Aperçu

Il s’agit d’une stratégie de suivi des tendances basée sur de multiples indicateurs techniques et de gestion des risques. La stratégie utilise de manière intégrée plusieurs indicateurs techniques tels que les moyennes mobiles, les indices de force relative (RSI), les indicateurs de mouvement (DMI) pour identifier les tendances du marché et protéger la sécurité des fonds grâce à des mesures de contrôle des risques telles que l’arrêt dynamique des pertes, la gestion des positions et la limite de retrait maximale mensuelle.

Principe de stratégie

La stratégie utilise un mécanisme de confirmation de tendance à plusieurs niveaux:

- Déterminez la direction de la tendance à l’aide de l’indice cyclique 8/21/50 des moyennes mobiles (EMA)

- Utilisation de la ligne médiane du canal de prix comme filtre de tendance

- Combiné avec la moyenne du RSI ((5 cycles) pour filtrer les fausses ruptures de mouvement dans la plage 35-65

- Confirmation de la force de la tendance par l’indicateur DMI (cycle 14)

- Utilisation de l’indicateur de dynamique ((8 cycles) et de l’amplification de la transaction pour vérifier la continuité de la tendance

- Le risque est contrôlé par un arrêt dynamique basé sur ATR.

- Gestion des positions avec un risque fixe de 5% du capital initial pour chaque transaction

- Limite de retrait mensuel maximal de 10% pour éviter les pertes excessives

Avantages stratégiques

- La vérification croisée de multiples indicateurs techniques améliore la précision des jugements de tendances

- Le mécanisme de stop-loss dynamique contrôle efficacement le risque d’une seule transaction

- La gestion des positions avec des risques fixes rend l’utilisation des fonds plus rationnelle

- La limite de retrait maximum mensuel offre une protection contre les risques systémiques

- La combinaison d’indicateurs d’échange améliore la fiabilité de la confirmation des tendances

- Un ratio de profit/perte de 2:1 améliore la rentabilité à long terme

Risque stratégique

- L’utilisation de multiples indicateurs peut entraîner un retard de signal

- Des signaux erronés peuvent être fréquents dans les marchés en crise

- Les modèles de risque fixe peuvent ne pas être suffisamment flexibles en cas de fortes fluctuations

- Les restrictions sur les retraits mensuels peuvent vous faire rater des opportunités de trading importantes

- La tendance à la reprise pourrait entraîner une rechute plus importante

Orientation de l’optimisation de la stratégie

- Introduction de paramètres d’indicateur adaptés pour s’adapter à différentes conditions du marché

- Développer des stratégies de gestion de position plus flexibles, en tenant compte des fluctuations du marché

- Évaluation quantitative de l’intensité des tendances et optimisation du moment de l’entrée

- Des mécanismes de réduction des risques mensuels plus intelligents

- Ajout d’un module de reconnaissance de l’environnement du marché pour ajuster les paramètres de la stratégie en fonction des différentes conditions du marché

Résumer

La stratégie a pour avantage de disposer d’un cadre complet de gestion des risques comprenant le stop-loss dynamique, la gestion des positions et le contrôle des retraits. Bien qu’il existe un certain risque de retard, la stratégie est susceptible de maintenir une performance stable dans différents environnements de marché grâce à l’optimisation et à l’amélioration. La clé est de renforcer son adaptabilité aux environnements de marché tout en conservant la logique centrale de la stratégie.

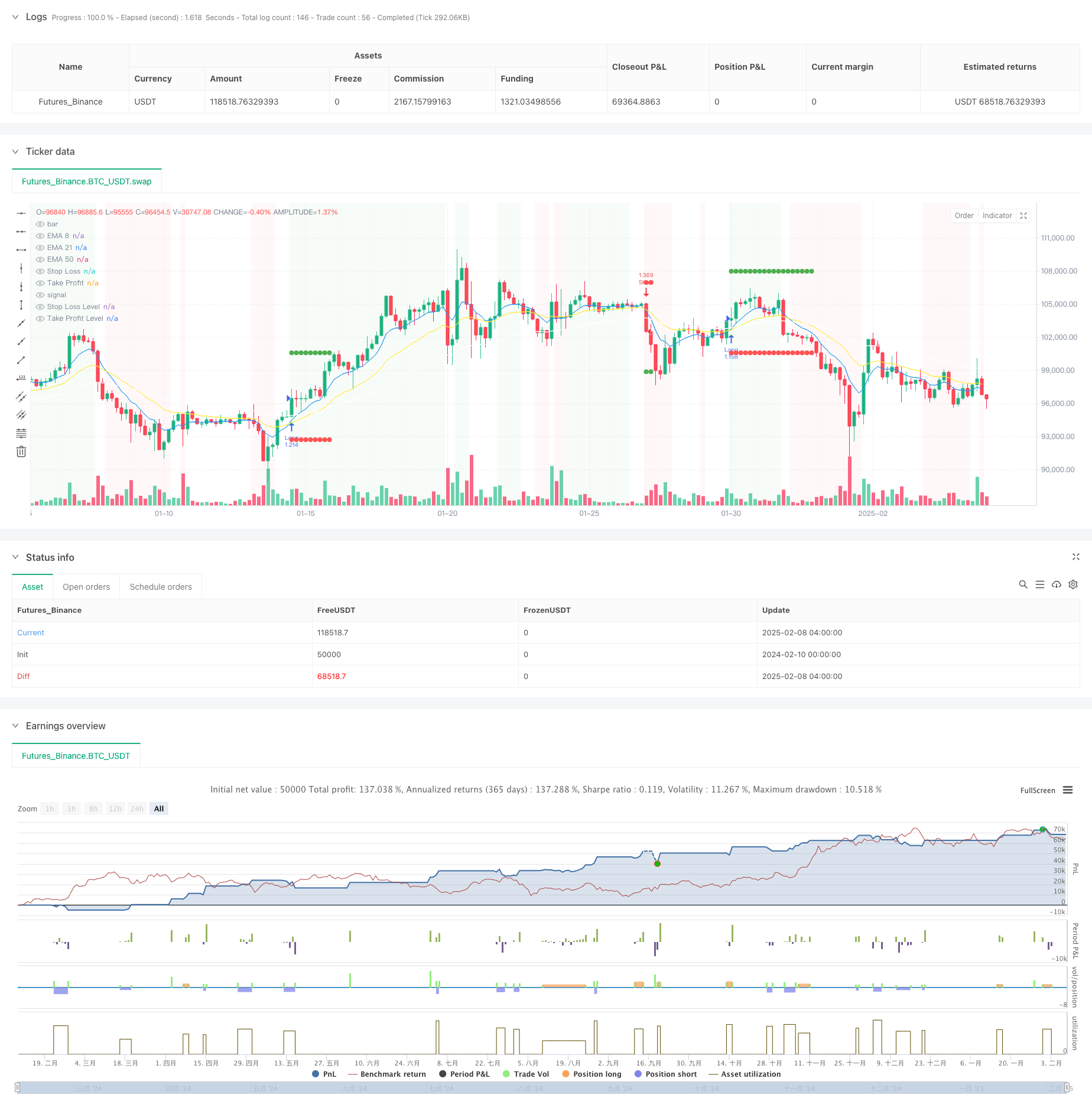

/*backtest

start: 2024-02-10 00:00:00

end: 2025-02-08 08:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("High Win-Rate Crypto Strategy with Drawdown Limit", overlay=true, initial_capital=10000, default_qty_type=strategy.fixed, process_orders_on_close=true)

// Moving Averages

ema8 = ta.ema(close, 8)

ema21 = ta.ema(close, 21)

ema50 = ta.ema(close, 50)

// RSI settings

rsi = ta.rsi(close, 14)

rsi_ma = ta.sma(rsi, 5)

// Momentum and Volume

mom = ta.mom(close, 8)

vol_ma = ta.sma(volume, 15)

high_vol = volume > vol_ma * 1

// Trend Strength

[diplus, diminus, _] = ta.dmi(14, 14)

strong_trend = diplus > 20 or diminus > 20

// Price channels

highest_15 = ta.highest(high, 15)

lowest_15 = ta.lowest(low, 15)

mid_channel = (highest_15 + lowest_15) / 2

// Trend Conditions

uptrend = ema8 > ema21 and close > mid_channel

downtrend = ema8 < ema21 and close < mid_channel

// Entry Conditions

longCondition = uptrend and ta.crossover(ema8, ema21) and rsi_ma > 35 and rsi_ma < 65 and mom > 0 and high_vol and diplus > diminus

shortCondition = downtrend and ta.crossunder(ema8, ema21) and rsi_ma > 35 and rsi_ma < 65 and mom < 0 and high_vol and diminus > diplus

// Dynamic Stop Loss based on ATR

atr = ta.atr(14)

stopSize = atr * 1.3

// Calculate position size based on fixed risk

riskAmount = strategy.initial_capital * 0.05

getLongPosSize(riskAmount, stopSize) => riskAmount / stopSize

getShortPosSize(riskAmount, stopSize) => riskAmount / stopSize

// Monthly drawdown tracking

var float peakEquity = na

var int currentMonth = na

var float monthlyDrawdown = na

maxDrawdownPercent = 10

// Variables for SL and TP

var float stopLoss = na

var float takeProfit = na

var bool inTrade = false

var string tradeType = na

// Reset monthly metrics

monthNow = month(time)

if na(currentMonth) or currentMonth != monthNow

currentMonth := monthNow

peakEquity := strategy.equity

monthlyDrawdown := 0.0

// Update drawdown metrics

peakEquity := math.max(peakEquity, strategy.equity)

monthlyDrawdown := math.max(monthlyDrawdown, (peakEquity - strategy.equity) / peakEquity * 100)

// Trading condition

canTrade = monthlyDrawdown < maxDrawdownPercent

// Entry and Exit Logic

if strategy.position_size == 0

inTrade := false

if longCondition and canTrade

stopLoss := low - stopSize

takeProfit := close + (stopSize * 2)

posSize = getLongPosSize(riskAmount, stopSize)

strategy.entry("Long", strategy.long, qty=posSize)

strategy.exit("Long Exit", "Long", stop=stopLoss, limit=takeProfit)

inTrade := true

tradeType := "long"

if shortCondition and canTrade

stopLoss := high + stopSize

takeProfit := close - (stopSize * 2)

posSize = getShortPosSize(riskAmount, stopSize)

strategy.entry("Short", strategy.short, qty=posSize)

strategy.exit("Short Exit", "Short", stop=stopLoss, limit=takeProfit)

inTrade := true

tradeType := "short"

// Plot variables

plotSL = inTrade ? stopLoss : na

plotTP = inTrade ? takeProfit : na

// EMA Plots

plot(ema8, "EMA 8", color=color.blue, linewidth=1)

plot(ema21, "EMA 21", color=color.yellow, linewidth=1)

plot(ema50, "EMA 50", color=color.white, linewidth=1)

// SL and TP Plots

plot(plotSL, "Stop Loss", color=color.red, style=plot.style_linebr, linewidth=1)

plot(plotTP, "Take Profit", color=color.green, style=plot.style_linebr, linewidth=1)

// Signal Plots

plotshape(longCondition and canTrade, "Buy Signal", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(shortCondition and canTrade, "Sell Signal", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// SL/TP Markers with correct y parameter syntax

plot(inTrade ? stopLoss : na, "Stop Loss Level", style=plot.style_circles, color=color.red, linewidth=2)

plot(inTrade ? takeProfit : na, "Take Profit Level", style=plot.style_circles, color=color.green, linewidth=2)

// Background Color

noTradingMonth = monthlyDrawdown >= maxDrawdownPercent

bgcolor(noTradingMonth ? color.new(color.gray, 80) : uptrend ? color.new(color.green, 95) : downtrend ? color.new(color.red, 95) : na)

// Drawdown Label

var label drawdownLabel = na

label.delete(drawdownLabel)

drawdownLabel := label.new(bar_index, high, "Monthly Drawdown: " + str.tostring(monthlyDrawdown, "#.##") + "%\n" + (noTradingMonth ? "NO TRADING" : "TRADING ALLOWED"), style=label.style_label_down, color=noTradingMonth ? color.red : color.green, textcolor=color.white, size=size.small)