Aperçu

Il s’agit d’une stratégie innovante d’indicateur de choc KDJ à cadres multi-temps, conçue pour fournir des signaux de trading plus précis et plus flexibles en ajustant dynamiquement les paramètres de l’indicateur et en analysant les tendances du marché sur plusieurs périodes. La stratégie, combinant le calcul de la longueur basée sur la volatilité, l’allocation de poids sur plusieurs périodes et le jugement de la tendance à cadres multiples, fournit aux traders un outil d’analyse complexe et puissant.

Principe de stratégie

Les principes centraux de la stratégie comprennent les technologies clés suivantes:

- Analyse de plusieurs périodes: trois périodes simultanées de 1, 5 et 15 minutes

- Calcul de la longueur de swing adaptative: paramètres de l’indicateur ajustés dynamiquement en fonction des fluctuations du taux de marché

- Allocation de poids dynamique: allocation de différents facteurs de poids pour différentes périodes

- Mécanisme de jugement de tendance: déterminer la direction de la tendance du marché en calculant la moyenne du smooth AvgTotal

- Génération de signaux intelligents: combinaison de signaux principaux et de signaux attendus pour une meilleure précision du signal

Avantages stratégiques

- Une grande flexibilité: un cadre de temps et une configuration de poids personnalisables

- Adaptabilité dynamique: les paramètres de l’indicateur sont ajustés en fonction des fluctuations du marché

- Analyse multidimensionnelle: intégrer des informations à plusieurs périodes

- Signal à basse latence: contient le signal principal et le signal attendu

- Filtrage de tendance intégré: réduire les fausses alertes dans des conditions de marché défavorables

Risque stratégique

- Risque de suradaptation des paramètres

- La complexité des signaux peut être augmentée par plusieurs périodes.

- La fiabilité du signal peut être réduite dans des conditions de marché extrêmes

- Signal de vérification de l’indicateur de confirmation supplémentaire requis

Orientation de l’optimisation de la stratégie

- Introduction d’un algorithme d’apprentissage automatique qui modifie dynamiquement le poids

- Ajout de conditions de filtrage supplémentaires

- Optimisation des mécanismes de couverture

- Le développement de l’adaptation entre les espèces

Résumer

Le cadre multi-temps s’adapte à la stratégie de l’indicateur de choc KDJ par une conception innovante, offrant aux traders un outil d’analyse de marché flexible, dynamique et multidimensionnel, avec un avantage technique significatif et un potentiel d’amélioration de la performance.

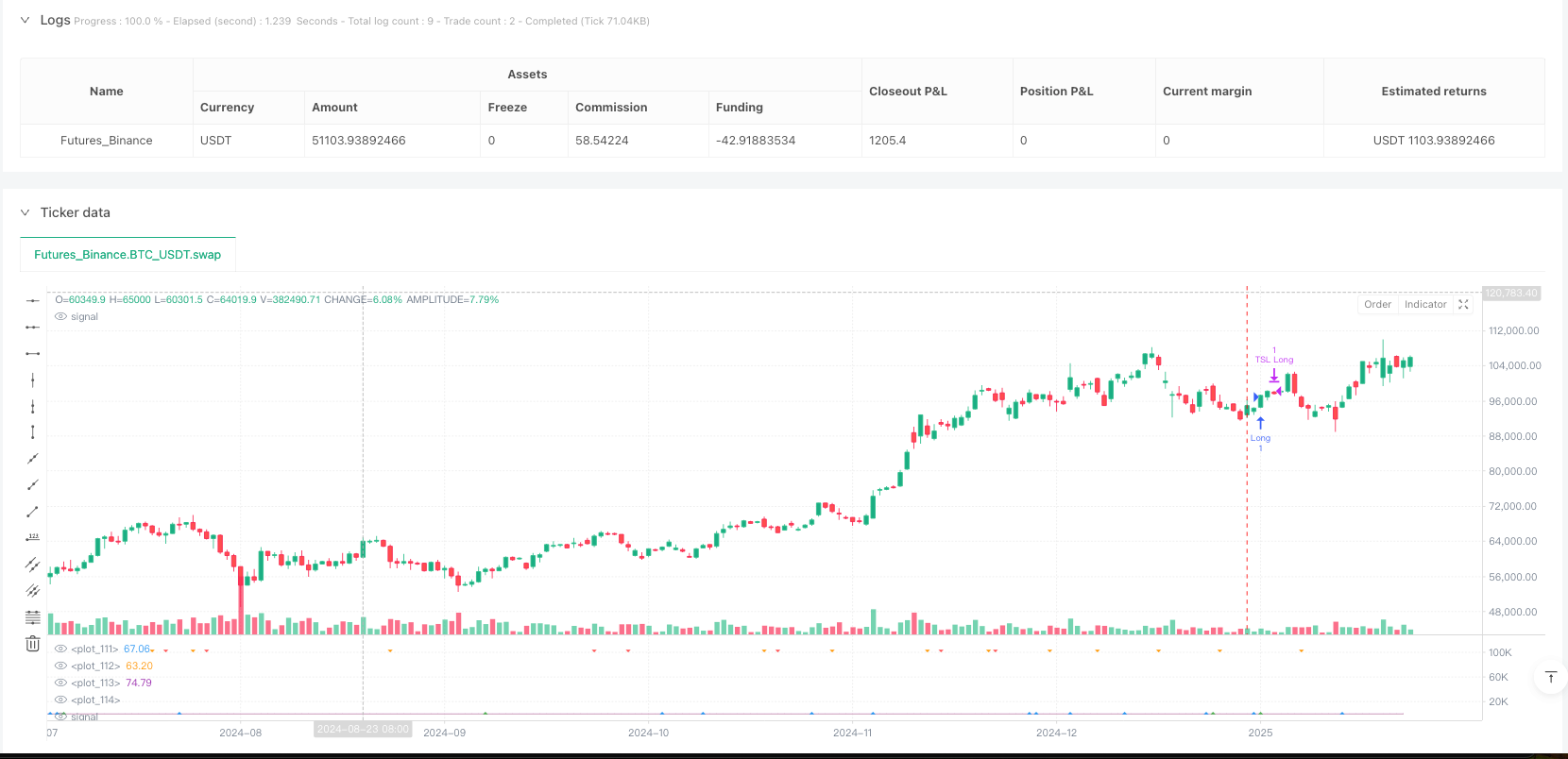

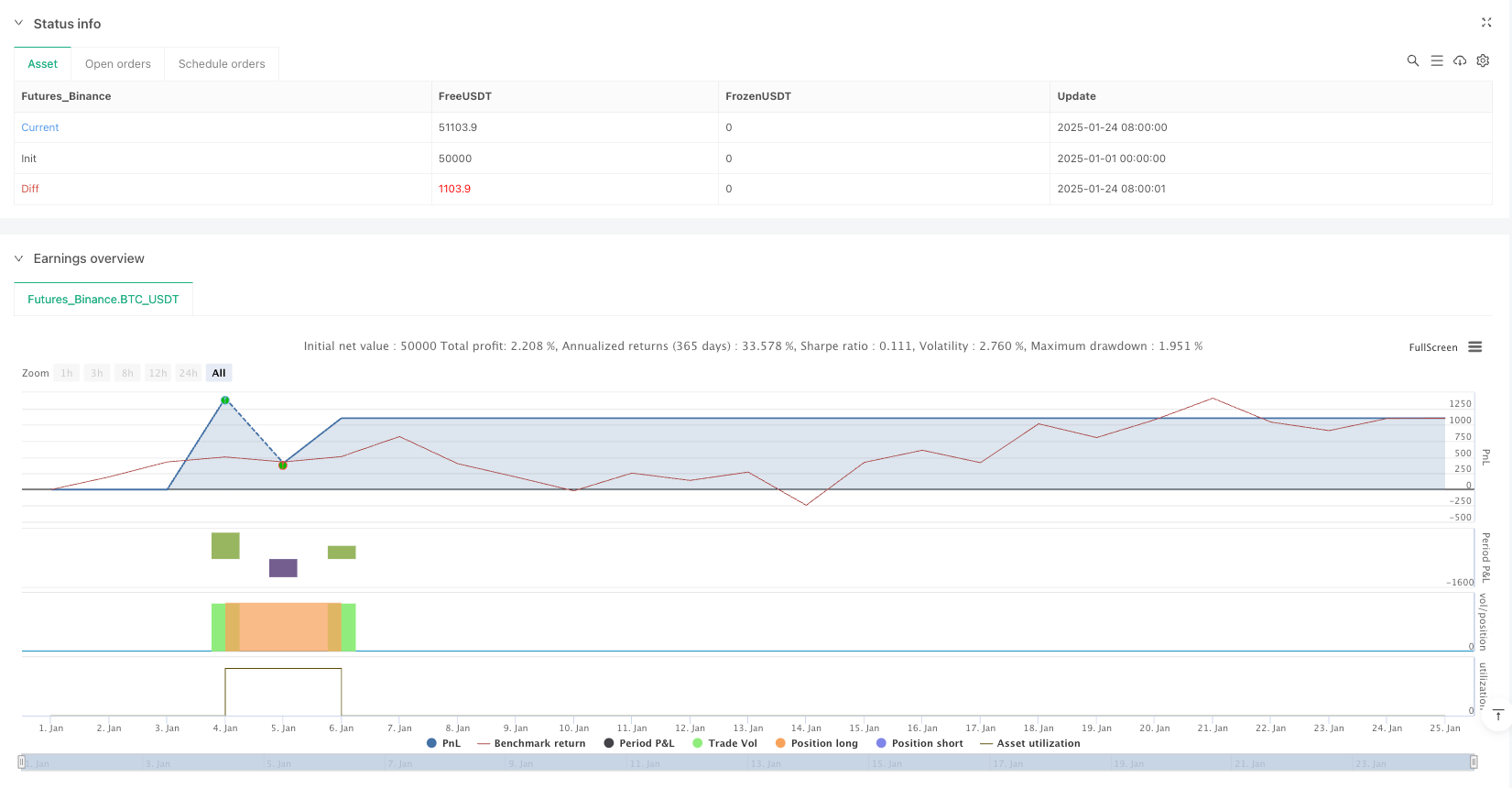

/*backtest

start: 2025-01-01 00:00:00

end: 2025-01-25 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ is subject to the Mozilla Public License 2.0 (https://mozilla.org/MPL/2.0/)

// © Lausekopf

//@version=5

strategy("Adaptive KDJ (MTF)", overlay=false)

// Dropdown for the swing length calculation method

method = input.int(1, title="Calculation Method", options=[1, 2, 3], tooltip="1: Volatility Based\n2: Inverse Volatility\n3: Fixed Length")

// Fixed length for method 3

fixedLength = input.int(9, title="Fixed KDJ Length", minval=3, maxval=15)

// Timeframes

tf1 = input.timeframe("1", title="Timeframe 1")

tf2 = input.timeframe("5", title="Timeframe 2")

tf3 = input.timeframe("15", title="Timeframe 3")

// Timeframe weighting

weightOption = input.int(1, title="Timeframe Weighting", options=[1, 2, 3, 4, 5])

weightTF1 = weightOption == 1 ? 0.5 : weightOption == 2 ? 0.4 : weightOption == 3 ? 0.33 : weightOption == 4 ? 0.2 : 0.1

weightTF2 = 0.33

weightTF3 = 1.0 - (weightTF1 + weightTF2)

// EMA smoothing length

smoothingLength = input.int(5, title="EMA Smoothing Length", minval=1, maxval=50)

// Trend calculation period

trendLength = input.int(40, title="Trend Calculation Period", minval=5, maxval=50)

// KDJ function

f_kdj(len, srcHigh, srcLow, srcClose) =>

roundedLen = int(math.round(len))

high_max = ta.highest(srcHigh, roundedLen)

low_min = ta.lowest(srcLow, roundedLen)

rsv = 100 * (srcClose - low_min) / (high_max - low_min)

k = ta.sma(rsv, 3)

d = ta.sma(k, 3)

j = 3 * k - 2 * d

[k, d, j]

// Swing length function

f_swingLength(tf) =>

atrLen = 14

volatility = request.security(syminfo.tickerid, tf, ta.atr(atrLen) / close)

var float length = na

if method == 1

length := volatility > 0.03 ? 3 : volatility > 0.002 ? 14 : 15

if method == 2

length := 18

if method == 3

length := fixedLength

length

// Calculate swing lengths for each timeframe

swingLength1 = f_swingLength(tf1)

swingLength2 = f_swingLength(tf2)

swingLength3 = f_swingLength(tf3)

// Calculate KDJ values

[k1, d1, j1] = f_kdj(swingLength1, request.security(syminfo.tickerid, tf1, high), request.security(syminfo.tickerid, tf1, low), request.security(syminfo.tickerid, tf1, close))

[k2, d2, j2] = f_kdj(swingLength2, request.security(syminfo.tickerid, tf2, high), request.security(syminfo.tickerid, tf2, low), request.security(syminfo.tickerid, tf2, close))

[k3, d3, j3] = f_kdj(swingLength3, request.security(syminfo.tickerid, tf3, high), request.security(syminfo.tickerid, tf3, low), request.security(syminfo.tickerid, tf3, close))

// Weighted averages

avgK = (k1 * weightTF1 + k2 * weightTF2 + k3 * weightTF3)

avgD = (d1 * weightTF1 + d2 * weightTF2 + d3 * weightTF3)

avgJ = (j1 * weightTF1 + j2 * weightTF2 + j3 * weightTF3)

smoothAvgK = ta.ema(avgK, smoothingLength)

smoothAvgD = ta.ema(avgD, smoothingLength)

smoothAvgJ = ta.ema(avgJ, smoothingLength)

smoothAvgTotal = ta.ema((avgK + avgD + avgJ) / 3, smoothingLength)

// Trend determination

trendAvg = ta.sma(smoothAvgTotal, trendLength)

isUptrend = trendAvg > 60

isDowntrend = trendAvg < 40

// Dynamic signal thresholds

buyLevel = isUptrend ? 40 : isDowntrend ? 15 : 25

sellLevel = isUptrend ? 85 : isDowntrend ? 60 : 75

// Buy/Sell signals

buySignal = smoothAvgJ < buyLevel and ta.crossover(smoothAvgK, smoothAvgD)

sellSignal = smoothAvgJ > sellLevel and ta.crossunder(smoothAvgK, smoothAvgD)

// Anticipated signals

anticipateBuy = (smoothAvgK - smoothAvgK[1]) > 0 and (smoothAvgD - smoothAvgD[1]) < 0 and math.abs(smoothAvgK - smoothAvgD) < 5

anticipateSell = (smoothAvgK - smoothAvgK[1]) < 0 and (smoothAvgD - smoothAvgD[1]) > 0 and math.abs(smoothAvgK - smoothAvgD) < 5

// Entry conditions

longEntryCondition = (buySignal or anticipateBuy) and smoothAvgTotal < 22

shortEntryCondition = (sellSignal or anticipateSell) and smoothAvgTotal > 78

// Entry orders

strategy.entry("Long", strategy.long, when=longEntryCondition)

strategy.entry("Short", strategy.short, when=shortEntryCondition)

// Trailing Stop-Loss

atrMultiplierTSL = 2.5

atrValueTSL = ta.atr(12) * atrMultiplierTSL

strategy.exit("TSL Long", from_entry="Long", trail_points=atrValueTSL / syminfo.mintick, stop=open * 0.9972)

strategy.exit("TSL Short", from_entry="Short", trail_points=atrValueTSL / syminfo.mintick, stop=open * 1.0028)

// Plot signals

plotshape(series=buySignal, location=location.bottom, style=shape.triangleup, color=color.green, size=size.small)

plotshape(series=sellSignal, location=location.top, style=shape.triangledown, color=color.red, size=size.small)

plotshape(series=anticipateBuy, location=location.bottom, style=shape.triangleup, color=color.blue, size=size.tiny, offset=-1)

plotshape(series=anticipateSell, location=location.top, style=shape.triangledown, color=color.orange, size=size.tiny, offset=-1)

// Plot KDJ lines

plot(smoothAvgK, color=color.blue, linewidth=1)

plot(smoothAvgD, color=color.orange, linewidth=1)

plot(smoothAvgJ, color=color.purple, linewidth=1)

plot(smoothAvgTotal, color=color.white, linewidth=1)

// Alert for impending signals

alertcondition(anticipateBuy or anticipateSell, title='Impending KDJ Crossover', message='Possible KDJ crossover detected!')

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Lausekopf