Aperçu

Il s’agit d’une stratégie de négociation innovante qui combine l’analyse des zones de liquidité et la dynamique de la structure du marché interne afin d’identifier des points d’entrée à haute probabilité. Cette stratégie offre aux traders une méthode d’entrée sur le marché flexible et précise en suivant l’interaction des prix avec les niveaux clés du marché et en exploitant la conversion du marché interne pour déclencher des transactions.

Principe de stratégie

La logique centrale de la stratégie est basée sur deux composantes clés: l’identification des zones de liquidité et la conversion des marchés internes. Les zones de liquidité sont déterminées dynamiquement par l’analyse des hauts et des bas locaux, tandis que la conversion des marchés internes est basée sur le fait que les prix franchissent les niveaux haussiers ou baissiers précédents pour juger de la direction du marché.

La stratégie présente les caractéristiques suivantes:

- La logique de conversion du marché intérieur: non dépendante de la forme traditionnelle du graphique, mais basée sur la rupture des niveaux critiques

- Suivi des zones de liquidité: identifier dynamiquement les zones de liquidité clés pour empêcher la négociation dans des conditions de marché faibles

- Flexibilité des modèles: offre trois modes de négociation “Both”, “Bullish Only” et “Bearish Only”

- Gestion des risques: personnalisation des niveaux de stop loss et de stop-loss

- Contrôle de l’espace-temps: contrôle précis de la période de la transaction

Avantages stratégiques

- Adaptabilité dynamique: les stratégies répondent rapidement aux changements de la structure du marché

- Entrée précise: accroître la précision de l’entrée en combinant la zone de liquidité et la conversion sur le marché intérieur

- Risques maîtrisés: mécanisme intégré d’arrêt et d’arrêt

- Flexibilité: choix des modes de négociation en fonction des différentes conditions du marché

- Analyse multidimensionnelle: prise en compte du comportement des prix, de la liquidité et de la structure du marché

Risque stratégique

- Les fortes fluctuations du marché peuvent entraîner le déclenchement d’un stop loss.

- Les signaux fréquents peuvent augmenter les coûts de transaction dans un marché en crise

- Des paramètres incorrects peuvent affecter les performances de la stratégie

- Les résultats de la détection peuvent être différents de ceux du disque dur

Orientation de l’optimisation de la stratégie

- L’introduction d’algorithmes d’apprentissage automatique pour l’optimisation de l’adaptation des paramètres

- Ajout d’autres conditions de filtrage, telles que le volume des transactions et les indicateurs de volatilité

- Développement d’un mécanisme de vérification à plusieurs périodes

- Optimisation des algorithmes de stop-loss et d’arrêt de vente, en tenant compte de l’ajustement dynamique des fluctuations du marché

Résumer

Il s’agit d’une stratégie de négociation innovante qui allie l’analyse de la liquidité et la dynamique de la structure du marché. Elle offre aux traders un outil de négociation puissant grâce à une logique de conversion de marché interne flexible et un suivi précis des zones de liquidité. La clé de la stratégie réside dans son adaptabilité et sa capacité d’analyse multidimensionnelle, capable de maintenir une efficacité d’exécution élevée dans différentes conditions de marché.

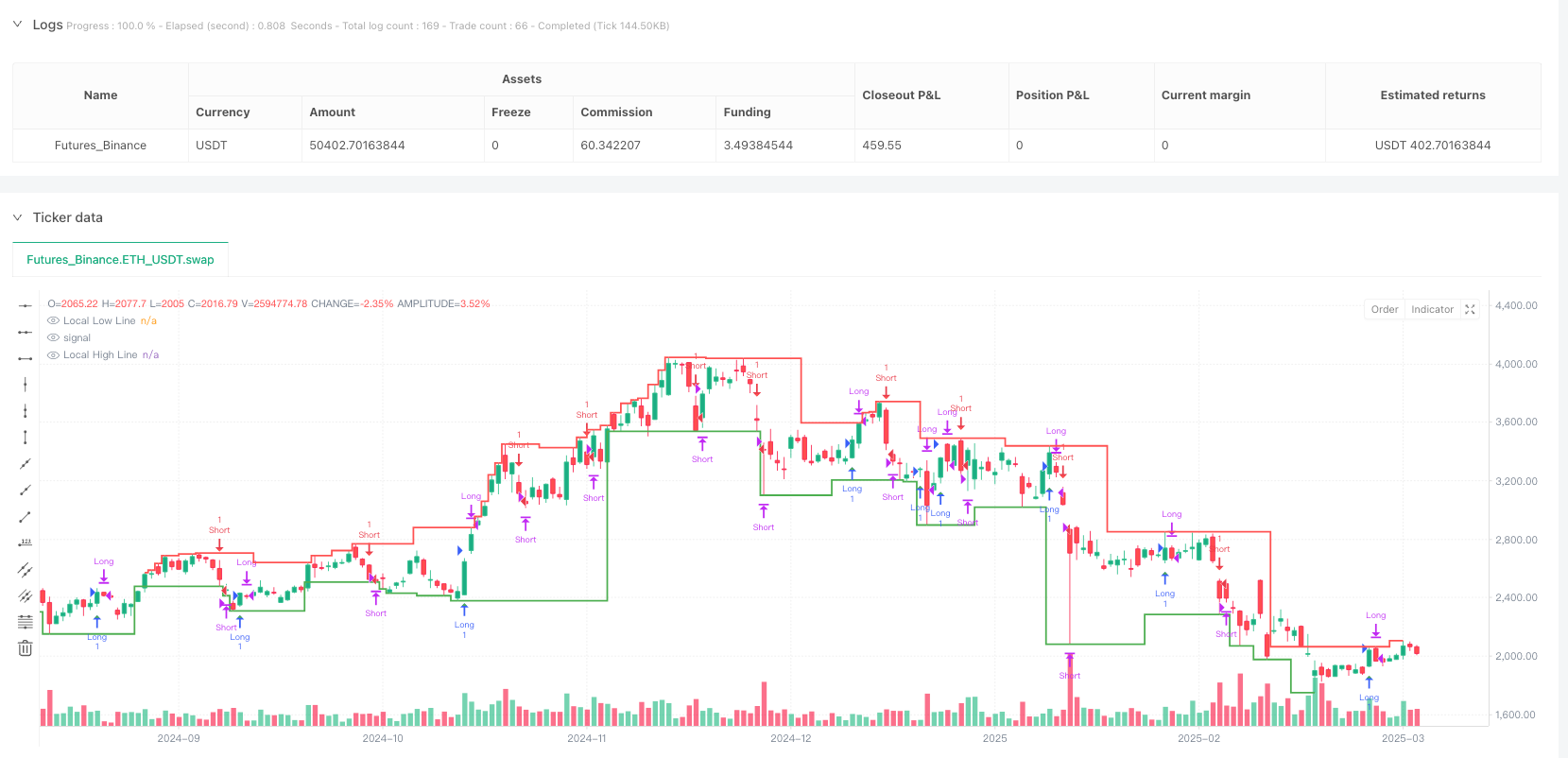

/*backtest

start: 2024-03-28 00:00:00

end: 2025-03-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Liquidity + Internal Market Shift Strategy", overlay=true)

// ======== Mode Selection ========

mode = input.string("Both", title="Mode", options=["Both", "Bullish Only", "Bearish Only"])

// ======== Stop-Loss and Take-Profit Input (in pips) ========

enableTakeProfit = input.bool(true, title="Enable Custom Take Profit") // Option to enable/disable take profit

stopLossPips = input.int(10, title="Stop Loss (in pips)", minval=1) // Stop loss in pips

takeProfitPips = input.int(20, title="Take Profit (in pips)", minval=1) // Take profit in pips

// ======== Internal Shift Logic ========

// Fixed number of consecutive candles to track (set to 1)

consecutiveBullishCount = 1

consecutiveBearishCount = 1

// Function to check for bullish and bearish candles

isBullish = close > open

isBearish = close < open

// Variables to track consecutive candles and mark lowest/highest

var int bullishCount = 0

var int bearishCount = 0

var float lowestBullishPrice = na

var float highestBearishPrice = na

var float previousBullishPrice = na // For the previous bullish lowest price

var float previousBearishPrice = na // For the previous bearish highest price

// Variables to track last internal shift type (1 = Bullish, -1 = Bearish, 0 = None)

var int lastInternalShift = 0

// Counting consecutive bullish and bearish candles

if isBullish

bullishCount := bullishCount + 1

bearishCount := 0

if bullishCount == 1 or low < lowestBullishPrice

lowestBullishPrice := low

else if isBearish

bearishCount := bearishCount + 1

bullishCount := 0

if bearishCount == 1 or high > highestBearishPrice

highestBearishPrice := high

else

bullishCount := 0

bearishCount := 0

lowestBullishPrice := na

highestBearishPrice := na

// Internal shift conditions

internalShiftBearish = close < previousBullishPrice and close < lowestBullishPrice

internalShiftBullish = close > previousBearishPrice and close > highestBearishPrice

// Condition to alternate internal shifts

allowInternalShiftBearish = internalShiftBearish and lastInternalShift != -1

allowInternalShiftBullish = internalShiftBullish and lastInternalShift != 1

// Tracking shifts

if bullishCount >= consecutiveBullishCount

previousBullishPrice := lowestBullishPrice

if bearishCount >= consecutiveBearishCount

previousBearishPrice := highestBearishPrice

// ======== Liquidity Seal-Off Points Logic ========

upperLiquidityLookback = input.int(10, title="Lookback Period for Upper Liquidity Line")

lowerLiquidityLookback = input.int(10, title="Lookback Period for Lower Liquidity Line")

isLocalHigh = high == ta.highest(high, upperLiquidityLookback)

isLocalLow = low == ta.lowest(low, lowerLiquidityLookback)

var bool touchedLowerLiquidityLine = false

var bool touchedUpperLiquidityLine = false

if (low <= ta.lowest(low, lowerLiquidityLookback))

touchedLowerLiquidityLine := true

if (high >= ta.highest(high, upperLiquidityLookback))

touchedUpperLiquidityLine := true

var bool lockedBullish = false

var bool lockedBearish = false

var int barSinceLiquidityTouch = na

// ======== Combined Signals ========

bullishSignal = allowInternalShiftBullish and touchedLowerLiquidityLine and not lockedBullish

bearishSignal = allowInternalShiftBearish and touchedUpperLiquidityLine and not lockedBearish

if bullishSignal

lockedBullish := true

touchedLowerLiquidityLine := false

barSinceLiquidityTouch := 0

if bearishSignal

lockedBearish := true

touchedUpperLiquidityLine := false

barSinceLiquidityTouch := 0

if not na(barSinceLiquidityTouch)

barSinceLiquidityTouch := barSinceLiquidityTouch + 1

if barSinceLiquidityTouch >= 3

lockedBullish := false

lockedBearish := false

if touchedLowerLiquidityLine

lockedBullish := false

if touchedUpperLiquidityLine

lockedBearish := false

// ======== Plot Combined Signals ========

plotshape(bullishSignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny, title="Bullish Signal")

plotshape(bearishSignal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny, title="Bearish Signal")

plot(isLocalHigh ? high : na, color=color.red, linewidth=2, style=plot.style_stepline, title="Local High Line")

plot(isLocalLow ? low : na, color=color.green, linewidth=2, style=plot.style_stepline, title="Local Low Line")

// ======== Track Entry and Opposing Signals ========

var float entryPrice = na

var int entryTime = na

var string positionSide = ""

// ======== Strategy Execution (Mode Logic) ========

if (mode == "Both")

// Short Entry Logic (Bearish Signal)

if (bearishSignal and na(entryPrice))

strategy.entry("Short", strategy.short)

entryPrice := close

entryTime := time

positionSide := "short"

// Long Entry Logic (Bullish Signal)

if (bullishSignal and na(entryPrice))

strategy.entry("Long", strategy.long)

entryPrice := close

entryTime := time

positionSide := "long"

// Exit Logic: Close on Opposing Signal (after the current signal is triggered)

if (positionSide == "short" and bullishSignal )

strategy.close("Short")

entryPrice := na

positionSide := ""

if (positionSide == "long" and bearishSignal)

strategy.close("Long")

entryPrice := na

positionSide := ""

// Stop-Loss and Take-Profit Logic (in pips)

stopLossPriceLong = entryPrice - stopLossPips * syminfo.mintick

takeProfitPriceLong = entryPrice + takeProfitPips * syminfo.mintick

stopLossPriceShort = entryPrice + stopLossPips * syminfo.mintick

takeProfitPriceShort = entryPrice - takeProfitPips * syminfo.mintick

// Long Stop-Loss and Take-Profit Conditions

if (positionSide == "long" and close <= stopLossPriceLong)

strategy.close("Long", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "long" and enableTakeProfit and close >= takeProfitPriceLong)

strategy.close("Long", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""

// Short Stop-Loss and Take-Profit Conditions

if (positionSide == "short" and close >= stopLossPriceShort)

strategy.close("Short", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "short" and enableTakeProfit and close <= takeProfitPriceShort)

strategy.close("Short", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""

if (mode == "Bullish Only")

if (bullishSignal and na(entryPrice))

strategy.entry("Long", strategy.long)

entryPrice := close

entryTime := time

positionSide := "long"

if (positionSide == "long" and bearishSignal)

strategy.close("Long")

entryPrice := na

positionSide := ""

// Stop-Loss and Take-Profit Logic (in pips)

stopLossPriceLong = entryPrice - stopLossPips * syminfo.mintick

takeProfitPriceLong = entryPrice + takeProfitPips * syminfo.mintick

if (positionSide == "long" and close <= stopLossPriceLong)

strategy.close("Long", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "long" and enableTakeProfit and close >= takeProfitPriceLong)

strategy.close("Long", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""

if (mode == "Bearish Only")

if (bearishSignal and na(entryPrice))

strategy.entry("Short", strategy.short)

entryPrice := close

entryTime := time

positionSide := "short"

if (positionSide == "short" and bullishSignal)

strategy.close("Short")

entryPrice := na

positionSide := ""

// Stop-Loss and Take-Profit Logic (in pips)

stopLossPriceShort = entryPrice + stopLossPips * syminfo.mintick

takeProfitPriceShort = entryPrice - takeProfitPips * syminfo.mintick

if (positionSide == "short" and close >= stopLossPriceShort)

strategy.close("Short", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "short" and enableTakeProfit and close <= takeProfitPriceShort)

strategy.close("Short", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""