0

iff_3 = src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos := src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ema = ta.ema(src, 1)

above = ta.crossover(ema, xATRTrailingStop)

below = ta.crossover(xATRTrailingStop, ema)

buy = src > xATRTrailingStop and above

sell = src < xATRTrailingStop and below

barbuy = src > xATRTrailingStop

barsell = src < xATRTrailingStop

// Alım ve Satım Sinyalleri

buySignal = src > xATRTrailingStop and above

sellSignal = src < xATRTrailingStop and below

// Kullanıcı girişi

sell_quantity = input.int(1, title="Sell Quantity", minval=1)

buy_quantity = input.int(1, title="Buy Quantity", minval=1)

// Portföy miktarı (örnek simülasyon verisi)

var portfolio_quantity = 0

// Sinyal üretimi (örnek sinyal, gerçek stratejinizle değiştirin)

indicator_signal = (src > xATRTrailingStop and above) ? "buy" :

(src < xATRTrailingStop and below) ? "sell" : "hold"

// Şartlara göre al/sat

if indicator_signal == "buy" and portfolio_quantity < buy_quantity

strategy.entry("Buy Order", strategy.long, qty=buy_quantity)

portfolio_quantity := portfolio_quantity + buy_quantity

if indicator_signal == "sell" and portfolio_quantity >= sell_quantity

strategy.close("Buy Order", qty=sell_quantity)

portfolio_quantity := portfolio_quantity - sell_quantity

// Plot buy and sell signals

plotshape(buy, title='Buy', text='Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(sell, title='Sell', text='Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

// Bar coloring

barcolor(barbuy ? color.rgb(6, 250, 14) : na)

barcolor(barsell ? color.red : na)

// Alerts

alertcondition(buy, 'UT Long', 'UT Long')

alertcondition(sell, 'UT Short', 'UT Short')

// Strategy Entry and Exit

if buy

strategy.entry('Long', strategy.long)

if sell

strategy.entry('Short', strategy.short)

// Optional Exit Conditions

if sell

strategy.close('Long')

if buy

strategy.close('Short')

// ///TARAMA///

// gurupSec = input.string(defval='1', options=['1', '2', '3', '4', '5','6','7'], group='Taraması yapılacak 40\'arlı gruplardan birini seçin', title='Grup seç')

// per = input.timeframe(defval='', title='PERİYOT',group = "Tarama yapmak istediğiniz periyotu seçin")

// loc = input.int(defval=20, title='Konum Ayarı', minval = -100,maxval = 200 , step = 5, group='Tablonun konumunu belirleyin')

// func() =>

// //ÖRNEK BİR FONKSİYON AŞAĞIDA YAZILMIŞTIR. SİZ DE İSTEDİĞİNİZ KOŞULLAR İÇİN TARAMA YAZABİLİRSİNİZ.

// //rsi = ta.rsi(close,14)

// //cond = rsi <= 30

// //[close,cond]

// ////value = ta.cci(close,length23)

// cond = buySignal or sellSignal

// [close,cond]

// c1 = input.symbol(title='1', defval='BIST:BRYAT',group = "1. Grup Hisseleri")

// c2 = input.symbol(title='2', defval='BIST:TARKM')

// c3 = input.symbol(title='3', defval='BIST:TNZTP')

// c4 = input.symbol(title='4', defval='BIST:ERBOS')

// c5 = input.symbol(title='5', defval='BIST:BFREN')

// c6 = input.symbol(title='6', defval='BIST:ALARK')

// c7 = input.symbol(title='7', defval='BIST:ISMEN')

// c8 = input.symbol(title='8', defval='BIST:CVKMD')

// c9 = input.symbol(title='9', defval='BIST:TTRAK')

// c10 = input.symbol(title='10', defval='BIST:ASELS')

// c11 = input.symbol(title='11', defval='BIST:ATAKP')

// c12 = input.symbol(title='12', defval='BIST:MGROS')

// c13 = input.symbol(title='13', defval='BIST:BRSAN')

// c14 = input.symbol(title='14', defval='BIST:ALFAS')

// c15 = input.symbol(title='15', defval='BIST:CWENE')

// c16 = input.symbol(title='16', defval='BIST:THYAO')

// c17 = input.symbol(title='17', defval='BIST:EREGL')

// c18 = input.symbol(title='18', defval='BIST:TUPRS')

// c19 = input.symbol(title='19', defval='BIST:YYLGD')

// c20 = input.symbol(title='20', defval='BIST:KLSER')

// c21 = input.symbol(title='21', defval='BIST:MIATK')

// c22 = input.symbol(title='22', defval='BIST:ASTOR')

// c23 = input.symbol(title='23', defval='BIST:DOAS')

// c24 = input.symbol(title='24', defval='BIST:ERCB')

// c25 = input.symbol(title='25', defval='BIST:REEDR')

// c26 = input.symbol(title='26', defval='BIST:DNISI')

// c27 = input.symbol(title='27', defval='BIST:ARZUM')

// c28 = input.symbol(title='28', defval='BIST:EBEBK')

// c29 = input.symbol(title='29', defval='BIST:KLKIM')

// c30 = input.symbol(title='30', defval='BIST:ONCSM')

// c31 = input.symbol(title='31', defval='BIST:SOKE')

// c32 = input.symbol(title='32', defval='BIST:GUBRF')

// c33 = input.symbol(title='33', defval='BIST:KONTR')

// c34 = input.symbol(title='34', defval='BIST:DAPGM')

// c35 = input.symbol(title='35', defval='BIST:BVSAN')

// c36 = input.symbol(title='36', defval='BIST:ODAS')

// c37 = input.symbol(title='37', defval='BIST:OYAKC')

// c38 = input.symbol(title='38', defval='BIST:KRPLS')

// c39 = input.symbol(title='39', defval='BIST:BOBET')

// [v1,s1] = request.security(c1, per, func())

// [v2,s2] = request.security(c2, per, func())

// [v3,s3] = request.security(c3, per, func())

// [v4,s4] = request.security(c4, per, func())

// [v5,s5] = request.security(c5, per, func())

// [v6,s6] = request.security(c6, per, func())

// [v7,s7] = request.security(c7, per, func())

// [v8,s8] = request.security(c8, per, func())

// [v9,s9] = request.security(c9, per, func())

// [v10,s10] = request.security(c10, per, func())

// [v11,s11] = request.security(c11, per, func())

// [v12,s12] = request.security(c12, per, func())

// [v13,s13] = request.security(c13, per, func())

// [v14,s14] = request.security(c14, per, func())

// [v15,s15] = request.security(c15, per, func())

// [v16,s16] = request.security(c16, per, func())

// [v17,s17] = request.security(c17, per, func())

// [v18,s18] = request.security(c18, per, func())

// [v19,s19] = request.security(c19, per, func())

// [v20,s20] = request.security(c20, per, func())

// [v21,s21] = request.security(c21, per, func())

// [v22,s22] = request.security(c22, per, func())

// [v23,s23] = request.security(c23, per, func())

// [v24,s24] = request.security(c24, per, func())

// [v25,s25] = request.security(c25, per, func())

// [v26,s26] = request.security(c26, per, func())

// [v27,s27] = request.security(c27, per, func())

// [v28,s28] = request.security(c28, per, func())

// [v29,s29] = request.security(c29, per, func())

// [v30,s30] = request.security(c30, per, func())

// [v31,s31] = request.security(c31, per, func())

// [v32,s32] = request.security(c32, per, func())

// [v33,s33] = request.security(c33, per, func())

// [v34,s34] = request.security(c34, per, func())

// [v35,s35] = request.security(c35, per, func())

// [v36,s36] = request.security(c36, per, func())

// [v37,s37] = request.security(c37, per, func())

// [v38,s38] = request.security(c38, per, func())

// [v39,s39] = request.security(c39, per, func())

// roundn(x, n) =>

// mult = 1

// if n != 0

// for i = 1 to math.abs(n) by 1

// mult *= 10

// mult

// n >= 0 ? math.round(x * mult) / mult : math.round(x / mult) * mult

// scr_label = 'A/G İZSÜREN\n'

// scr_label := s1 ? scr_label + syminfo.ticker(c1) + ' ' + str.tostring(roundn(v1, 2)) + '\n' : scr_label

// scr_label := s2 ? scr_label + syminfo.ticker(c2) + ' ' + str.tostring(roundn(v2, 2)) + '\n' : scr_label

// scr_label := s3 ? scr_label + syminfo.ticker(c3) + ' ' + str.tostring(roundn(v3, 2)) + '\n' : scr_label

// scr_label := s4 ? scr_label + syminfo.ticker(c4) + ' ' + str.tostring(roundn(v4, 2)) + '\n' : scr_label

// scr_label := s5 ? scr_label + syminfo.ticker(c5) + ' ' + str.tostring(roundn(v5, 2)) + '\n' : scr_label

// scr_label := s6 ? scr_label + syminfo.ticker(c6) + ' ' + str.tostring(roundn(v6, 2)) + '\n' : scr_label

// scr_label := s7 ? scr_label + syminfo.ticker(c7) + ' ' + str.tostring(roundn(v7, 2)) + '\n' : scr_label

// scr_label := s8 ? scr_label + syminfo.ticker(c8) + ' ' + str.tostring(roundn(v8, 2)) + '\n' : scr_label

// scr_label := s9 ? scr_label + syminfo.ticker(c9) + ' ' + str.tostring(roundn(v9, 2)) + '\n' : scr_label

// scr_label := s10 ? scr_label + syminfo.ticker(c10) + ' ' + str.tostring(roundn(v10, 2)) + '\n' : scr_label

// scr_label := s11 ? scr_label + syminfo.ticker(c11) + ' ' + str.tostring(roundn(v11, 2)) + '\n' : scr_label

// scr_label := s12 ? scr_label + syminfo.ticker(c12) + ' ' + str.tostring(roundn(v12, 2)) + '\n' : scr_label

// scr_label := s13 ? scr_label + syminfo.ticker(c13) + ' ' + str.tostring(roundn(v13, 2)) + '\n' : scr_label

// scr_label := s14 ? scr_label + syminfo.ticker(c14) + ' ' + str.tostring(roundn(v14, 2)) + '\n' : scr_label

// scr_label := s15 ? scr_label + syminfo.ticker(c15) + ' ' + str.tostring(roundn(v15, 2)) + '\n' : scr_label

// scr_label := s16 ? scr_label + syminfo.ticker(c16) + ' ' + str.tostring(roundn(v16, 2)) + '\n' : scr_label

// scr_label := s17 ? scr_label + syminfo.ticker(c17) + ' ' + str.tostring(roundn(v17, 2)) + '\n' : scr_label

// scr_label := s18 ? scr_label + syminfo.ticker(c18) + ' ' + str.tostring(roundn(v18, 2)) + '\n' : scr_label

// scr_label := s19 ? scr_label + syminfo.ticker(c19) + ' ' + str.tostring(roundn(v19, 2)) + '\n' : scr_label

// scr_label := s20 ? scr_label + syminfo.ticker(c20) + ' ' + str.tostring(roundn(v20, 2)) + '\n' : scr_label

// scr_label := s21 ? scr_label + syminfo.ticker(c21) + ' ' + str.tostring(roundn(v21, 2)) + '\n' : scr_label

// scr_label := s22 ? scr_label + syminfo.ticker(c22) + ' ' + str.tostring(roundn(v22, 2)) + '\n' : scr_label

// scr_label := s23 ? scr_label + syminfo.ticker(c23) + ' ' + str.tostring(roundn(v23, 2)) + '\n' : scr_label

// scr_label := s24 ? scr_label + syminfo.ticker(c24) + ' ' + str.tostring(roundn(v24, 2)) + '\n' : scr_label

// scr_label := s25 ? scr_label + syminfo.ticker(c25) + ' ' + str.tostring(roundn(v25, 2)) + '\n' : scr_label

// scr_label := s26 ? scr_label + syminfo.ticker(c26) + ' ' + str.tostring(roundn(v26, 2)) + '\n' : scr_label

// scr_label := s27 ? scr_label + syminfo.ticker(c27) + ' ' + str.tostring(roundn(v27, 2)) + '\n' : scr_label

// scr_label := s28 ? scr_label + syminfo.ticker(c28) + ' ' + str.tostring(roundn(v28, 2)) + '\n' : scr_label

// scr_label := s29 ? scr_label + syminfo.ticker(c29) + ' ' + str.tostring(roundn(v29, 2)) + '\n' : scr_label

// scr_label := s30 ? scr_label + syminfo.ticker(c30) + ' ' + str.tostring(roundn(v30, 2)) + '\n' : scr_label

// scr_label := s31 ? scr_label + syminfo.ticker(c31) + ' ' + str.tostring(roundn(v31, 2)) + '\n' : scr_label

// scr_label := s32 ? scr_label + syminfo.ticker(c32) + ' ' + str.tostring(roundn(v32, 2)) + '\n' : scr_label

// scr_label := s33 ? scr_label + syminfo.ticker(c33) + ' ' + str.tostring(roundn(v33, 2)) + '\n' : scr_label

// scr_label := s34 ? scr_label + syminfo.ticker(c34) + ' ' + str.tostring(roundn(v34, 2)) + '\n' : scr_label

// scr_label := s35 ? scr_label + syminfo.ticker(c35) + ' ' + str.tostring(roundn(v35, 2)) + '\n' : scr_label

// scr_label := s36 ? scr_label + syminfo.ticker(c36) + ' ' + str.tostring(roundn(v36, 2)) + '\n' : scr_label

// scr_label := s37 ? scr_label + syminfo.ticker(c37) + ' ' + str.tostring(roundn(v37, 2)) + '\n' : scr_label

// scr_label := s38 ? scr_label + syminfo.ticker(c38) + ' ' + str.tostring(roundn(v38, 2)) + '\n' : scr_label

// scr_label := s39 ? scr_label + syminfo.ticker(c39) + ' ' + str.tostring(roundn(v39, 2)) + '\n' : scr_label

// var panel = table.new(position = position.top_right,columns = 10,rows = 10,bgcolor = color.green,frame_color = color.white,border_color = color.red)

// if barstate.islast

// table.cell(panel,0,0,text = str.tostring(scr_label))

// //------------------------------------------------------