Aperçu

La stratégie est un système de trading de suivi de tendance combinant plusieurs moyennes mobiles (SMA) et des indicateurs aléatoires (KDJ). La stratégie utilise un mécanisme de stop-loss dynamique pour ajuster la gestion des positions en fonction des mouvements du marché, à la fois pour protéger les bénéfices et ne pas quitter le marché trop tôt.

Principe de stratégie

La stratégie repose sur les éléments fondamentaux suivants :

- Système de double équilibre: utilisation des SMA de 19 cycles et de 74 cycles comme outil de jugement de tendance

- Les fourchettes de prix sont divisées en cinq niveaux pour déterminer la force et la faiblesse du marché.

- Indicateur aléatoire: utilisation d’un indicateur aléatoire de 60 cycles pour juger des surachats et des survente

- Confirmation de la tendance: déterminer la continuité de la tendance à partir de trois lignes K successives

- Conditions d’entrée: entrée lorsque le prix franchit le SMA de 74 cycles et se situe dans la fourchette correspondante

- Système d’arrêt des pertes: suivi des pertes et sortie en cas de changement de tendance

Avantages stratégiques

- Intégrité du système: une analyse complète du marché, combinée à un suivi des tendances et à des indicateurs dynamiques

- Gestion des risques: utilisation de mécanismes de stop multiples, y compris le stop de dureté et le stop de suivi

- Adaptabilité: la capacité à s’adapter à différents environnements de marché en ajustant les paramètres

- Capture des tendances: capture des tendances à moyen et long terme et évite les faux signaux

- Gestion des positions: Adaptation des positions en fonction de la dynamique du marché pour améliorer l’efficacité de l’utilisation des fonds

Risque stratégique

- Risque de choc: des échanges fréquents sur le marché horizontal

- Risque de glissement: des glissements plus importants sont possibles à grande vitesse

- Sensibilité des paramètres : différentes combinaisons de paramètres peuvent entraîner de grandes différences dans les performances de la stratégie

- Dépendance aux conditions du marché: les stratégies sont plus performantes dans les marchés en tendance

- Risques de gestion des fonds: les opérations à plein régime peuvent entraîner des risques de retrait plus importants

Orientation de l’optimisation de la stratégie

- Introduction de l’indicateur de volatilité: envisagez d’ajouter l’indicateur ATR pour ajuster dynamiquement le stop loss

- Optimiser le timing de l’admission: augmenter la confirmation de la quantité d’admission pour améliorer la précision de l’admission

- Amélioration de la gestion des fonds: ajout d’un module de gestion des positions, adapté à la dynamique des risques

- Augmentation du jugement sur les conditions du marché: des indicateurs de force de tendance peuvent être ajoutés pour filtrer les signaux de trading

- Amélioration des mécanismes d’arrêt des pertes: envisagez d’utiliser le suivi des pertes en pourcentage pour améliorer la flexibilité

Résumer

La stratégie, combinant plusieurs indicateurs techniques pour construire un système de négociation complet, avec une bonne capacité de suivi des tendances et un mécanisme de gestion des risques. Bien que cela puisse être difficile dans certains environnements de marché, la stratégie est susceptible de maintenir une performance stable dans différents environnements de marché grâce à une optimisation et une amélioration continues. Il est recommandé aux traders de surveiller les positions, de fixer des arrêts de perte raisonnables et d’ajuster les paramètres en temps opportun en fonction des conditions du marché.

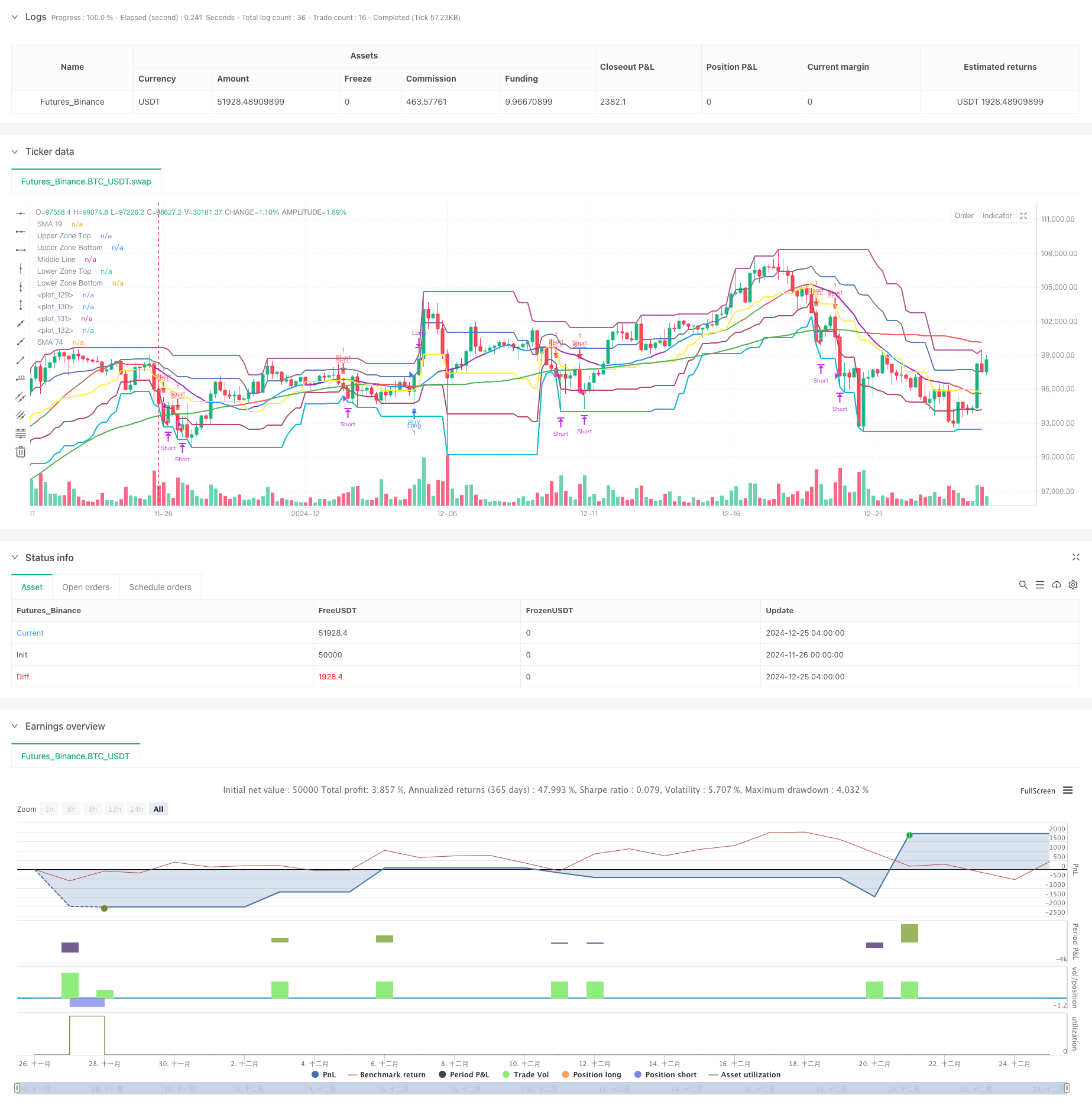

/*backtest

start: 2024-11-26 00:00:00

end: 2024-12-25 08:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Purple SMA Strategy", overlay=true)

// === INPUTS ===

zoneLength = input.int(20, "Price Zone Length", minval=5)

tickSize = input.float(1.0, "Tick Size for Hard Stop")

hardStopTicks = input.int(50, "Hard Stop Loss in Ticks")

// === CALCULATE ZONES ===

h = ta.highest(high, zoneLength)

l = ta.lowest(low, zoneLength)

priceRange = h - l

lvl5 = h

lvl4 = l + (priceRange * 0.75) // Orange line

lvl3 = l + (priceRange * 0.50) // Yellow line

lvl2 = l + (priceRange * 0.25) // Green line

lvl1 = l

// === INDICATORS ===

sma19 = ta.sma(close, 19)

sma74 = ta.sma(close, 74)

// === CANDLE COLOR CONDITIONS ===

isGreenCandle = close > open

isRedCandle = close < open

// === CONTINUOUS TREND DETECTION ===

isThreeGreenCandles = close > open and close[1] > open[1] and close[2] > open[2]

isThreeRedCandles = close < open and close[1] < open[1] and close[2] < open[2]

var bool inGreenTrend = false

var bool inRedTrend = false

// Update trends

if isThreeGreenCandles

inGreenTrend := true

inRedTrend := false

if isThreeRedCandles

inRedTrend := true

inGreenTrend := false

if (inGreenTrend and isRedCandle) or (inRedTrend and isGreenCandle)

inGreenTrend := false

inRedTrend := false

// === STOCHASTIC CONDITIONS ===

k = ta.stoch(close, high, low, 60)

d = ta.sma(k, 10)

isOverbought = d >= 80

isOversold = d <= 20

stochUp = d > d[1]

stochDown = d < d[1]

// === SMA COLOR LOGIC ===

sma19Color = if isOverbought and stochUp

color.green

else if isOverbought and stochDown

color.red

else if isOversold and stochUp

color.green

else if isOversold and stochDown

color.red

else if stochUp

color.blue

else if stochDown

color.purple

else

color.gray

sma74Color = sma74 < sma19 ? color.green : color.red

// === CROSSING CONDITIONS ===

crossUpSMA = ta.crossover(close, sma74)

crossDownSMA = ta.crossunder(close, sma74)

// === ENTRY CONDITIONS ===

buyCondition = crossUpSMA and close > lvl4

sellCondition = crossDownSMA and close < lvl2

// === POSITION MANAGEMENT ===

var float stopLevel = na

var bool xMode = false

// Entry and Stop Loss

if buyCondition

strategy.entry(id="Long", direction=strategy.long)

stopLevel := close - (hardStopTicks * tickSize)

xMode := false

if sellCondition

strategy.entry(id="Short", direction=strategy.short)

stopLevel := close + (hardStopTicks * tickSize)

xMode := false

// Update stops based on X's

if strategy.position_size != 0 and (inGreenTrend or inRedTrend)

xMode := true

if strategy.position_size > 0 // Long position

stopLevel := low

else // Short position

stopLevel := high

// Exit logic

if strategy.position_size > 0 // Long position

if low <= stopLevel

strategy.close(id="Long")

else if xMode and not (inGreenTrend or inRedTrend)

strategy.close(id="Long")

if strategy.position_size < 0 // Short position

if high >= stopLevel

strategy.close(id="Short")

else if xMode and not (inGreenTrend or inRedTrend)

strategy.close(id="Short")

// === PLOTTING ===

plot(sma19, "SMA 19", color=sma19Color, linewidth=2)

plot(sma74, "SMA 74", color=sma74Color, linewidth=2)

plot(lvl5, "Upper Zone Top", color=color.red, linewidth=2)

plot(lvl4, "Upper Zone Bottom", color=color.orange, linewidth=2)

plot(lvl3, "Middle Line", color=color.yellow, linewidth=2)

plot(lvl2, "Lower Zone Top", color=color.green, linewidth=2)

plot(lvl1, "Lower Zone Bottom", color=color.blue, linewidth=2)

// Plot X signals

plotshape(inGreenTrend, title="Bullish Line", style=shape.xcross, location=location.belowbar, color=color.white, size=size.tiny)

plotshape(inRedTrend, title="Bearish Line", style=shape.xcross, location=location.abovebar, color=color.white, size=size.tiny)

// Zone fills

var p1 = plot(lvl5, display=display.none)

var p2 = plot(lvl4, display=display.none)

var p3 = plot(lvl2, display=display.none)

var p4 = plot(lvl1, display=display.none)

fill(p1, p2, color=color.new(color.red, 90))

fill(p3, p4, color=color.new(color.green, 90))

// Plot entry signals

plotshape(buyCondition, title="Buy", style=shape.square, location=location.belowbar, color=color.new(color.blue, 20), size=size.tiny, text="BUY", textcolor=color.blue)

plotshape(sellCondition, title="Sell", style=shape.square, location=location.abovebar, color=color.new(color.red, 20), size=size.tiny, text="SELL", textcolor=color.red)