Aperçu

Il s’agit d’une stratégie innovante de confirmation de tendance sans repérage de Heikin-Ashi, qui vise à résoudre le problème de la repérage de la stratégie de Heikin-Ashi dans la vue de trading traditionnelle. La stratégie offre une méthode de négociation plus fiable et plus transparente en calculant manuellement Heikin-Ashi et le mécanisme de confirmation de tendance multiple.

Principe de stratégie

Le principe de base de la stratégie comprend trois étapes clés:

Le calcul de l’équivalent de Haïkan Asif n’a pas été réalisé manuellement:

- Le prix de clôture, le prix d’ouverture, le prix le plus élevé et le prix le plus bas sont calculés à l’aide d’une formule unique.

- S’assurer que les données historiques des prix restent stables lors des mises à jour ultérieures de la ligne K

- Éviter les problèmes de redessinage fréquents dans les stratégies traditionnelles de Haïkanasi

Les tendances multiples sont confirmées:

- La demande de confirmation de la tendance par plusieurs chaînes

- Signal d’entrée de jeu: il faut une série d’X-Royces

- Signal d’entrée vide: besoin d’une série de baisses de la racine X

- Amélioration de la fiabilité des stratégies grâce à des filtres de confirmation multiples pour détecter les fausses alertes

Le modèle de transaction flexible:

- Soutenir le modèle traditionnel de suivi des tendances

- Offrir une option de reprise de tendance

- Modes de négociation personnalisables (tous, seulement plus, seulement vide)

Avantages stratégiques

- Élimination des problèmes de redimensionnement: les données historiques restent stables et les résultats de la rétroanalyse sont en parfaite harmonie avec l’exécution sur disque

- Confirmation de multiples tendances: réduire les transactions inutiles en filtrant les faux signaux en continu

- Hauteur personnalisable:

- Flexible pour les paramètres d’entrée et de sortie

- Aide au suivi de la tendance et au renversement de la tendance

- Ligne K standard masquable pour une visualisation plus claire

- Convient pour les transactions à moyen et à long terme: particulièrement adapté pour les transactions à oscillation et le suivi des tendances

Risque stratégique

Limites de fonctionnalité:

- Ne convient pas aux transactions à haute fréquence de scalping

- La performance pourrait être plus faible dans les marchés en chute libre où la tendance n’est pas évidente.

- Paramètres à ajuster pour différentes périodes

Contrôle des risques potentiels:

- Il est recommandé de mettre en place des mécanismes de prévention appropriés.

- Paramètres d’optimisation continue dans différentes conditions de marché

- Vérification croisée avec d’autres indicateurs techniques

Orientation de l’optimisation de la stratégie

Adaptation dynamique des paramètres:

- Développement d’algorithmes d’entrée et de sortie adaptatifs

- Adaptation en temps réel du nombre de coups consécutifs en fonction de la volatilité du marché

- Présentation des algorithmes d’apprentissage automatique pour optimiser la sélection des paramètres

Une meilleure gestion des risques:

- Gestion dynamique intégrée des positions

- Ajouter un filtre de pertinence

- Développer des mécanismes de freinage plus intelligents

Composé des indicateurs:

- En combinaison avec d’autres indicateurs techniques (comme le RSI, le MACD)

- Développement d’un système de vérification à plusieurs indicateurs

- Amélioration de la précision et de la fiabilité des signaux

Résumer

La stratégie de confirmation de tendance de repérage d’Afrique de l’Ouest offre aux traders un outil de négociation plus fiable et plus transparent grâce à des méthodes innovantes de calcul de la courbe et de confirmation de tendance multiple. La stratégie montre le potentiel d’innovation technologique dans le trading quantifié en éliminant les problèmes de repérage, en filtrant les faux signaux et en offrant un modèle de négociation flexible.

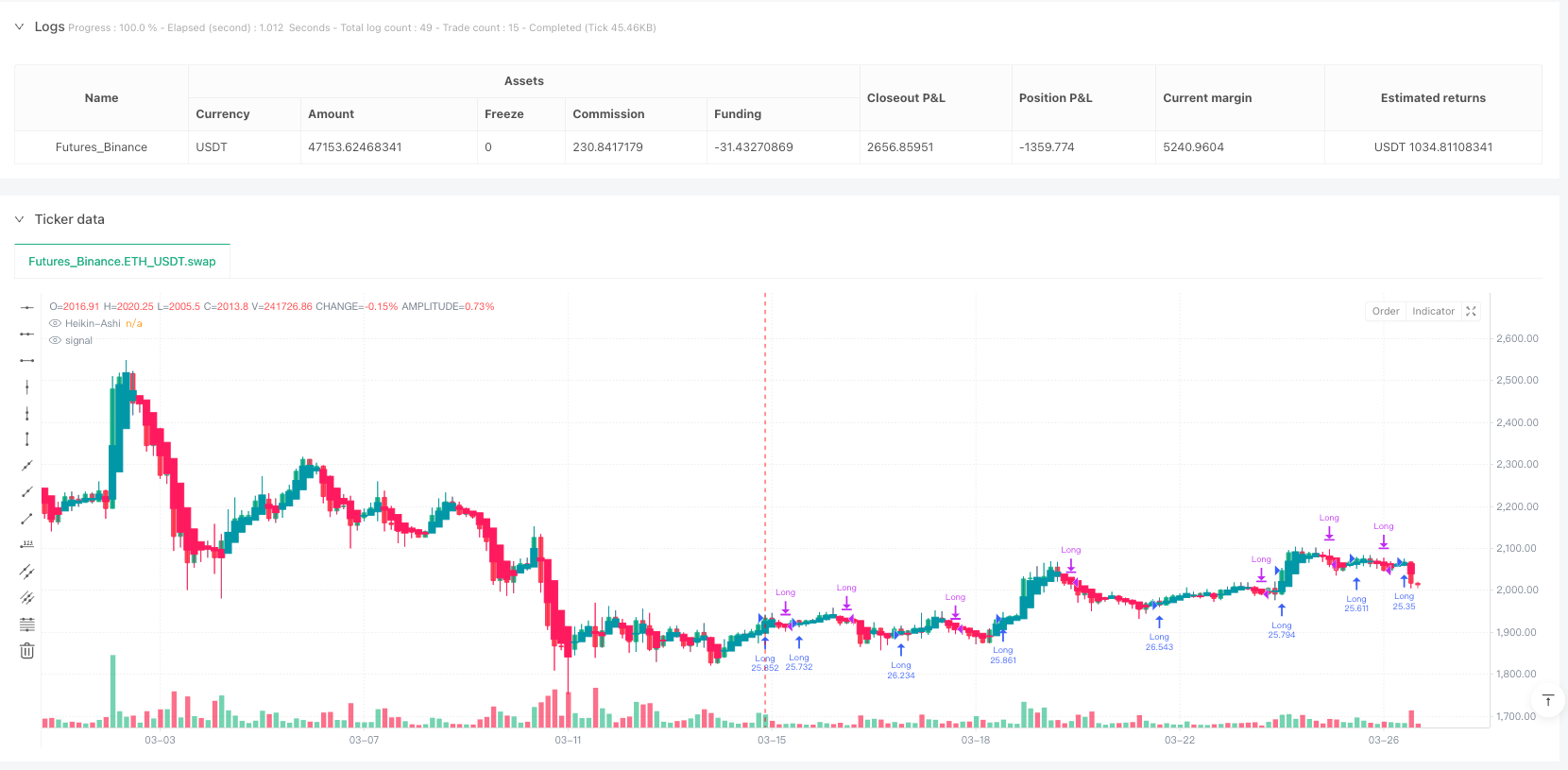

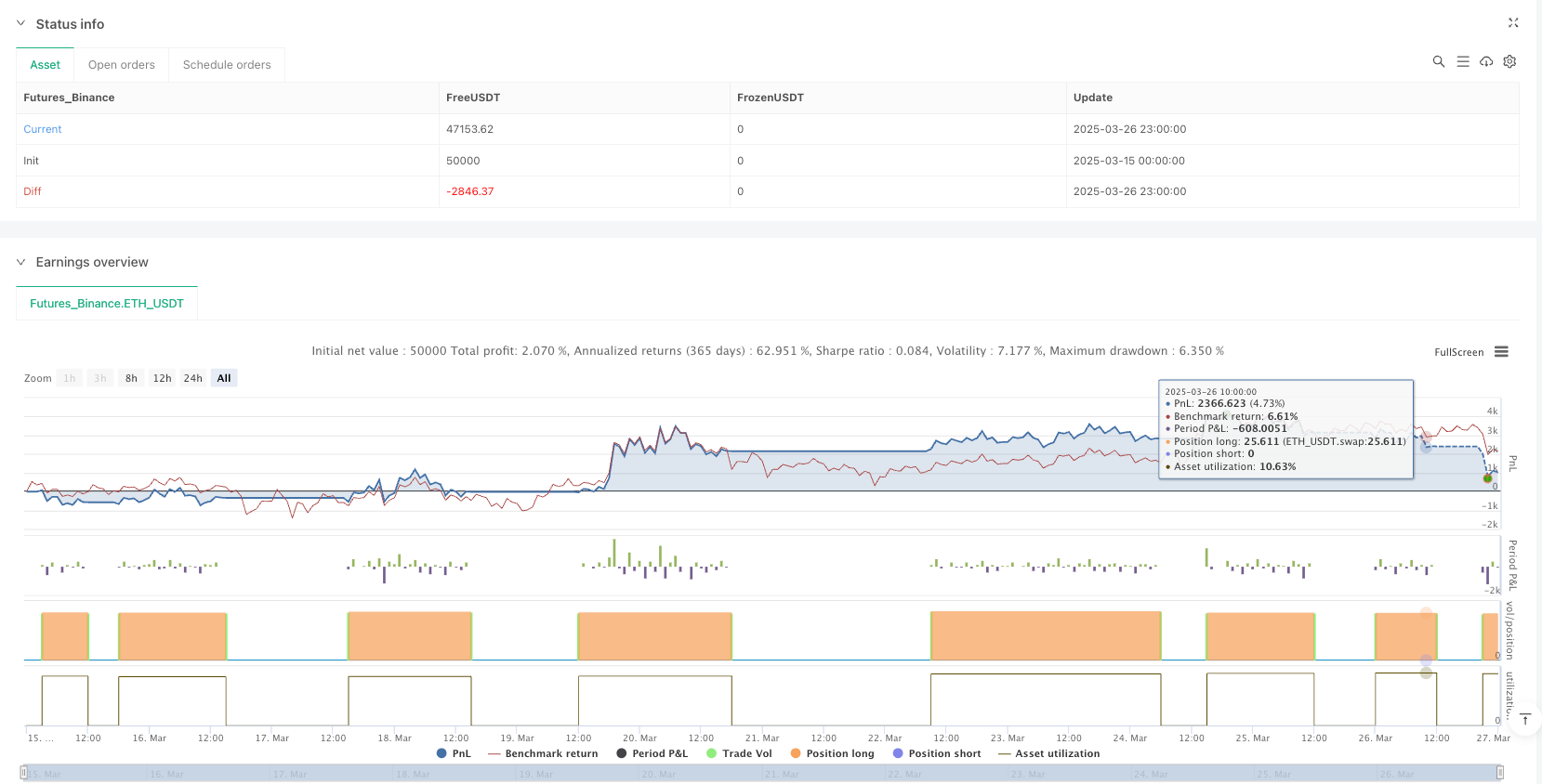

/*backtest

start: 2025-03-15 00:00:00

end: 2025-03-27 00:00:00

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

//© PineIndicators

strategy("Heikin-Ashi Non-Repainting Strategy [PineIndicators]", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, max_boxes_count=500, max_labels_count=500, max_lines_count=500, commission_value=0.01, process_orders_on_close=true, slippage= 2, behind_chart=false)

//====================================

// INPUTS

//====================================

// Number of consecutive candles required for entry and exit

openThreshold = input.int(title="Number of Candles for Entry", defval=2, minval=1)

exitThreshold = input.int(title="Number of Candles for Exit", defval=2, minval=1)

// Trade mode selection: "Long & Short", "Only Long", or "Only Short"

tradeMode = input.string(title="Trade Mode", defval="Only Long", options=["Long & Short", "Only Long", "Only Short"])

// Option to invert the trading logic (bullish signals become short signals, and vice versa)

invertTrades = input.bool(title="Invert Trading Logic (Long ↔ Short)", defval=false)

// Option to hide the standard candles (bodies only)

hideStandard = input.bool(title="Hide Standard Candles", defval=true)

// Heikin-Ashi transparency is fixed (0 = fully opaque)

heikinTransparency = 0

//====================================

// HIDE STANDARD CANDLES

//====================================

// Hide the body of the standard candles by setting them to 100% transparent.

// Note: The wicks of the standard candles cannot be hidden via code.

barcolor(hideStandard ? color.new(color.black, 100) : na)

//====================================

// HEIKIN-ASHI CALCULATION

//====================================

// Calculate Heikin-Ashi values manually

haClose = (open + high + low + close) / 4

var float haOpen = na

haOpen := na(haOpen[1]) ? (open + close) / 2 : (haOpen[1] + haClose[1]) / 2

haHigh = math.max(high, math.max(haOpen, haClose))

haLow = math.min(low, math.min(haOpen, haClose))

// Define colors for Heikin-Ashi candles (using fixed transparency)

bullColor = color.new(#0097a7, heikinTransparency)

bearColor = color.new(#ff195f, heikinTransparency)

//====================================

// PLOT HEIKIN-ASHI CANDLES

//====================================

// Plot the manually calculated Heikin-Ashi candles over the chart.

// The candle body, wicks, and borders will be colored based on whether the candle is bullish or bearish.

plotcandle(haOpen, haHigh, haLow, haClose, title="Heikin-Ashi",

color = haClose >= haOpen ? bullColor : bearColor,

wickcolor = haClose >= haOpen ? bullColor : bearColor,

bordercolor = haClose >= haOpen ? bullColor : bearColor,

force_overlay = true)

//====================================

// COUNT CONSECUTIVE TREND CANDLES

//====================================

// Count the number of consecutive bullish or bearish Heikin-Ashi candles.

var int bullishCount = 0

var int bearishCount = 0

if haClose > haOpen

bullishCount := bullishCount + 1

bearishCount := 0

else if haClose < haOpen

bearishCount := bearishCount + 1

bullishCount := 0

else

bullishCount := 0

bearishCount := 0

//====================================

// DEFINE ENTRY & EXIT SIGNALS

//====================================

// The signals are based on the number of consecutive trend candles.

// In normal logic: bullish candles trigger a long entry and bearish candles trigger a short entry.

// If invertTrades is enabled, the signals are swapped.

var bool longEntrySignal = false

var bool shortEntrySignal = false

var bool exitLongSignal = false

var bool exitShortSignal = false

if not invertTrades

longEntrySignal := bullishCount >= openThreshold

shortEntrySignal := bearishCount >= openThreshold

exitLongSignal := bearishCount >= exitThreshold

exitShortSignal := bullishCount >= exitThreshold

else

// Inverted logic: bullish candles trigger short entries and bearish candles trigger long entries.

longEntrySignal := bearishCount >= openThreshold

shortEntrySignal := bullishCount >= openThreshold

exitLongSignal := bullishCount >= exitThreshold

exitShortSignal := bearishCount >= exitThreshold

//====================================

// APPLY TRADE MODE RESTRICTIONS

//====================================

// If the user selects "Only Long", disable short signals (and vice versa).

if tradeMode == "Only Long"

shortEntrySignal := false

exitShortSignal := false

else if tradeMode == "Only Short"

longEntrySignal := false

exitLongSignal := false

//====================================

// TRADING STRATEGY LOGIC

//====================================

// Execute trades based on the calculated signals.

// If a long position is open:

if strategy.position_size > 0

if shortEntrySignal

strategy.close("Long", comment="Reverse Long")

strategy.entry("Short", strategy.short, comment="Enter Short")

else if exitLongSignal

strategy.close("Long", comment="Exit Long")

// If a short position is open:

if strategy.position_size < 0

if longEntrySignal

strategy.close("Short", comment="Reverse Short")

strategy.entry("Long", strategy.long, comment="Enter Long")

else if exitShortSignal

strategy.close("Short", comment="Exit Short")

// If no position is open:

if strategy.position_size == 0

if longEntrySignal

strategy.entry("Long", strategy.long, comment="Enter Long")

else if shortEntrySignal

strategy.entry("Short", strategy.short, comment="Enter Short")