क्या यह रणनीति काम कर रही है?

क्या आप जानते हैं? यह रणनीति एक सुपर-लचीला “विभिन्न रंगों का व्यापारी” की तरह है! यह एकतरफा रणनीति की तरह नहीं है, लेकिन बाजार की स्थिति के अनुसार किसी भी समय बहु-दिशाओं में स्विच करने में सक्षम है। कल्पना कीजिए कि आपके पास एक बूढ़ा ड्राइवर है जो ड्राइव और रिवर्स दोनों कर सकता है, जो बाजार की दिशा में तेजी से चलता है!

कोर टेक्नोलॉजी इंडिकेटर पोर्टफोलियो

इस रणनीति में पांच शक्तिशाली संकेतकों के संयोजन का उपयोग किया गया हैः

- कर्नेल वापसीयह जीपीएस नेविगेशन की तरह है जो कीमतों की दिशा को इंगित करता है।

- VWAPव्यापार भारित औसत मूल्य आपको बताता है कि ‘बड़ा पैसा’ कहां है

- सीवीडी के लिए एक संचयी अंतरइस लेख में, हम आपको बताएँगे कि कैसे एक व्यक्ति एक व्यापारिक व्यक्ति बन सकता है।

- आरएसआई की तुलनात्मक कमजोरीइस लेख में, हम आपको बता रहे हैं कि कैसे आप अपने जीवन में सबसे कठिन समय का सामना कर सकते हैं।

- एटीआर वास्तविक अस्थिरता: बाजार में उतार-चढ़ाव के लिए स्टॉपलॉस को गतिशील रूप से समायोजित करना

एकाधिक सत्यापन तंत्र

इस रणनीति में सबसे चतुर बात यह है कि यह “बहु-सत्यापन” है, जैसे कि एक घर खरीदने के लिए क्षेत्र, घर के प्रकार और कीमत की जांच करना, यह पूछता हैः

- प्रवृत्ति एकजुटता ((केर्नेल + वीडब्ल्यूपीएपी दोहरी पुष्टि)

- परिपक्वता संयोजन (या तो मात्रा या निरंतर वृद्धि)

- K-लाइन आकृति पारगमन (≥ 60% एंटिटी, क्रॉसस्टार ट्रैप से बचें)

- समय विंडो की सीमा (केवल 9:15-15:15 के बीच व्यापार करें, ओपन और क्लोज की गड़बड़ी से बचें)

️ स्मार्ट जोखिम प्रबंधन

इस रणनीति का जोखिम नियंत्रण पाठ्यपुस्तक स्तर पर है!

- गतिशील रोकएटीआर, फिक्स्ड पॉइंट स्कोर और स्विंग हाई-लो-पॉइंट तीन मोड

- बैचों को रोकनापहला लक्ष्यः 50 प्रतिशत की स्थिति को खाली करना और मुनाफे को चलाना

- ट्रैक रोक“मैंने कभी नहीं सोचा था कि मैं कभी भी किसी के लिए कुछ कर सकता हूं।

- दैनिक सीमाइस तरह की घटनाओं के बीच, व्यापारियों ने एक-दूसरे के साथ व्यापार करने से इनकार कर दिया है।

- धन प्रबंधनहर लेनदेन पर 1 प्रतिशत से कम का जोखिम

युद्धाभ्यास के लिए सुझाव

यदि आप इस रणनीति का लाभ उठाना चाहते हैं, तो निम्नलिखित बातों को ध्यान में रखेंः

- सबसे अच्छा चक्र5:5-मिनट का चार्ट सबसे अच्छा प्रदर्शन करता है क्योंकि यह अल्पकालिक उतार-चढ़ाव को पकड़ता है और बहुत बार नहीं होता है

- उपयुक्त किस्म: विशेष रूप से बैंकिंग सूचकांक के लिए डिज़ाइन किया गया है, लेकिन अन्य सूचकांक भी उपलब्ध हैं

- लेनदेन समयभारतीय समयानुसार, 9:15-15:15 बजे, डिस्क के सामने दो के-लाइनों के शोर से बचें।

- स्थिति नियंत्रण25 से 75 अनुबंधों की सिफारिश की जाती है, अधिकतम 200 से अधिक नहीं

इस रणनीति की सबसे बड़ी विशेषता यह है कि हम हमला कर सकते हैं, हम बचाव कर सकते हैं, बैल बाजार अधिक कर सकता है, भालू बाजार खाली हो सकता है, और बाजार के झटके से कोई डर नहीं है! यह एक स्विस तलवार की तरह है, जो किसी भी स्थिति से निपट सकता है।

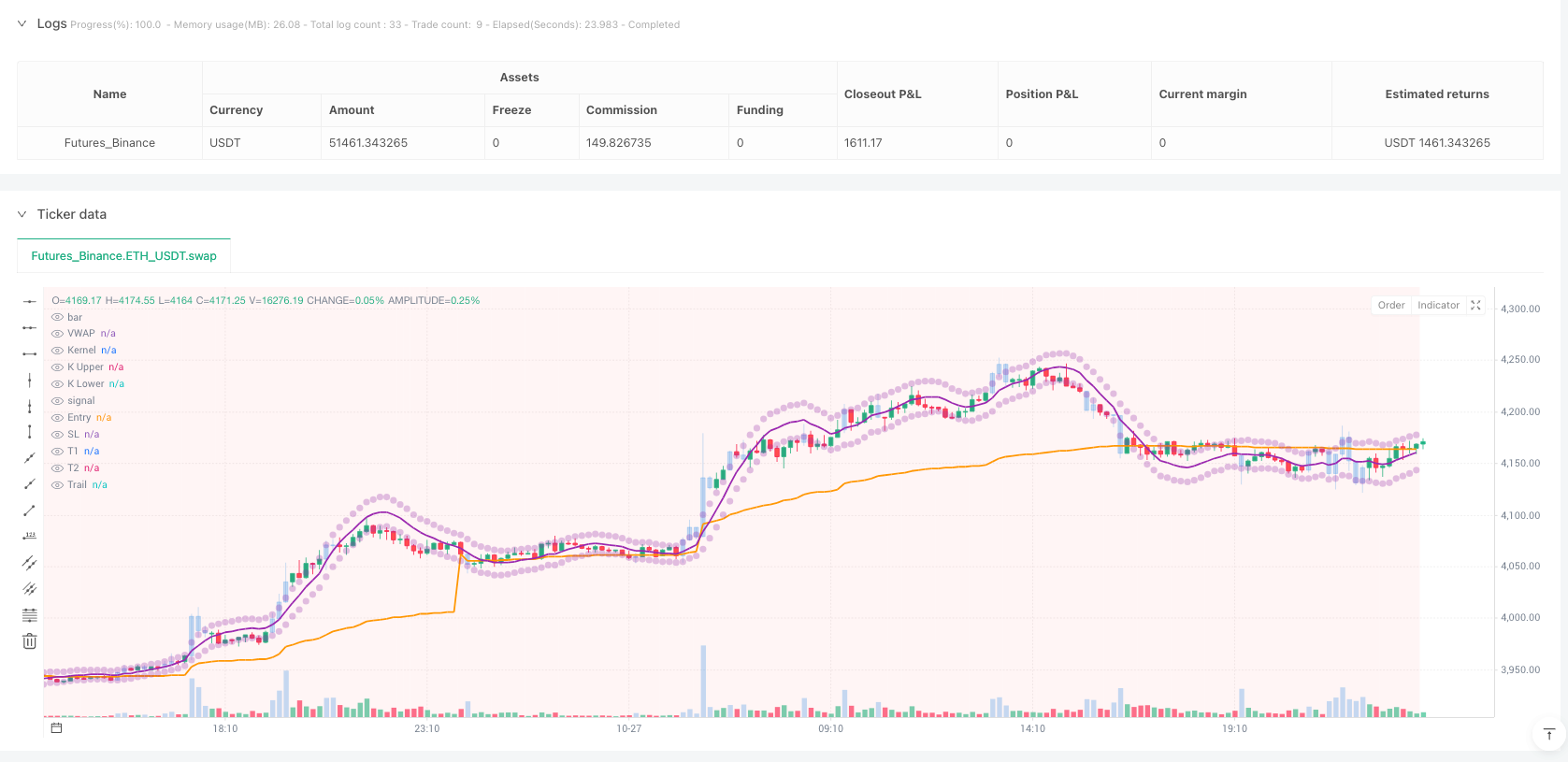

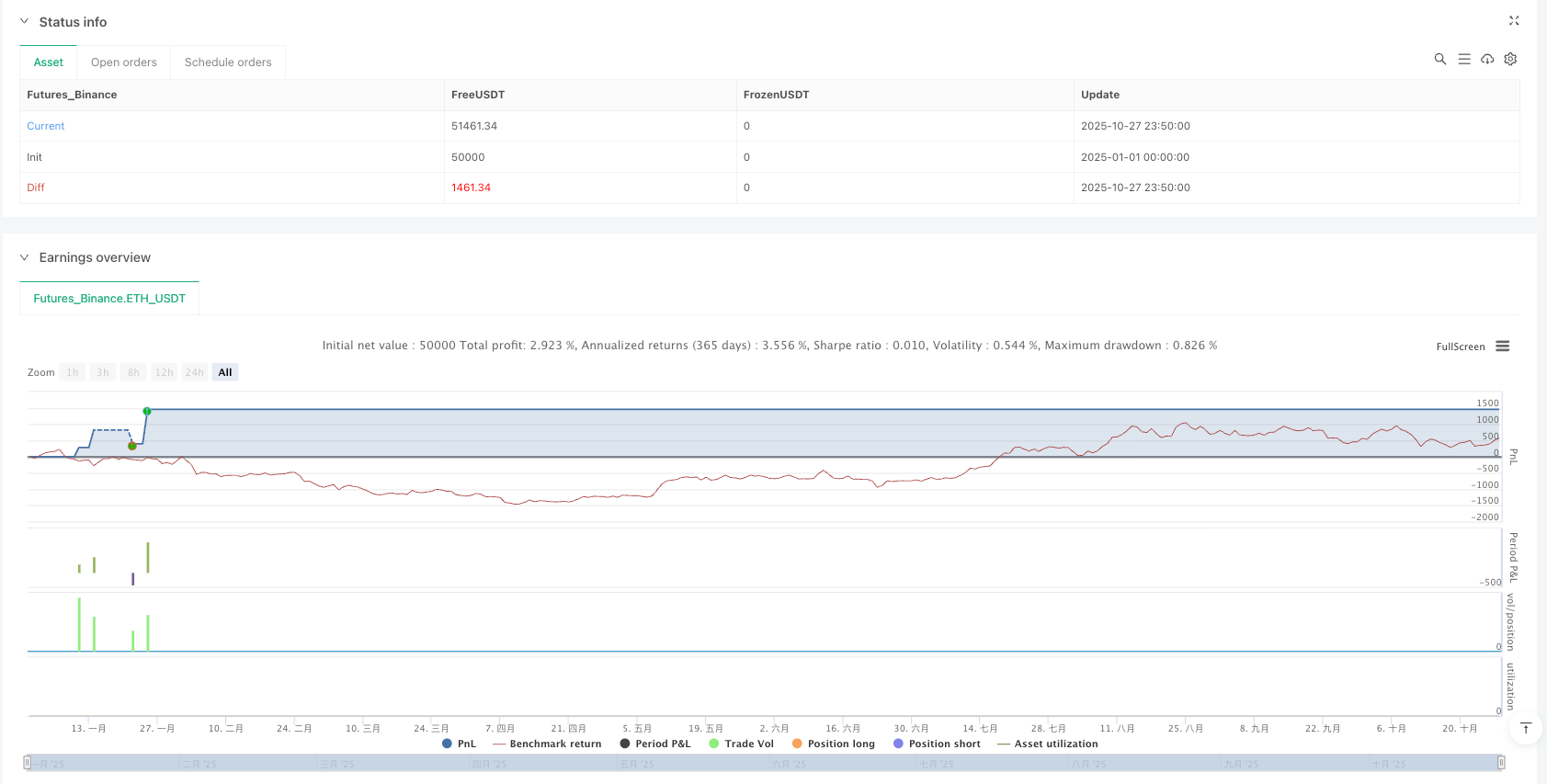

/*backtest

start: 2025-01-01 00:00:00

end: 2025-10-28 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("BankNifty LONG & SHORT Multi-Confluence",

shorttitle="BN Long-Short",

overlay=true)

// ═══════════════════════════════════════════════════════════

// 📊 STRATEGY INFO

// ═══════════════════════════════════════════════════════════

// Timeframe: 5-MINUTE CHART (Recommended)

// Direction: LONG & SHORT (Both directions)

// Asset: BankNifty Futures

// Style: Intraday Momentum Trading

// ═══════════════════════════════════════════════════════════

// ═══════════════════════════════════════════════════════════

// ⚙️ INPUT PARAMETERS

// ═══════════════════════════════════════════════════════════

// Trading Direction

tradingDirection = input.string("Both", "Trading Direction",

options=["Long Only", "Short Only", "Both"], group="🎯 Strategy Type")

// Trading Hours (IST)

startHour = input.int(9, "Start Hour", minval=0, maxval=23, group="⏰ Trading Session")

startMinute = input.int(15, "Start Minute", minval=0, maxval=59, group="⏰ Trading Session")

endHour = input.int(15, "End Hour", minval=0, maxval=23, group="⏰ Trading Session")

endMinute = input.int(15, "End Minute", minval=0, maxval=59, group="⏰ Trading Session")

avoidFirstCandles = input.int(2, "Skip First N Candles", minval=0, maxval=10, group="⏰ Trading Session")

// Position Sizing

lotSize = input.int(25, "Lot Size", minval=15, maxval=75, group="💰 Position Management")

maxContracts = input.int(75, "Max Contracts", minval=25, maxval=200, step=25, group="💰 Position Management")

riskPercent = input.float(1.0, "Risk % Per Trade", minval=0.5, maxval=3.0, step=0.1, group="💰 Position Management")

// Kernel Regression

kernelLength = input.int(20, "Kernel Length", minval=10, maxval=50, group="📈 Indicators")

// VWAP

vwapSource = input.string("Session", "VWAP Type", options=["Session", "Rolling"], group="📈 Indicators")

vwapRollingLength = input.int(20, "Rolling VWAP Length", minval=10, maxval=100, group="📈 Indicators")

// Volume

volumeLength = input.int(20, "Volume MA Length", minval=10, maxval=50, group="📊 Volume")

volumeMultiplier = input.float(1.5, "Volume Spike", minval=1.1, maxval=3.0, step=0.1, group="📊 Volume")

// CVD

useCVD = input.bool(true, "Use CVD Filter", group="📊 Volume")

cvdLength = input.int(10, "CVD Smoothing", minval=5, maxval=30, group="📊 Volume")

// RSI

useRSI = input.bool(true, "Use RSI Filter", group="🎯 Filters")

rsiLength = input.int(14, "RSI Length", minval=7, maxval=30, group="🎯 Filters")

rsiOverbought = input.int(70, "RSI Overbought", minval=60, maxval=85, group="🎯 Filters")

rsiOversold = input.int(30, "RSI Oversold", minval=15, maxval=40, group="🎯 Filters")

// Price Action

candleBodyPercent = input.float(0.6, "Min Body %", minval=0.4, maxval=0.9, step=0.05, group="🎯 Filters")

minCandlePoints = input.float(20.0, "Min Candle Size", minval=10.0, maxval=100.0, step=5.0, group="🎯 Filters")

// Stop Loss

stopLossType = input.string("ATR", "Stop Loss Type", options=["Fixed", "ATR", "Swing"], group="🛡️ Exits")

atrLength = input.int(14, "ATR Length", minval=7, maxval=30, group="🛡️ Exits")

atrMultiplier = input.float(1.5, "ATR Multiplier", minval=0.5, maxval=3.0, step=0.1, group="🛡️ Exits")

fixedStopLoss = input.float(50.0, "Fixed SL (points)", minval=20.0, maxval=200.0, step=10.0, group="🛡️ Exits")

swingLookback = input.int(10, "Swing Lookback", minval=5, maxval=30, group="🛡️ Exits")

// Targets

rrTarget1 = input.float(1.5, "Target 1 R:R", minval=0.5, maxval=3.0, step=0.1, group="🛡️ Exits")

rrTarget2 = input.float(2.5, "Target 2 R:R", minval=1.0, maxval=5.0, step=0.5, group="🛡️ Exits")

partialExitPercent = input.int(50, "Partial Exit %", minval=25, maxval=75, step=5, group="🛡️ Exits")

// Trailing

useTrailing = input.bool(true, "Trailing Stop", group="🛡️ Exits")

trailActivationRR = input.float(1.2, "Activate at R:R", minval=0.5, maxval=2.0, step=0.1, group="🛡️ Exits")

trailStopRR = input.float(0.8, "Trail Stop R:R", minval=0.3, maxval=1.5, step=0.1, group="🛡️ Exits")

// Risk Management

maxTradesPerDay = input.int(5, "Max Trades/Day", minval=1, maxval=20, group="🚨 Risk")

maxConsecutiveLosses = input.int(2, "Stop After Losses", minval=1, maxval=5, group="🚨 Risk")

dailyLossLimit = input.float(2.5, "Daily Loss %", minval=1.0, maxval=10.0, step=0.5, group="🚨 Risk")

dailyProfitTarget = input.float(5.0, "Daily Target %", minval=2.0, maxval=20.0, step=0.5, group="🚨 Risk")

// ═══════════════════════════════════════════════════════════

// 📊 INDICATORS

// ═══════════════════════════════════════════════════════════

// Kernel Regression

kernel = ta.linreg(close, kernelLength, 0)

kernelSlope = kernel - kernel[1]

// VWAP

vwapValue = vwapSource == "Session" ? ta.vwap(close) : ta.sma(hlc3, vwapRollingLength)

vwapSlope = vwapValue - vwapValue[1]

// Volume

volumeMA = ta.sma(volume, volumeLength)

highVolume = volume > volumeMA * volumeMultiplier

volumeIncreasing = volume > volume[1] and volume[1] > volume[2]

// CVD

buyVolume = close > open ? volume : 0

sellVolume = close < open ? volume : 0

volumeDelta = buyVolume - sellVolume

cvd = ta.cum(volumeDelta)

cvdMA = ta.sma(cvd, cvdLength)

// RSI

rsi = ta.rsi(close, rsiLength)

// ATR

atr = ta.atr(atrLength)

// Price Action

candleRange = high - low

candleBody = math.abs(close - open)

bodyPercent = candleRange > 0 ? candleBody / candleRange : 0

// Swing High/Low

swingHigh = ta.highest(high, swingLookback)

swingLow = ta.lowest(low, swingLookback)

// ═══════════════════════════════════════════════════════════

// ⏰ TIME MANAGEMENT

// ═══════════════════════════════════════════════════════════

currentMinutes = hour * 60 + minute

startMinutes = startHour * 60 + startMinute

endMinutes = endHour * 60 + endMinute

tradingTime = currentMinutes >= startMinutes and currentMinutes <= endMinutes

var int barsToday = 0

newDay = ta.change(dayofweek)

if newDay

barsToday := 0

if tradingTime

barsToday += 1

skipInitialBars = barsToday <= avoidFirstCandles

forceExitTime = currentMinutes >= (endMinutes - 5)

// ═══════════════════════════════════════════════════════════

// 💼 POSITION TRACKING

// ═══════════════════════════════════════════════════════════

var int todayTrades = 0

var int consecutiveLosses = 0

var float todayPnL = 0.0

var float entryPrice = na

var int entryBar = 0

var float stopLoss = na

var float target1 = na

var float target2 = na

var float trailStop = na

var bool target1Hit = false

var bool trailActive = false

// Daily Reset

if newDay

todayTrades := 0

consecutiveLosses := 0

todayPnL := 0.0

// Track P&L

if strategy.closedtrades > 0 and strategy.closedtrades != strategy.closedtrades[1]

lastPnL = strategy.closedtrades.profit(strategy.closedtrades - 1)

todayPnL += lastPnL

if lastPnL < 0

consecutiveLosses += 1

else

consecutiveLosses := 0

// Risk Limits

lossLimit = strategy.initial_capital * (dailyLossLimit / 100)

profitTarget = strategy.initial_capital * (dailyProfitTarget / 100)

hitDailyTarget = todayPnL >= profitTarget

hitLossLimit = math.abs(todayPnL) >= lossLimit

canTrade = todayTrades < maxTradesPerDay and

consecutiveLosses < maxConsecutiveLosses and

not hitDailyTarget and

not hitLossLimit and

tradingTime and

not skipInitialBars and

strategy.position_size == 0

// ═══════════════════════════════════════════════════════════

// 🎯 LONG ENTRY CONDITIONS

// ═══════════════════════════════════════════════════════════

// Bullish Trend

longTrend = kernelSlope > 0 and close > kernel

longVWAP = close > vwapValue and vwapSlope > 0

longCVD = useCVD ? cvd > cvdMA and ta.rising(cvd, 2) : true

longRSI = useRSI ? rsi > rsiOversold and rsi < rsiOverbought : true

longVolume = highVolume or volumeIncreasing

longCandle = close > open and bodyPercent >= candleBodyPercent and

candleRange >= minCandlePoints and close >= (high - (candleRange * 0.25))

longSignal = longTrend and longVWAP and longCVD and longRSI and longVolume and longCandle and canTrade and

(tradingDirection == "Long Only" or tradingDirection == "Both")

// ═══════════════════════════════════════════════════════════

// 🎯 SHORT ENTRY CONDITIONS

// ═══════════════════════════════════════════════════════════

// Bearish Trend

shortTrend = kernelSlope < 0 and close < kernel

shortVWAP = close < vwapValue and vwapSlope < 0

shortCVD = useCVD ? cvd < cvdMA and ta.falling(cvd, 2) : true

shortRSI = useRSI ? rsi < rsiOverbought and rsi > rsiOversold : true

shortVolume = highVolume or volumeIncreasing

shortCandle = close < open and bodyPercent >= candleBodyPercent and

candleRange >= minCandlePoints and close <= (low + (candleRange * 0.25))

shortSignal = shortTrend and shortVWAP and shortCVD and shortRSI and shortVolume and shortCandle and canTrade and

(tradingDirection == "Short Only" or tradingDirection == "Both")

// ═══════════════════════════════════════════════════════════

// 💰 POSITION SIZING

// ═══════════════════════════════════════════════════════════

calcPositionSize(stopDistance) =>

riskAmount = strategy.initial_capital * (riskPercent / 100)

contracts = math.floor(riskAmount / stopDistance)

math.min(contracts, maxContracts)

// ═══════════════════════════════════════════════════════════

// 📥 LONG ENTRY

// ═══════════════════════════════════════════════════════════

if longSignal

entryPrice := close

entryBar := bar_index

// Calculate Stop Loss

if stopLossType == "ATR"

stopLoss := close - (atr * atrMultiplier)

else if stopLossType == "Swing"

stopLoss := math.min(swingLow, close - (atr * atrMultiplier))

else

stopLoss := close - fixedStopLoss

risk = entryPrice - stopLoss

target1 := entryPrice + (risk * rrTarget1)

target2 := entryPrice + (risk * rrTarget2)

qty = calcPositionSize(risk)

trailStop := stopLoss

target1Hit := false

trailActive := false

todayTrades += 1

strategy.entry("LONG", strategy.long, qty=qty, comment="Long-" + str.tostring(todayTrades))

// ═══════════════════════════════════════════════════════════

// 📥 SHORT ENTRY

// ═══════════════════════════════════════════════════════════

if shortSignal

entryPrice := close

entryBar := bar_index

// Calculate Stop Loss

if stopLossType == "ATR"

stopLoss := close + (atr * atrMultiplier)

else if stopLossType == "Swing"

stopLoss := math.max(swingHigh, close + (atr * atrMultiplier))

else

stopLoss := close + fixedStopLoss

risk = stopLoss - entryPrice

target1 := entryPrice - (risk * rrTarget1)

target2 := entryPrice - (risk * rrTarget2)

qty = calcPositionSize(risk)

trailStop := stopLoss

target1Hit := false

trailActive := false

todayTrades += 1

strategy.entry("SHORT", strategy.short, qty=qty, comment="Short-" + str.tostring(todayTrades))

// ═══════════════════════════════════════════════════════════

// 🏃 TRAILING STOP (LONG)

// ═══════════════════════════════════════════════════════════

if strategy.position_size > 0 and useTrailing

unrealizedProfit = close - entryPrice

risk = entryPrice - stopLoss

if unrealizedProfit >= (risk * trailActivationRR) and not trailActive

trailActive := true

trailStop := close - (risk * trailStopRR)

if trailActive

newTrailStop = close - (risk * trailStopRR)

if newTrailStop > trailStop

trailStop := newTrailStop

// ═══════════════════════════════════════════════════════════

// 🏃 TRAILING STOP (SHORT)

// ═══════════════════════════════════════════════════════════

if strategy.position_size < 0 and useTrailing

unrealizedProfit = entryPrice - close

risk = stopLoss - entryPrice

if unrealizedProfit >= (risk * trailActivationRR) and not trailActive

trailActive := true

trailStop := close + (risk * trailStopRR)

if trailActive

newTrailStop = close + (risk * trailStopRR)

if newTrailStop < trailStop

trailStop := newTrailStop

// ═══════════════════════════════════════════════════════════

// 📤 LONG EXIT

// ═══════════════════════════════════════════════════════════

if strategy.position_size > 0

activeSL = trailActive and useTrailing ? trailStop : stopLoss

// Stop Loss

if low <= activeSL

strategy.close("LONG", comment="Long-SL")

// Target 1

else if high >= target1 and not target1Hit

exitQty = math.floor(strategy.position_size * (partialExitPercent / 100))

strategy.close("LONG", qty=exitQty, comment="Long-T1")

target1Hit := true

stopLoss := entryPrice

// Target 2

else if high >= target2

strategy.close("LONG", comment="Long-T2")

// Force Exit

else if forceExitTime

strategy.close("LONG", comment="Long-EOD")

// ═══════════════════════════════════════════════════════════

// 📤 SHORT EXIT

// ═══════════════════════════════════════════════════════════

if strategy.position_size < 0

activeSL = trailActive and useTrailing ? trailStop : stopLoss

// Stop Loss

if high >= activeSL

strategy.close("SHORT", comment="Short-SL")

// Target 1

else if low <= target1 and not target1Hit

exitQty = math.floor(math.abs(strategy.position_size) * (partialExitPercent / 100))

strategy.close("SHORT", qty=exitQty, comment="Short-T1")

target1Hit := true

stopLoss := entryPrice

// Target 2

else if low <= target2

strategy.close("SHORT", comment="Short-T2")

// Force Exit

else if forceExitTime

strategy.close("SHORT", comment="Short-EOD")

// ═══════════════════════════════════════════════════════════

// ⚠️ REVERSAL EXIT

// ═══════════════════════════════════════════════════════════

longReversal = strategy.position_size > 0 and (close < kernel and kernelSlope < 0 or close < vwapValue)

shortReversal = strategy.position_size < 0 and (close > kernel and kernelSlope > 0 or close > vwapValue)

if longReversal and target1Hit

strategy.close("LONG", comment="Long-Rev")

if shortReversal and target1Hit

strategy.close("SHORT", comment="Short-Rev")

// ═══════════════════════════════════════════════════════════

// 🎨 VISUALIZATION

// ═══════════════════════════════════════════════════════════

// Indicators

plot(kernel, "Kernel", color=color.new(color.purple, 0), linewidth=2)

plot(vwapValue, "VWAP", color=color.new(color.orange, 0), linewidth=2)

kernelUpper = kernel + atr

kernelLower = kernel - atr

plot(kernelUpper, "K Upper", color=color.new(color.purple, 70), linewidth=1, style=plot.style_circles)

plot(kernelLower, "K Lower", color=color.new(color.purple, 70), linewidth=1, style=plot.style_circles)

// Signals

plotshape(longSignal, "LONG", shape.triangleup, location.belowbar,

color=color.new(color.lime, 0), size=size.normal, text="LONG")

plotshape(shortSignal, "SHORT", shape.triangledown, location.abovebar,

color=color.new(color.red, 0), size=size.normal, text="SHORT")

// Position Levels

posColor = strategy.position_size > 0 ? color.blue : strategy.position_size < 0 ? color.orange : na

plot(strategy.position_size != 0 ? entryPrice : na, "Entry",

color=color.new(posColor, 0), style=plot.style_linebr, linewidth=2)

slColor = strategy.position_size > 0 ? color.red : color.fuchsia

plot(strategy.position_size != 0 ? stopLoss : na, "SL",

color=color.new(slColor, 0), style=plot.style_linebr, linewidth=2)

t1Color = strategy.position_size > 0 ? color.green : color.aqua

plot(strategy.position_size != 0 ? target1 : na, "T1",

color=color.new(t1Color, 0), style=plot.style_linebr, linewidth=1)

plot(strategy.position_size != 0 ? target2 : na, "T2",

color=color.new(t1Color, 0), style=plot.style_linebr, linewidth=2)

plot(strategy.position_size != 0 and trailActive ? trailStop : na, "Trail",

color=color.new(color.yellow, 0), style=plot.style_linebr, linewidth=2)

// Volume

barcolor(highVolume ? color.new(color.blue, 70) : na)

// Background

bgcolor(tradingTime ? color.new(color.green, 98) : color.new(color.gray, 95))

bgcolor(strategy.position_size > 0 ? color.new(color.blue, 97) :

strategy.position_size < 0 ? color.new(color.orange, 97) : na)

bgcolor(hitDailyTarget ? color.new(color.green, 92) : hitLossLimit ? color.new(color.red, 92) : na)

// ═══════════════════════════════════════════════════════════

// 📊 STATS TABLE

// ═══════════════════════════════════════════════════════════

var table stats = table.new(position.top_right, 2, 11, border_width=1)

if barstate.islast

// Header

table.cell(stats, 0, 0, "📊 LONG & SHORT", bgcolor=color.blue, text_color=color.white, text_size=size.small)

table.cell(stats, 1, 0, "STRATEGY", bgcolor=color.blue, text_color=color.white, text_size=size.small)

// Trades

table.cell(stats, 0, 1, "Trades", text_size=size.small)

table.cell(stats, 1, 1, str.tostring(todayTrades) + "/" + str.tostring(maxTradesPerDay),

bgcolor=todayTrades >= maxTradesPerDay ? color.red : color.green, text_color=color.white, text_size=size.small)

// Losses

table.cell(stats, 0, 2, "Losses", text_size=size.small)

table.cell(stats, 1, 2, str.tostring(consecutiveLosses),

bgcolor=consecutiveLosses >= maxConsecutiveLosses ? color.red : color.green,

text_color=color.white, text_size=size.small)

// P&L

pnlPct = (todayPnL / strategy.initial_capital) * 100

table.cell(stats, 0, 3, "P&L", text_size=size.small)

table.cell(stats, 1, 3, str.tostring(todayPnL, "#,###") + "\n" + str.tostring(pnlPct, "#.##") + "%",

bgcolor=todayPnL > 0 ? color.green : todayPnL < 0 ? color.red : color.gray,

text_color=color.white, text_size=size.small)

// Position

table.cell(stats, 0, 4, "Position", text_size=size.small)

posText = strategy.position_size > 0 ? "LONG\n" + str.tostring(strategy.position_size) :

strategy.position_size < 0 ? "SHORT\n" + str.tostring(math.abs(strategy.position_size)) : "FLAT"

posBg = strategy.position_size > 0 ? color.blue : strategy.position_size < 0 ? color.orange : color.gray

table.cell(stats, 1, 4, posText, bgcolor=posBg, text_color=color.white, text_size=size.small)

if strategy.position_size != 0

// Entry

table.cell(stats, 0, 5, "Entry", text_size=size.small)

table.cell(stats, 1, 5, str.tostring(entryPrice, "#.##"), text_size=size.small)

// Live P&L

livePnL = strategy.position_size > 0 ? (close - entryPrice) * strategy.position_size :

(entryPrice - close) * math.abs(strategy.position_size)

livePct = strategy.position_size > 0 ? ((close - entryPrice) / entryPrice) * 100 :

((entryPrice - close) / entryPrice) * 100

table.cell(stats, 0, 6, "Live P&L", text_size=size.small)

table.cell(stats, 1, 6, str.tostring(livePnL, "#,###") + "\n" + str.tostring(livePct, "#.##") + "%",

bgcolor=livePnL > 0 ? color.green : color.red, text_color=color.white, text_size=size.small)

// Bars

bars = bar_index - entryBar

table.cell(stats, 0, 7, "Bars", text_size=size.small)

table.cell(stats, 1, 7, str.tostring(bars), text_size=size.small)

// Stop

table.cell(stats, 0, 8, "Stop", text_size=size.small)

table.cell(stats, 1, 8, str.tostring(trailActive ? trailStop : stopLoss, "#.##") +

(trailActive ? " 🟡" : ""), text_size=size.small)

// T1

table.cell(stats, 0, 9, "T1", text_size=size.small)

table.cell(stats, 1, 9, str.tostring(target1, "#.##") + (target1Hit ? " ✓" : ""), text_size=size.small)

// T2

table.cell(stats, 0, 10, "T2", text_size=size.small)

table.cell(stats, 1, 10, str.tostring(target2, "#.##"), text_size=size.small)

// ═══════════════════════════════════════════════════════════

// 🔔 ALERTS

// ═══════════════════════════════════════════════════════════

alertcondition(longSignal, "🟢 LONG SIGNAL", "LONG Entry Signal")

alertcondition(shortSignal, "🔴 SHORT SIGNAL", "SHORT Entry Signal")

alertcondition(longReversal or shortReversal, "⚠️ REVERSAL", "Reversal Detected")