Le cœur de la stratégie de Liu: l’argent intelligent dans le marché du week-end

Vous le savez ? Le marché de la cryptographie cache des façades pendant que les géants de Wall Street sont en vacances le week-end ! Cette tactique ressemble à celle d’un garde de nuit qui s’échappe quand les investisseurs institutionnels sont “ en congé “.

La mise au point !Cette stratégie ne fonctionne que le samedi, et plus particulièrement le dimanche entre 0h00 et 8h00 UTC. Pourquoi ? Parce que c’est une période où la liquidité est relativement faible et où l’analyse technique est plus efficace, comme lorsqu’il est plus facile d’entendre des sons minuscules dans une bibliothèque silencieuse.

La convergence des multiples indicateurs: pas une lutte solitaire

Cette stratégie est comme monter une coalition d’Avengers:

- Le RSI est de 8 cycles.Les signaux de survente et d’achat ont été rapidement capturés.

- MACD(8,17,9)La dynamique de la tendance est confirmée

- Ceinture de BrinIdentifier les zones de prix extrêmes

- La CVD s’est détournéeLe blogueur a publié un article sur le sujet, intitulé “Smart Money: Discovering the Real Intention”.

Un guide pour éviter les fossesLe seul indicateur est comme regarder un film seul, et il est facile d’être induit en erreur par le scénario.

Une gestion intelligente de l’argent: 500 dollars pour jouer

Le système a été conçu pour les petits capitalistes:

- Au moins 120 $ par billet.Je ne vous ferai pas un “ha”

- Un maximum de 4 positions simultanéesLe risque est dispersé, pas un œuf dans un panier.

- 5 à 20 fois le levier dynamiqueLes prix sont automatiquement ajustés en fonction de la volatilité du marché.

Comme pour la conduite d’une voiture, il faut aller vite sur la route, mais lentement dans le petit panier. Le système ajuste la taille de la position en fonction des caractéristiques de risque des différentes devises.

️ Contrôle des risques: plus préoccupant que votre mère

Le mécanisme de triple protection:

- Limite de perte journalière de 5%Je ne sais pas si j’ai bien compris, mais je ne suis pas d’accord avec toi.

- Le week-end est plafonné à 15%.Le week-end, c’est aussi la fin du monde

- Quatre arrêts de pertes consécutivesLes échanges émotionnels:

Système de freinage d’urgenceSi le compte perd plus de 30%, cessez immédiatement toutes les transactions. C’est comme l’ABS d’une voiture, il sauve des vies aux moments critiques !

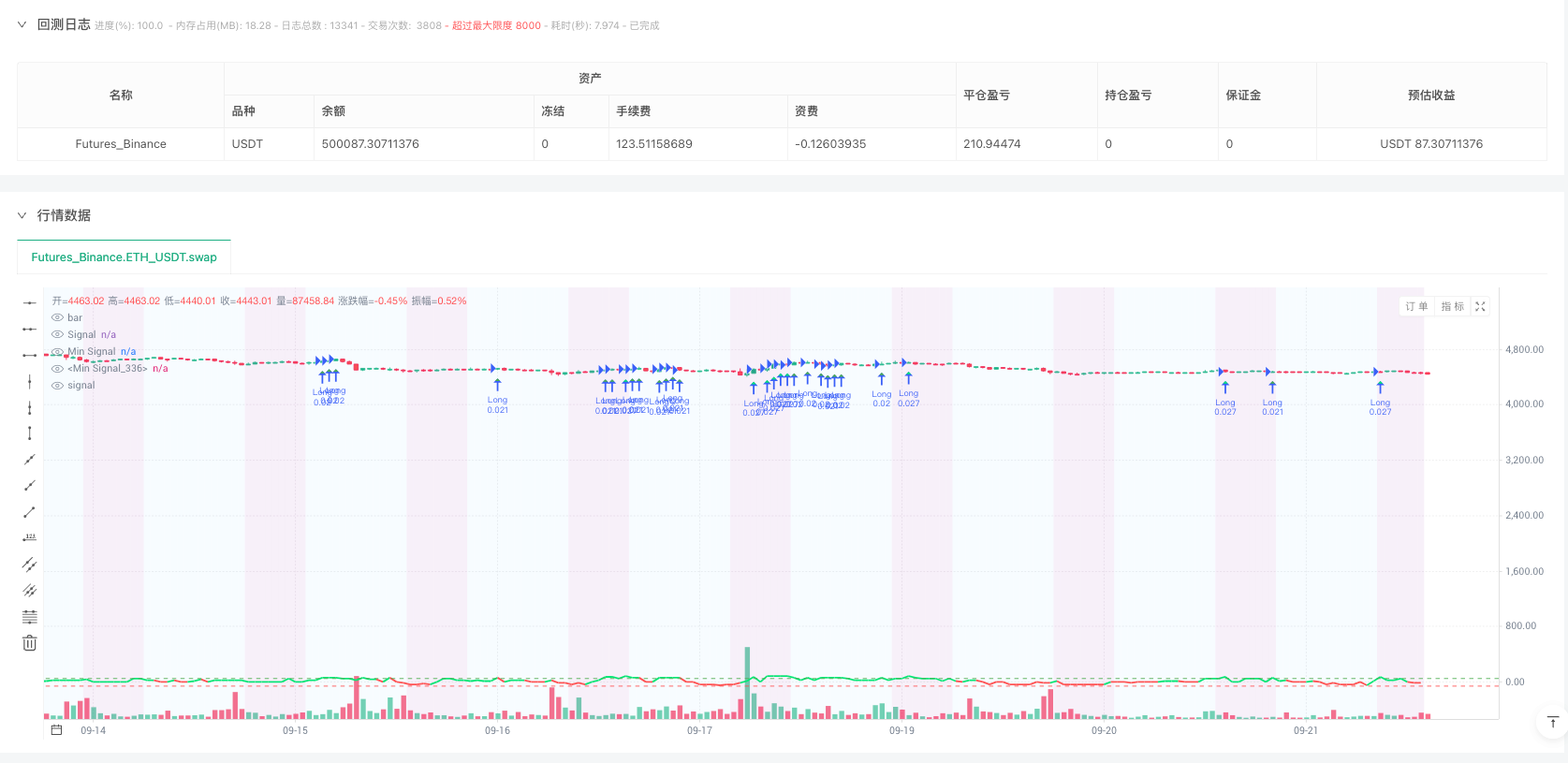

/*backtest

start: 2024-09-24 00:00:00

end: 2025-09-22 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=6

strategy("Weekend Hunter Ultimate v6.2 [PRODUCTION READY]",

overlay=true,

pyramiding=0,

calc_bars_count=5000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10,

commission_type=strategy.commission.percent,

commission_value=0.075,

slippage=3,

initial_capital=500)

// ========================================

// WEEKEND-ONLY CONFIGURATION

// ========================================

enable_weekend_only = input.bool(true, "WEEKEND TRADING ONLY", tooltip="Saturday-Sunday when institutions are offline")

weekend_start_day = input.string("Saturday", "Weekend Start", options=["Friday", "Saturday"])

weekend_end_day = input.string("Sunday", "Weekend End", options=["Sunday", "Monday"])

// Optimal Weekend Windows (Research-Based)

optimal_saturday_start = input.int(0, "Saturday Start Hour (UTC)", minval=0, maxval=23)

optimal_sunday_end = input.int(23, "Sunday End Hour (UTC)", minval=0, maxval=23)

prime_sunday_window = input.bool(true, "Enable Prime Sunday Window (0-8 UTC)")

// Weekend Detection Logic

is_saturday = dayofweek == dayofweek.saturday

is_sunday = dayofweek == dayofweek.sunday

is_weekend = is_saturday or is_sunday

current_hour = hour(time)

// Prime Weekend Window

in_prime_window = is_sunday and current_hour >= 0 and current_hour <= 8

in_weekend_hours = (is_saturday and current_hour >= optimal_saturday_start) or

(is_sunday and current_hour <= optimal_sunday_end)

weekend_trading_active = enable_weekend_only ? (is_weekend and in_weekend_hours) : true

// ========================================

// POSITION & CAPITAL MANAGEMENT

// ========================================

var float daily_pnl = 0.0

var float weekend_pnl = 0.0

var int last_day = 0

var int consecutive_losses = 0

// Maximum concurrent positions with $500

max_concurrent_positions = 4

current_positions = strategy.opentrades

// Smart Capital Management

available_capital = strategy.equity - (strategy.position_size * close)

min_capital_per_trade = 120.0

safety_buffer = 50.0

can_afford_position = available_capital > (min_capital_per_trade + safety_buffer)

position_available = current_positions < max_concurrent_positions

// ========================================

// AGGRESSIVE 65% WIN RATE CONFIGURATION

// ========================================

historical_win_rate = input.float(65.0, "Target Win Rate %", minval=60.0, maxval=70.0) / 100

avg_win_percent = input.float(5.5, "Average Win %", minval=4.0, maxval=7.0) / 100

avg_loss_percent = input.float(1.8, "Average Loss %", minval=1.5, maxval=2.5) / 100

// Loss Limits

max_daily_loss = input.float(5.0, "Max Daily Loss %", minval=3.0, maxval=8.0)

max_weekend_loss = input.float(15.0, "Max Weekend Loss %", minval=10.0, maxval=20.0)

max_consecutive_losses_allowed = 4

// ========================================

// DYNAMIC LEVERAGE SYSTEM 5-20x

// ========================================

min_leverage = input.float(5.0, "Minimum Leverage", minval=5.0, maxval=10.0)

max_leverage = input.float(20.0, "Maximum Leverage", minval=15.0, maxval=25.0)

// EXACT COIN-SPECIFIC RISK PROFILES

symbol_risk_profile = syminfo.ticker == "BTCUSDT" ? 0.9 :

syminfo.ticker == "ETHUSDT" ? 0.85 :

syminfo.ticker == "LINKUSDT" ? 0.75 :

syminfo.ticker == "XRPUSDT" ? 0.75 :

syminfo.ticker == "DOGEUSDT" ? 0.6 :

syminfo.ticker == "SOLUSDT" ? 0.7 :

syminfo.ticker == "AVAXUSDT" ? 0.7 :

syminfo.ticker == "1000PEPEUSDT" ? 0.5 :

syminfo.ticker == "TONUSDT" ? 0.65 :

syminfo.ticker == "POLUSDT" ? 0.7 : 0.5

// ========================================

// PROFIT PROTECTION SYSTEM

// ========================================

use_trailing = input.bool(true, "Enable Smart Trailing", tooltip="Protects profits when approaching target")

trailing_activation_percent = input.float(2.5, "Trailing Activation %", minval=2.0, maxval=3.5)

trailing_distance_percent = input.float(1.5, "Trail Distance %", minval=1.0, maxval=2.0)

// ========================================

// MULTI-TIMEFRAME CONFLUENCE

// ========================================

// 4H Trend Bias

htf_4h_close = request.security(syminfo.tickerid, "240", close, lookahead=barmerge.lookahead_off)

htf_4h_ema50 = request.security(syminfo.tickerid, "240", ta.ema(close, 50), lookahead=barmerge.lookahead_off)

// 1H Momentum Confirmation - Fixed MACD

[htf_1h_macd, htf_1h_signal, htf_1h_hist] = request.security(syminfo.tickerid, "60", ta.macd(close, 12, 26, 9), lookahead=barmerge.lookahead_off)

htf_1h_rsi = request.security(syminfo.tickerid, "60", ta.rsi(close, 14), lookahead=barmerge.lookahead_off)

// Trend Alignment Scoring

htf_4h_trend = htf_4h_close > htf_4h_ema50 ? 1 : -1

htf_1h_momentum = htf_1h_macd > htf_1h_signal ? 1 : -1

current_trend = close > ta.ema(close, 20) ? 1 : -1

trend_alignment = (htf_4h_trend + htf_1h_momentum + current_trend) / 3.0

// ========================================

// VOLATILITY & MARKET REGIME

// ========================================

atr_period = 14

atr_value = ta.atr(atr_period)

atr_percentage = (atr_value / close) * 100

volatility_regime = atr_percentage < 2.0 ? "Low" : atr_percentage < 5.0 ? "Medium" : "High"

// Weekend Liquidity Adjustment

volume_sma = ta.sma(volume, 20)

current_liquidity_ratio = volume / volume_sma

weekend_liquidity_adjustment = is_weekend ? math.min(current_liquidity_ratio * 0.8, 1.0) : 1.0

// ========================================

// CVD DIVERGENCE DETECTION

// ========================================

var float cvd = 0.0

bull_volume = close > open ? volume : 0

bear_volume = close < open ? volume : 0

volume_delta = bull_volume - bear_volume

cvd := cvd + volume_delta

// Divergence Detection

price_higher = close > close[10]

cvd_lower = cvd < cvd[10]

bearish_divergence = price_higher and cvd_lower

price_lower = close < close[10]

cvd_higher = cvd > cvd[10]

bullish_divergence = price_lower and cvd_higher

// ========================================

// SIGNAL GENERATION SYSTEM

// ========================================

// Primary Indicators

rsi = ta.rsi(close, 8)

// Fixed MACD unpacking

[macd_line, signal_line, histogram] = ta.macd(close, 8, 17, 9)

// Fixed Bollinger Bands unpacking

[bb_upper, bb_middle, bb_lower] = ta.bb(close, 20, 2.5)

// Volume Confirmation

volume_surge = volume > (volume_sma * 1.5)

min_volume_threshold = ta.sma(volume, 100) * 0.1

valid_volume = volume > min_volume_threshold

volume_confirmation = volume_surge and current_liquidity_ratio > 0.7 and valid_volume

// Signal Strength Calculation

var float signal_strength = 0.0

// Trend Component (40% weight)

trend_score = trend_alignment * 40

// Momentum Component (30% weight)

momentum_bullish = rsi < 30 and rsi > rsi[1]

momentum_bearish = rsi > 70 and rsi < rsi[1]

momentum_score = momentum_bullish ? 30 : momentum_bearish ? -30 : 0

// Volume Component (20% weight)

volume_score = volume_confirmation ? 20 : 0

volume_score := volume_score + (bullish_divergence ? 10 : bearish_divergence ? -10 : 0)

// Weekend Component (10% weight) - Fixed type

weekend_score = is_weekend ? 10.0 : 0.0

if in_prime_window

weekend_score := weekend_score * 1.5

signal_strength := trend_score + momentum_score + volume_score + weekend_score

// Weekend Signal Boost

if is_weekend

signal_strength := signal_strength * 1.2

if in_prime_window

signal_strength := signal_strength * 1.3

// ========================================

// DYNAMIC LEVERAGE CALCULATION

// ========================================

// Safety Score Components

volatility_safety = volatility_regime == "Low" ? 1.0 : volatility_regime == "Medium" ? 0.7 : 0.4

signal_confidence = math.abs(signal_strength) / 100

overall_safety = (volatility_safety + signal_confidence) / 2 * symbol_risk_profile

// Calculate Dynamic Leverage

leverage_range = max_leverage - min_leverage

dynamic_leverage = min_leverage + (leverage_range * overall_safety)

final_leverage = math.round(math.max(min_leverage, math.min(max_leverage, dynamic_leverage)), 1)

// ========================================

// POSITION SIZING WITH CAPITAL CHECK

// ========================================

// Signal Thresholds

min_signal_strength = input.float(55.0, "Minimum Signal Strength", minval=45.0, maxval=65.0)

high_confidence_threshold = input.float(75.0, "High Confidence Threshold", minval=70.0, maxval=85.0)

high_confidence = math.abs(signal_strength) > high_confidence_threshold

position_multiplier = high_confidence ? 1.3 : 1.0

// Calculate Position Size

base_position_usd = 120.0

desired_position_usd = base_position_usd * position_multiplier

// Pair-specific adjustment

pair_multiplier = syminfo.ticker == "1000PEPEUSDT" ? 0.5 : syminfo.ticker == "BTCUSDT" ? 1.0 : syminfo.ticker == "ETHUSDT" ? 1.0 : 0.8

final_position_usd = desired_position_usd * pair_multiplier

contracts = can_afford_position ? final_position_usd / close : 0

// ========================================

// ENTRY CONDITIONS WITH ALL SAFETY CHECKS

// ========================================

// Signal Conditions

strong_bullish_signal = signal_strength > min_signal_strength and trend_alignment > 0

strong_bearish_signal = signal_strength < -min_signal_strength and trend_alignment < 0

// Flash Crash Protection (8%)

flash_crash_detected = math.abs((close - close[4]) / close[4]) > 0.08

// Loss Tracking

if dayofmonth != last_day

daily_pnl := 0.0

if dayofweek == dayofweek.monday

weekend_pnl := 0.0

last_day := dayofmonth

daily_loss_pct = (daily_pnl / strategy.equity) * 100

weekend_loss_pct = (weekend_pnl / strategy.equity) * 100

loss_limits_active = daily_loss_pct <= -max_daily_loss or weekend_loss_pct <= -max_weekend_loss or consecutive_losses >= max_consecutive_losses_allowed

// Emergency Stop at -30% Account Level

account_emergency_stop = strategy.equity < (strategy.initial_capital * 0.7)

// Final Entry Conditions (fixed line continuation)

can_enter_long = strong_bullish_signal and weekend_trading_active and not loss_limits_active and position_available and can_afford_position and strategy.position_size == 0 and not flash_crash_detected and not account_emergency_stop

can_enter_short = strong_bearish_signal and weekend_trading_active and not loss_limits_active and position_available and can_afford_position and strategy.position_size == 0 and not flash_crash_detected and not account_emergency_stop

// ========================================

// DYNAMIC STOP LOSS & TAKE PROFIT

// ========================================

// ATR-Based with Leverage Adjustment

base_atr_mult_sl = input.float(1.5, "Base ATR Multiplier SL", minval=1.0, maxval=2.0)

base_atr_mult_tp = input.float(4.5, "Base ATR Multiplier TP", minval=3.5, maxval=6.0)

leverage_adjustment = 1.0 + (final_leverage - 5) / 50

atr_mult_sl = base_atr_mult_sl / leverage_adjustment

atr_mult_tp = base_atr_mult_tp * (1.0 + signal_confidence * 0.2)

stop_distance = atr_value * atr_mult_sl

tp_distance = atr_value * atr_mult_tp

long_stop = close - stop_distance

long_tp = close + tp_distance

short_stop = close + stop_distance

short_tp = close - tp_distance

// ========================================

// STRATEGY EXECUTION WITH ALERTS

// ========================================

// Long Entry with alert

if can_enter_long

alert_message = '{"action":"open_long","ticker":"' + syminfo.ticker + '","price":"' + str.tostring(close) + '","leverage":"' + str.tostring(final_leverage) + '","stop_loss":"' + str.tostring(long_stop) + '","take_profit":"' + str.tostring(long_tp) + '"}'

strategy.entry("Long", strategy.long, qty=contracts, comment="L " + str.tostring(final_leverage, "#.#") + "x S:" + str.tostring(signal_strength, "#"))

alert(alert_message, alert.freq_once_per_bar)

if use_trailing

strategy.exit("Long Exit", "Long", stop=long_stop, limit=long_tp, trail_points=close * trailing_activation_percent / 100, trail_offset=close * trailing_distance_percent / 100)

else

strategy.exit("Long Exit", "Long", stop=long_stop, limit=long_tp)

// Short Entry with alert

if can_enter_short

alert_message = '{"action":"open_short","ticker":"' + syminfo.ticker + '","price":"' + str.tostring(close) + '","leverage":"' + str.tostring(final_leverage) + '","stop_loss":"' + str.tostring(short_stop) + '","take_profit":"' + str.tostring(short_tp) + '"}'

strategy.entry("Short", strategy.short, qty=contracts, comment="S " + str.tostring(final_leverage, "#.#") + "x S:" + str.tostring(signal_strength, "#"))

alert(alert_message, alert.freq_once_per_bar)

if use_trailing

strategy.exit("Short Exit", "Short", stop=short_stop, limit=short_tp, trail_points=close * trailing_activation_percent / 100, trail_offset=close * trailing_distance_percent / 100)

else

strategy.exit("Short Exit", "Short", stop=short_stop, limit=short_tp)

// Emergency Exits with alert

if strategy.position_size != 0

entry_price = strategy.position_avg_price

current_profit_pct = strategy.position_size > 0 ? ((close - entry_price) / entry_price * 100) : ((entry_price - close) / entry_price * 100)

// Liquidation Protection

liq_distance = 100 / final_leverage * 0.8

approaching_liquidation = math.abs(current_profit_pct) > liq_distance

if approaching_liquidation or flash_crash_detected or account_emergency_stop

alert('{"action":"close_all","ticker":"' + syminfo.ticker + '"}', alert.freq_once_per_bar)

strategy.close_all(comment="EMERGENCY")

// Weekend End Exit

if dayofweek == dayofweek.monday and hour == 0 and strategy.position_size != 0

alert('{"action":"close_all","ticker":"' + syminfo.ticker + '"}', alert.freq_once_per_bar)

strategy.close_all(comment="Weekend End")

// Weekend Background

bgcolor(is_weekend ? color.new(color.blue, 95) : na, title="Weekend")

bgcolor(in_prime_window ? color.new(color.purple, 90) : na, title="Prime")

// Signal Strength

plot(signal_strength, "Signal", signal_strength > 0 ? color.lime : color.red, 2)

hline(min_signal_strength, "Min Signal", color.green, hline.style_dashed)

hline(-min_signal_strength, "Min Signal", color.red, hline.style_dashed)

// Entry Signals

plotshape(can_enter_long, "Long", shape.triangleup, location.belowbar, high_confidence ? color.lime : color.green, size=size.small)

plotshape(can_enter_short, "Short", shape.triangledown, location.abovebar, high_confidence ? color.red : color.maroon, size=size.small)

// Warnings

bgcolor(loss_limits_active ? color.new(color.red, 80) : na, title="Loss Limit")

bgcolor(account_emergency_stop ? color.new(color.purple, 80) : na, title="Emergency")