Je ne sais pas ce qu’il en est de cette stratégie.

Cette stratégie est comme un “commerçant changeant de couleur” super-flexible, qui, contrairement aux stratégies unidirectionnelles rigides, peut changer de direction à tout moment en fonction des conditions du marché. Imaginez que vous ayez un vieux chauffeur qui sait conduire et faire des allers-retours, et qui peut suivre le rythme, quelle que soit la direction du marché !

Portfolio des indicateurs technologiques de base

Cette stratégie utilise la combinaison de cinq indicateurs extrêmement puissants:

- Retour au noyauLes prix des produits et services de base sont très différents selon les pays.

- VWAPLe volume des transactions pondéré en prix moyen vous indique où se trouvent les “grands capitaux”

- Les CVD se sont accumulées en une mauvaise circulationLe pays est en train de devenir une zone de libre-échange.

- Indicateur de faiblesse relative du RSILe blogueur de l’époque a écrit:

- La gamme réelle d’ATRLa réaction de la banque a été très positive.

Mécanisme de confirmation multiple

La meilleure partie de cette stratégie est la “multi-confirmation”, qui, tout comme pour l’achat d’une maison, se base sur le terrain, le type de logement et le prix:

- Une tendance à la convergence ((Kernel + VWAP double confirmation)

- Coopération de la quantité de rendement ((soit en quantité ou en augmentation continue))

- Transition en forme de ligne K (≥ 60% d’entités pour éviter le piège des étoiles croisées)

- Limitation de la fenêtre de temps (transaction seulement de 9h15 à 15h15, évitant ainsi le chaos des ouvertures et des fermetures)

️ Gestion intelligente des risques

La gestion des risques de cette stratégie est à la hauteur des livres !

- Défaillance dynamiqueTrois modes sont proposés: ATR, point fixe, point bas et point haut oscillant

- Distribution de l’arrêt de la coquilleLa première cible est de réduire la position de 50% et de laisser les bénéfices s’échapper.

- Suivre le stop lossLa première étape consiste à déposer automatiquement la perte de capital et à verrouiller les bénéfices.

- Limite quotidienneLe blogueur a écrit sur son blog:

- Gestion des fondsLe risque de chaque transaction est contrôlé à moins de 1%.

Recommandations pour une utilisation au combat

Si vous voulez utiliser cette stratégie, gardez à l’esprit les points suivants:

- Le meilleur cycleLes graphiques de 5 minutes sont les plus performants, car ils capturent les fluctuations à court terme sans être trop fréquents.

- Variété admissible: conçu pour les futures des indices bancaires, mais d’autres indices sont également disponibles

- Période de la transactionLes deux lignes K avant le disque doivent être évitées.

- Contrôle de positionLe nombre de contrats par équipe est de 25 à 75, avec un maximum de 200 joueurs.

Le plus grand avantage de cette stratégie est que l’on peut attaquer et se défendre, le marché haussier peut faire plus, le marché baissier peut faire moins, et le marché oscillant n’a pas peur !

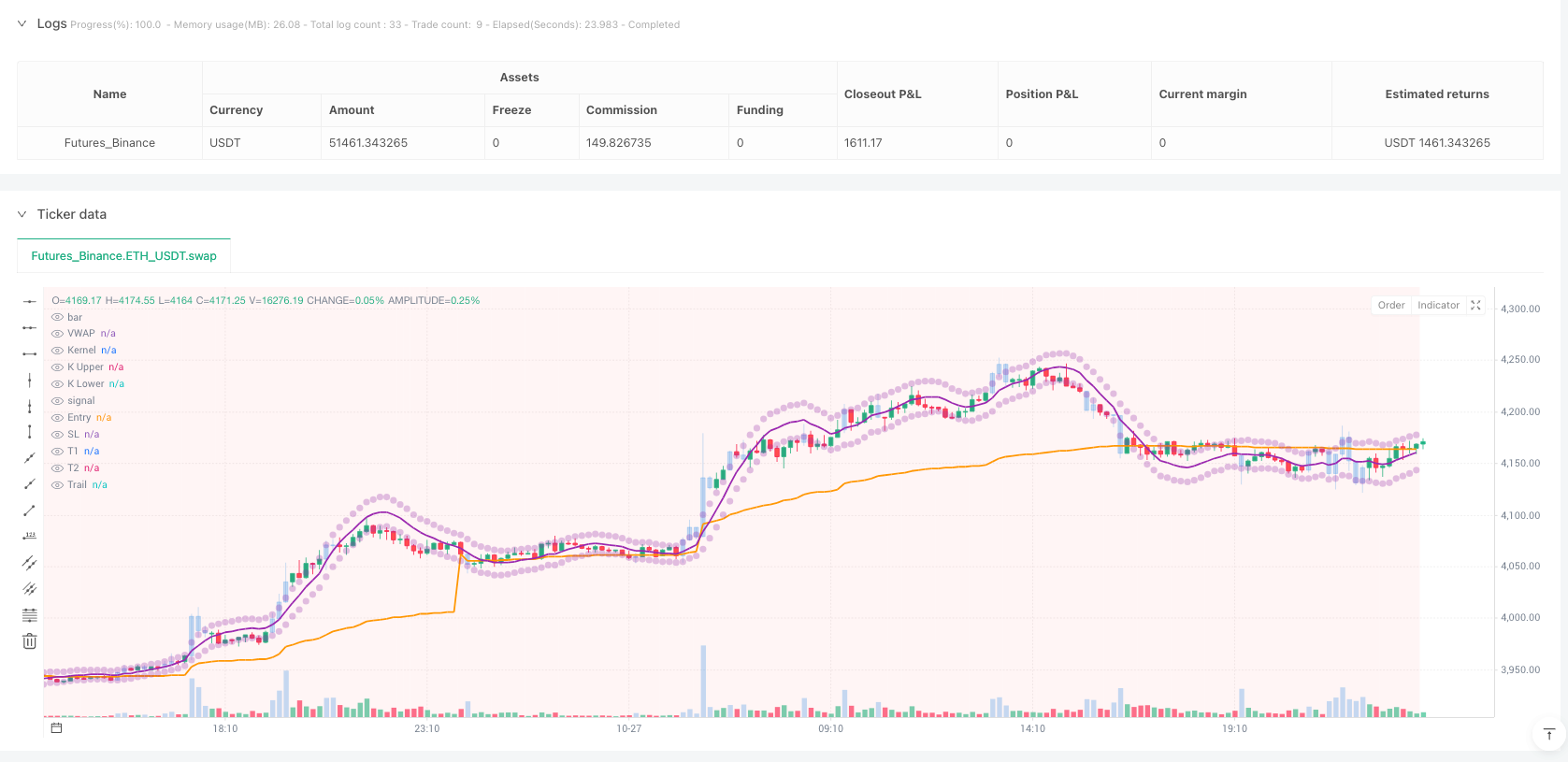

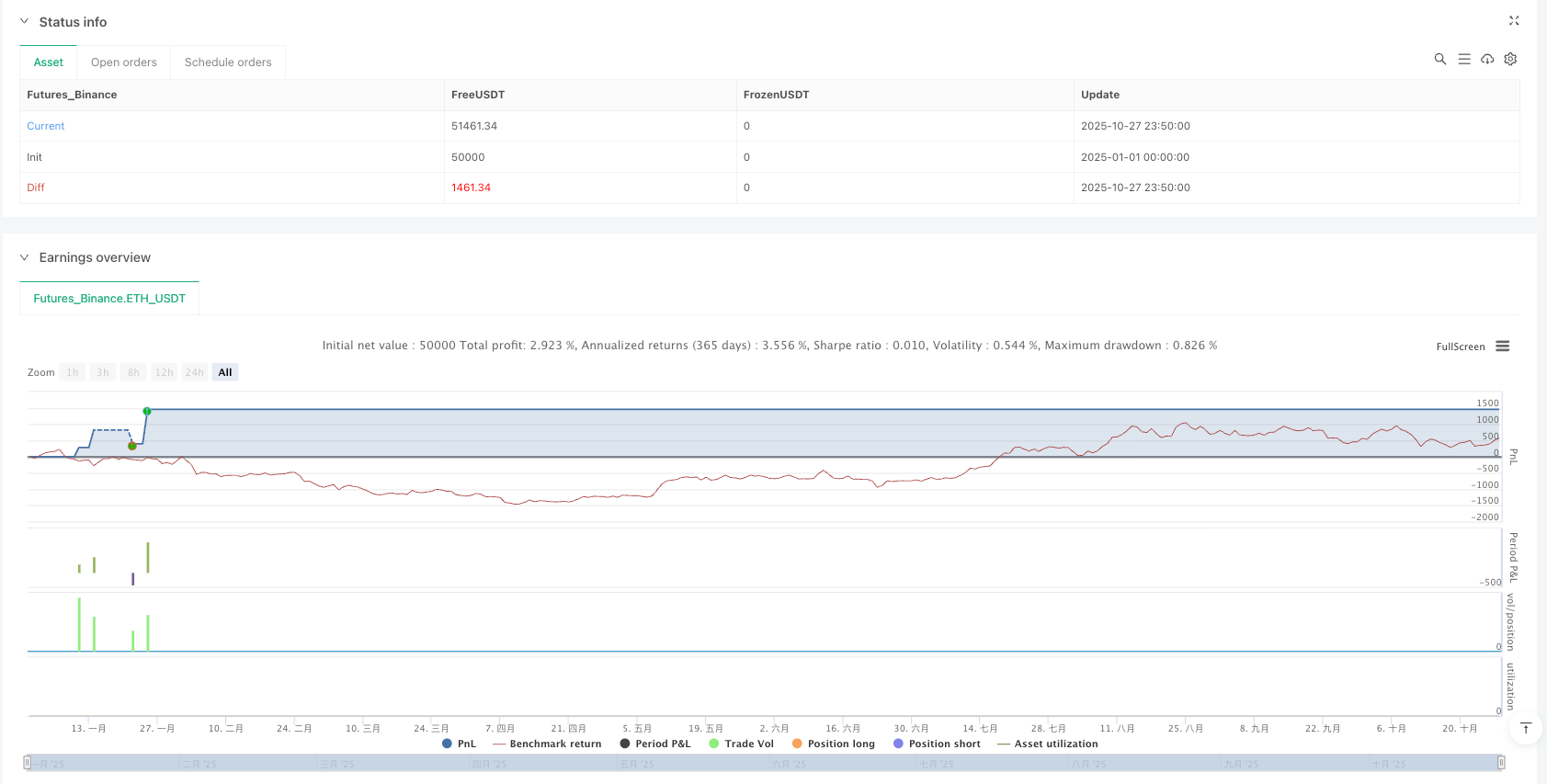

/*backtest

start: 2025-01-01 00:00:00

end: 2025-10-28 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("BankNifty LONG & SHORT Multi-Confluence",

shorttitle="BN Long-Short",

overlay=true)

// ═══════════════════════════════════════════════════════════

// 📊 STRATEGY INFO

// ═══════════════════════════════════════════════════════════

// Timeframe: 5-MINUTE CHART (Recommended)

// Direction: LONG & SHORT (Both directions)

// Asset: BankNifty Futures

// Style: Intraday Momentum Trading

// ═══════════════════════════════════════════════════════════

// ═══════════════════════════════════════════════════════════

// ⚙️ INPUT PARAMETERS

// ═══════════════════════════════════════════════════════════

// Trading Direction

tradingDirection = input.string("Both", "Trading Direction",

options=["Long Only", "Short Only", "Both"], group="🎯 Strategy Type")

// Trading Hours (IST)

startHour = input.int(9, "Start Hour", minval=0, maxval=23, group="⏰ Trading Session")

startMinute = input.int(15, "Start Minute", minval=0, maxval=59, group="⏰ Trading Session")

endHour = input.int(15, "End Hour", minval=0, maxval=23, group="⏰ Trading Session")

endMinute = input.int(15, "End Minute", minval=0, maxval=59, group="⏰ Trading Session")

avoidFirstCandles = input.int(2, "Skip First N Candles", minval=0, maxval=10, group="⏰ Trading Session")

// Position Sizing

lotSize = input.int(25, "Lot Size", minval=15, maxval=75, group="💰 Position Management")

maxContracts = input.int(75, "Max Contracts", minval=25, maxval=200, step=25, group="💰 Position Management")

riskPercent = input.float(1.0, "Risk % Per Trade", minval=0.5, maxval=3.0, step=0.1, group="💰 Position Management")

// Kernel Regression

kernelLength = input.int(20, "Kernel Length", minval=10, maxval=50, group="📈 Indicators")

// VWAP

vwapSource = input.string("Session", "VWAP Type", options=["Session", "Rolling"], group="📈 Indicators")

vwapRollingLength = input.int(20, "Rolling VWAP Length", minval=10, maxval=100, group="📈 Indicators")

// Volume

volumeLength = input.int(20, "Volume MA Length", minval=10, maxval=50, group="📊 Volume")

volumeMultiplier = input.float(1.5, "Volume Spike", minval=1.1, maxval=3.0, step=0.1, group="📊 Volume")

// CVD

useCVD = input.bool(true, "Use CVD Filter", group="📊 Volume")

cvdLength = input.int(10, "CVD Smoothing", minval=5, maxval=30, group="📊 Volume")

// RSI

useRSI = input.bool(true, "Use RSI Filter", group="🎯 Filters")

rsiLength = input.int(14, "RSI Length", minval=7, maxval=30, group="🎯 Filters")

rsiOverbought = input.int(70, "RSI Overbought", minval=60, maxval=85, group="🎯 Filters")

rsiOversold = input.int(30, "RSI Oversold", minval=15, maxval=40, group="🎯 Filters")

// Price Action

candleBodyPercent = input.float(0.6, "Min Body %", minval=0.4, maxval=0.9, step=0.05, group="🎯 Filters")

minCandlePoints = input.float(20.0, "Min Candle Size", minval=10.0, maxval=100.0, step=5.0, group="🎯 Filters")

// Stop Loss

stopLossType = input.string("ATR", "Stop Loss Type", options=["Fixed", "ATR", "Swing"], group="🛡️ Exits")

atrLength = input.int(14, "ATR Length", minval=7, maxval=30, group="🛡️ Exits")

atrMultiplier = input.float(1.5, "ATR Multiplier", minval=0.5, maxval=3.0, step=0.1, group="🛡️ Exits")

fixedStopLoss = input.float(50.0, "Fixed SL (points)", minval=20.0, maxval=200.0, step=10.0, group="🛡️ Exits")

swingLookback = input.int(10, "Swing Lookback", minval=5, maxval=30, group="🛡️ Exits")

// Targets

rrTarget1 = input.float(1.5, "Target 1 R:R", minval=0.5, maxval=3.0, step=0.1, group="🛡️ Exits")

rrTarget2 = input.float(2.5, "Target 2 R:R", minval=1.0, maxval=5.0, step=0.5, group="🛡️ Exits")

partialExitPercent = input.int(50, "Partial Exit %", minval=25, maxval=75, step=5, group="🛡️ Exits")

// Trailing

useTrailing = input.bool(true, "Trailing Stop", group="🛡️ Exits")

trailActivationRR = input.float(1.2, "Activate at R:R", minval=0.5, maxval=2.0, step=0.1, group="🛡️ Exits")

trailStopRR = input.float(0.8, "Trail Stop R:R", minval=0.3, maxval=1.5, step=0.1, group="🛡️ Exits")

// Risk Management

maxTradesPerDay = input.int(5, "Max Trades/Day", minval=1, maxval=20, group="🚨 Risk")

maxConsecutiveLosses = input.int(2, "Stop After Losses", minval=1, maxval=5, group="🚨 Risk")

dailyLossLimit = input.float(2.5, "Daily Loss %", minval=1.0, maxval=10.0, step=0.5, group="🚨 Risk")

dailyProfitTarget = input.float(5.0, "Daily Target %", minval=2.0, maxval=20.0, step=0.5, group="🚨 Risk")

// ═══════════════════════════════════════════════════════════

// 📊 INDICATORS

// ═══════════════════════════════════════════════════════════

// Kernel Regression

kernel = ta.linreg(close, kernelLength, 0)

kernelSlope = kernel - kernel[1]

// VWAP

vwapValue = vwapSource == "Session" ? ta.vwap(close) : ta.sma(hlc3, vwapRollingLength)

vwapSlope = vwapValue - vwapValue[1]

// Volume

volumeMA = ta.sma(volume, volumeLength)

highVolume = volume > volumeMA * volumeMultiplier

volumeIncreasing = volume > volume[1] and volume[1] > volume[2]

// CVD

buyVolume = close > open ? volume : 0

sellVolume = close < open ? volume : 0

volumeDelta = buyVolume - sellVolume

cvd = ta.cum(volumeDelta)

cvdMA = ta.sma(cvd, cvdLength)

// RSI

rsi = ta.rsi(close, rsiLength)

// ATR

atr = ta.atr(atrLength)

// Price Action

candleRange = high - low

candleBody = math.abs(close - open)

bodyPercent = candleRange > 0 ? candleBody / candleRange : 0

// Swing High/Low

swingHigh = ta.highest(high, swingLookback)

swingLow = ta.lowest(low, swingLookback)

// ═══════════════════════════════════════════════════════════

// ⏰ TIME MANAGEMENT

// ═══════════════════════════════════════════════════════════

currentMinutes = hour * 60 + minute

startMinutes = startHour * 60 + startMinute

endMinutes = endHour * 60 + endMinute

tradingTime = currentMinutes >= startMinutes and currentMinutes <= endMinutes

var int barsToday = 0

newDay = ta.change(dayofweek)

if newDay

barsToday := 0

if tradingTime

barsToday += 1

skipInitialBars = barsToday <= avoidFirstCandles

forceExitTime = currentMinutes >= (endMinutes - 5)

// ═══════════════════════════════════════════════════════════

// 💼 POSITION TRACKING

// ═══════════════════════════════════════════════════════════

var int todayTrades = 0

var int consecutiveLosses = 0

var float todayPnL = 0.0

var float entryPrice = na

var int entryBar = 0

var float stopLoss = na

var float target1 = na

var float target2 = na

var float trailStop = na

var bool target1Hit = false

var bool trailActive = false

// Daily Reset

if newDay

todayTrades := 0

consecutiveLosses := 0

todayPnL := 0.0

// Track P&L

if strategy.closedtrades > 0 and strategy.closedtrades != strategy.closedtrades[1]

lastPnL = strategy.closedtrades.profit(strategy.closedtrades - 1)

todayPnL += lastPnL

if lastPnL < 0

consecutiveLosses += 1

else

consecutiveLosses := 0

// Risk Limits

lossLimit = strategy.initial_capital * (dailyLossLimit / 100)

profitTarget = strategy.initial_capital * (dailyProfitTarget / 100)

hitDailyTarget = todayPnL >= profitTarget

hitLossLimit = math.abs(todayPnL) >= lossLimit

canTrade = todayTrades < maxTradesPerDay and

consecutiveLosses < maxConsecutiveLosses and

not hitDailyTarget and

not hitLossLimit and

tradingTime and

not skipInitialBars and

strategy.position_size == 0

// ═══════════════════════════════════════════════════════════

// 🎯 LONG ENTRY CONDITIONS

// ═══════════════════════════════════════════════════════════

// Bullish Trend

longTrend = kernelSlope > 0 and close > kernel

longVWAP = close > vwapValue and vwapSlope > 0

longCVD = useCVD ? cvd > cvdMA and ta.rising(cvd, 2) : true

longRSI = useRSI ? rsi > rsiOversold and rsi < rsiOverbought : true

longVolume = highVolume or volumeIncreasing

longCandle = close > open and bodyPercent >= candleBodyPercent and

candleRange >= minCandlePoints and close >= (high - (candleRange * 0.25))

longSignal = longTrend and longVWAP and longCVD and longRSI and longVolume and longCandle and canTrade and

(tradingDirection == "Long Only" or tradingDirection == "Both")

// ═══════════════════════════════════════════════════════════

// 🎯 SHORT ENTRY CONDITIONS

// ═══════════════════════════════════════════════════════════

// Bearish Trend

shortTrend = kernelSlope < 0 and close < kernel

shortVWAP = close < vwapValue and vwapSlope < 0

shortCVD = useCVD ? cvd < cvdMA and ta.falling(cvd, 2) : true

shortRSI = useRSI ? rsi < rsiOverbought and rsi > rsiOversold : true

shortVolume = highVolume or volumeIncreasing

shortCandle = close < open and bodyPercent >= candleBodyPercent and

candleRange >= minCandlePoints and close <= (low + (candleRange * 0.25))

shortSignal = shortTrend and shortVWAP and shortCVD and shortRSI and shortVolume and shortCandle and canTrade and

(tradingDirection == "Short Only" or tradingDirection == "Both")

// ═══════════════════════════════════════════════════════════

// 💰 POSITION SIZING

// ═══════════════════════════════════════════════════════════

calcPositionSize(stopDistance) =>

riskAmount = strategy.initial_capital * (riskPercent / 100)

contracts = math.floor(riskAmount / stopDistance)

math.min(contracts, maxContracts)

// ═══════════════════════════════════════════════════════════

// 📥 LONG ENTRY

// ═══════════════════════════════════════════════════════════

if longSignal

entryPrice := close

entryBar := bar_index

// Calculate Stop Loss

if stopLossType == "ATR"

stopLoss := close - (atr * atrMultiplier)

else if stopLossType == "Swing"

stopLoss := math.min(swingLow, close - (atr * atrMultiplier))

else

stopLoss := close - fixedStopLoss

risk = entryPrice - stopLoss

target1 := entryPrice + (risk * rrTarget1)

target2 := entryPrice + (risk * rrTarget2)

qty = calcPositionSize(risk)

trailStop := stopLoss

target1Hit := false

trailActive := false

todayTrades += 1

strategy.entry("LONG", strategy.long, qty=qty, comment="Long-" + str.tostring(todayTrades))

// ═══════════════════════════════════════════════════════════

// 📥 SHORT ENTRY

// ═══════════════════════════════════════════════════════════

if shortSignal

entryPrice := close

entryBar := bar_index

// Calculate Stop Loss

if stopLossType == "ATR"

stopLoss := close + (atr * atrMultiplier)

else if stopLossType == "Swing"

stopLoss := math.max(swingHigh, close + (atr * atrMultiplier))

else

stopLoss := close + fixedStopLoss

risk = stopLoss - entryPrice

target1 := entryPrice - (risk * rrTarget1)

target2 := entryPrice - (risk * rrTarget2)

qty = calcPositionSize(risk)

trailStop := stopLoss

target1Hit := false

trailActive := false

todayTrades += 1

strategy.entry("SHORT", strategy.short, qty=qty, comment="Short-" + str.tostring(todayTrades))

// ═══════════════════════════════════════════════════════════

// 🏃 TRAILING STOP (LONG)

// ═══════════════════════════════════════════════════════════

if strategy.position_size > 0 and useTrailing

unrealizedProfit = close - entryPrice

risk = entryPrice - stopLoss

if unrealizedProfit >= (risk * trailActivationRR) and not trailActive

trailActive := true

trailStop := close - (risk * trailStopRR)

if trailActive

newTrailStop = close - (risk * trailStopRR)

if newTrailStop > trailStop

trailStop := newTrailStop

// ═══════════════════════════════════════════════════════════

// 🏃 TRAILING STOP (SHORT)

// ═══════════════════════════════════════════════════════════

if strategy.position_size < 0 and useTrailing

unrealizedProfit = entryPrice - close

risk = stopLoss - entryPrice

if unrealizedProfit >= (risk * trailActivationRR) and not trailActive

trailActive := true

trailStop := close + (risk * trailStopRR)

if trailActive

newTrailStop = close + (risk * trailStopRR)

if newTrailStop < trailStop

trailStop := newTrailStop

// ═══════════════════════════════════════════════════════════

// 📤 LONG EXIT

// ═══════════════════════════════════════════════════════════

if strategy.position_size > 0

activeSL = trailActive and useTrailing ? trailStop : stopLoss

// Stop Loss

if low <= activeSL

strategy.close("LONG", comment="Long-SL")

// Target 1

else if high >= target1 and not target1Hit

exitQty = math.floor(strategy.position_size * (partialExitPercent / 100))

strategy.close("LONG", qty=exitQty, comment="Long-T1")

target1Hit := true

stopLoss := entryPrice

// Target 2

else if high >= target2

strategy.close("LONG", comment="Long-T2")

// Force Exit

else if forceExitTime

strategy.close("LONG", comment="Long-EOD")

// ═══════════════════════════════════════════════════════════

// 📤 SHORT EXIT

// ═══════════════════════════════════════════════════════════

if strategy.position_size < 0

activeSL = trailActive and useTrailing ? trailStop : stopLoss

// Stop Loss

if high >= activeSL

strategy.close("SHORT", comment="Short-SL")

// Target 1

else if low <= target1 and not target1Hit

exitQty = math.floor(math.abs(strategy.position_size) * (partialExitPercent / 100))

strategy.close("SHORT", qty=exitQty, comment="Short-T1")

target1Hit := true

stopLoss := entryPrice

// Target 2

else if low <= target2

strategy.close("SHORT", comment="Short-T2")

// Force Exit

else if forceExitTime

strategy.close("SHORT", comment="Short-EOD")

// ═══════════════════════════════════════════════════════════

// ⚠️ REVERSAL EXIT

// ═══════════════════════════════════════════════════════════

longReversal = strategy.position_size > 0 and (close < kernel and kernelSlope < 0 or close < vwapValue)

shortReversal = strategy.position_size < 0 and (close > kernel and kernelSlope > 0 or close > vwapValue)

if longReversal and target1Hit

strategy.close("LONG", comment="Long-Rev")

if shortReversal and target1Hit

strategy.close("SHORT", comment="Short-Rev")

// ═══════════════════════════════════════════════════════════

// 🎨 VISUALIZATION

// ═══════════════════════════════════════════════════════════

// Indicators

plot(kernel, "Kernel", color=color.new(color.purple, 0), linewidth=2)

plot(vwapValue, "VWAP", color=color.new(color.orange, 0), linewidth=2)

kernelUpper = kernel + atr

kernelLower = kernel - atr

plot(kernelUpper, "K Upper", color=color.new(color.purple, 70), linewidth=1, style=plot.style_circles)

plot(kernelLower, "K Lower", color=color.new(color.purple, 70), linewidth=1, style=plot.style_circles)

// Signals

plotshape(longSignal, "LONG", shape.triangleup, location.belowbar,

color=color.new(color.lime, 0), size=size.normal, text="LONG")

plotshape(shortSignal, "SHORT", shape.triangledown, location.abovebar,

color=color.new(color.red, 0), size=size.normal, text="SHORT")

// Position Levels

posColor = strategy.position_size > 0 ? color.blue : strategy.position_size < 0 ? color.orange : na

plot(strategy.position_size != 0 ? entryPrice : na, "Entry",

color=color.new(posColor, 0), style=plot.style_linebr, linewidth=2)

slColor = strategy.position_size > 0 ? color.red : color.fuchsia

plot(strategy.position_size != 0 ? stopLoss : na, "SL",

color=color.new(slColor, 0), style=plot.style_linebr, linewidth=2)

t1Color = strategy.position_size > 0 ? color.green : color.aqua

plot(strategy.position_size != 0 ? target1 : na, "T1",

color=color.new(t1Color, 0), style=plot.style_linebr, linewidth=1)

plot(strategy.position_size != 0 ? target2 : na, "T2",

color=color.new(t1Color, 0), style=plot.style_linebr, linewidth=2)

plot(strategy.position_size != 0 and trailActive ? trailStop : na, "Trail",

color=color.new(color.yellow, 0), style=plot.style_linebr, linewidth=2)

// Volume

barcolor(highVolume ? color.new(color.blue, 70) : na)

// Background

bgcolor(tradingTime ? color.new(color.green, 98) : color.new(color.gray, 95))

bgcolor(strategy.position_size > 0 ? color.new(color.blue, 97) :

strategy.position_size < 0 ? color.new(color.orange, 97) : na)

bgcolor(hitDailyTarget ? color.new(color.green, 92) : hitLossLimit ? color.new(color.red, 92) : na)

// ═══════════════════════════════════════════════════════════

// 📊 STATS TABLE

// ═══════════════════════════════════════════════════════════

var table stats = table.new(position.top_right, 2, 11, border_width=1)

if barstate.islast

// Header

table.cell(stats, 0, 0, "📊 LONG & SHORT", bgcolor=color.blue, text_color=color.white, text_size=size.small)

table.cell(stats, 1, 0, "STRATEGY", bgcolor=color.blue, text_color=color.white, text_size=size.small)

// Trades

table.cell(stats, 0, 1, "Trades", text_size=size.small)

table.cell(stats, 1, 1, str.tostring(todayTrades) + "/" + str.tostring(maxTradesPerDay),

bgcolor=todayTrades >= maxTradesPerDay ? color.red : color.green, text_color=color.white, text_size=size.small)

// Losses

table.cell(stats, 0, 2, "Losses", text_size=size.small)

table.cell(stats, 1, 2, str.tostring(consecutiveLosses),

bgcolor=consecutiveLosses >= maxConsecutiveLosses ? color.red : color.green,

text_color=color.white, text_size=size.small)

// P&L

pnlPct = (todayPnL / strategy.initial_capital) * 100

table.cell(stats, 0, 3, "P&L", text_size=size.small)

table.cell(stats, 1, 3, str.tostring(todayPnL, "#,###") + "\n" + str.tostring(pnlPct, "#.##") + "%",

bgcolor=todayPnL > 0 ? color.green : todayPnL < 0 ? color.red : color.gray,

text_color=color.white, text_size=size.small)

// Position

table.cell(stats, 0, 4, "Position", text_size=size.small)

posText = strategy.position_size > 0 ? "LONG\n" + str.tostring(strategy.position_size) :

strategy.position_size < 0 ? "SHORT\n" + str.tostring(math.abs(strategy.position_size)) : "FLAT"

posBg = strategy.position_size > 0 ? color.blue : strategy.position_size < 0 ? color.orange : color.gray

table.cell(stats, 1, 4, posText, bgcolor=posBg, text_color=color.white, text_size=size.small)

if strategy.position_size != 0

// Entry

table.cell(stats, 0, 5, "Entry", text_size=size.small)

table.cell(stats, 1, 5, str.tostring(entryPrice, "#.##"), text_size=size.small)

// Live P&L

livePnL = strategy.position_size > 0 ? (close - entryPrice) * strategy.position_size :

(entryPrice - close) * math.abs(strategy.position_size)

livePct = strategy.position_size > 0 ? ((close - entryPrice) / entryPrice) * 100 :

((entryPrice - close) / entryPrice) * 100

table.cell(stats, 0, 6, "Live P&L", text_size=size.small)

table.cell(stats, 1, 6, str.tostring(livePnL, "#,###") + "\n" + str.tostring(livePct, "#.##") + "%",

bgcolor=livePnL > 0 ? color.green : color.red, text_color=color.white, text_size=size.small)

// Bars

bars = bar_index - entryBar

table.cell(stats, 0, 7, "Bars", text_size=size.small)

table.cell(stats, 1, 7, str.tostring(bars), text_size=size.small)

// Stop

table.cell(stats, 0, 8, "Stop", text_size=size.small)

table.cell(stats, 1, 8, str.tostring(trailActive ? trailStop : stopLoss, "#.##") +

(trailActive ? " 🟡" : ""), text_size=size.small)

// T1

table.cell(stats, 0, 9, "T1", text_size=size.small)

table.cell(stats, 1, 9, str.tostring(target1, "#.##") + (target1Hit ? " ✓" : ""), text_size=size.small)

// T2

table.cell(stats, 0, 10, "T2", text_size=size.small)

table.cell(stats, 1, 10, str.tostring(target2, "#.##"), text_size=size.small)

// ═══════════════════════════════════════════════════════════

// 🔔 ALERTS

// ═══════════════════════════════════════════════════════════

alertcondition(longSignal, "🟢 LONG SIGNAL", "LONG Entry Signal")

alertcondition(shortSignal, "🔴 SHORT SIGNAL", "SHORT Entry Signal")

alertcondition(longReversal or shortReversal, "⚠️ REVERSAL", "Reversal Detected")