Aperçu

Cet article présente une stratégie de trading composite qui combine les Bollinger Bands et les indicateurs SuperTrend. Cette stratégie vise à fournir des signaux d’entrée et de sortie plus précis, tout en réduisant le risque de trading, en intégrant plusieurs outils d’analyse technique.

Principe de stratégie

Le cœur de la stratégie se compose de deux composants principaux: les bandes de Bollinger et l’indicateur SuperTrend.

- Le calcul de la ceinture de Brin:

- La ligne de référence est calculée à l’aide d’une moyenne mobile configurable (MA)

- Génération d’une orbite ascendante et descendante selon le multiple de la différence standard

- Prise en charge de plusieurs types de moyennes mobiles: moyennes mobiles simples (SMA), moyennes mobiles indicielles (EMA), moyennes mobiles lisses (SMMA), moyennes mobiles pondérées (WMA) et moyennes mobiles pondérées en volume (VWMA)

- Le blogueur a également publié un article sur le sujet.

- Le stop loss est calculé en utilisant la plage de fluctuation réelle moyenne (ATR)

- Dynamique pour juger de la direction des tendances du marché

- Générer des signaux d’achat et de vente en fonction des variations de la tendance

Avantages stratégiques

- Combinaison de plusieurs indicateurs: amélioration de l’exactitude du signal en combinant les bandes de Brin et les supertrends

- Configuration flexible: type de moyenne mobile, paramètres et méthodes de calcul personnalisables

- Stop-loss dynamique: un mécanisme de stop-loss basé sur l’ATR permet de contrôler efficacement le risque

- Augmentation visuelle: fournit le remplissage de l’état de tendance et les balises de signal

- Gestion des risques: mise en place d’une gestion des pourcentages de position et d’une limite de négociation pyramidale

Risque stratégique

- Sensitivité des paramètres: les paramètres peuvent nécessiter des ajustements fréquents dans différents environnements de marché

- Limitations de la rétroaction: les performances historiques ne sont pas représentatives des performances futures du marché

- Risque de commutation multiple: le changement fréquent de position peut augmenter les coûts de transaction

- Légèreté des indicateurs: les indicateurs techniques présentent un certain retard de signal

Orientation de l’optimisation de la stratégie

- Paramètres d’optimisation dynamique pour les algorithmes d’apprentissage automatique

- Ajout de conditions de filtrage supplémentaires, telles que la confirmation de la livraison

- Développement d’un mécanisme de vérification à plusieurs périodes

- Optimisation du module de gestion des risques et introduction de stratégies de contrôle des positions plus précises

Résumer

Il s’agit d’une stratégie de négociation qui combine plusieurs indicateurs dynamiques et offre un système de signaux de négociation relativement complet grâce à une combinaison de bandes de Brent et de supertrends. Le cœur de la stratégie est d’équilibrer la précision des signaux et la gestion des risques, mais elle nécessite toujours une optimisation et une adaptation continues en fonction des différentes conditions du marché.

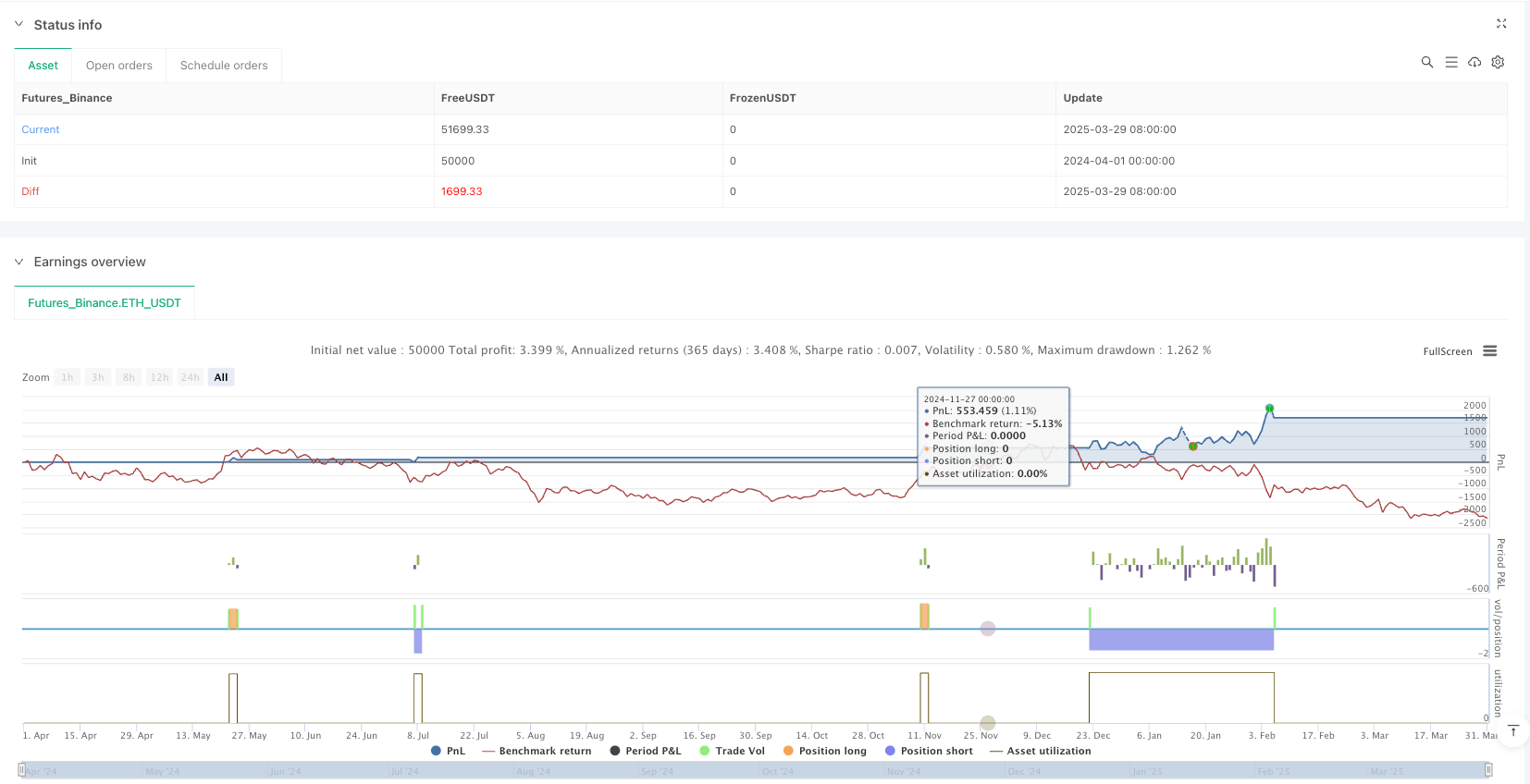

/*backtest

start: 2024-04-01 00:00:00

end: 2025-03-31 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Combined BB & New SuperTrend Strategy", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10, pyramiding=0)

//============================

// Bollinger Bands Parameters

//============================

lengthBB = input.int(20, minval=1, title="BB Length")

maType = input.string("SMA", "BB Basis MA Type", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

srcBB = input(close, title="BB Source")

multBB = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev Multiplier")

offsetBB = input.int(0, title="BB Offset", minval=-500, maxval=500)

// Moving average function based on chosen type

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

// Bollinger Bands calculations

basis = ma(srcBB, lengthBB, maType)

dev = multBB * ta.stdev(srcBB, lengthBB)

upperBB = basis + dev

lowerBB = basis - dev

// Plot Bollinger Bands

plot(basis, title="BB Basis", color=color.blue, offset=offsetBB)

p1 = plot(upperBB, title="BB Upper", color=color.red, offset=offsetBB)

p2 = plot(lowerBB, title="BB Lower", color=color.green, offset=offsetBB)

fill(p1, p2, title="BB Fill", color=color.new(color.blue, 90))

//============================

// New SuperTrend Parameters & Calculations

// (Based on the new script you provided)

//============================

st_length = input.int(title="ATR Period", defval=22)

st_mult = input.float(title="ATR Multiplier", step=0.1, defval=3)

st_src = input.source(title="SuperTrend Source", defval=hl2)

st_wicks = input.bool(title="Take Wicks into Account?", defval=true)

st_showLabels = input.bool(title="Show Buy/Sell Labels?", defval=true)

st_highlightState = input.bool(title="Highlight State?", defval=true)

// Calculate ATR component for SuperTrend

st_atr = st_mult * ta.atr(st_length)

// Price selection based on wicks option

st_highPrice = st_wicks ? high : close

st_lowPrice = st_wicks ? low : close

st_doji4price = (open == close and open == low and open == high)

// Calculate SuperTrend stop levels

st_longStop = st_src - st_atr

st_longStopPrev = nz(st_longStop[1], st_longStop)

if st_longStop > 0

if st_doji4price

st_longStop := st_longStopPrev

else

st_longStop := (st_lowPrice[1] > st_longStopPrev ? math.max(st_longStop, st_longStopPrev) : st_longStop)

else

st_longStop := st_longStopPrev

st_shortStop = st_src + st_atr

st_shortStopPrev = nz(st_shortStop[1], st_shortStop)

if st_shortStop > 0

if st_doji4price

st_shortStop := st_shortStopPrev

else

st_shortStop := (st_highPrice[1] < st_shortStopPrev ? math.min(st_shortStop, st_shortStopPrev) : st_shortStop)

else

st_shortStop := st_shortStopPrev

// Determine trend direction: 1 for bullish, -1 for bearish

var int st_dir = 1

st_dir := st_dir == -1 and st_highPrice > st_shortStopPrev ? 1 : st_dir == 1 and st_lowPrice < st_longStopPrev ? -1 : st_dir

// Define colors for SuperTrend

st_longColor = color.green

st_shortColor = color.red

// Plot SuperTrend stops

st_longStopPlot = plot(st_dir == 1 ? st_longStop : na, title="Long Stop", style=plot.style_line, linewidth=2, color=st_longColor)

st_shortStopPlot = plot(st_dir == -1 ? st_shortStop : na, title="Short Stop", style=plot.style_line, linewidth=2, color=st_shortColor)

// Generate SuperTrend signals based on direction change

st_buySignal = st_dir == 1 and st_dir[1] == -1

st_sellSignal = st_dir == -1 and st_dir[1] == 1

// Optionally plot labels for buy/sell signals

if st_buySignal and st_showLabels

label.new(bar_index, st_longStop, "Buy", style=label.style_label_up, color=st_longColor, textcolor=color.white, size=size.tiny)

if st_sellSignal and st_showLabels

label.new(bar_index, st_shortStop, "Sell", style=label.style_label_down, color=st_shortColor, textcolor=color.white, size=size.tiny)

// Fill the state area (optional visual enhancement)

st_midPricePlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=1, display=display.none)

st_longFillColor = st_highlightState ? (st_dir == 1 ? st_longColor : na) : na

st_shortFillColor = st_highlightState ? (st_dir == -1 ? st_shortColor : na) : na

fill(st_midPricePlot, st_longStopPlot, title="Long State Filling", color=st_longFillColor)

fill(st_midPricePlot, st_shortStopPlot, title="Short State Filling", color=st_shortFillColor)

//============================

// Trading Logic

//============================

// When a bullish reversal occurs, close any short position before entering long.

if st_buySignal

strategy.close("Short")

strategy.entry("Long", strategy.long)

// When a bearish reversal occurs, close any long position before entering short.

if st_sellSignal

strategy.close("Long")

strategy.entry("Short", strategy.short)

// Exit conditions using Bollinger Bands:

// - For a long position: exit if price reaches (or exceeds) the upper Bollinger Band.

// - For a short position: exit if price reaches (or falls below) the lower Bollinger Band.

if strategy.position_size > 0 and close >= upperBB

strategy.close("Long", comment="Exit Long via BB Upper")

if strategy.position_size < 0 and close <= lowerBB

strategy.close("Short", comment="Exit Short via BB Lower")