Aperçu

Il s’agit d’une stratégie de négociation innovante à cycles multiples combinant l’exposant Hurst et le niveau de rétraction Fibonacci. La stratégie évalue les caractéristiques de la tendance du marché en calculant l’exposant Hurst pour différentes périodes de temps et identifie les opportunités de négociation potentielles en combinaison avec les niveaux de prix critiques Fibonacci. La stratégie utilise un cadre de gestion du risque strict, comprenant des ratios de risque fixes, des marges de gain et de perte cibles et des limites de fréquence de négociation quotidienne et globale.

Principe de stratégie

La logique centrale de la stratégie repose sur deux composantes principales:

- L’indice de Hurst est utilisé pour évaluer la tendance du marché en calculant l’indice de Hurst pour les périodes actuelles et supérieures. Un indice de Hurst supérieur à 0,5 indique que le marché a tendance à la continuité, et un indice inférieur à 0,5 indique que le marché peut présenter des caractéristiques de régression de la moyenne.

- Utilisez le niveau de rétractation Fibonacci pour calculer les hauts et les bas de chaque jour, en se concentrant sur les deux niveaux de 61.8% (la division de l’or) et 38.2%. Si l’indice de jour est supérieur à 0.5 et que le prix franchit le niveau de 61.8%, déclenchez un signal plus; Si l’indice de jour est inférieur à 0.5 et que le prix franchit le niveau de 38.2%, déclenchez un signal vide.

Avantages stratégiques

- Analyse multidimensionnelle: fournit une perspective plus complète du marché en combinant l’analyse des tendances et des niveaux de prix pour différentes périodes de temps

- Gestion des risques: un cadre de gestion des risques avec un ratio de risque fixe de 2 pour cent et un objectif de profit/perte de 1 pour cent

- Contrôle de la fréquence des transactions: définissez des limites de nombre maximum de transactions par jour et de nombre total de transactions, afin d’éviter les transactions excessives

- Aide visuelle: Tableau d’informations sur les changements de couleurs de fond et les indicateurs clés pour les tendances du marché en temps réel

Risque stratégique

- Dépendance aux conditions du marché: risque de sous-performance sur des marchés horizontaux où la tendance n’est pas claire

- Sensitivité des paramètres: le choix de la période de calcul de l’indice de Hurst et de la période de temps de Fibonacci affecte la performance de la stratégie

- Effets de dérapage: un risque de dérapage plus élevé est possible dans des conditions de marché moins fluides

- Complexité du système: la combinaison de plusieurs composants augmente la probabilité que la stratégie échoue

Orientation de l’optimisation de la stratégie

- Ajustement des paramètres dynamiques: les cycles de calcul de l’indice de Hurst peuvent être automatiquement ajustés en fonction des fluctuations du marché

- Ajout de filtres: introduction de filtres supplémentaires de l’état du marché pour améliorer la qualité du signal

- Optimisation de la gestion des positions: mise en œuvre d’une gestion dynamique des positions basée sur la volatilité

- Améliorer les mécanismes de départ: développer des méthodes plus flexibles de fixation des objectifs de profit

Résumer

Il s’agit d’une stratégie innovante qui combine les outils classiques de l’analyse technique avec des méthodes modernes de quantification. Par l’analyse de plusieurs cycles de temps et la gestion rigoureuse des risques, la stratégie maintient la base théorique tout en mettant l’accent sur la faisabilité pratique. Bien qu’il existe une certaine marge d’optimisation, le cadre global présente une bonne extensibilité et une valeur pratique.

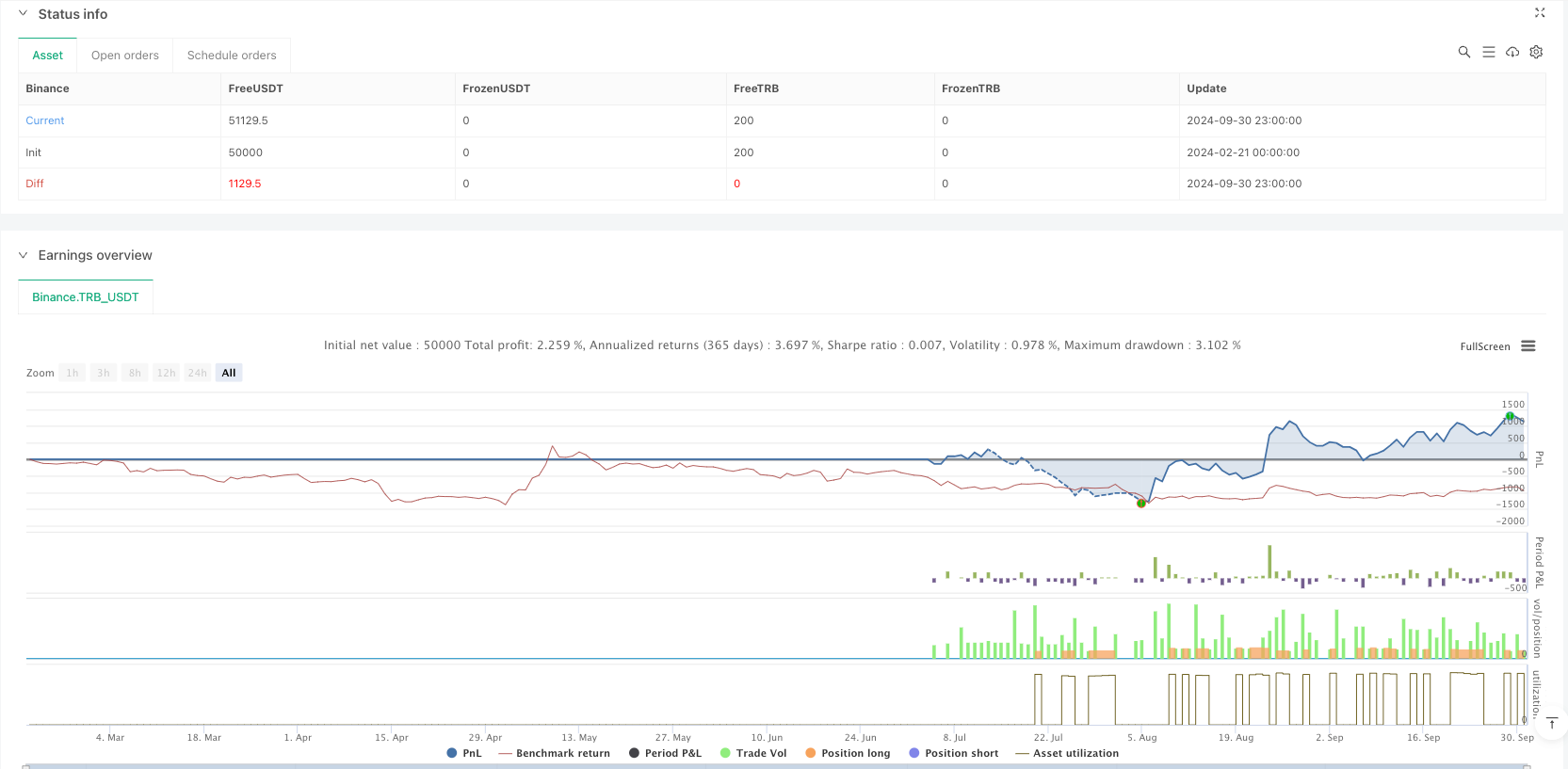

/*backtest

start: 2024-02-21 00:00:00

end: 2024-10-01 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"TRB_USDT"}]

*/

//@version=5

// Advanced Multi-Timeframe Trading System (Risk Managed)

//

// Description:

// This strategy combines an approximate measure of market trending via a Hurst exponent

// calculation with Fibonacci retracement levels derived from a higher timeframe (default: Daily)

// to identify potential reversal zones and trade opportunities. The Hurst exponent is calculated

// as a rough indicator of market persistence, while the Fibonacci retracement levels provide potential

// support and resistance areas.

//

// Signal Logic:

// - A long entry is signaled when the price crosses above the 61.8% Fibonacci level (Golden Ratio)

// and the daily Hurst exponent is above 0.5 (suggesting a trending market).

// - A short entry is signaled when the price crosses below the 38.2% Fibonacci level and the daily Hurst

// exponent is below 0.5.

//

// Risk Management:

// Each trade is risk-managed with a stop-loss set at 2% below (or above for shorts) the entry price,

// and a take profit order is set to achieve a 1:2 risk-reward ratio. Position sizing is fixed at 10% of

// equity per trade. Additionally, the strategy limits trading to a maximum of 5 trades per day and 510 trades

// overall (for backtesting since 2019) to ensure a realistic number of orders.

//

// Backtesting Parameters:

// - Initial Capital: $10,000

// - Commission: 0.1% per trade

// - Slippage: 1 tick per bar

// - Position Sizing: 10% of equity per trade

//

// Disclaimer:

// Past performance is not indicative of future results. This strategy is experimental and is provided solely

// for educational purposes. Use caution and perform your own testing before any live deployment.

//

// Author: [Your Name]

// Date: [Date]

strategy("Advanced Multi-Timeframe Trading System (Risk Managed)",

overlay=true,

max_bars_back=500,

initial_capital=10000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10, // 10% of equity per trade

commission_type=strategy.commission.percent,

commission_value=0.1, // 0.1% commission per trade

slippage=1, // 1 tick per bar

calc_on_order_fills=true,

calc_on_every_tick=true)

// ─── INPUTS ─────────────────────────────────────────────────────────────

hurstLen = input.int(50, title="Hurst Lookback Period", minval=10)

fibTF = input.timeframe("D", title="Fibonacci Retracement Timeframe")

maxTradesPerDay = input.int(5, title="Max Trades Per Day", minval=1)

maxTotalTrades = input.int(510, title="Max Total Trades since 2019", minval=1)

riskPerc = input.float(2.0, title="Risk Percent per Trade (%)", step=0.1) * 0.01 // 2% risk per trade

rrRatio = input.float(2.0, title="Risk-Reward Ratio", step=0.1) // Target profit = 2x risk

// ─── FUNCTION: Approximate Hurst Exponent Calculation ──────────────────────

// This function uses a simple rescaled range method to approximate the Hurst exponent.

// Note: This is an experimental calculation and should be interpreted as a rough gauge of market trending.

calcHurst(src, len) =>

mean = ta.sma(src, len)

dev = src - mean

cumDev = 0.0

for i = 0 to len - 1

cumDev := cumDev + dev[i]

R = ta.highest(cumDev, len) - ta.lowest(cumDev, len)

S = ta.stdev(src, len)

hurst = na(S) or S == 0 ? na : math.log(R / S) / math.log(len)

hurst

// Calculate the Hurst exponent on the current timeframe and from a higher timeframe (daily)

currHurst = calcHurst(close, hurstLen)

dailyHurst = request.security(syminfo.tickerid, "D", calcHurst(close, hurstLen))

// ─── FIBONACCI RETRACEMENT LEVELS (WITH GOLDEN RATIO) ──────────────────────────

// Retrieve the daily high/low from the selected timeframe (default: Daily)

dHigh = request.security(syminfo.tickerid, fibTF, high)

dLow = request.security(syminfo.tickerid, fibTF, low)

// Define Fibonacci levels between the daily low and high.

fib_0 = dLow

fib_100 = dHigh

fib_236 = dLow + 0.236 * (dHigh - dLow)

fib_382 = dLow + 0.382 * (dHigh - dLow)

fib_500 = dLow + 0.5 * (dHigh - dLow)

fib_618 = dLow + 0.618 * (dHigh - dLow) // Golden ratio level

// Plot the Fibonacci levels for reference.

pFib0 = plot(fib_0, color=color.gray, title="Fib 0%")

pFib236 = plot(fib_236, color=color.blue, title="Fib 23.6%")

pFib382 = plot(fib_382, color=color.orange, title="Fib 38.2%")

pFib500 = plot(fib_500, color=color.purple, title="Fib 50%")

pFib618 = plot(fib_618, color=color.green, title="Fib 61.8% (Golden Ratio)")

pFib100 = plot(fib_100, color=color.gray, title="Fib 100%")

// Fill the area between the 61.8% and 38.2% levels to highlight the key retracement zone.

fill(pFib618, pFib382, color=color.new(color.yellow, 80), title="Fibonacci Retracement Zone")

// ─── TRADE COUNT MANAGEMENT ─────────────────────────────────────────────────

// To simulate realistic trading frequency, the strategy limits trades to a maximum of 5 per day and 510 overall.

var int tradesToday = 0

var int globalTradeCount = 0

// Reset the daily trade counter at the start of a new day.

newDay = ta.change(time("D"))

if newDay

tradesToday := 0

// Allow new trades only if within the daily and overall trade limits.

canTrade = (tradesToday < maxTradesPerDay) and (globalTradeCount < maxTotalTrades)

// ─── TRADING SIGNALS ─────────────────────────────────────────────────────────

// Entry conditions based on Fibonacci levels and daily Hurst conditions:

// • Long: Price crosses above the 61.8% (Golden Ratio) level and daily Hurst > 0.5.

// • Short: Price crosses below the 38.2% level and daily Hurst < 0.5.

longCond = ta.crossover(close, fib_618) and (dailyHurst > 0.5)

shortCond = ta.crossunder(close, fib_382) and (dailyHurst < 0.5)

if longCond and canTrade

strategy.entry("Long", strategy.long)

tradesToday := tradesToday + 1

globalTradeCount := globalTradeCount + 1

if shortCond and canTrade

strategy.entry("Short", strategy.short)

tradesToday := tradesToday + 1

globalTradeCount := globalTradeCount + 1

// ─── RISK MANAGEMENT: STOP-LOSS & TAKE-PROFIT ──────────────────────────────

// For active positions, define stop-loss and take profit levels based on the entry price.

// This ensures that each trade risks approximately 2% of the entry price with a target

// of 2x the risk (1:2 risk-reward ratio).

if strategy.position_size > 0

longStop = strategy.position_avg_price * (1 - riskPerc)

longTarget = strategy.position_avg_price * (1 + rrRatio * riskPerc)

strategy.exit("Long Exit", from_entry="Long", stop=longStop, limit=longTarget)

if strategy.position_size < 0

shortStop = strategy.position_avg_price * (1 + riskPerc)

shortTarget = strategy.position_avg_price * (1 - rrRatio * riskPerc)

strategy.exit("Short Exit", from_entry="Short", stop=shortStop, limit=shortTarget)

// ─── CHART OVERLAYS & VISUAL AIDS ────────────────────────────────────────────

// Background color indicates the daily market trend:

// Green for trending conditions (dailyHurst > 0.5) and red for less trending conditions.

bgcolor(dailyHurst > 0.5 ? color.new(color.green, 90) : color.new(color.red, 90), title="Daily Trend Background")

// Display an information table in the top-right corner to help interpret key values.

var table infoTable = table.new(position.top_right, 2, 4, border_width=1, frame_color=color.gray)

if barstate.islast

table.cell(infoTable, 0, 0, "Current Hurst", text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 1, 0, str.tostring(currHurst, "#.###"), text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 0, 1, "Daily Hurst", text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 1, 1, str.tostring(dailyHurst, "#.###"), text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 0, 2, "Trades Today", text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 1, 2, str.tostring(tradesToday), text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 0, 3, "Global Trades", text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 1, 3, str.tostring(globalTradeCount), text_color=color.white, bgcolor=color.black)

// Optional: Add labels on the final bar to mark the key Fibonacci levels.

if barstate.islast

label.new(bar_index, fib_618, "61.8% (Golden Ratio)", style=label.style_label_left, color=color.green, textcolor=color.white, size=size.tiny)

label.new(bar_index, fib_382, "38.2%", style=label.style_label_left, color=color.orange, textcolor=color.white, size=size.tiny)