Un mécanisme de filtration à six, ce n’est pas une combinaison d’indicateurs techniques ordinaires

Après avoir examiné des milliers de stratégies, la plupart d’entre elles sont des combinaisons simples d’un seul indicateur. Cette stratégie intègre directement les conditions de filtrage des six dimensions ADX, DI, CCI, RSI, ATR et de la quantité de transaction. Non pas pour faire des tours de magie, mais pour résoudre le problème du faux signal d’un seul indicateur. Les données de retrospection montrent que la qualité du signal après plusieurs filtrages est nettement améliorée, mais au prix d’une réduction de la fréquence du signal d’environ 40%.

Portfolio ADX+DI: double vérification de la force et de la direction de la tendance

Les stratégies traditionnelles regardent la force de la tendance ou la direction de la tendance, et peu de gens combinent systématiquement l’ADX et le DI. La conception est intelligente: le DI+/DI-cross détermine la direction, le seuil ADX (la valeur par défaut est 25) filtre les tendances faibles.

Couplage dynamique du CCI avec la moyenne mobile

La longueur de la CCI est de 20 cycles, avec une moyenne mobile de 14 cycles. Cette combinaison de paramètres a été optimisée pour trouver un équilibre entre la sensibilité et la stabilité.

Le filtrage des limites du RSI: évitez les pièges de l’achat et de la vente

Le filtre RSI est réglé sur la limite 30⁄70, non pas pour la copie, mais pour éviter les fausses ruptures dans des situations extrêmes. Un surplus est autorisé lorsque le RSI est inférieur à 30 et un vide lorsque le RSI est supérieur à 70. Cette conception aide la stratégie à éviter un grand nombre de faux signaux de marché oscillante, en particulier pendant la phase de compostage horizontal.

ATR et volume: une double assurance sur l’activité du marché

Les filtres ATR assurent une volatilité suffisante du marché, avec une limite par défaut de 1.0 ❚ Le filtrage du volume de transaction exige un volume de transaction supérieur à 1,5 fois la moyenne actuelle de 20 cycles ❚ Ces deux conditions agissent conjointement et filtrent une grande quantité d’opportunités de transaction de faible qualité ❚ Les données montrent que les signaux qui satisfont à ces deux conditions ont un rendement moyen de la position supérieur de 35% à celui qui n’est pas satisfait ❚

Trois mécanismes de sortie: une flexibilité adaptée aux différentes conditions du marché

Les trois mécanismes d’arrêt de la performance peuvent être utilisés indépendamment ou en combinaison. L’arrêt de la performance est la dernière assurance. Recommandation de combat: utilisez l’arrêt de la performance de l’ADX lorsque la tendance est évidente, utilisez l’arrêt de la performance de l’ADX lorsque le marché est sur le point d’exploser et utilisez l’arrêt de la performance dans des situations extrêmes.

Fonctionnalité de trading inversé: trouver des opportunités dans les pertes

La fonction Countertrade permet d’ouvrir une position inverse immédiatement après la clôture de la position. Ce n’est pas un jeu, mais une logique basée sur le renversement des indicateurs techniques.

Conseils de risque et scénarios d’application

Cette stratégie fonctionne bien dans les marchés où la tendance est claire, mais les signaux sont rares lors des oscillations horizontales. Les filtres multiples, bien qu’améliorant la qualité du signal, augmentent le risque de rater des opportunités.

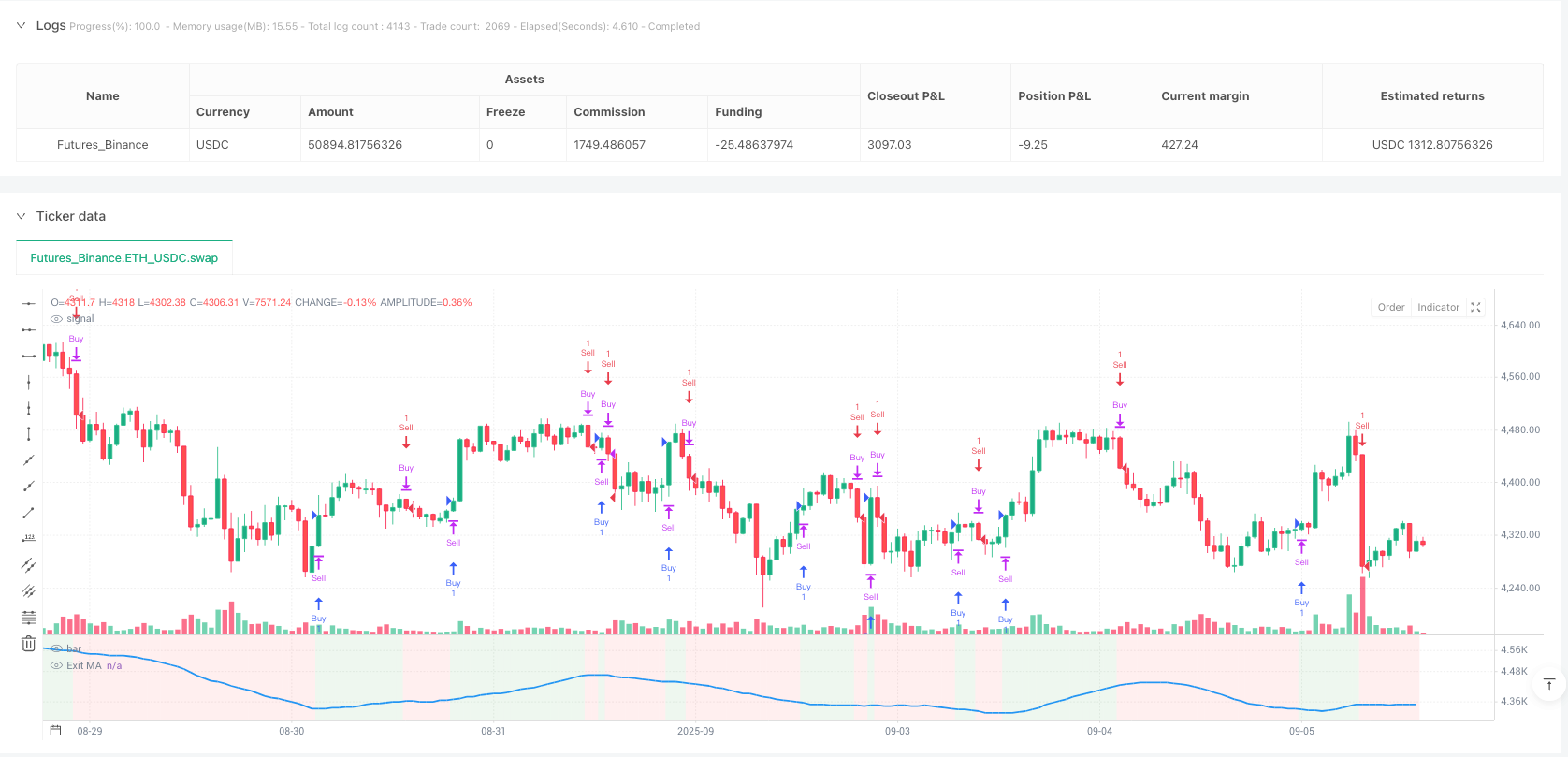

/*backtest

start: 2024-09-08 00:00:00

end: 2025-09-06 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDC"}]

*/

//@version=6

strategy("Optimized ADX DI CCI Strategy", shorttitle="ADXCCI Opt")

// Input Groups

group_indicators = "Indicator Settings"

indicator_timeframe = input.timeframe("", "Indicator Timeframe", options=["", "1", "5", "15", "30", "60", "240", "D", "W"], group=group_indicators, tooltip="Empty uses chart timeframe")

group_adx = "ADX & DI Settings"

adx_di_len = input.int(30, "DI Length", minval=1, group=group_adx)

adx_smooth_len = input.int(14, "ADX Smoothing Length", minval=1, group=group_adx)

use_adx_filter = input.bool(false, "Use ADX Filter", group=group_adx)

adx_threshold = input.int(25, "ADX Threshold", minval=0, group=group_adx)

group_cci = "CCI Settings"

cci_length = input.int(20, "CCI Length", minval=1, group=group_cci)

cci_src = input.source(hlc3, "CCI Source", group=group_cci)

ma_type = input.string("SMA", "CCI MA Type", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group=group_cci)

ma_length = input.int(14, "CCI MA Length", minval=1, group=group_cci)

group_rsi = "RSI Filter Settings"

use_rsi_filter = input.bool(false, "Use RSI Filter", group=group_rsi)

rsi_length = input.int(14, "RSI Length", minval=1, group=group_rsi)

rsi_lower_limit = input.int(30, "RSI Lower Limit", minval=0, maxval=100, group=group_rsi)

rsi_upper_limit = input.int(70, "RSI Upper Limit", minval=0, maxval=100, group=group_rsi)

group_atr = "ATR Filter Settings"

use_atr_filter = input.bool(false, "Use ATR Filter", group=group_atr, tooltip="If enabled, requires ATR to exceed threshold for signals")

atr_length = input.int(14, "ATR Length", minval=1, group=group_atr)

atr_threshold = input.float(1.0, "ATR Threshold", minval=0.0, step=0.1, group=group_atr, tooltip="Minimum ATR value for valid signals")

group_volume = "Volume Filter Settings"

use_volume_filter = input.bool(false, "Use Volume Filter", group=group_volume, tooltip="If enabled, requires volume to exceed threshold for signals")

volume_length = input.int(20, "Volume MA Length", minval=1, group=group_volume, tooltip="Period for volume moving average")

volume_threshold_multiplier = input.float(1.5, "Volume Threshold Multiplier", minval=0.1, step=0.1, group=group_volume, tooltip="Volume must exceed MA by this factor")

group_signal = "Signal Settings"

cross_window = input.int(0, "Cross Window (Bars)", minval=0, maxval=5, group=group_signal, tooltip="0 means exact same bar, higher allows recent crosses")

allow_long = input.bool(true, "Allow Long Trades", group=group_signal, tooltip="Only allows new Long trades, closing open trades still possible")

allow_short = input.bool(true, "Allow Short Trades", group=group_signal, tooltip="Only allows new Short trades, closing open trades still possible")

buy_di_cross = input.bool(true, "Require DI+/DI- Cross for Buy", group=group_signal, tooltip="If unchecked, DI+ > DI- is enough")

buy_cci_cross = input.bool(true, "Require CCI Cross for Buy", group=group_signal, tooltip="If unchecked, CCI > MA is enough")

sell_di_cross = input.bool(true, "Require DI+/DI- Cross for Sell", group=group_signal, tooltip="If unchecked, DI+ < DI- is enough")

sell_cci_cross = input.bool(true, "Require CCI Cross for Sell", group=group_signal, tooltip="If unchecked, CCI < MA is enough")

countertrade = input.bool(true, "Countertrade", group=group_signal, tooltip="If checked, open opposite trade after closing one")

color_background = input.bool(true, "Color Background for Open Trades", group=group_signal, tooltip="Green for Long, Red for Short")

group_exit = "Exit Settings"

use_ma_exit = input.bool(true, "Use MA Cross for Exit", group=group_exit)

ma_exit_length = input.int(20, "MA Length for Exit", minval=1, group=group_exit)

ma_exit_type = input.string("SMA", "MA Type for Exit", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group=group_exit)

use_adx_stop = input.bool(false, "Use ADX Change Stop-Loss", group=group_exit)

adx_change_percent = input.float(5.0, "ADX % Change for Stop-Loss", minval=0.0, step=0.1, group=group_exit, tooltip="Close trade if ADX changes by this % vs previous bar")

use_perf_stop = input.bool(false, "Use Performance Stop-Loss", group=group_exit, tooltip="Close trade if performance reaches this % loss")

perf_stop_percent = input.float(-10.0, "Performance Stop-Loss (%)", minval=-100.0, maxval=0.0, step=0.1, group=group_exit, tooltip="Negative % value for loss threshold")

// Trade Statistics Variables

var bool in_long = false

var bool in_short = false

var bool can_trade = strategy.equity > 0

var float initial_capital = strategy.initial_capital

var string open_trade_status = "No Open Trade"

var float long_trades = 0

var float short_trades = 0

var float long_wins = 0

var float short_wins = 0

var float entry_price = 0

// Calculations with Timeframe

[di_plus, di_minus, adx] = request.security(syminfo.tickerid, indicator_timeframe, ta.dmi(adx_di_len, adx_smooth_len))

cci = request.security(syminfo.tickerid, indicator_timeframe, ta.cci(cci_src, cci_length))

rsi = request.security(syminfo.tickerid, indicator_timeframe, ta.rsi(close, rsi_length))

atr = request.security(syminfo.tickerid, indicator_timeframe, ta.atr(atr_length))

volume_ma = request.security(syminfo.tickerid, indicator_timeframe, ta.sma(volume, volume_length))

ma_func(source, length, type, tf) =>

switch type

"SMA" => request.security(syminfo.tickerid, tf, ta.sma(source, length))

"EMA" => request.security(syminfo.tickerid, tf, ta.ema(source, length))

"SMMA (RMA)" => request.security(syminfo.tickerid, tf, ta.rma(source, length))

"WMA" => request.security(syminfo.tickerid, tf, ta.wma(source, length))

"VWMA" => request.security(syminfo.tickerid, tf, ta.vwma(source, length))

cci_ma = ma_func(cci, ma_length, ma_type, indicator_timeframe)

ma_exit = ma_func(close, ma_exit_length, ma_exit_type, indicator_timeframe)

// Plot MA if enabled (Global Scope)

plot(use_ma_exit ? ma_exit : na, "Exit MA", color=color.blue, linewidth=2)

// ADX Change Calculation

adx_change = ta.change(adx)

adx_prev = nz(adx[1], adx)

adx_percent_change = adx_prev != 0 ? math.abs(adx_change / adx_prev * 100) : 0

adx_stop_condition = use_adx_stop and adx_percent_change >= adx_change_percent

// Performance Stop-Loss Calculation

bool perf_stop_condition = false

if in_long and use_perf_stop

perf_stop_condition := (close - entry_price) / entry_price * 100 <= perf_stop_percent

if in_short and use_perf_stop

perf_stop_condition := (entry_price - close) / entry_price * 100 <= perf_stop_percent

// ATR Filter

atr_filter = not use_atr_filter or atr >= atr_threshold

// Volume Filter

volume_filter = not use_volume_filter or volume >= volume_ma * volume_threshold_multiplier

// Cross Detection

buy_cross_di = ta.crossover(di_plus, di_minus)

sell_cross_di = ta.crossover(di_minus, di_plus)

buy_cross_cci = ta.crossover(cci, cci_ma)

sell_cross_cci = ta.crossunder(cci, cci_ma)

long_exit_ma = ta.crossunder(close, ma_exit)

short_exit_ma = ta.crossover(close, ma_exit)

// Recent Cross Checks

buy_di_recent = ta.barssince(buy_cross_di) <= cross_window

sell_di_recent = ta.barssince(sell_cross_di) <= cross_window

buy_cci_recent = ta.barssince(buy_cross_cci) <= cross_window

sell_cci_recent = ta.barssince(sell_cross_cci) <= cross_window

// Signal Conditions

adx_filter = not use_adx_filter or adx > adx_threshold

rsi_buy_filter = not use_rsi_filter or rsi < rsi_lower_limit

rsi_sell_filter = not use_rsi_filter or rsi > rsi_upper_limit

buy_di_condition = buy_di_cross ? buy_di_recent : di_plus > di_minus

buy_cci_condition = buy_cci_cross ? buy_cci_recent : cci > cci_ma

sell_di_condition = sell_di_cross ? sell_di_recent : di_plus < di_minus

sell_cci_condition = sell_cci_cross ? sell_cci_recent : cci < cci_ma

buy_signal = buy_di_condition and buy_cci_condition and adx_filter and rsi_buy_filter and atr_filter and volume_filter

sell_signal = sell_di_condition and sell_cci_condition and adx_filter and rsi_sell_filter and atr_filter and volume_filter

// Alarms

alertcondition(buy_signal, title="Buy Signal Alert", message="ADXCCI Strategy: Buy Signal Triggered")

alertcondition(sell_signal, title="Sell Signal Alert", message="ADXCCI Strategy: Sell Signal Triggered")

// Strategy Entries and Labels

float chart_bottom = ta.lowest(low, 100)

if buy_signal and not in_long and allow_long and can_trade

strategy.entry("Buy", strategy.long)

label.new(bar_index, chart_bottom, "↑", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "BUY", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_long := true

in_short := false

long_trades := long_trades + 1

entry_price := close

if sell_signal and not in_short and allow_short and can_trade

strategy.entry("Sell", strategy.short)

label.new(bar_index, chart_bottom, "↓", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "SELL", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_short := true

in_long := false

short_trades := short_trades + 1

entry_price := close

// Reverse Exits (only if MA exit, ADX stop, and Perf stop are not used)

if not use_ma_exit and not adx_stop_condition and not perf_stop_condition

if sell_signal and in_long

strategy.close("Buy")

label.new(bar_index, chart_bottom, "↓", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close > entry_price

long_wins := long_wins + 1

in_long := false

if countertrade and allow_short and can_trade

strategy.entry("Sell", strategy.short)

label.new(bar_index, chart_bottom, "↓", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "SELL", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_short := true

in_long := false

short_trades := short_trades + 1

entry_price := close

if buy_signal and in_short

strategy.close("Sell")

label.new(bar_index, chart_bottom, "↑", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close < entry_price

short_wins := short_wins + 1

in_short := false

if countertrade and allow_long and can_trade

strategy.entry("Buy", strategy.long)

label.new(bar_index, chart_bottom, "↑", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "BUY", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_long := true

in_short := false

long_trades := long_trades + 1

entry_price := close

// MA Exit

if use_ma_exit

if in_long and long_exit_ma

strategy.close("Buy")

label.new(bar_index, chart_bottom, "↓", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close > entry_price

long_wins := long_wins + 1

in_long := false

if countertrade and allow_short and can_trade

strategy.entry("Sell", strategy.short)

label.new(bar_index, chart_bottom, "↓", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "SELL", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_short := true

in_long := false

short_trades := short_trades + 1

entry_price := close

if in_short and short_exit_ma

strategy.close("Sell")

label.new(bar_index, chart_bottom, "↑", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close < entry_price

short_wins := short_wins + 1

in_short := false

if countertrade and allow_long and can_trade

strategy.entry("Buy", strategy.long)

label.new(bar_index, chart_bottom, "↑", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "BUY", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_long := true

in_short := false

long_trades := long_trades + 1

entry_price := close

// ADX Stop-Loss

if adx_stop_condition

if in_long

strategy.close("Buy")

label.new(bar_index, chart_bottom, "↓", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close > entry_price

long_wins := long_wins + 1

in_long := false

if countertrade and allow_short and can_trade

strategy.entry("Sell", strategy.short)

label.new(bar_index, chart_bottom, "↓", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "SELL", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_short := true

in_long := false

short_trades := short_trades + 1

entry_price := close

if in_short

strategy.close("Sell")

label.new(bar_index, chart_bottom, "↑", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close < entry_price

short_wins := short_wins + 1

in_short := false

if countertrade and allow_long and can_trade

strategy.entry("Buy", strategy.long)

label.new(bar_index, chart_bottom, "↑", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "BUY", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_long := true

in_short := false

long_trades := long_trades + 1

entry_price := close

// Performance Stop-Loss

if perf_stop_condition

if in_long

strategy.close("Buy")

label.new(bar_index, chart_bottom, "↓", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close > entry_price

long_wins := long_wins + 1

in_long := false

if countertrade and allow_short and can_trade

strategy.entry("Sell", strategy.short)

label.new(bar_index, chart_bottom, "↓", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "SELL", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_short := true

in_long := false

short_trades := short_trades + 1

entry_price := close

if in_short

strategy.close("Sell")

label.new(bar_index, chart_bottom, "↑", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close < entry_price

short_wins := short_wins + 1

in_short := false

if countertrade and allow_long and can_trade

strategy.entry("Buy", strategy.long)

label.new(bar_index, chart_bottom, "↑", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "BUY", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_long := true

in_short := false

long_trades := long_trades + 1

entry_price := close

// Warn if Equity is Negative

if not can_trade and (buy_signal or sell_signal)

label.new(bar_index, close, "No Equity", color=color.yellow, style=label.style_label_center, textcolor=color.black, size=size.tiny)

// Background Coloring (Global Scope)

bgcolor(color_background ? (in_long ? color.new(color.green, 90) : in_short ? color.new(color.red, 90) : na) : na)