C’est la stratégie FVG la plus simple de la légende ?

Ne vous laissez pas tromper par le nom “stratégie de grand-mère”.50 cycles EMA pour juger de la direction de la tendance + la faille de juste valeur (FVG) pour saisir les opportunités de reprise + 2 fois plus de risques de retour que de profits de verrouillage◦ Les retours d’expérience ont montré une excellente performance dans les marchés à tendance claire, mais avec des conditions d’entrée strictes.

Les principaux points forts de la stratégie:4 lignes K pour une position précise de l’heure d’entréeC0-C1 forme une ouverture de FVG, C2 balaie la liquidité pour un rappel, et C3 confirme le signal de retour. Cette conception est plus précise que les stratégies de percée traditionnelles, évitant ainsi de nombreux faux pièges de percée.

Le filtre de préférence de l’EMA: la tendance est votre meilleure amie

50 cycles d’EMA n’est pas une disposition, c’est une ligne de vie ou de mort❚ La stratégie impose que les signaux à tête multiple doivent être au-dessus de l’EMA, et les signaux à tête vide doivent être en dessous de l’EMA. ❚ Cette conception filtre directement 70% des transactions négatives, ce qui augmente considérablement le taux de victoire.

Plus intelligent encore, vous pouvez choisir d’utiliser le prix de clôture de n’importe quelle ligne K de C0, C1, C2 ou C3 pour juger de la préférence de l’EMA. Le paramètre par défaut est de vérifier C0 (… la première ligne K) et de s’assurer que l’ensemble de la forme est dans la bonne direction de tendance. Si vous voulez être plus radical, vous pouvez choisir C3, qui permet plus d’entrées mais prend plus de risques.

Gestion des risques: Objectifs 2R + mécanisme de couverture dynamique

Le réglage de stop loss est extrêmement précis.: le stop multiple est fixé au point C1 bas, le stop vide au point C1 haut. Vous pouvez ajouter un décalage de tick supplémentaire pour éviter d’être balayé instantanément. Le taux de retour sur risque par défaut de 2 fois signifie un stop de 10 points et un profit de 20 points.

La fonctionnalité de sauvegarde dynamique est un point fort: Lorsque le prix atteint 1R ou 2R, le stop loss est automatiquement déplacé vers le prix d’entrée. Cette conception vous permet de tenir plus longtemps dans la tendance tout en protégeant les bénéfices déjà réalisés. Les données historiques montrent que le retrait maximal est réduit de 35% après l’activation du mécanisme de garantie.

Conditions d’entrée: 4 lignes K parfaitement alignées

Logic stricte de la mise en place de plusieurs têtes:

- C1 doit être le clin d’oeil qui a le fil de l’ombre (trap de liquidité)

- Il y a un vide FVG entre C0 et C2[2] > Le sommet[0])

- C2 balaie le bas de C1 puis se referme au-dessus du bas de C1 (fausse confirmation de rupture)

- C3 renverser la porte FVG et se refermer sous le prix d’ouverture de C1 (confirmation de renversement)

Cette logique est bien plus qu’une simple résistance de support à une rupture de Gauss.Une chance de revenir en arrière après une percée ratée。

Espace d’optimisation stratégique: 5 exceptions à mettre en place pour libérer le potentiel

Le code fournit 5 commutateurs d’exception qui vous permettent d’ajuster votre stratégie en fonction des caractéristiques du marché:

- Désactiver le filtre EMALe gouvernement a décidé d’ouvrir un nouveau magasin dans un marché en pleine crise.

- Permettre à C3 de se réfugier à l’intérieur du FVGLe nombre d’accès augmente, mais la qualité du signal diminue

- Permet à C3 de dépasser le prix d’ouverture de C1Les conditions d’entrée sont plus radicales:

- Permettre à C2 de revenir à la clôtureLa direction de la C2 doit être assouplie

- Filtre de fenêtre de tempsLe gouvernement a décidé de limiter les heures de négociation pour éviter les périodes de faible liquidité.

Conseils de guerre: quand les utiliser et quand les éviter

Le meilleur environnement de marchéDans ce type d’environnement, le taux de réussite de la stratégie peut atteindre plus de 65% et le ratio de gain/perte moyen est proche de 2,5.

Les situations à éviter: Marché oscillant horizontal. Les signaux FVG sont fréquents mais de très mauvaise qualité lorsque les prix fluctuent fréquemment près de l’EMA. Il est recommandé de suspendre l’utilisation lorsque l’ATR est inférieur à la moyenne des 20 cycles.

Conseils à la prudence: les retracements historiques ne représentent pas les gains futurs, il existe un risque de perte continue de la stratégie. Il est recommandé de limiter le risque individuel à 1 à 2% du compte et d’appliquer une discipline stricte de stop-loss. Les performances varient considérablement selon les conditions du marché et nécessitent une surveillance et un ajustement continus.

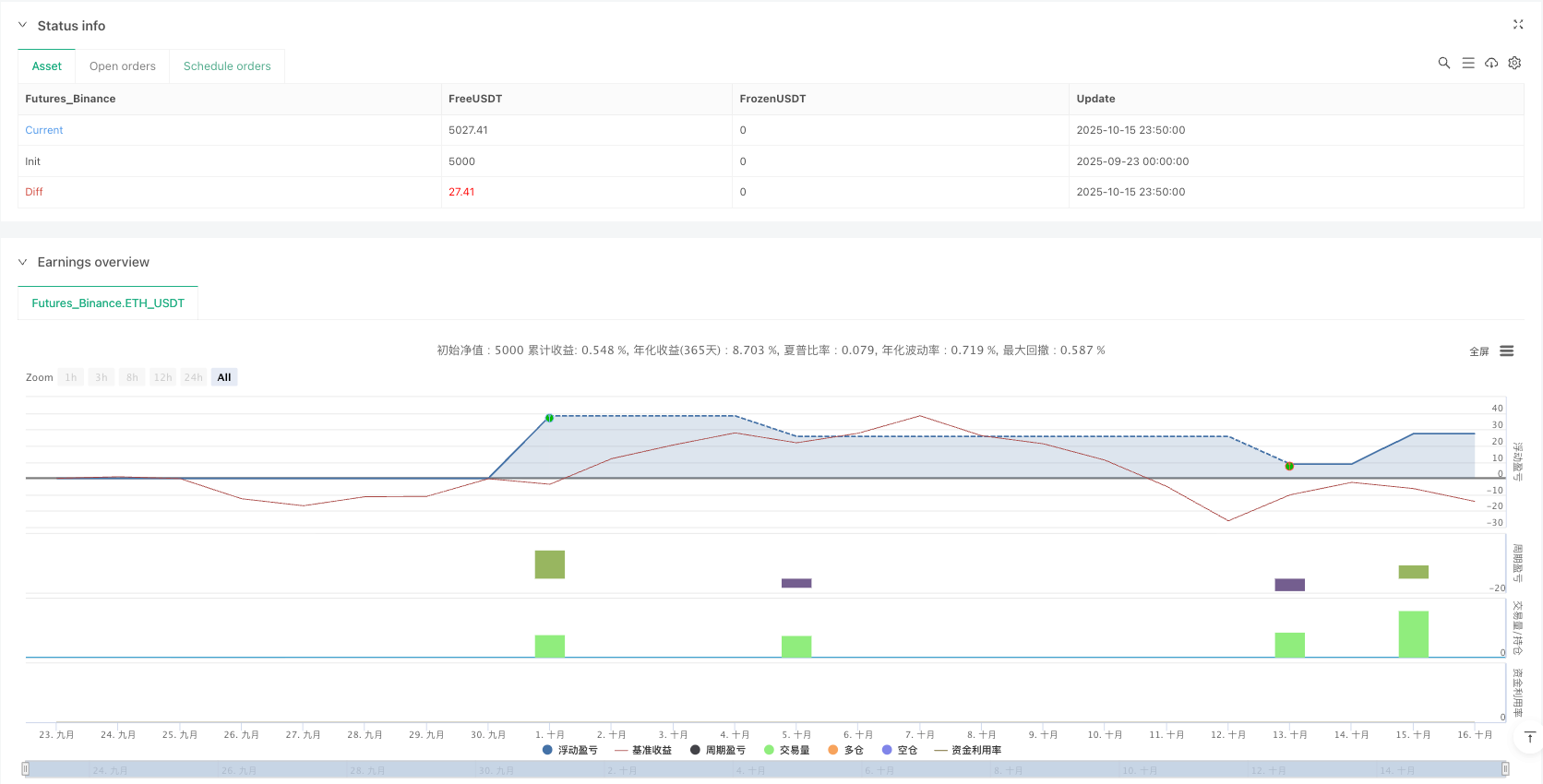

/*backtest

start: 2025-09-23 00:00:00

end: 2025-10-16 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":5000}]

*/

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © rdjxyz

//@version=5

strategy("Granny Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// ============================================================================

// INPUTS

// ============================================================================

// Display

showCandleNumbers = input.bool(false, "Show Candle Numbers (0, 1, 2, 3)", group="Display")

// Time Filter

useTimeFilter = input.bool(false, "Use Time Window Filter", group="Time Filter")

timeZone = input.string("America/New_York", "Timezone", options=["America/New_York", "America/Chicago", "America/Los_Angeles", "Europe/London", "Europe/Paris", "Europe/Berlin", "Asia/Tokyo", "Asia/Hong_Kong", "Asia/Shanghai", "Australia/Sydney", "UTC"], group="Time Filter")

sessionTime = input("0930-1600", "Trading Hours (Start-End)", group="Time Filter", tooltip="Set the start and end time for the trading window. Format: HHMM-HHMM")

// EMA

showEMA = input.bool(true, "Show EMA", group="EMA")

emaLength = input.int(50, "EMA Length", minval=1, group="EMA")

// Risk/Reward

stopLossTicks = input.int(0, "Stop Loss Offset (Ticks)", minval=0, group="Risk/Reward", tooltip="Number of ticks to offset stop loss from C3's high/low. 0 = exact high/low, positive = further away")

riskRewardRatio = input.float(2.0, "Risk:Reward Ratio", minval=0.1, step=0.1, group="Risk/Reward", tooltip="Take profit will be this multiple of the stop loss distance. E.g., 2.0 = 2R, 1.5 = 1.5R")

breakEvenAtRR = input.float(0, "Move SL to Break Even at R:R", minval=0, step=0.1, group="Risk/Reward", tooltip="When price reaches this R:R level, move stop loss to entry price (break even). Set to 0 to disable. E.g., 1.0 = break even at 1R, 2.0 = break even at 2R")

// Exceptions

emaBiasCandle = input.string("C0", "Check EMA Bias on Candle", options=["C0", "C1", "C2", "C3"], group="Exceptions", tooltip="Select which candle's close should be checked against the EMA for bias")

disableEMAFilter = input.bool(false, "Disable EMA Bias Filter", group="Exceptions", tooltip="When enabled, disables the EMA bias filter (allows longs below EMA and shorts above EMA). When disabled (default), only look for longs above EMA and shorts below EMA")

allowC3InsideFVG = input.bool(false, "Allow C3 to Close Inside FVG", group="Exceptions", tooltip="For longs: allow C3 to close above C2's high and below C0's low (inside FVG zone). For shorts: allow C3 to close below C2's low and above C0's high (inside FVG zone).")

allowC3OutsideC1Open = input.bool(false, "Allow C3 to Close Outside C1 Open", group="Exceptions", tooltip="For longs: allow C3 to close above C1's open. For shorts: allow C3 to close below C1's open.")

allowC2OppositeDirection = input.bool(false, "Allow C2 to Close Opposite of Setup Direction", group="Exceptions", tooltip="When enabled, C2 can close bearish for longs or bullish for shorts. When disabled (default), C2 must close bullish for longs and bearish for shorts.")

// Debugging

// showDebug = input.bool(false, "Show Debug Markers", group="Debugging")

// ============================================================================

// INDICATORS

// ============================================================================

ema50 = ta.ema(close, emaLength)

// ============================================================================

// TIME WINDOW CHECK

// ============================================================================

// Check if current bar is within the trading window

inTimeWindow = not useTimeFilter or not na(time(timeframe.period, sessionTime, timeZone))

// ============================================================================

// HELPER FUNCTIONS

// ============================================================================

// Check if candle is bullish

isBullish(index) =>

close[index] > open[index]

// Check if candle is bearish

isBearish(index) =>

close[index] < open[index]

// Check if candle has bottom wick

hasBottomWick(index) =>

low[index] < math.min(open[index], close[index])

// Check if candle has top wick

hasTopWick(index) =>

high[index] > math.max(open[index], close[index])

// ============================================================================

// LONG SETUP DETECTION

// ============================================================================

// Detection happens progressively as candles form:

// - C0 and C1 are marked when we're on C2 (can confirm FVG exists)

// - C2 is marked when it forms (current bar meets sweep criteria)

// - C3 is marked when it forms (current bar inverts FVG)

// Check for C2 (current bar): Sweeps C1 low, closes bullish inside C1 range

// When on C2: C0 is at [2], C1 is at [1], C2 is at [0]

// The pattern is: C0 -> C1 (bearish, creates FVG) -> C2 (sweeps and recovers)

// C1 checks (the bar at [1])

c1_is_bearish = close[1] < open[1]

c1_has_wick = low[1] < math.min(open[1], close[1])

// FVG check: gap between C0 and C2 after the bearish move

// The bearish FVG is the gap between C0's low and C2's high (current bar)

fvg_gap_exists = low[2] > high[0]

// C2 checks (current bar at [0])

c2_sweeps_c1_low = low < low[1]

c2_closes_above_c1_low = close > low[1]

c2_closes_below_c0_low = close < low[2]

c2_direction_ok_long = allowC2OppositeDirection or close > open

// EMA bias check for C2 detection (C0, C1, or C2)

ema_check_c2_long = disableEMAFilter or (emaBiasCandle == "C0" ? close[2] > ema50[2] : emaBiasCandle == "C1" ? close[1] > ema50[1] : emaBiasCandle == "C2" ? close > ema50 : true)

isC2Long = c1_is_bearish and c1_has_wick and fvg_gap_exists and c2_sweeps_c1_low and c2_closes_above_c1_low and c2_closes_below_c0_low and c2_direction_ok_long and ema_check_c2_long

// Store that C2 formed (for detecting C3 on the very next bar)

var bool c2LongFormed = false

if isC2Long

c2LongFormed := true

else

c2LongFormed := false // Reset if not C2 - ensures C3 must be the immediate next bar

// Check for C3 (current bar): Inverts FVG and closes below C1 open

// IMPORTANT: C3 must be the bar immediately after C2 (no gaps allowed)

// When on C3: C0 is at [3], C1 is at [2], C2 is at [1]

// "Invert" means price closes back below C1's open (reversing back toward the FVG)

// Must also close above C0's low (staying within the reversal zone)

c2_formed_prev_long = c2LongFormed[1]

c3_c1_open_condition_long = allowC3OutsideC1Open or close < open[2]

c3_range_condition_long = allowC3InsideFVG ? (close > high[1] and close < low[3]) : close > low[3]

isC3Long = c2_formed_prev_long and c3_c1_open_condition_long and c3_range_condition_long

// Debug for C3 conditions

// if showDebug and c2_formed_prev_long

// debugC3 = "C3: "

// debugC3 += c2_formed_prev_long ? "C2✓ " : "C2✗ "

// debugC3 += c3_c1_open_condition_long ? "OPEN✓ " : "OPEN✗ "

// debugC3 += c3_range_condition_long ? "RANGE✓" : "RANGE✗"

// debugC3 += " | C1open:" + str.tostring(open[2]) + " C0low:" + str.tostring(low[3]) + " Close:" + str.tostring(close)

// label.new(bar_index, high, debugC3, color=color.new(color.orange, 70), textcolor=color.white, style=label.style_label_down, size=size.small)

// EMA bias check for C3 (if user selected C3)

ema_check_c3_long = disableEMAFilter or emaBiasCandle != "C3" or close > ema50

// Overall long setup condition

longSetup = isC3Long and ema_check_c3_long

// Candle markers - visible when showCandleNumbers is enabled

// Mark C0 when on C2

plotchar(showCandleNumbers and isC2Long, "C0 Long", "0", location.abovebar, color.white, size=size.tiny, offset=-2)

// Mark C1 when on C2

plotchar(showCandleNumbers and isC2Long, "C1 Long", "1", location.belowbar, color.white, size=size.tiny, offset=-1)

// Mark C2 on current bar

plotchar(showCandleNumbers and isC2Long, "C2 Long", "2", location.belowbar, color.white, size=size.tiny)

// Mark C3 - number (when showCandleNumbers enabled) + emoji on C2 (always)

invalidC3Long = c2_formed_prev_long and not isC3Long

plotchar(showCandleNumbers and (isC3Long or invalidC3Long), "C3 Long", "3", location.belowbar, color.white, size=size.tiny)

plotchar(isC3Long, "Valid Long Setup", "👵🏻", location.belowbar, color.green, size=size.tiny, offset=-1)

plotchar(invalidC3Long, "Invalid Long Setup", "🤡", location.belowbar, color.red, size=size.tiny, offset=-1)

// Variables to store active trade lines for longs

var line longEntryLine = na

var line longSLLine = na

var line longTPLine = na

var label longEntryLabel = na

var label longSLLabel = na

var label longTPLabel = na

// Variables to track break even for longs

var bool longBreakEvenTriggered = false

var float longEntryPrice = na

var float longOneRLevel = na

var float longTPLevel = na

// Draw entry, stop loss, and take profit lines when C3 forms - always visible

if isC3Long

slLevel = low - (stopLossTicks * syminfo.mintick) // Stop loss level with tick offset

// Take profit line

slDistance = close - slLevel // Stop loss distance

tpLevel = close + (slDistance * riskRewardRatio) // Take profit level

// ============================================================================

// SHORT SETUP DETECTION

// ============================================================================

// Check for C2 (current bar): Sweeps C1 high, closes bearish inside C1 range

// C1 would be at [1], C0 at [2]

c1_is_bullish = close[1] > open[1]

c1_has_top_wick = high[1] > math.max(open[1], close[1])

// FVG check: gap between C0 and C2 after the bullish move

// The bullish FVG is the gap between C0's high and C2's low (current bar)

fvg_gap_exists_short = high[2] < low[0]

c2_sweeps_c1_high = high > high[1]

c2_closes_below_c1_high = close < high[1]

c2_closes_above_c0_high = close > high[2]

c2_direction_ok_short = allowC2OppositeDirection or close < open

// EMA bias check for C2 detection (C0, C1, or C2)

ema_check_c2_short = disableEMAFilter or (emaBiasCandle == "C0" ? close[2] < ema50[2] : emaBiasCandle == "C1" ? close[1] < ema50[1] : emaBiasCandle == "C2" ? close < ema50 : true)

isC2Short = c1_is_bullish and c1_has_top_wick and fvg_gap_exists_short and c2_sweeps_c1_high and c2_closes_below_c1_high and c2_closes_above_c0_high and c2_direction_ok_short and ema_check_c2_short

// Store that C2 formed (for detecting C3 on the very next bar)

var bool c2ShortFormed = false

if isC2Short

c2ShortFormed := true

else

c2ShortFormed := false // Reset if not C2 - ensures C3 must be the immediate next bar

// Check for C3 (current bar): Inverts FVG and closes above C1 open

// IMPORTANT: C3 must be the bar immediately after C2 (no gaps allowed)

// When on C3: C0 is at [3], C1 is at [2], C2 is at [1]

// "Invert" means price closes back above C1's open (reversing back toward the FVG)

// Must also close below C0's high (staying within the reversal zone)

c2_formed_prev_short = c2ShortFormed[1]

c3_c1_open_condition_short = allowC3OutsideC1Open or close > open[2]

c3_range_condition_short = allowC3InsideFVG ? (close < low[1] and close > high[3]) : close < high[3]

isC3Short = c2_formed_prev_short and c3_c1_open_condition_short and c3_range_condition_short

// EMA bias check for C3 (if user selected C3)

ema_check_c3_short = disableEMAFilter or emaBiasCandle != "C3" or close < ema50

// Overall short setup condition

shortSetup = isC3Short and ema_check_c3_short

// Candle markers - visible when showCandleNumbers is enabled

// Mark C0 when on C2

plotchar(showCandleNumbers and isC2Short, "C0 Short", "0", location.belowbar, color.white, size=size.tiny, offset=-2)

// Mark C1 when on C2

plotchar(showCandleNumbers and isC2Short, "C1 Short", "1", location.abovebar, color.white, size=size.tiny, offset=-1)

// Mark C2 on current bar

plotchar(showCandleNumbers and isC2Short, "C2 Short", "2", location.abovebar, color.white, size=size.tiny)

// Mark C3 - number (when showCandleNumbers enabled) + emoji on C2 (always)

invalidC3Short = c2_formed_prev_short and not isC3Short

plotchar(showCandleNumbers and (isC3Short or invalidC3Short), "C3 Short", "3", location.abovebar, color.white, size=size.tiny)

plotchar(isC3Short, "Valid Short Setup", "👵🏻", location.abovebar, color.green, size=size.tiny, offset=-1)

plotchar(invalidC3Short, "Invalid Short Setup", "🤡", location.abovebar, color.red, size=size.tiny, offset=-1)

// Variables to store active trade lines for shorts

var line shortEntryLine = na

var line shortSLLine = na

var line shortTPLine = na

var label shortEntryLabel = na

var label shortSLLabel = na

var label shortTPLabel = na

// Variables to track break even for shorts

var bool shortBreakEvenTriggered = false

var float shortEntryPrice = na

var float shortOneRLevel = na

var float shortTPLevel = na

// Draw entry, stop loss, and take profit lines when C3 forms - always visible

if isC3Short

slLevelShort = high + (stopLossTicks * syminfo.mintick) // Stop loss level with tick offset

// Take profit line

slDistanceShort = slLevelShort - close // Stop loss distance

tpLevelShort = close - (slDistanceShort * riskRewardRatio) // Take profit level

// ============================================================================

// ENTRY & EXIT LOGIC

// ============================================================================

// Long entry

if longSetup and strategy.position_size == 0 and inTimeWindow

slLevel = low - (stopLossTicks * syminfo.mintick) // Stop loss level with tick offset

slDistance = close - slLevel // Stop loss distance

tpLevel = close + (slDistance * riskRewardRatio) // Take profit level

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", "Long", stop=slLevel, limit=tpLevel)

// Initialize break even tracking

if breakEvenAtRR > 0

longBreakEvenTriggered := false

longEntryPrice := close

longOneRLevel := close + (slDistance * breakEvenAtRR) // R:R trigger level

longTPLevel := tpLevel

// Check for break even trigger on long trades

if strategy.position_size > 0 and breakEvenAtRR > 0 and not longBreakEvenTriggered

// Check if price has reached the specified R:R level

if high >= longOneRLevel

// Move stop loss to break even (entry price)

strategy.exit("Long Exit", "Long", stop=longEntryPrice, limit=longTPLevel)

longBreakEvenTriggered := true

// Short entry

if shortSetup and strategy.position_size == 0 and inTimeWindow

slLevelShort = high + (stopLossTicks * syminfo.mintick) // Stop loss level with tick offset

slDistanceShort = slLevelShort - close // Stop loss distance

tpLevelShort = close - (slDistanceShort * riskRewardRatio) // Take profit level

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", "Short", stop=slLevelShort, limit=tpLevelShort)

// Initialize break even tracking

if breakEvenAtRR > 0

shortBreakEvenTriggered := false

shortEntryPrice := close

shortOneRLevel := close - (slDistanceShort * breakEvenAtRR) // R:R trigger level

shortTPLevel := tpLevelShort

// Check for break even trigger on short trades

if strategy.position_size < 0 and breakEvenAtRR > 0 and not shortBreakEvenTriggered

// Check if price has reached the specified R:R level

if low <= shortOneRLevel

// Move stop loss to break even (entry price)

strategy.exit("Short Exit", "Short", stop=shortEntryPrice, limit=shortTPLevel)

shortBreakEvenTriggered := true

// ============================================================================

// VISUALIZATION

// ============================================================================

// Plot EMA

plot(showEMA ? ema50 : na, "EMA", color=color.white, linewidth=2)

// Background color for bias

bgcolor(close > ema50 ? color.new(color.green, 95) : close < ema50 ? color.new(color.red, 95) : na)