C’est quoi cette tactique des dieux saints ?

Vous savez ? Cette stratégie est comme un “ détective de la bulle ” super calme ! Quand le marché monte comme un sanglier, il ne suit pas le vent, mais attend patiemment le moment où la bulle éclate. Comme quand on voit quelqu’un devenir follement riche dans son cercle d’amis, on sait qu’il risque de “ faire faillite ” bientôt 😏

La logique de base de la stratégie révélée

La mise au point !La stratégie présente deux opportunités d’entrée extrêmement intelligentes:

- Mode de refroidissement à mousseLa stratégie est marquée comme une “bulle” lorsque le RSI est supérieur à 70 ou lorsque le volume de transactions est multiplié par 1,5, puis attend patiemment que le RSI revienne en dessous de 60 avant d’envisager de faire une pause.

- Nouveau modèle de piège à hauteurLe prix de l’or a augmenté de 0,6 à 0,9 pour le dollar américain, et de 0,3 à 0,9 pour le dollar américain.

C’est comme attendre un bus, il ne faut pas que chaque voiture monte, il faut attendre le bon groupe !

Combien de vaches sont à risque ?

Le guide de la fosse est arrivé !Le plus puissant de cette stratégie est son système d’alerte:

- Si vous avez déjà fait une pause et que vous vous apercevez qu’une autre bulle est apparue, dégagez immédiatement !

- Le stop-loss est de 2%, le stop-loss est de 6%, le risque-rendement est de 1:3.

- Il y a des “zones interdites” spéciales pour éviter les opérations à des heures dangereuses.

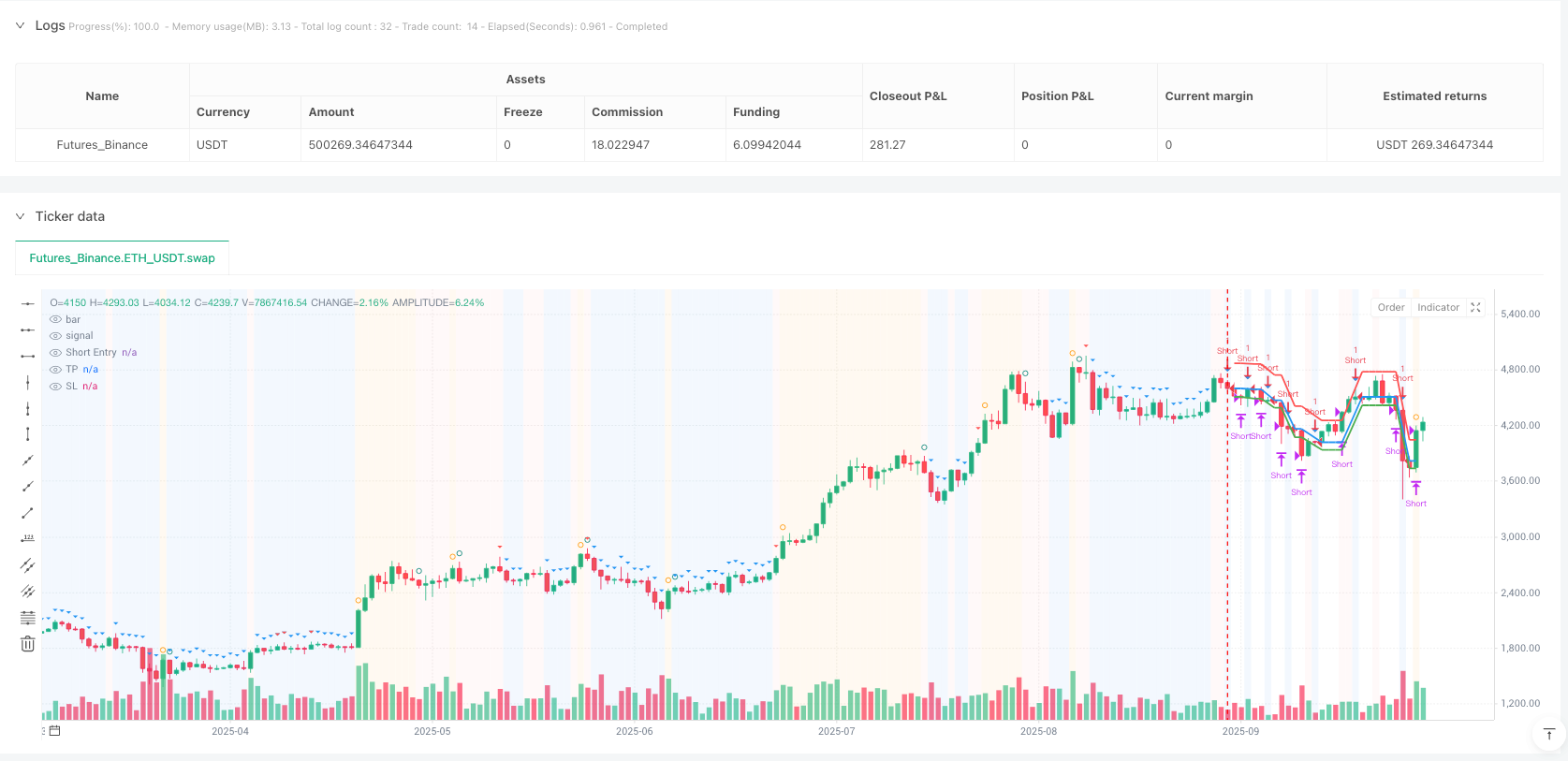

L’interface visuelle est très sympathique.

Le graphique de cette stratégie est encore plus beau que l’interface de l’iPhone !

- Fond orange = Foumage en cours, évitez d’entrer

- En arrière-plan bleu = zone vide après la bulle, l’occasion est venue 💙

- Fond rouge = Zone interdite à la mise en place, honnêtement

- Des petites icônes marquent les points clés, à première vue

Quelle est la couleur qui vous convient ?

Si vous êtes un de ces traders, cette stratégie est faite pour vous:

- Les rationalistes n’aiment pas poursuivre les perdants.

- Les investisseurs de valeur qui croient que “le plus vite possible, c’est aussi le plus vite possible”

- Les gens intelligents qui aiment rester calmes quand les autres sont avides

N’oubliez pas: les marchés ne manquent jamais d’opportunités, ce qui manque, c’est la patience et la sagesse d’attendre les bonnes opportunités ! ✨

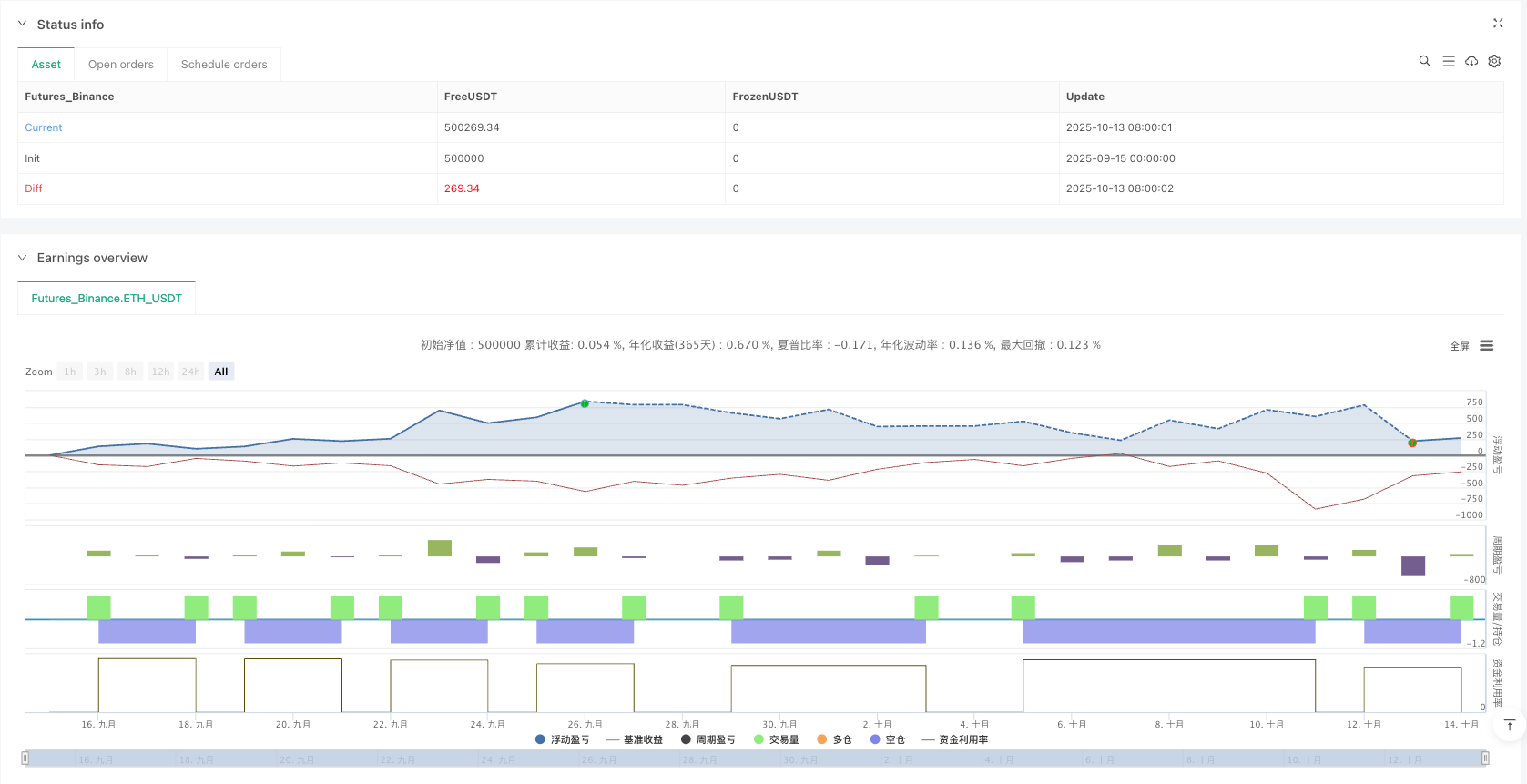

/*backtest

start: 2025-09-15 00:00:00

end: 2025-10-14 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

strategy("Pump-Smart Shorting Strategy", overlay=true)

// Inputs

lookbackPeriod = input.int(20, "Lookback Period for New High", minval=5)

minProfitPerc = input.float(0.02, "Take Profit %", minval=0.001)

stopLossPerc = input.float(0.06, "Stop Loss %", minval=0.001)

hedgeTokens = input.int(1, "Hedge Tokens")

// Pump detection inputs

rsiPeriod = input.int(14, "RSI Period")

rsiHigh = input.float(70, "Pump RSI ≥")

rsiCool = input.float(60, "Pump cool-off RSI ≤")

volMult = input.float(1.5, "Volume Pump Multiplier")

pctUp = input.float(0.05, "1-bar Up % for Pump")

barsWait = input.int(0, "Bars to wait after pump ends", minval=0, maxval=10)

// Tech

rsi = ta.rsi(close, rsiPeriod)

avgVol = ta.sma(volume, 20)

oneBarUp = (close - close[1]) / close[1]

// Pump on if any strong up-move pattern

pumpOn = (rsi >= rsiHigh) or (volume > avgVol * volMult and oneBarUp > pctUp)

// Track pump state with var and transitions

var bool wasPump = false

pumpStart = not wasPump and pumpOn

pumpEnd = wasPump and not pumpOn

// Update state each bar

wasPump := pumpOn

// Count bars since pump ended

var int barsSincePumpEnd = 10000

barsSincePumpEnd := pumpEnd ? 0 : math.min(10000, barsSincePumpEnd + 1)

// Define "pump ended and cooled" condition

cooled = (rsi <= rsiCool) and (oneBarUp <= pctUp/2 or volume <= avgVol * (volMult * 0.8))

// Immediate short signal when pump finishes and cooled (with optional wait)

shortAfterPump = (barsSincePumpEnd >= barsWait) and cooled and not pumpOn and strategy.position_size == 0

// Also allow shorts on fresh new highs when not pumping (optional, keep for more entries)

isNewHigh = high > ta.highest(high, lookbackPeriod)[1]

shortOnPeak = isNewHigh and not pumpOn and strategy.position_size == 0

// Define conditions where we DON'T short (for red background)

noShortZone = pumpOn or (isNewHigh and pumpOn) or (barsSincePumpEnd < barsWait) or not cooled

// Preemptive close if pump turns on while short

var float shortEntry = na

inShort = strategy.position_size < 0 and not na(shortEntry)

if inShort and pumpOn

strategy.close("Short")

shortEntry := na

// Entry rules: short either right after pump ends OR on new high when not pumping

if (shortAfterPump or shortOnPeak) and strategy.position_size == 0

strategy.entry("Short", strategy.short, qty=hedgeTokens)

shortEntry := na

// Track entry price

if strategy.position_size < 0 and na(shortEntry)

shortEntry := strategy.position_avg_price

if strategy.position_size == 0

shortEntry := na

inShort := strategy.position_size < 0 and not na(shortEntry)

// TP/SL

tp = shortEntry * (1 - minProfitPerc)

sl = shortEntry * (1 + stopLossPerc)

exitTP = inShort and close <= tp

exitSL = inShort and close >= sl

if exitTP

strategy.close("Short")

if exitSL

strategy.close("Short")

// Visuals - REMOVED TEXT FROM ARROWS

plotshape(pumpStart, style=shape.circle, color=color.orange, location=location.abovebar, size=size.tiny)

plotshape(pumpEnd, style=shape.circle, color=color.teal, location=location.abovebar, size=size.tiny)

plotshape(shortAfterPump, style=shape.triangledown, color=color.blue, location=location.abovebar, size=size.small)

plotshape(shortOnPeak, style=shape.triangledown, color=color.red, location=location.abovebar, size=size.tiny)

plot(inShort ? shortEntry : na, color=color.blue, linewidth=2, title="Short Entry")

plot(inShort ? tp : na, color=color.green, linewidth=2, title="TP")

plot(inShort ? sl : na, color=color.red, linewidth=2, title="SL")

// Background colors - ADDED RED NO-SHORT ZONES

bgcolor(pumpOn ? color.new(color.orange, 92) : na, title="Pump Zone")

bgcolor(shortAfterPump ? color.new(color.blue, 92) : na, title="Post-Pump Short Zone")

bgcolor(noShortZone and not pumpOn ? color.new(color.red, 95) : na, title="No Short Zone")