Aperçu

La stratégie est un système de trading auto-adaptatif combinant un retour en ZigZag et des indicateurs aléatoires. Il identifie les points de retournement critiques en calculant dynamiquement les fluctuations du marché et en combinant des signaux aléatoires de surachat et de survente pour déterminer le moment de la transaction. La stratégie intègre un mécanisme automatique de stop-loss pour gérer efficacement les risques.

Principe de stratégie

Le cœur de la stratégie est de suivre dynamiquement les tendances du marché via la méthode du pourcentage inverse. Il permet aux utilisateurs de choisir de définir manuellement le pourcentage inverse ou le calcul dynamique de l’ATR sur la base de différentes périodes (de 5 à 250 jours). Un signal de multiplication est généré lorsque le prix franchit la ligne inverse et que la valeur K de l’indicateur aléatoire est inférieure à 30; un signal de pause est généré lorsque le prix franchit la ligne inverse et que la valeur K est supérieure à 70.

Avantages stratégiques

- L’utilisation d’une méthode de calcul inversé qui s’adapte dynamiquement permet une meilleure adaptation aux différentes conditions du marché

- Combiné à un indicateur de tendance inverse et dynamique, il fournit des signaux de trading plus fiables

- Un système de stop-loss intégré pour aider les traders à gérer leurs risques automatiquement

- Les paramètres flexibles permettent aux traders d’optimiser en fonction de leur style de trading personnel

- Des signaux de négociation visualisés pour faciliter l’analyse et la prise de décision

Risque stratégique

- Les faux signaux peuvent être fréquents dans les marchés en crise

- Le choix du cycle ATR influe sur la performance de la stratégie

- Le stop loss fixe peut ne pas être adapté à toutes les conditions du marché

- Indicateur aléatoire qui peut être en retard dans certaines conditions de marché

- Les paramètres doivent être raisonnablement réglés pour éviter les transactions excessives

Orientation de l’optimisation de la stratégie

- Introduction d’analyses multi-temps pour améliorer la fiabilité du signal

- Ajustement dynamique des niveaux de stop loss pour mieux s’adapter aux fluctuations du marché

- Ajout d’un indicateur de volume de transaction comme signal de confirmation

- Développer des paramètres aléatoires qui s’adaptent

- Augmentation de l’intensité de la tendance et réduction des faux signaux par le filtre

Résumer

Il s’agit d’une stratégie de trading moderne combinant les outils classiques de l’analyse technique. Elle offre aux traders un système de trading complet en intégrant le retour ZigZag, les indicateurs aléatoires et la gestion des risques. La stratégie est hautement personnalisable et adaptée aux traders ayant des préférences de risque différentes.

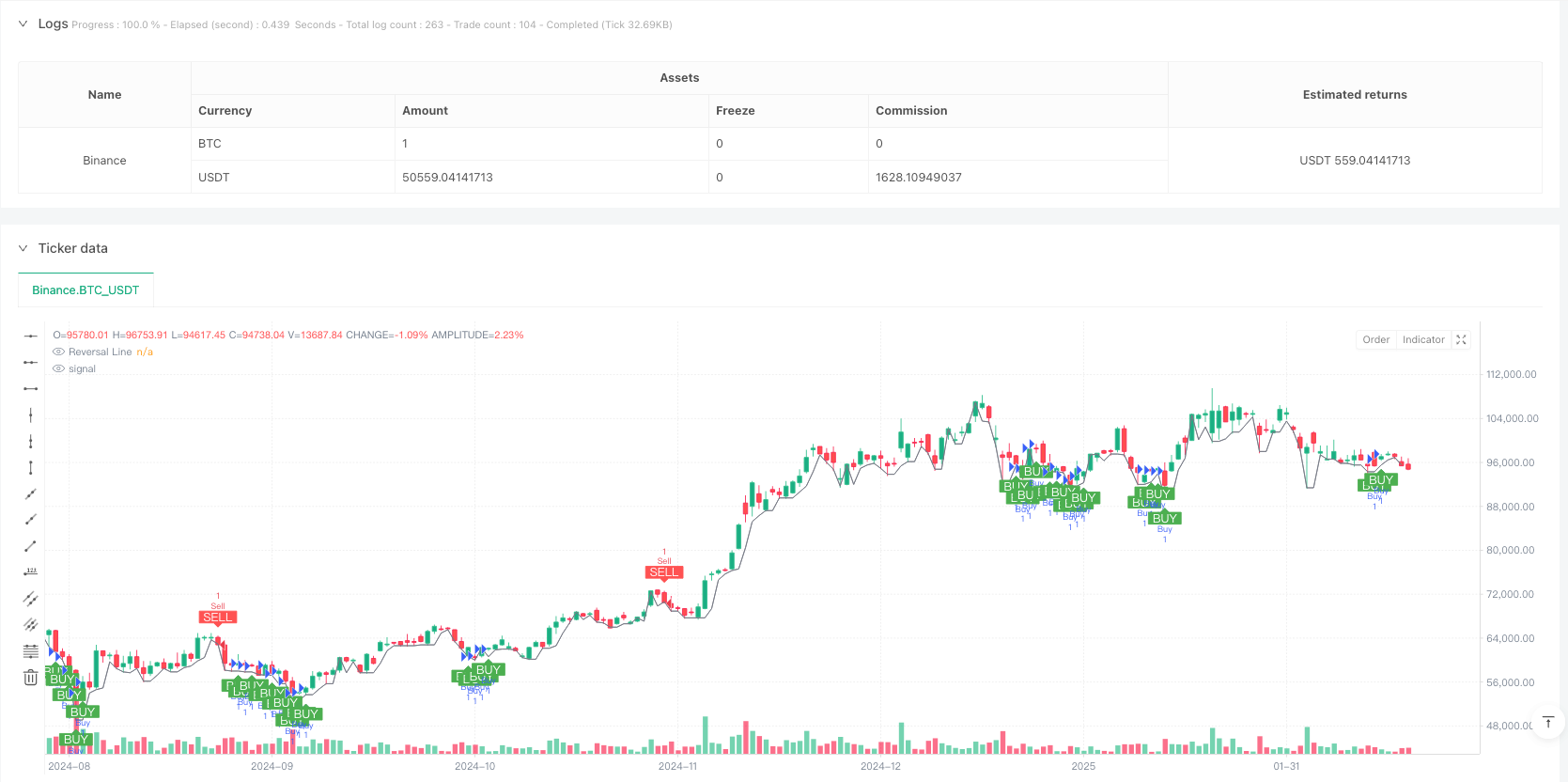

/*backtest

start: 2024-06-04 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("[RS]ZigZag Percent Reversal with Stochastic Strategy", overlay=true)

// ZigZag Settings

string percent_method = input.string(

defval="MANUAL",

title="Method to use for the zigzag reversal range:",

options=[

"MANUAL",

"ATR005 * X", "ATR010 * X", "ATR020 * X", "ATR050 * X", "ATR100 * X", "ATR250 * X"

]

)

var float percent = input.float(

defval=0.25,

title="Percent of last pivot price for zigzag reversal:",

minval=0.0, maxval=99.0

) / 100

float percent_multiplier = input.float(

defval=1.0,

title="Multiplier to apply to ATR if applicable:"

)

if percent_method == "ATR005 * X"

percent := ta.atr(5) / open * percent_multiplier

if percent_method == "ATR010 * X"

percent := ta.atr(10) / open * percent_multiplier

if percent_method == "ATR020 * X"

percent := ta.atr(20) / open * percent_multiplier

if percent_method == "ATR050 * X"

percent := ta.atr(50) / open * percent_multiplier

if percent_method == "ATR100 * X"

percent := ta.atr(100) / open * percent_multiplier

if percent_method == "ATR250 * X"

percent := ta.atr(250) / open * percent_multiplier

// Zigzag function

f_zz(_percent)=>

// Direction

var bool _is_direction_up = na

var float _htrack = na

var float _ltrack = na

var float _pivot = na

float _reverse_range = 0.0

var int _real_pivot_time = na

var int _htime = na

var int _ltime = na

var float _reverse_line = na

if bar_index >= 1

if na(_is_direction_up)

_is_direction_up := true

_reverse_range := nz(_pivot[1]) * _percent

if _is_direction_up

_ltrack := na

_ltime := time

if na(_htrack)

if high > high[1]

_htrack := high

_htime := time

else

_htrack := high[1]

_htime := time[1]

else

if high > _htrack

_htrack := high

_htime := time

_reverse_line := _htrack - _reverse_range

if close <= _reverse_line

_pivot := _htrack

_real_pivot_time := _htime

_is_direction_up := false

if not _is_direction_up

_htrack := na

_htime := na

if na(_ltrack)

if low < low[1]

_ltrack := low

_ltime := time

else

_ltrack := low[1]

_ltime := time[1]

else

if low < _ltrack

_ltrack := low

_ltime := time

_reverse_line := _ltrack + _reverse_range

if close >= _reverse_line

_pivot := _ltrack

_real_pivot_time := _ltime

_is_direction_up := true

[_pivot, _is_direction_up, _reverse_line, _real_pivot_time]

[pivot, direction_up, reverse_line, pivot_time] = f_zz(percent)

// Reversal line

var float static_reverse_line = na

if (not na(reverse_line))

static_reverse_line := reverse_line

plot(series=static_reverse_line, color=color.gray, style=plot.style_line, title="Reversal Line", trackprice=false)

// Stochastic Settings

K_length = input.int(9, title="Stochastic K Length", minval=1) // User input

K_smoothing = input.int(3, title="Stochastic K Smoothing", minval=1) // User input

stochK = ta.sma(ta.stoch(close, high, low, K_length), K_smoothing)

// User Input: Take Profit and Stop Loss Levels

stop_loss_pips = input.int(100, title="Stop Loss (pips)", minval=1) // Stop Loss

take_profit_pips = input.int(300, title="Take Profit (pips)", minval=1) // Take Profit

// Calculating levels

long_stop_loss = close - stop_loss_pips * syminfo.mintick

long_take_profit = close + take_profit_pips * syminfo.mintick

short_stop_loss = close + stop_loss_pips * syminfo.mintick

short_take_profit = close - take_profit_pips * syminfo.mintick

// Buy and Sell Conditions

buy_signal = close > static_reverse_line and stochK < 30 // K < 30 condition

sell_signal = close < static_reverse_line and stochK > 70 // K > 70 condition

if buy_signal

strategy.entry("Buy", strategy.long)

strategy.exit("TP/SL", "Buy", stop=long_stop_loss, limit=long_take_profit)

if sell_signal

strategy.entry("Sell", strategy.short)

strategy.exit("TP/SL", "Sell", stop=short_stop_loss, limit=short_take_profit)

// Signal Visualization

plotshape(series=buy_signal, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY", textcolor=color.white)

plotshape(series=sell_signal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL", textcolor=color.white)