Strategi manajemen uang dinamis multi-faktor

Ringkasan

Strategi ini menggunakan berbagai indikator teknis seperti MACD, RSI, dan PSAR, serta prinsip-prinsip pengelolaan dana yang dinamis, untuk melacak tren dan membalikkan perdagangan dalam kerangka waktu yang berbeda. Strategi ini dapat digunakan untuk perdagangan garis pendek, garis tengah, dan garis panjang.

Prinsip

Strategi menggunakan indikator PSAR untuk menentukan arah tren. EMA garis lambat dan BB garis tengah yang bersilang sebagai titik konfirmasi pertama. MACD arah pilar grafik sebagai titik konfirmasi kedua. RSI melewati zona jual beli sebagai titik konfirmasi ketiga.

Setelah masuk, atur stop loss. Atur stop loss dengan beberapa kali lipat dari nilai ATR. Atur stop loss dengan setara. Atur stop loss dengan persentase floating loss. Atur stop loss ketika kerugian mencapai persentase tertentu dari total ekuitas akun.

Ada juga setelan persentase. Jika keuntungan mencapai persentase tertentu dari total ekuitas akun, maka Anda berhenti bermain.

Pengelolaan Dana Dinamis Menghitung ukuran posisi berdasarkan total ekuitas, ATR, dan stop loss multiplier yang disetel.

Keunggulan

Multi-factor verifikasi, menghindari penembusan palsu, meningkatkan akurasi masuk.

Manajemen Dana Dinamis Mengontrol Risiko Individual dan Melindungi Akun Secara Efektif.

Stop loss stop stop adalah setelan ATR yang dapat disesuaikan dengan volatilitas pasar.

Setelan persentase fluktuasi untuk mengunci keuntungan dan menghindari pengembalian.

Risiko

Portfolio multifaktor mungkin melewatkan beberapa peluang perdagangan.

Persentase yang terlalu tinggi dapat menyebabkan kerugian meningkat.

Setting nilai ATR yang tidak tepat dapat menyebabkan stop loss terlalu longgar atau terlalu radikal.

Pengaturan manajemen dana yang tidak tepat dapat menyebabkan posisi tunggal terlalu besar.

Arah optimasi

Menyesuaikan berat faktor masuk, mengoptimalkan akurasi sinyal.

Uji berbagai pengaturan parameter persentase untuk menemukan kombinasi optimal.

Pilihlah ATR yang wajar sesuai dengan karakteristik varietas yang berbeda.

Parameter pengelolaan dana secara dinamis disesuaikan dengan hasil pengukuran.

Optimalkan pengaturan periode waktu, uji waktu transaksi.

Meringkaskan

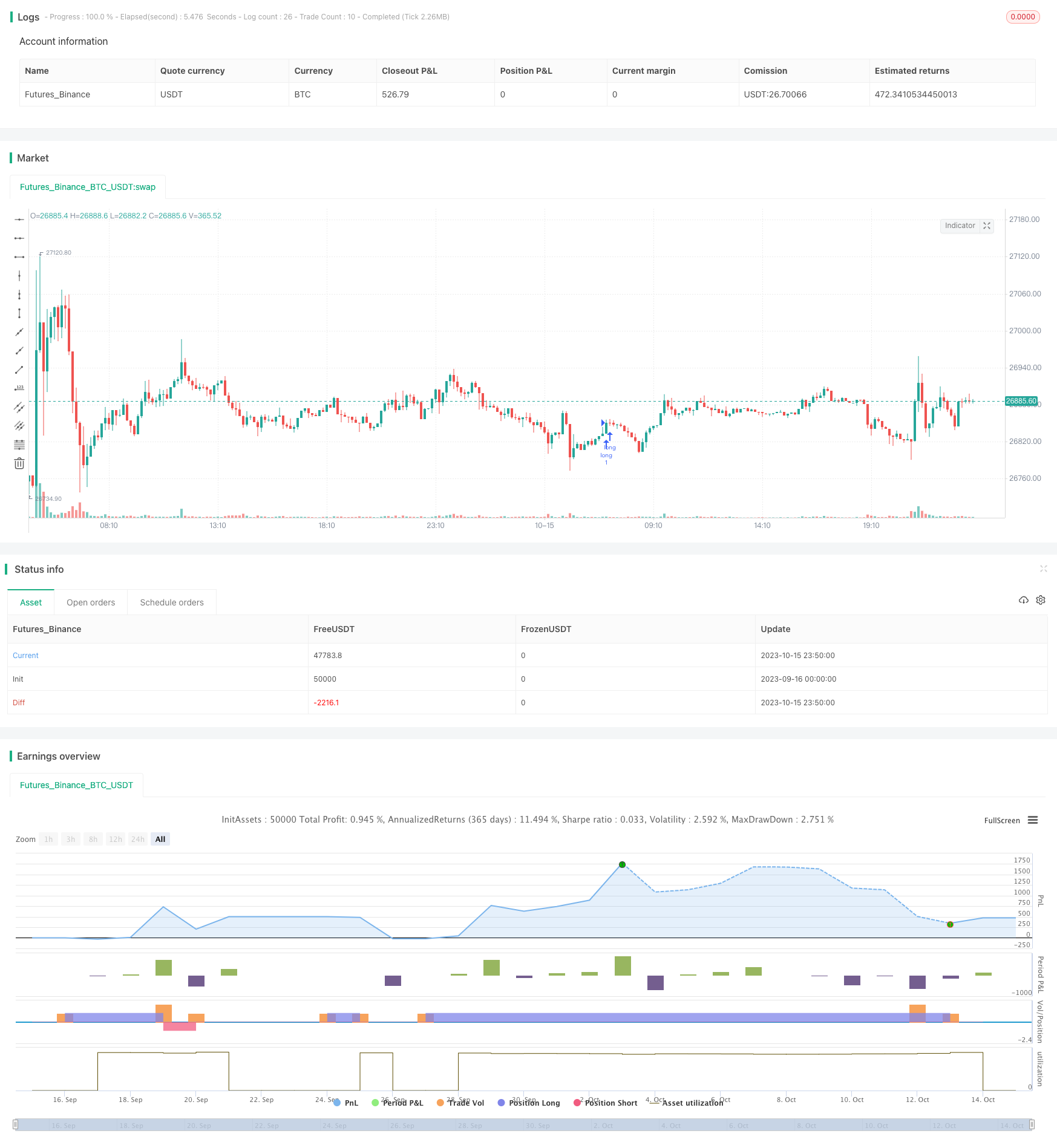

Strategi ini mengintegrasikan beberapa indikator teknis untuk menilai tren, menambahkan risiko pengendalian pengelolaan dana yang dinamis, dan mencapai keuntungan yang stabil dalam kerangka waktu yang lebih banyak. Berdasarkan hasil pengukuran, faktor-faktor berat, parameter pengendalian risiko, dan pengaturan pengelolaan dana dapat terus dioptimalkan untuk mendapatkan hasil yang lebih baik.

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SoftKill21

//@version=4

strategy("EURUSD 1min strat RISK %% ", overlay=false, initial_capital = 1000)

// BACKTESTING RANGE

// From Date Inputs

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 6, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2020, title = "From Year", minval = 1970)

// To Date Inputs

toDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2020, title = "To Year", minval = 1970)

// Calculate start/end date and time condition

DST = 1 //day light saving for usa

//--- Europe

London = iff(DST==0,"0000-0900","0100-1000")

//--- America

NewYork = iff(DST==0,"0400-1500","0500-1600")

//--- Pacific

Sydney = iff(DST==0,"1300-2200","1400-2300")

//--- Asia

Tokyo = iff(DST==0,"1500-2400","1600-0100")

//-- Time In Range

timeinrange(res, sess) => time(res, sess) != 0

london = timeinrange(timeframe.period, London)

newyork = timeinrange(timeframe.period, NewYork)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = true

//

//

// rsi

length = input( 5 )

overSold = input( 23 )

overBought = input( 72 )

price = close

vrsi = rsi(price, length)

co = crossover(vrsi, overSold)

cu = crossunder(vrsi, overBought)

// macd

fast_length_macd = input(title="Fast Length", type=input.integer, defval=12)

slow_length_macd = input(title="Slow Length", type=input.integer, defval=26)

src_macd = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=true)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=true)

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

// Calculating

fast_ma = sma_source ? sma(src_macd, fast_length_macd) : ema(src_macd, fast_length_macd)

slow_ma = sma_source ? sma(src_macd, slow_length_macd) : ema(src_macd, slow_length_macd)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

//plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below) ), transp=0 )

// sar

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := min(AF + increment, maximum)

else

if low < EP

EP := low

AF := min(AF + increment, maximum)

if uptrend

SAR := min(SAR, low[1])

if bar_index > 1

SAR := min(SAR, low[2])

else

SAR := max(SAR, high[1])

if bar_index > 1

SAR := max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

//plot(SAR, style=plot.style_cross, linewidth=3, color=color.orange)

//plot(nextBarSAR, style=plot.style_cross, linewidth=3, color=color.aqua)

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

//bb

length_bb = input(17, minval=1)

src_bb = input(close, title="Source")

mult_bb = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis_bb = sma(src_bb, length_bb)

dev_bb = mult_bb * stdev(src_bb, length_bb)

upper_bb = basis_bb + dev_bb

lower_bb = basis_bb - dev_bb

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

//plot(basis_bb, "Basis", color=#872323, offset = offset)

//p1_bb = plot(upper_bb, "Upper", color=color.teal, offset = offset)

//p2_bb = plot(lower_bb, "Lower", color=color.teal, offset = offset)

//fill(p1_bb, p2_bb, title = "Background", color=#198787, transp=95)

//ema

len_ema = input(10, minval=1, title="Length")

src_ema = input(close, title="Source")

offset_ema = input(title="Offset", type=input.integer, defval=0, minval=-500, maxval=500)

out_ema = ema(src_ema, len_ema)

//plot(out_ema, title="EMA", color=color.blue, offset=offset_ema)

//out_ema e emaul

//basis_bb e middle de la bb

//hist e histograma

// rsi cu band0 cross pt rsi

// confirmarea

shortCondition = (uptrend==false and crossunder(ema(src_ema, len_ema),sma(src_bb, length_bb)) and hist < 0 and vrsi < overSold) //and time_cond

longCondition = (uptrend==true and crossover(ema(src_ema, len_ema),sma(src_bb, length_bb)) and hist > 0 and vrsi > overBought ) //and time_cond

//tp=input(0.0025,type=input.float, title="tp")

//sl=input(0.001,type=input.float, title="sl")

//INDICATOR---------------------------------------------------------------------

//Average True Range (1. RISK)

atr_period = input(14, "Average True Range Period")

atr = atr(atr_period)

strategy.initial_capital = 50000

//MONEY MANAGEMENT--------------------------------------------------------------

balance = strategy.netprofit + strategy.initial_capital //current balance

floating = strategy.openprofit //floating profit/loss

risk = input(2,type=input.float,title="Risk %")/100 //risk % per trade

isTwoDigit = input(false,"Is this a 2 digit pair? (JPY, XAU, XPD...")

equity_protector = input(1 ,type=input.float, title="Equity Protection %")/100 //equity protection %

equity_protectorTP = input(2 ,type=input.float, title="Equity TP %")/100 //equity protection %

multtp = input(5,type=input.float, title="multi atr tp")

multsl = input(5,type=input.float, title="multi atr sl")

stop = atr*100000*input(1,"SL X")* multsl //Stop level

if(isTwoDigit)

stop := stop/100

target = atr*100000*input(1,"TP X")*multtp //Stop level

//Calculate current DD and determine if stopout is necessary

equity_stopout = false

if(floating<0 and abs(floating/balance)>equity_protector)

equity_stopout := true

equity_stopout2 = false

if(floating>0 and abs(floating/balance)>equity_protectorTP)

equity_stopout2 := true

//Calculate the size of the next trade

temp01 = balance * risk //Risk in USD

temp02 = temp01/stop //Risk in lots

temp03 = temp02*100000 //Convert to contracts

size = temp03 - temp03%1000 //Normalize to 1000s (Trade size)

if(size < 10000)

size := 10000 //Set min. lot size

//TRADE EXECUTION---------------------------------------------------------------

strategy.close_all(equity_stopout, comment="equity sl", alert_message = "equity_sl") //Close all trades w/equity protector

//strategy.close_all(equity_stopout2, comment="equity tp", alert_message = "equity_tp") //Close all trades w/equity protector

is_open = strategy.opentrades > 0

strategy.entry("long",true,oca_name="a",when=longCondition and not is_open) //Long entry

strategy.entry("short",false,oca_name="a",when=shortCondition and not is_open) //Short entry

strategy.exit("exit_long","long",loss=stop, profit=target) //Long exit (stop loss)

strategy.close("long",when=shortCondition) //Long exit (exit condition)

strategy.exit("exit_short","short",loss=stop, profit=target) //Short exit (stop loss)

strategy.close("short",when=longCondition) //Short exit (exit condition)

//strategy.entry("long", strategy.long,size,when=longCondition , comment="long" , alert_message = "long")

//strategy.entry("short", strategy.short, size,when=shortCondition , comment="short" , alert_message = "short")

//strategy.exit("closelong", "long" , profit = close * tp / syminfo.mintick, alert_message = "closelong")

//strategy.exit("closeshort", "short" , profit = close * tp / syminfo.mintick, alert_message = "closeshort")

//strategy.exit("closelong", "long" ,size, profit = close * tp / syminfo.mintick, loss = close * sl / syminfo.mintick, alert_message = "closelong")

//strategy.exit("closeshort", "short" , size, profit = close * tp / syminfo.mintick, loss = close * sl / syminfo.mintick, alert_message = "closeshort")

//strategy.close("long" , when=not (time_cond), comment="time", alert_message = "closelong" )

//strategy.close("short" , when=not (time_cond), comment="time", alert_message = "closeshort")

//strategy.close_all(when=not (time_cond), comment ='time')