Strategi perdagangan batas waktu MA ganda

Ringkasan

Strategi ini didasarkan pada strategi perdagangan linier ganda yang asli, dengan menambahkan modul pembatasan waktu untuk mengontrol waktu memulai strategi. Modul ini dapat secara efektif mengelola waktu operasi strategi dan mengurangi risiko perdagangan dalam kondisi pasar yang tidak ideal.

Prinsip

Strategi menggunakan MA cepat dan MA lambat untuk membangun sinyal perdagangan. Parameter MA cepat adalah 14 hari dan MA lambat adalah 21 hari. Sinyal beli dihasilkan ketika MA cepat melewati MA lambat; Sinyal jual dihasilkan ketika MA cepat melewati MA lambat.

Strategi ini juga memperkenalkan opsi reversal trading, yang dapat membalikkan arah sinyal trading asli.

Modul pembatasan waktu membandingkan waktu saat ini dengan waktu yang ditetapkan untuk memulai, mengembalikan nilai yang benar, untuk mengontrol apakah kebijakan dimulai. Modul ini perlu mengatur tahun, bulan, hari, jam, dan menit untuk memulai, dan kebijakan akan dimulai hanya jika waktu saat ini melebihi waktu yang ditetapkan.

Keunggulan

- Menggunakan MA ganda untuk membentuk sinyal perdagangan, dapat secara efektif menangkap tren jangka pendek dan menengah

- Tambahkan modul pembatasan waktu untuk mengontrol waktu operasi strategi dengan lebih tepat dan menghindari transaksi yang tidak perlu dalam kondisi pasar yang tidak ideal

- Opsi reversal trading meningkatkan fleksibilitas strategi

Risiko dan Solusi

- Strategi MA ganda mungkin menghasilkan sinyal perdagangan beberapa kali, yang menghasilkan frekuensi perdagangan yang lebih tinggi dan biaya perdagangan

- Salah mengatur modul pembatasan waktu dapat menyebabkan peluang perdagangan yang hilang

- Pemilihan pembalikan perdagangan yang tidak tepat dapat menyebabkan kesalahan sinyal perdagangan

Anda dapat mengoptimalkan parameter siklus MA dengan tepat, mengurangi frekuensi perdagangan. Anda juga dapat mengatur waktu yang masuk akal untuk membatasi waktu peluncuran modul dan menghindari peluang yang terlewatkan. Terakhir, pilihlah dengan hati-hati apakah Anda perlu membalikkan arah sinyal perdagangan sesuai dengan kondisi pasar yang berbeda.

Arah optimasi

- Menambahkan modul stop loss untuk mengendalikan risiko transaksi tunggal

- Menambahkan pelacakan stop loss mobile yang memungkinkan stop loss bergerak secara bertahap sesuai dengan tren, untuk menghasilkan keuntungan yang diikuti

- Kombinasi sinyal operasi dari beberapa standar, dapat meningkatkan kualitas sinyal, mengurangi sinyal palsu

- Mengembangkan modul optimasi parameter yang dapat secara otomatis mencari kombinasi parameter yang optimal

Meringkaskan

Strategi ini dengan membentuk sinyal perdagangan dengan double MA, dan menambahkan waktu pembatasan modul strategi kontrol waktu berjalan, dapat secara efektif menangkap tren, sementara menghindari risiko di bawah kondisi pasar yang tidak ideal. Strategi ini juga dapat lebih lanjut meningkatkan dengan cara seperti pengaturan parameter yang dioptimalkan, modul stop loss dan operasi lintas standar, meningkatkan stabilitas dan profitabilitas setiap perdagangan sambil mengurangi frekuensi perdagangan.

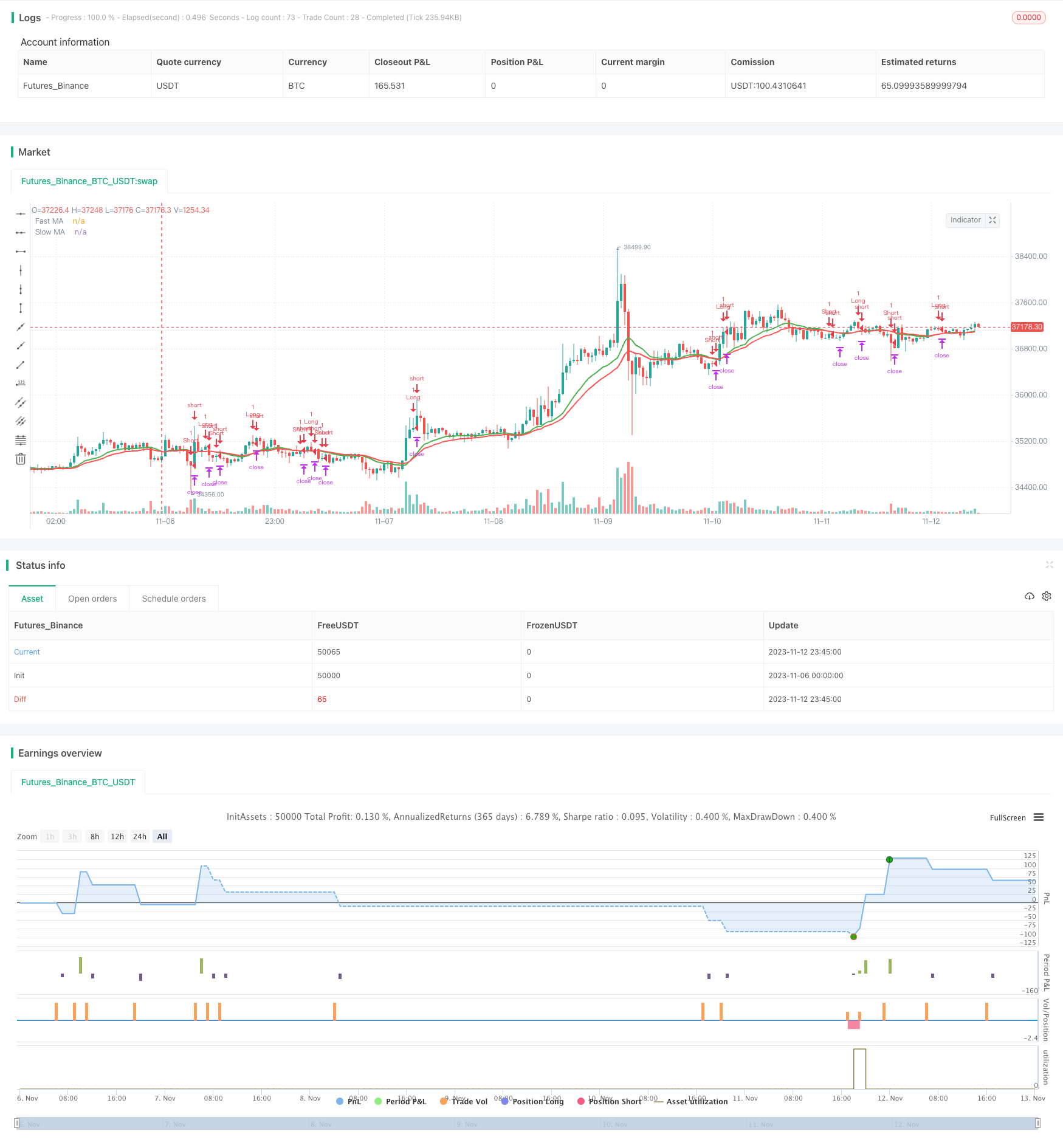

/*backtest

start: 2023-11-06 00:00:00

end: 2023-11-13 00:00:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title = "Strategy Code Example", shorttitle = "Strategy Code Example", overlay = true)

// Revision: 1

// Author: @JayRogers

//

// *** THIS IS JUST AN EXAMPLE OF STRATEGY TIME LIMITING ***

//

// This is a follow up to my previous strategy example for risk management, extended to include a time limiting factor.

// === GENERAL INPUTS ===

// short ma

maFastSource = input(defval = open, title = "Fast MA Source")

maFastLength = input(defval = 14, title = "Fast MA Period", minval = 1)

// long ma

maSlowSource = input(defval = open, title = "Slow MA Source")

maSlowLength = input(defval = 21, title = "Slow MA Period", minval = 1)

// === STRATEGY RELATED INPUTS ===

tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// Risk management

inpTakeProfit = input(defval = 1000, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 200, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 200, title = "Trailing Stop Loss", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset", minval = 0)

// *** FOCUS OF EXAMPLE ***

// Time limiting

// a toggle for enabling/disabling

useTimeLimit = input(defval = true, title = "Use Start Time Limiter?")

// set up where we want to run from

startYear = input(defval = 2016, title = "Start From Year", minval = 0, step = 1)

startMonth = input(defval = 05, title = "Start From Month", minval = 0,step = 1)

startDay = input(defval = 01, title = "Start From Day", minval = 0,step = 1)

startHour = input(defval = 00, title = "Start From Hour", minval = 0,step = 1)

startMinute = input(defval = 00, title = "Start From Minute", minval = 0,step = 1)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// *** FOCUS OF EXAMPLE ***

// === TIME LIMITER CHECKING FUNCTION ===

// using a multi line function to return true or false depending on our input selection

// multi line function logic must be indented.

startTimeOk() =>

// get our input time together

inputTime = timestamp(syminfo.timezone, startYear, startMonth, startDay, startHour, startMinute)

// check the current time is greater than the input time and assign true or false

timeOk = time > inputTime ? true : false

// last line is the return value, we want the strategy to execute if..

// ..we are using the limiter, and the time is ok -OR- we are not using the limiter

r = (useTimeLimit and timeOk) or not useTimeLimit

// === SERIES SETUP ===

/// a couple of ma's..

maFast = ema(maFastSource, maFastLength)

maSlow = ema(maSlowSource, maSlowLength)

// === PLOTTING ===

fast = plot(maFast, title = "Fast MA", color = green, linewidth = 2, style = line, transp = 50)

slow = plot(maSlow, title = "Slow MA", color = red, linewidth = 2, style = line, transp = 50)

// === LOGIC ===

// is fast ma above slow ma?

aboveBelow = maFast >= maSlow ? true : false

// are we inverting our trade direction?

tradeDirection = tradeInvert ? aboveBelow ? false : true : aboveBelow ? true : false

// *** FOCUS OF EXAMPLE ***

// wrap our strategy execution in an if statement which calls the time checking function to validate entry

// like the function logic, content to be included in the if statement must be indented.

if( startTimeOk() )

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong = not tradeDirection[1] and tradeDirection

exitLong = tradeDirection[1] and not tradeDirection

strategy.entry( id = "Long", long = true, when = enterLong )

strategy.close( id = "Long", when = exitLong )

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort = tradeDirection[1] and not tradeDirection

exitShort = not tradeDirection[1] and tradeDirection

strategy.entry( id = "Short", long = false, when = enterShort )

strategy.close( id = "Short", when = exitShort )

// === STRATEGY RISK MANAGEMENT EXECUTION ===

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)